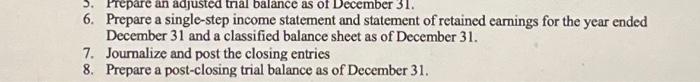

Please do 6-8. Thank you!

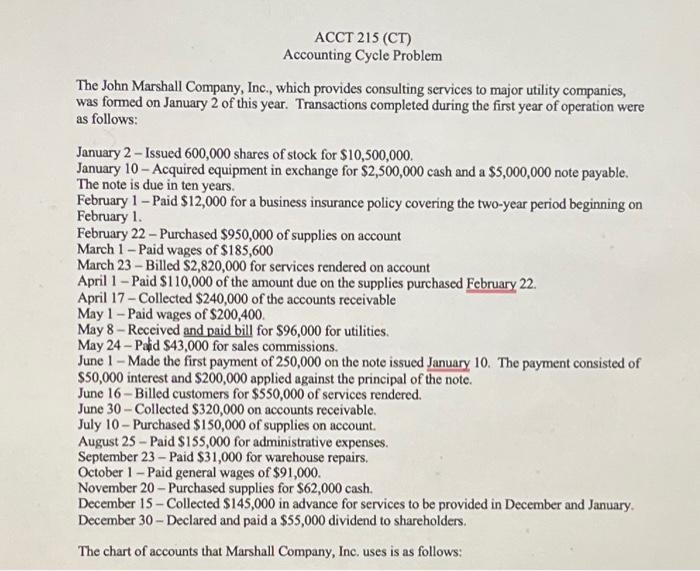

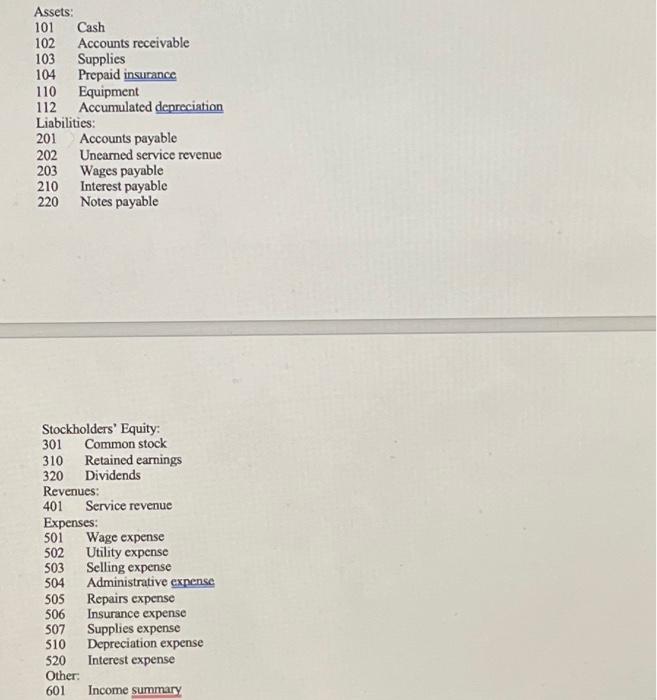

Accounting Cycle Problem The John Marshall Company, Inc., which provides consulting services to major utility companies, was formed on January 2 of this year. Transactions completed during the first year of operation were as follows: January 2 - Issued 600,000 shares of stock for $10,500,000. January 10 - Acquired equipment in exchange for $2,500,000 cash and a $5,000,000 note payable. The note is due in ten years. February 1 - Paid $12,000 for a business insurance policy covering the two-year period beginning on February 1. February 22 - Purchased $950,000 of supplies on account March 1 - Paid wages of $185,600 March 23 - Billed $2,820,000 for services rendered on account April 1 - Paid $110,000 of the amount due on the supplies purchased February 22. April 17 - Collected $240,000 of the accounts receivable May 1 - Paid wages of $200,400. May 8 - Received and paid bill for $96,000 for utilities. May 24 - Padd $43,000 for sales commissions. June 1 - Made the first payment of 250,000 on the note issued January 10. The payment consisted of $50,000 interest and $200,000 applied against the principal of the note. June 16 - Billed customers for $550,000 of services rendered. June 30 - Collected $320,000 on accounts receivable. July 10 - Purchased $150,000 of supplies on account. August 25 - Paid $155,000 for administrative expenses. September 23 - Paid $31,000 for warehouse repairs. October 1 - Paid general wages of $91,000. November 20 - Purchased supplies for $62,000cash. December 15 - Collected $145,000 in advance for services to be provided in December and January. December 30 - Declared and paid a $55,000 dividend to shareholders. The chart of accounts that Marshall Company, Inc. uses is as follows: Assets: 101102103104110112Liabilities:201202203210220CashAccountsreceivableSuppliesPrepaidincuranceEquipmentAccumulateddepreciationAccountspayableUnearnedservicerevenueWagespayableInterestpayableNotespayable 6. Prepare a single-step income statement and statement of retained earnings for the year ended December 31 and a classified balance sheet as of December 31 . 7. Journalize and post the closing entries 8. Prepare a post-closing trial balance as of December 31