Answered step by step

Verified Expert Solution

Question

1 Approved Answer

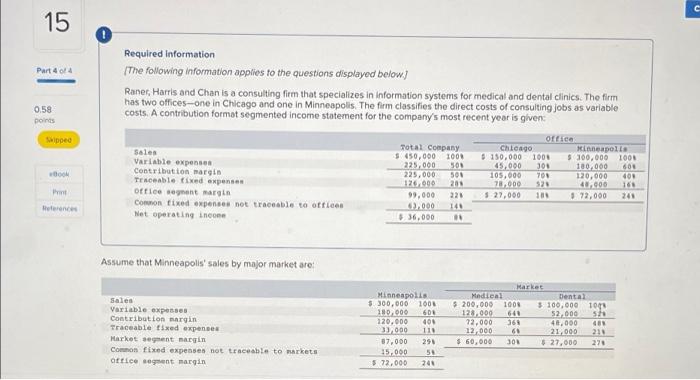

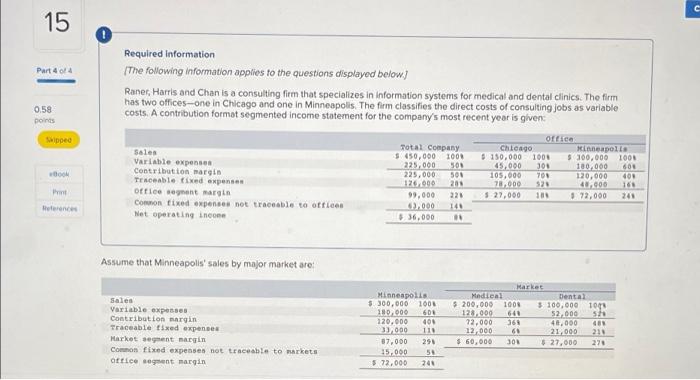

please do all 3 requirements C C 15 Part 4/4 0.58 points Required information The following information applies to the questions displayed below) Raner Harris

please do all 3 requirements

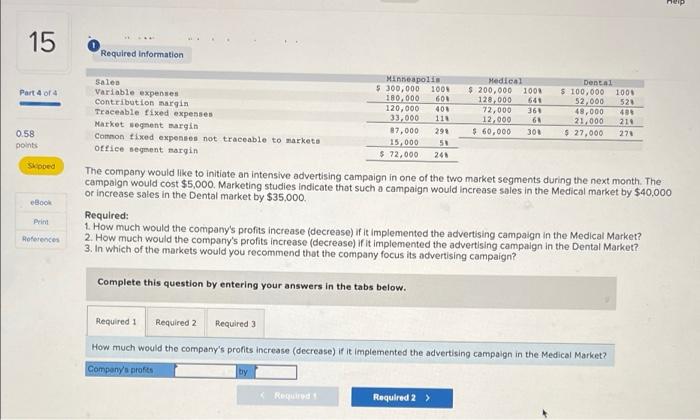

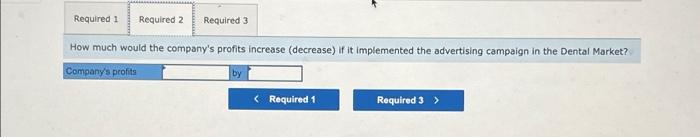

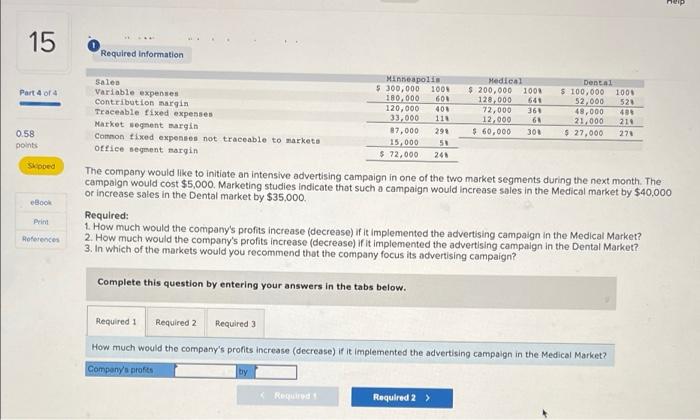

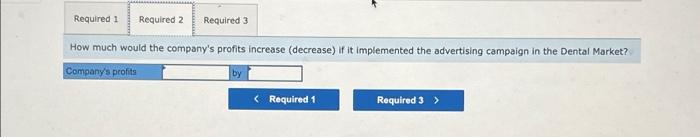

C C 15 Part 4/4 0.58 points Required information The following information applies to the questions displayed below) Raner Harris and Chan is a consulting firm that specializes in Information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given office Total Company Chicago Rinneapolis Sales Variable expenses $ 450,000 2001 $ 150,000 1000 $ 100,000 1001 225,000 SON 45,000 300 180.000 600 Contribution margin 225,000 500 709 105,000 Traceable fixed expenses 120,000 400 120.000 200 78,000 520 40.000 169 office sognent margin 99,000 220 $ 27,000 101 $72,000 Connon fixed expenses not traceable to offices 0.000 140 Net operating in 5 36,000 Shipped ence Assume that Minneapolis sales by major market are Sales Variable exposes Contribution margin Traceable fixed expenses Market segment margin Common fixed expenses not traceable to markets ottice spent margin Minneapolis 5 300.000 1001 180.000 600 120.000 31,000 87.000 291 25.000 58 5.72.000 240 Market Medical Dental $ 200,0001008 $ 100,000 1001 128.000 640 52.000 72.000 365 40.000 489 12,000 66 21,000 $ 60,000 JON $ 27,000 27 15 Required information Part 4 of 4 641 0.58 points 400 111 298 50 245 Sloved Minneapolis Sales Medical Dental $ 300,000 100 $ 200,000 1001 $100,000 1000 Variable expenses 180,000 600 128,000 52.000 520 Contribution margin 120,000 72,000 361 48,000 485 Teaceable fixed expenses 33,000 12,000 68 21,000 210 Market segment margin 87,000 $ 60,000 300 $ 27,000 270 Comon taxed expenses not traceable to markets 15,000 ottice segment margin $ 72,000 The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,000. Marketing studies indicate that such a campaign would increase sales in the Medical market by $40,000 or increase sales in the Dental market by $35,000 Required: 1. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) ir it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? eBook Print References Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? Company's profits by Red Required 2 > Required 1 Required 2 Required 3 How much would the company's profits Increase (decrease) If it implemented the advertising campaign in the Dental Market? Company's profits by complete his questio your answers in the tabs below. orences Required 1. Required 2 Required 3 In which of the markets would you recommend that the company focus its advertising campaign? Medical Dental

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started