Please do all for a hugeee like

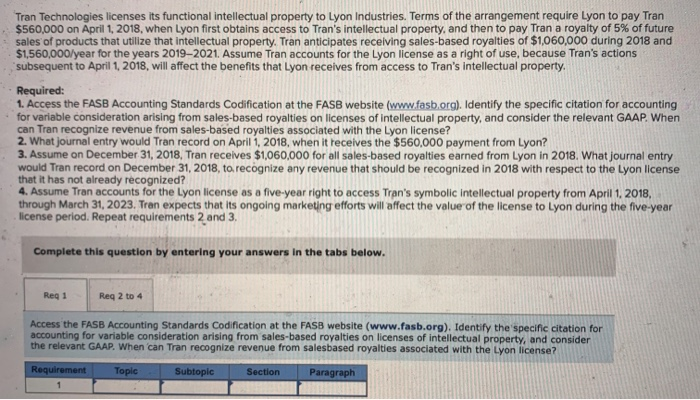

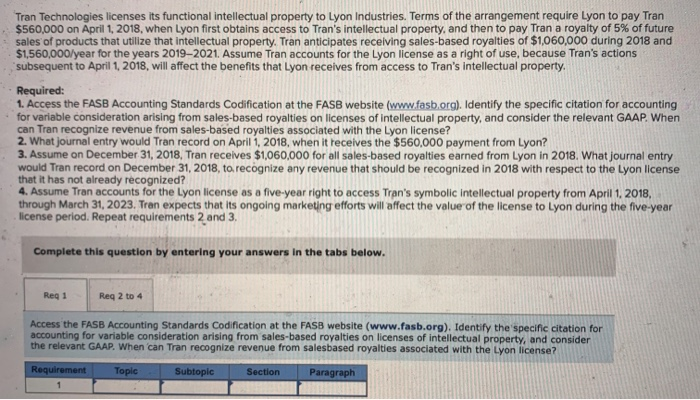

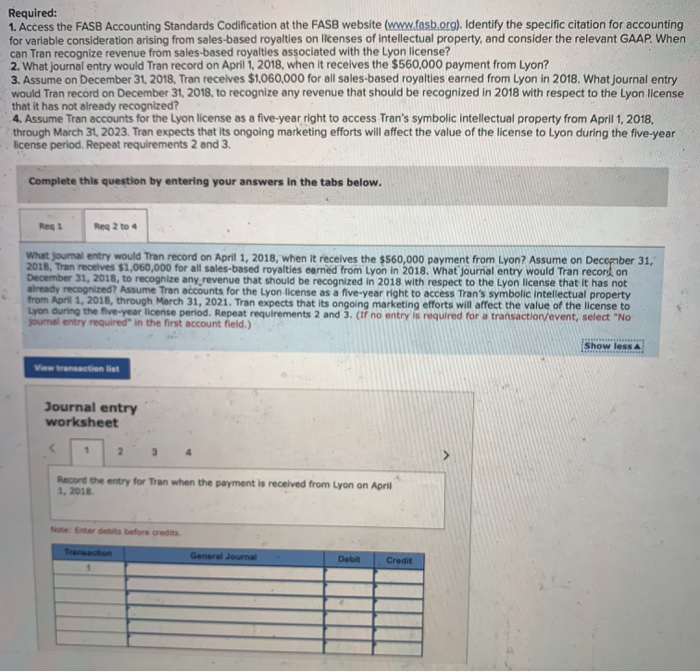

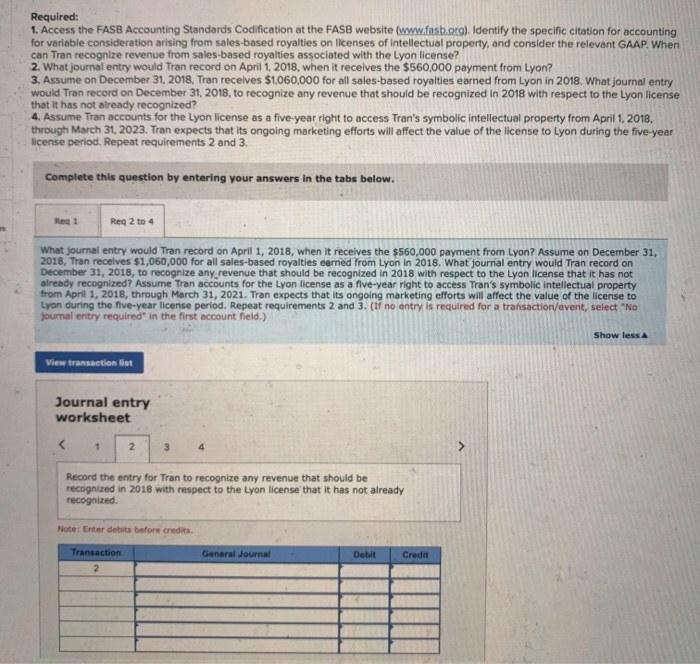

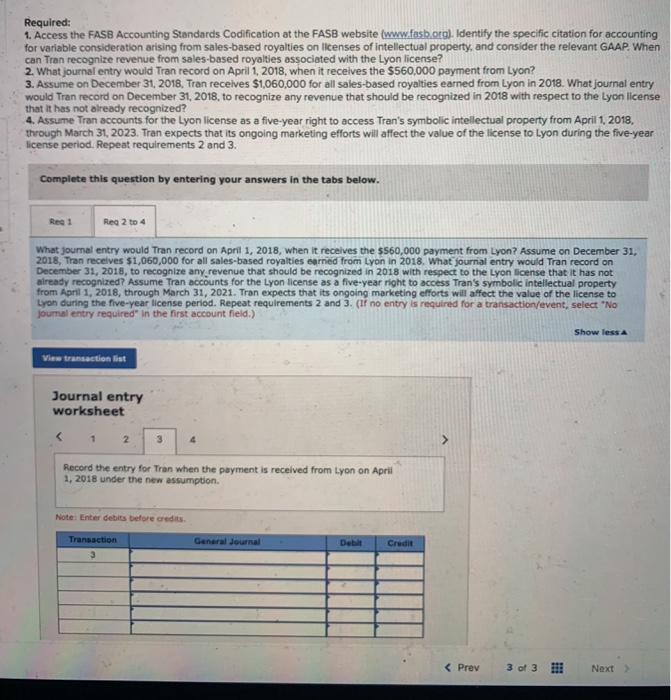

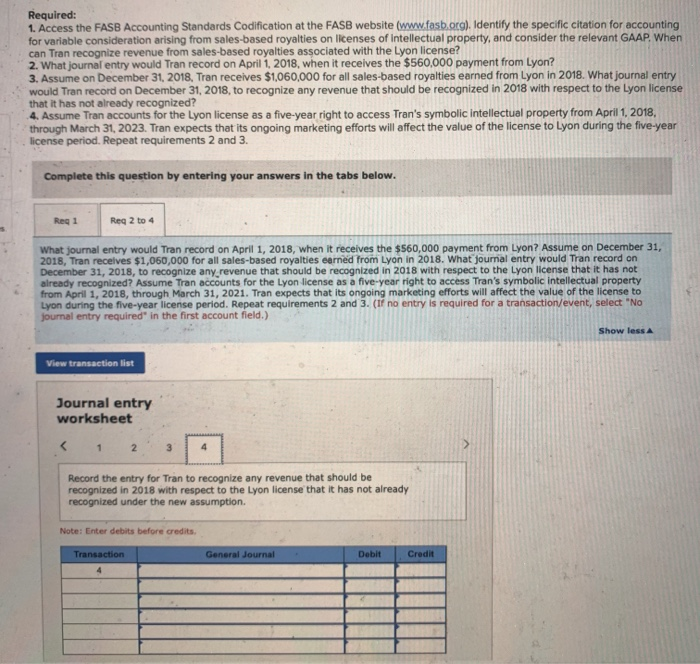

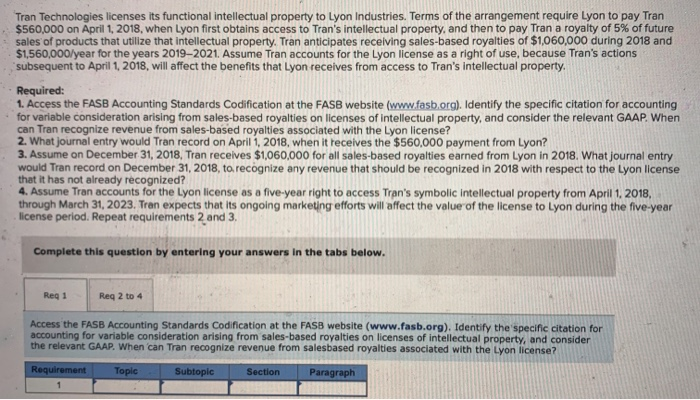

Tran Technologies licenses its functional intellectual property to Lyon Industries. Terms of the arrangement require Lyon to pay Tran $560,000 on April 1, 2018, when Lyon first obtains access to Tran's intellectual property, and then to pay Tran a royalty of 5% of future sales of products that utilize that intellectual property. Tran anticipates receiving sales-based royalties of $1,060,000 during 2018 and $1,560,000/year for the years 2019-2021. Assume Tran accounts for the Lyon license as a right of use, because Tran's actions subsequent to April 1, 2018, will affect the benefits that Lyon receives from access to Tran's intellectual property. Required: 1. Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Identify the specific citation for accounting for variable consideration arising from sales-based royalties on licenses of intellectual property, and consider the relevant GAAP. When can Tran recognize revenue from sales-based royalties associated with the Lyon license? 2. What journal entry would Tran record on April 1, 2018, when it receives the $560,000 payment from Lyon? 3. Assume on December 31, 2018, Tran receives $1,060,000 for all sales-based royalties earned from Lyon in 2018. What journal entry would Tran record on December 31, 2018, to recognize any revenue that should be recognized in 2018 with respect to the Lyon license 4. Assume Tran accounts for the Lyon license as a five-year right to access Tran's symbolic intellectual property from April 1, 2018, through March 31, 2023. Tran expects that its ongoing marketing efforts will affect the value of the license to Lyon during the five-year license period. Repeat requirements 2 and 3. