Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do all parts in 30 minutes please urgently... I'll give you up thumb definitely BALANCE SHEET CASH AND MARKETABLE SECURITIES ACCOUNTS RECEIVABLE INVENTORIES 2020

please do all parts in 30 minutes please urgently... I'll give you up thumb definitely

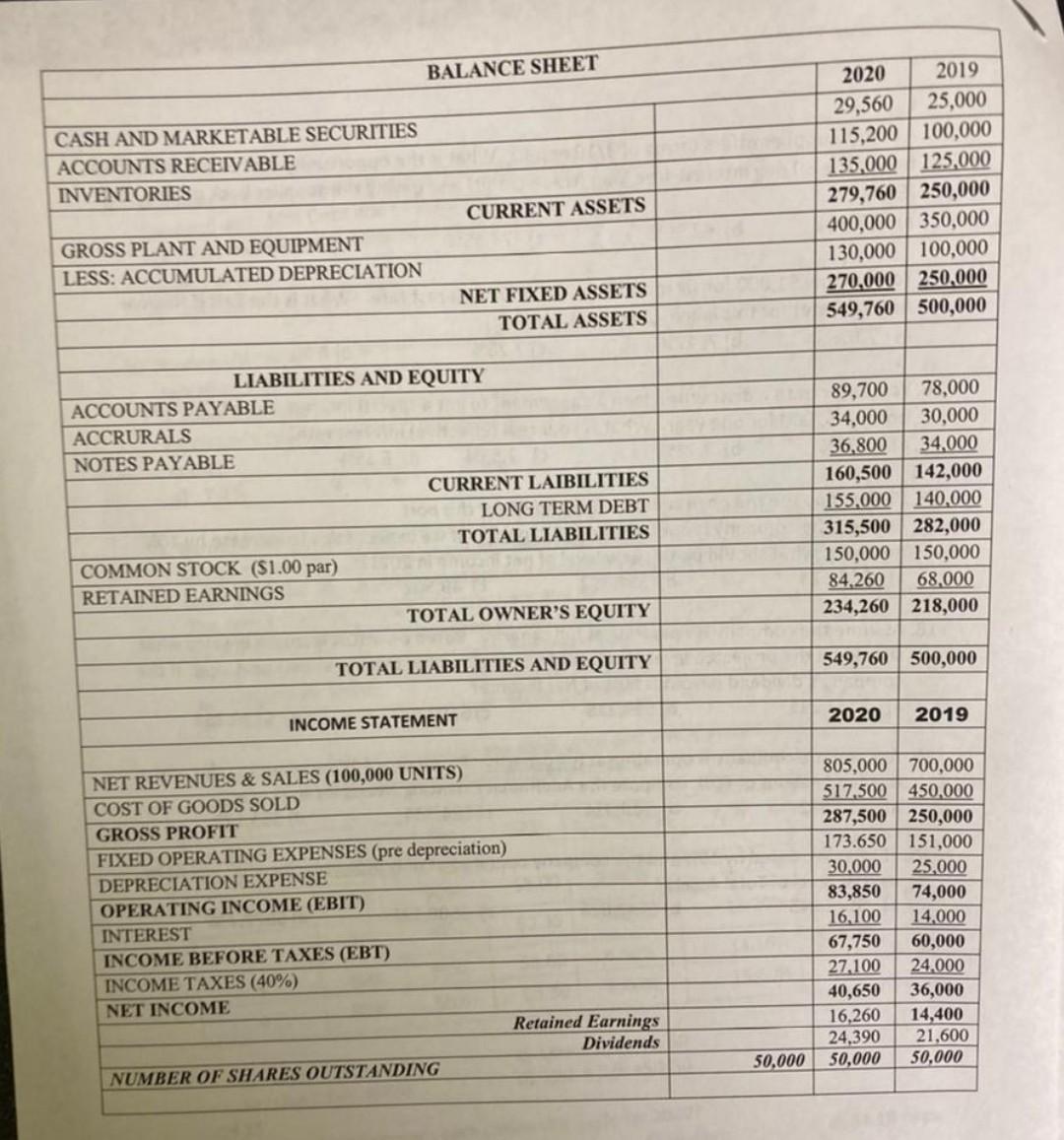

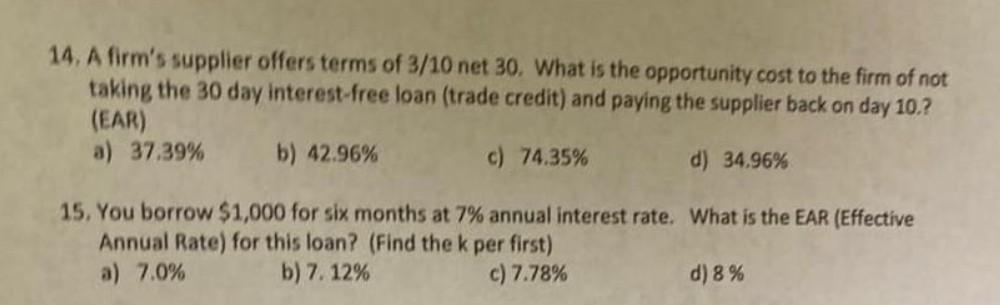

BALANCE SHEET CASH AND MARKETABLE SECURITIES ACCOUNTS RECEIVABLE INVENTORIES 2020 2019 29,560 25,000 115,200 100,000 135,000 125.000 279,760 250,000 400,000 350,000 130,000 100,000 270,000 250.000 549,760 500,000 CURRENT ASSETS GROSS PLANT AND EQUIPMENT LESS: ACCUMULATED DEPRECIATION NET FIXED ASSETS TOTAL ASSETS LIABILITIES AND EQUITY ACCOUNTS PAYABLE ACCRURALS NOTES PAYABLE CURRENT LAIBILITIES LONG TERM DEBT TOTAL LIABILITIES COMMON STOCK ($1.00 par) RETAINED EARNINGS TOTAL OWNER'S EQUITY 89,700 78,000 34,000 30,000 36,800 34,000 160,500 142,000 155,000 140,000 315,500 282,000 150,000 | 150,000 84.260 68,000 234,260 218,000 TOTAL LIABILITIES AND EQUITY 549,760 500,000 2020 2019 INCOME STATEMENT NET REVENUES & SALES (100,000 UNITS) COST OF GOODS SOLD GROSS PROFIT FIXED OPERATING EXPENSES (pre depreciation) DEPRECIATION EXPENSE OPERATING INCOME (EBIT) INTEREST INCOME BEFORE TAXES (EBT) INCOME TAXES (40%) NET INCOME Retained Earnings Dividends NUMBER OF SHARES OUTSTANDING 805,000 700,000 517,500 450,000 287,500 250,000 173.650 151,000 30,000 25,000 83,850 74,000 16,100 14,000 67,750 60,000 27.100 24.000 40,650 36,000 16,260 14,400 24,390 21,600 50,000 50,000 NI 50,000 14. A firm's supplier offers terms of 3/10 net 30. What is the opportunity cost to the firm of not taking the 30 day interest-free loan (trade credit) and paying the supplier back on day 10.? (EAR) a) 37.39% b) 42.96% c) 74.35% 34.96% 15. You borrow $1,000 for six months at 7% annual interest rate. What is the EAR (Effective Annual Rate) for this loan? (Find the k per first) a) 7.0% b) 7. 12% c) 7.78% d) 8 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started