Please do all parts.Thanks

Please do all parts.Thanks

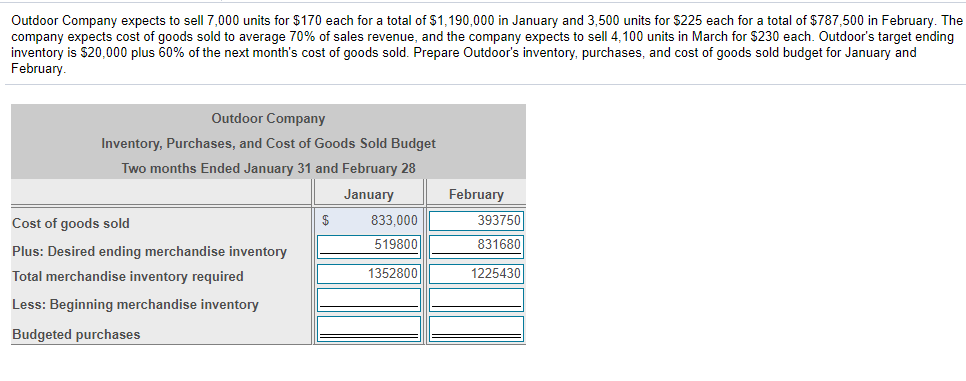

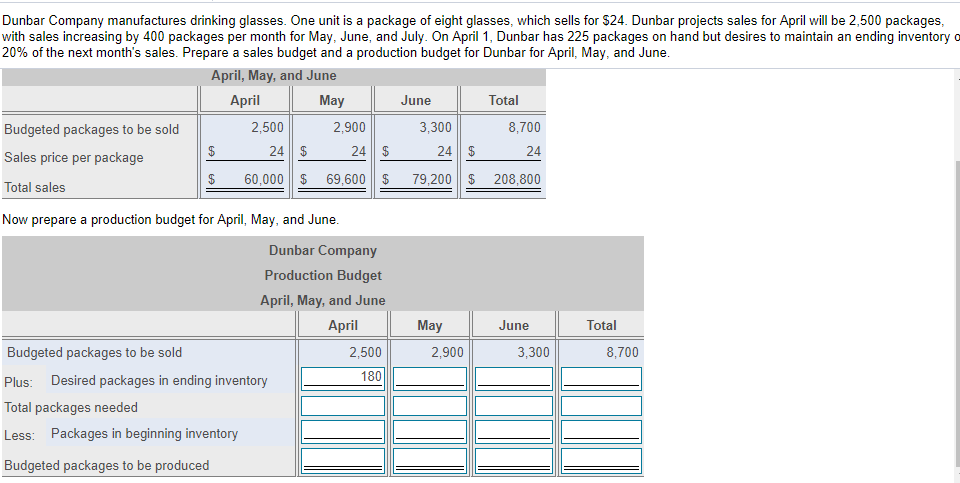

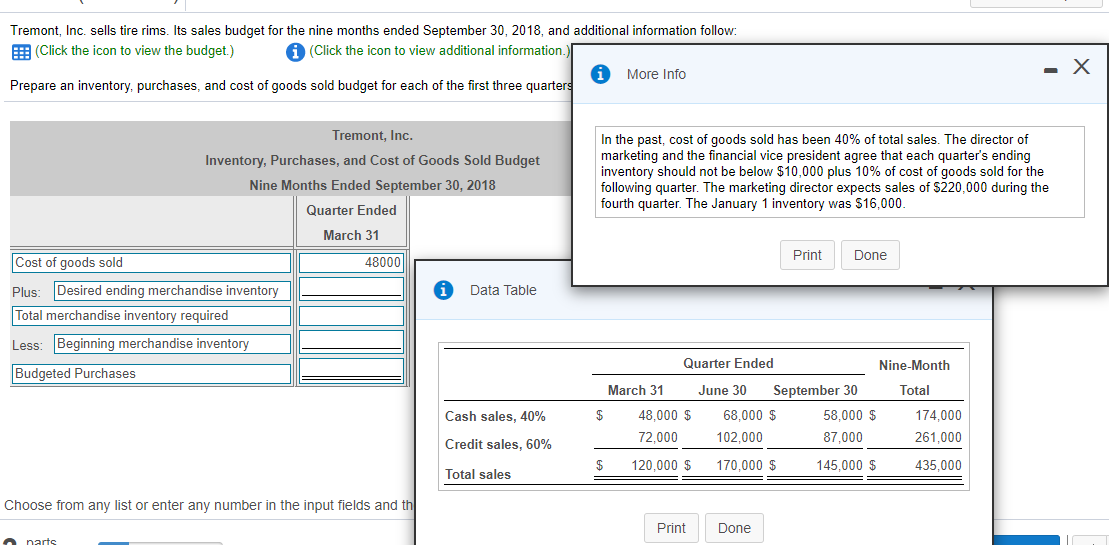

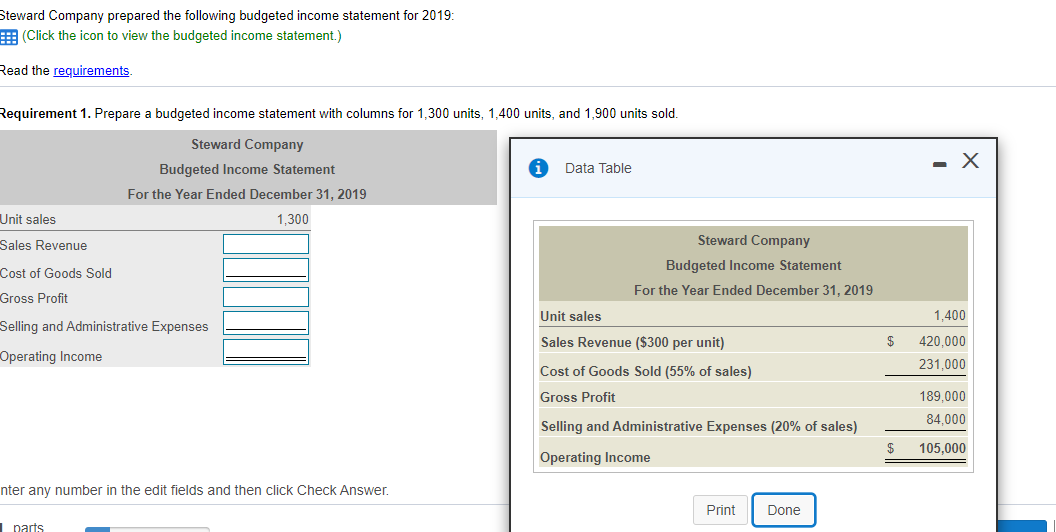

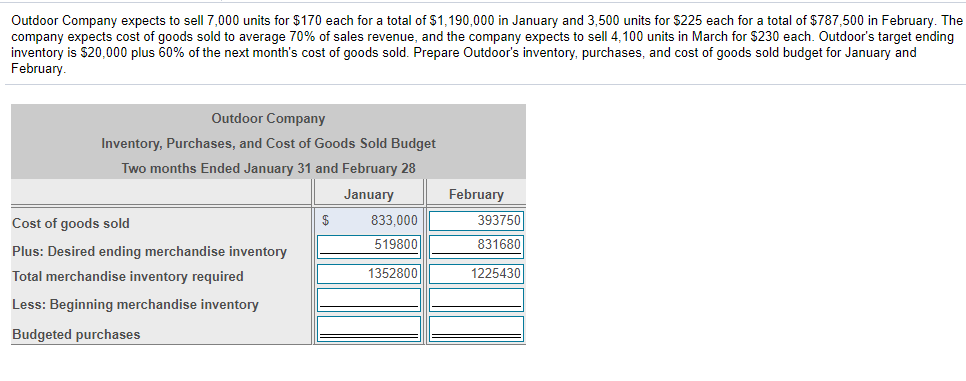

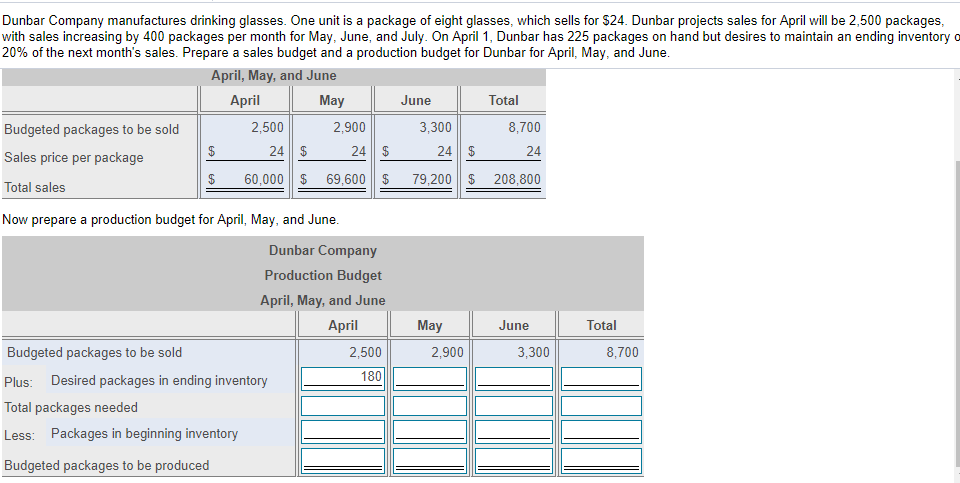

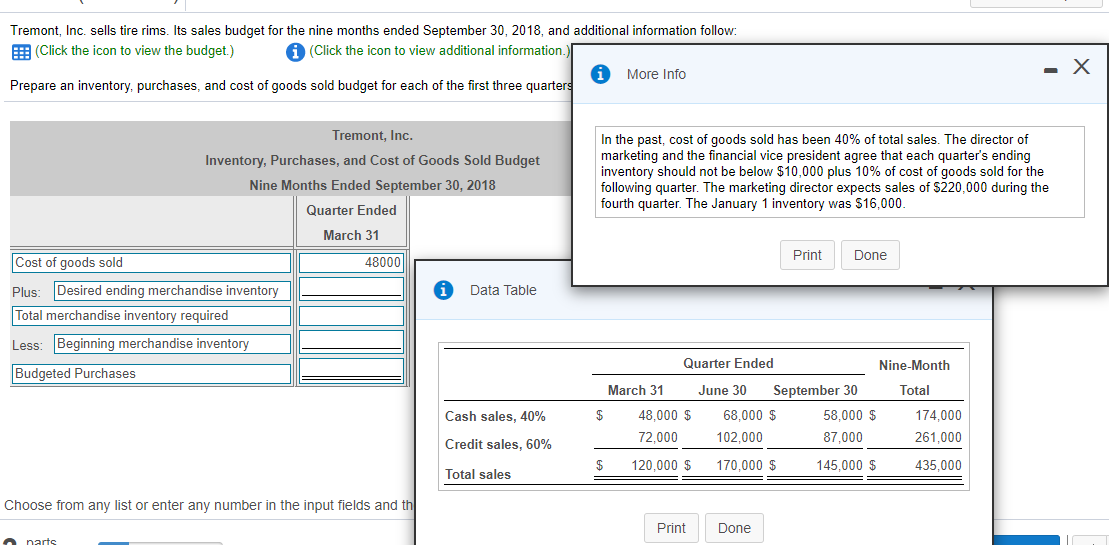

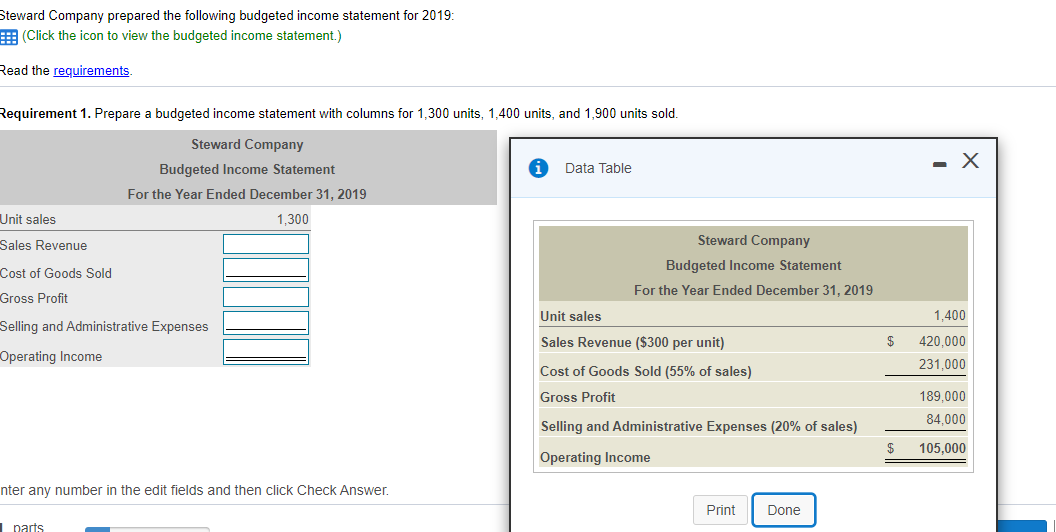

Outdoor Company expects to sell 7,000 units for $170 each for a total of $1,190,000 in January and 3,500 units for $225 each for a total of $787,500 in February. The company expects cost of goods sold to average 70% of sales revenue, and the company expects to sell 4.100 units