please do all parts

please do all parts

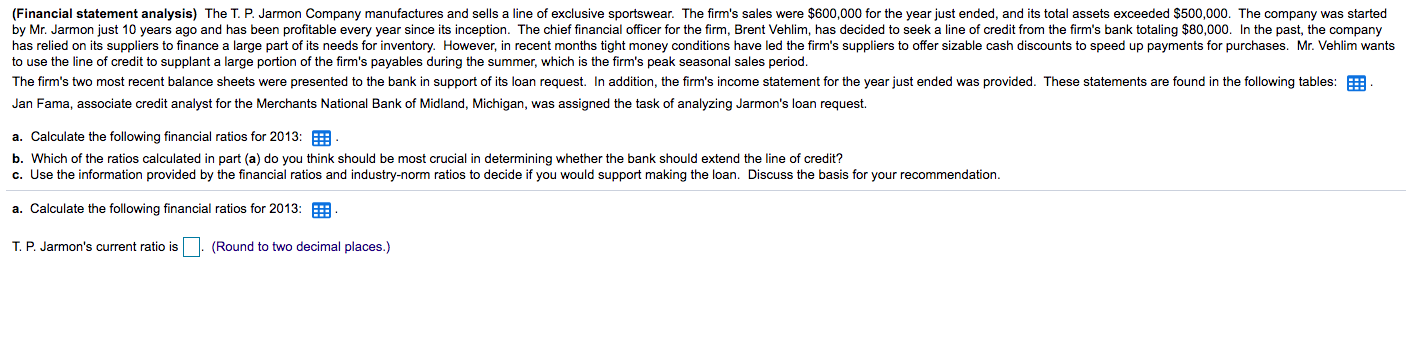

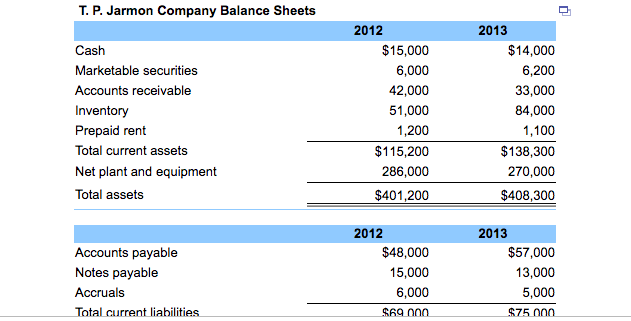

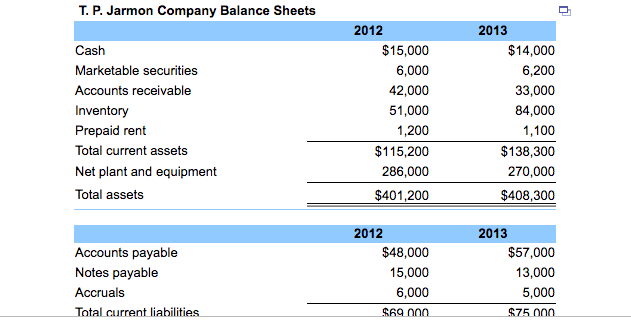

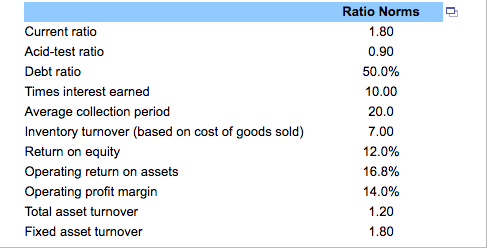

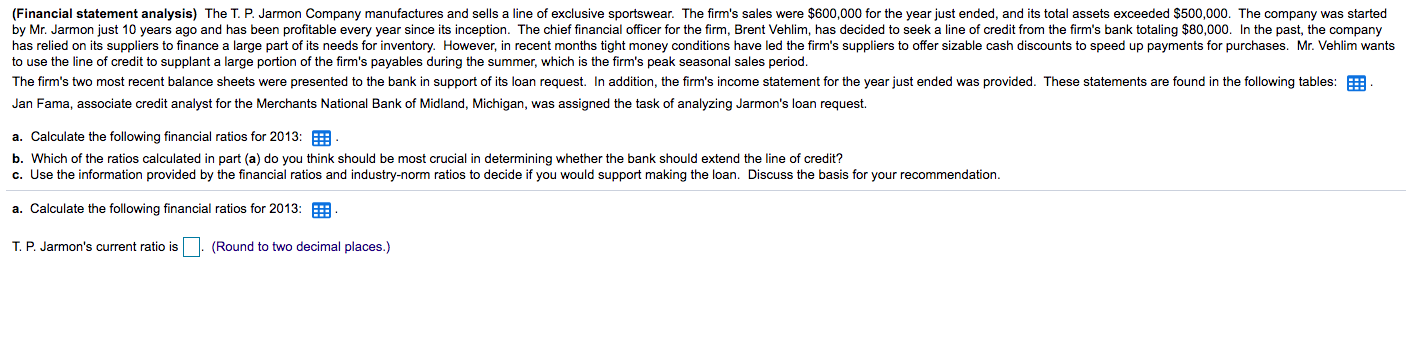

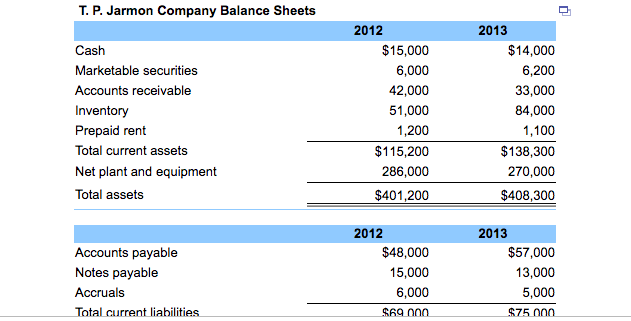

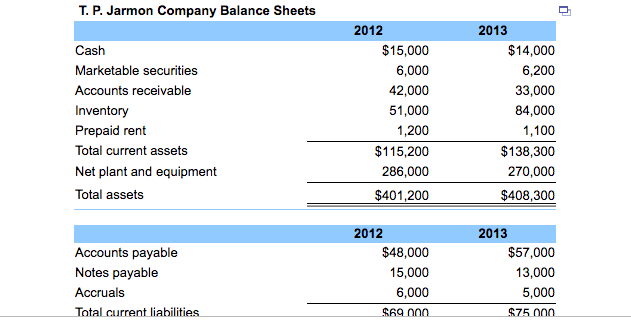

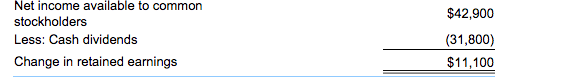

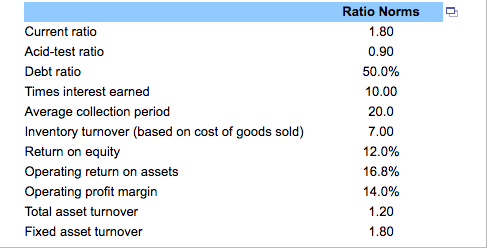

(Financial statement analysis) The T. P. Jarmon Company manufactures and sells a line of exclusive sportswear. The firm's sales were $600,000 for the year just ended, and its total assets exceeded $500,000. The company was started by Mr. Jarmon just 10 years ago and has been profitable every year since its inception. The chief financial officer for the firm, Brent Vehlim, has decided to seek a line of credit from the firm's bank totaling $80,000. In the past, the company has relied on its suppliers to finance a large part of its needs for inventory. However, in recent months tight money conditions have led the firm's suppliers to offer sizable cash discounts to speed up payments for purchases. Mr. Vehlim wants to use the line of credit to supplant a large portion of the firm's payables during the summer, which is the firm's peak seasonal sales period. The firm's two most recent balance sheets were presented to the bank in support of its loan request. In addition, the firm's income statement for the year just ended was provided. These statements are found in the following tables: 5 Jan Fama, associate credit analyst for the Merchants National Bank of Midland, Michigan, was assigned the task of analyzing Jarmon's loan request. a. Calculate the following financial ratios for 2013: : b. Which of the ratios calculated in part (a) do you think should be most crucial in determining whether the bank should extend the line of credit? c. Use the information provided by the financial ratios and industry-norm ratios to decide if you would support making the loan. Discuss the basis for your recommendation. a. Calculate the following financial ratios for 2013: : T. P. Jarmon's current ratio is (Round to two decimal places.) T. P. Jarmon Company