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 to 4 Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org), Identify the specific citation for accounting for variable consideration arising from sales-based royalties on licenses of intellectual property, and consider the relevant GAAP. When can Tran recognize revenue from salesbased royalties associated with the Lyon license? Requirement Topic Subtopic Section Paragraph Required: 1. Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Identify the specific citation for accounting for variable consideration arising from sales-based royalties on licenses of intellectual property, and consider the relevant GAAP. When can Tran recognize revenue from sales-based royalties associated with the Lyon license? 2. What journal entry would Tran record on April 1, 2018, when it receives the $560,000 payment from Lyon? 3. Assume on December 31, 2018, Tran receives $1,060,000 for all sales-based royalties earned from Lyon in 2018. What journal entry would Tran record on December 31, 2018, to recognize any revenue that should be recognized in 2018 with respect to the Lyon license that it has not already recognized? 4. Assume Tran accounts for the Lyon license as a five-year right to access Tran's symbolic intellectual property from April 1, 2018, through March 31, 2023. Tran expects that its ongoing marketing efforts will affect the value of the license to Lyon during the five-year license period. Repeat requirements 2 and 3. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 to 4 What journal entry would Tran record on April 1, 2018, when it receives the $560,000 payment from Lyon? Assume on December 31, 2016, Tran receives $1,060,000 for all sales-based royalties earned from Lyon in 2018. What journal entry would Tran recont on December 31, 2018, to recognize any revenue that should be recognized in 2018 with respect to the Lyon license that it has not already recognized? Assume Tran accounts for the Lyon license as a five-year right to access Tran's symbolic intellectual property from April 1, 2018, through March 31, 2021. Tran expects that its ongoing marketing efforts will affect the value of the license to Lyon during the five-year license period. Repeat requirements 2 and 3. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) Show less View transaction lit Journal entry worksheet 1 2 3 Record the entry for Tran when the payment is received from Lyon on April 1, 2018 NoteEnter de bore credits Transaction General Journal Debit Credit Required: 1. Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Identify the specific citation for accounting for variable consideration arising from sales-based royalties on licenses of intellectual property, and consider the relevant GAAP. When can Tran recognize revenue from sales-based royalties associated with the Lyon license? 2. What journal entry would Tran record on April 1, 2018, when it receives the $560,000 payment from Lyon? 3. Assume on December 31, 2018, Tran receives $1,060,000 for all sales-based royalties earned from Lyon in 2018. What journal entry would Tran record on December 31, 2018, to recognize any revenue that should be recognized in 2018 with respect to the Lyon license that it has not already recognized? 4. Assume Tran accounts for the Lyon license as a five-year right to access Tran's symbolic intellectual property from April 1, 2018, through March 31, 2023. Tran expects that its ongoing marketing efforts will affect the value of the license to Lyon during the five-year license period. Repeat requirements 2 and 3. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 to 4 What journal entry would Tran record on April 1, 2018, when it receives the $560,000 payment from Lyon? Assume on December 31, 2018, Tran receives $1,060,000 for all sales-based royalties earned from Lyon in 2018. What journal entry would Tran record on December 31, 2018, to recognize any revenue that should be recognized in 2018 with respect to the Lyon license that it has not already recognized? Assume Tran accounts for the Lyon license as a five-year right to access Tran's symbolic intellectual property from April 1, 2018, through March 31, 2021. Tran expects that its ongoing marketing efforts will affect the value of the license to Lyon during the five-year license period. Repeat requirements 2 and 3. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less View transaction fist Journal entry worksheet 1 2 3 4 Record the entry for Tran to recognize any revenue that should be recognized in 2018 with respect to the Lyon license that it has not already recognized Note: Enter debits before credits General Journal Debit Credit Transaction 2 Required: 1. Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Identify the specific citation for accounting for variable consideration arising from sales-based royalties on licenses of intellectual property, and consider the relevant GAAP. When can Tran recognize revenue from sales-based royalties associated with the Lyon license? 2. What journal entry would Tran record on April 1. 2018, when it receives the $560.000 payment from Lyon? 3. Assume on December 31, 2018, Tran receives $1,060,000 for all sales-based royalties earned from Lyon in 2018. What journal entry would Tran record on December 31, 2018, to recognize any revenue that should be recognized in 2018 with respect to the Lyon license that it has not already recognized? 4. Assume Tran accounts for the Lyon license as a five-year right to access Tran's symbolic intellectual property from April 1, 2018, through March 31, 2023. Tran expects that its ongoing marketing efforts will affect the value of the license to Lyon during the five-year license period. Repeat requirements 2 and 3. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 to 4 What journal entry would Tran record on April 1, 2018, when it receives the $560,000 payment from Lyon? Assume on December 31, 2018, Tran receives $1,060,000 for all sales-based royalties earned from Lyon in 2018. What journal entry would Tran record on December 31, 2018, to recognize any revenue that should be recognized in 2018 with respect to the Lyon license that it has not already recognized? Assume Tran accounts for the Lyon license as a five-year right to access Tran's symbolic intellectual property from April 1, 2018, through March 31, 2021. Tran expects that its ongoing marketing efforts will affect the value of the license to Lyon during the five-year license period. Repeat requirements 2 and 3. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) Show less View transaction list Journal entry worksheet 1 2. 3 4 Record the entry for Tran when the payment is received from Lyon on April 1, 2018 under the new assumption. Note: Enter debits before credits Transaction 3 General Journal Debit Credit