Please do all parts, thank you.

Please do all parts, thank you.

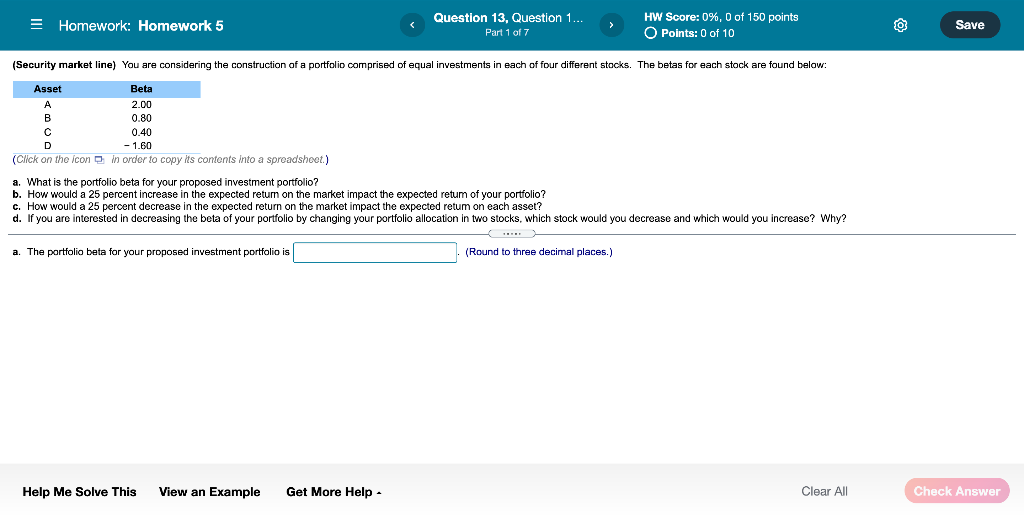

Homework: Homework 5 Question 13, Question 1... Part 1 of 7 HW Score: 0%, 0 of 150 points O Points: 0 of 10 O Save (Security market line) You are considering the construction of a portfolio comprised of equal investments in each of four different stocks. The betas for each stock are found below: A B C Asset Beta 2.00 0.80 0.40 - 1.60 (Click on the icon in order to copy its contents into a spreadshoct.) What is the portfolio beta for your proposed investment portfolio? b. How would a 25 percent increase in the expected return on the market impact the expected retum of your portfolio? c. How would a 25 percent decrease in the expected return on the market impact the expected retum on each asset? d. If you are interested in decreasing the beta of your portfolio by changing your portfolio allocation in two stocks, which stock would you decrease and which would you increase? Why? a. The portfolio beta for your proposed investment portfolio is (Round to three decimal places.) Help Me Solve This View an Example Get More Help Clear All Check Answer Homework: Homework 5 Question 13, Question 1... Part 1 of 7 HW Score: 0%, 0 of 150 points O Points: 0 of 10 O Save (Security market line) You are considering the construction of a portfolio comprised of equal investments in each of four different stocks. The betas for each stock are found below: A B C Asset Beta 2.00 0.80 0.40 - 1.60 (Click on the icon in order to copy its contents into a spreadshoct.) What is the portfolio beta for your proposed investment portfolio? b. How would a 25 percent increase in the expected return on the market impact the expected retum of your portfolio? c. How would a 25 percent decrease in the expected return on the market impact the expected retum on each asset? d. If you are interested in decreasing the beta of your portfolio by changing your portfolio allocation in two stocks, which stock would you decrease and which would you increase? Why? a. The portfolio beta for your proposed investment portfolio is (Round to three decimal places.) Help Me Solve This View an Example Get More Help Clear All Check

Please do all parts, thank you.

Please do all parts, thank you.