Balance Sheets Cash Marketable securities Accounts receivable Inventory Prepaid rent Total current assets Net plant and equipment Total assets 2012 $15,000 6,000 42,000 51,000 1,200 $115,200 286,000 $401,200 2013 $14,000 6,200 33,000 84,000 1,100 $138,300 270,000 $408,300 Accounts payable Notes payable Accruals Total current liabilities 2012 $48,000 15,000 6,000 2013 $57,000 13,000 5,000 $69 000 $75 000 T. P. Jarmon Company Balance Sheets Cash Marketable securities Accounts receivable Inventory Prepaid rent Total current assets Net plant and equipment Total assets 2012 $15,000 6,000 42,000 51,000 1,200 $115,200 286,000 $401,200 2013 $14,000 6,200 33,000 84,000 1,100 $138,300 270,000 $408,300 Accounts payable Notes payable Accruals Total current liabilities 2012 $48,000 15,000 6,000 2013 $57,000 13,000 5,000 $69 000 $75 000 $42,900 Net income available to common stockholders Less: Cash dividends Change in retained earnings (31,800) $11,100 n Current ratio Acid-test ratio Debt ratio Times interest earned Average collection period Inventory turnover (based on cost of goods sold) Return on equity Operating return on assets Operating profit margin Total asset turnover Fixed asset turnover Ratio Norms 1.80 0.90 50.0% 10.00 20.0 7.00 12.0% 16.8% 14.0% 1.20 1.80 (Financial statement analysis) The T. P. Jarmon Company manufactures and sells a line of exclusive sportswear. The firm's sales were $600,000 for the year just ended, and its total assets exceeded $500,000. The company was started by Mr. Jarmon just 10 years ago and has been profitable every year since its inception. The chief financial officer for the firm, Brent Vehlim, has decided to seek a line of credit from the firm's bank totaling $80,000. In the past, the company has relied on its suppliers to finance a large part of its needs for inventory. However, in recent months tight money conditions have led the firm's suppliers to offer sizable cash discounts to speed up payments for purchases. Mr. Vehlim wants to use the line of credit to supplant a large portion of the firm's payables during the summer, which is the firm's peak seasonal sales period. The firm's two most recent balance