Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do A and B preferrably in Excel Problem 2 On May 15, 2014, the Treasury issued a 30-year T-Bond maturing on May 15, 2044.

Please do A and B preferrably in Excel

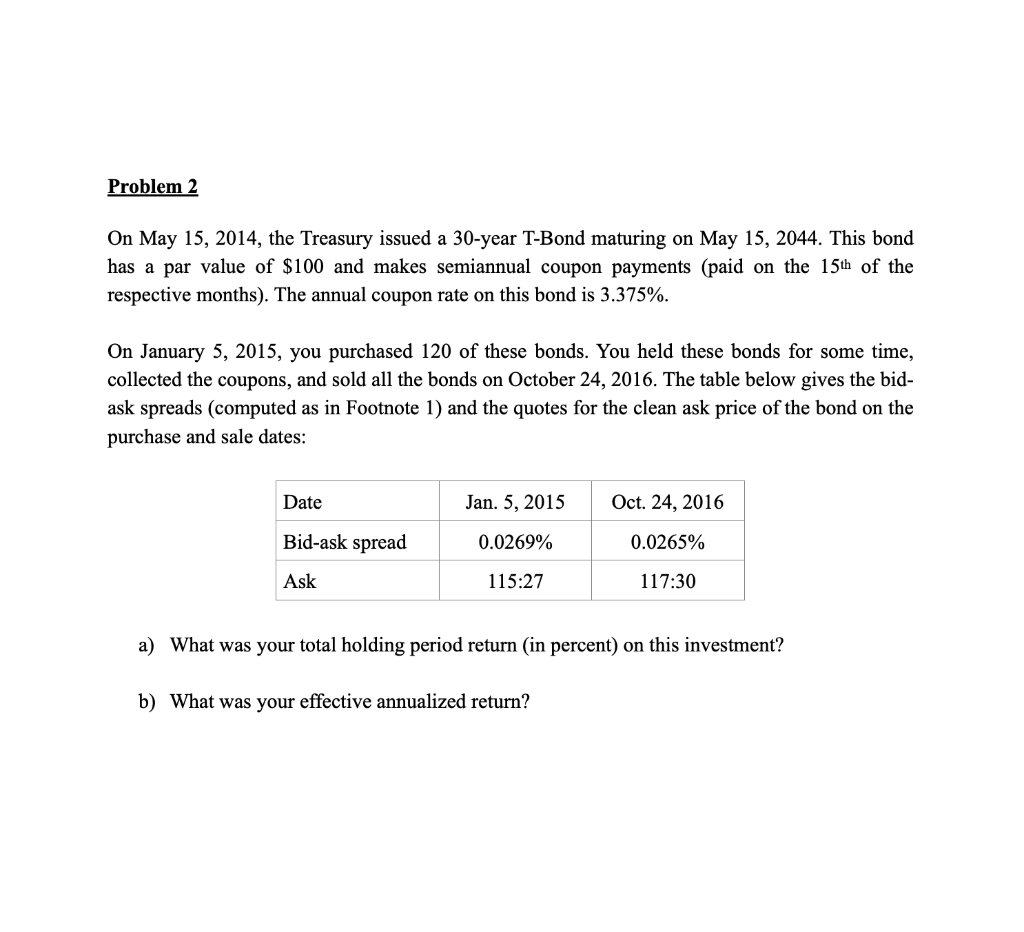

Problem 2 On May 15, 2014, the Treasury issued a 30-year T-Bond maturing on May 15, 2044. This bond has a par value of $100 and makes semiannual coupon payments (paid on the 15th of the respective months). The annual coupon rate on this bond is 3.375%. On January 5, 2015, you purchased 120 of these bonds. You held these bonds for some time, collected the coupons, and sold all the bonds on October 24, 2016. The table below gives the bid- ask spreads (computed as in Footnote 1) and the quotes for the clean ask price of the bond on the purchase and sale dates: Date Jan. 5, 2015 Oct. 24, 2016 Bid-ask spread 0.0269% 0.0265% Ask 115:27 117:30 a) What was your total holding period return (in percent) on this investment? b) What was your effective annualized return? Problem 2 On May 15, 2014, the Treasury issued a 30-year T-Bond maturing on May 15, 2044. This bond has a par value of $100 and makes semiannual coupon payments (paid on the 15th of the respective months). The annual coupon rate on this bond is 3.375%. On January 5, 2015, you purchased 120 of these bonds. You held these bonds for some time, collected the coupons, and sold all the bonds on October 24, 2016. The table below gives the bid- ask spreads (computed as in Footnote 1) and the quotes for the clean ask price of the bond on the purchase and sale dates: Date Jan. 5, 2015 Oct. 24, 2016 Bid-ask spread 0.0269% 0.0265% Ask 115:27 117:30 a) What was your total holding period return (in percent) on this investment? b) What was your effective annualized returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started