sheets were presented to the bank in support of its loan request. In addition, the firm's income statement for the year just ended was provided. These statements are found in the following tables: 5 Jan Fama, associate credit analyst for the Merchants National Bank of Midland, Michigan, was assigned the task of analyzing Jarmon's loan request. a. Calculate the following financial ratios for 2013: : b. Which of the ratios calculated in part (a) do you think should be most crucial in determining whether the bank should extend the line of credit? c. Use the information provided by the financial ratios and industry-norm ratios to decide if you would support making the loan. Discuss the basis for your recommendation. a. Calculate the following financial ratios for 2013: : T. P. Jarmon's current ratio is (Round to two decimal places.) T. P. Jarmon Company Balance Sheets Cash Marketable securities Accounts receivable Inventory Prepaid rent Total current assets Net plant and equipment Total assets 2012 $15,000 6,000 42,000 51,000 1,200 $115,200 286,000 $401,200 2013 $14,000 6,200 33,000 84,000 1,100 $138,300 270,000 $408,300 Accounts payable Notes payable Accruals Total current liabilities 2012 $48,000 15,000 6,000 2013 $57,000 13,000 5,000 $69 000 $75 000 T. P. Jarmon Company Balance Sheets Cash Marketable securities Accounts receivable Inventory Prepaid rent Total current assets Net plant and equipment Total assets 2012 $15,000 6,000 42,000 51,000 1,200 $115,200 286,000 $401,200 2013 $14,000 6,200 33,000 84,000 1,100 $138,300 270,000 $408,300 Accounts payable Notes payable Accruals Total current liabilities 2012 $48,000 15,000 6,000 2013 $57,000 13,000 5,000 $69 000 $75 000 $42,900 Net income available to common stockholders Less: Cash dividends Change in retained earnings (31,800) $11,100 n Current ratio Acid-test ratio Debt ratio Times interest earned Average collection period Inventory turnover (based on cost of goods sold) Return on equity Operating return on assets Operating profit margin Total asset turnover Fixed asset turnover Ratio Norms 1.80 0.90 50.0% 10.00 20.0 7.00 12.0% 16.8% 14.0% 1.20 1.80

please do all parts

please do all parts