in March for $230 each. Outdoor's target ending inventory is $20,000 plus 60% of the next month's cost of goods sold. Prepare Outdoor's inventory, purchases, and cost of goods sold budget for January and February February 393750 Outdoor Company Inventory, Purchases, and Cost of Goods Sold Budget Two months Ended January 31 and February 28 January $ Cost of goods sold 833,000 519800 Plus: Desired ending merchandise inventory Total merchandise inventory required 1352800 Less: Beginning merchandise inventory Budgeted purchases 831680 1225430 Dunbar Company manufactures drinking glasses. One unit is a package of eight glasses, which sells for $24. Dunbar projects sales for April will be 2,500 packages, with sales increasing by 400 packages per month for May, June and July. On April 1, Dunbar has 225 packages on hand but desires to maintain an ending inventory 20% of the next month's sales. Prepare a sales budget and a production budget for Dunbar for April, May, and June. April, May, and June April May June Total Budgeted packages to be sold 2,500 2,900 3,300 8,700 Sales price per package 24 | $ 24 | $ 24 $ 24 Total sales 60,000 $ 69,600 || $ 79,200 208.800 Now prepare a production budget for April, May, and June. Dunbar Company Production Budget April, May, and June April Budgeted packages to be sold 2,500 180 Plus: Desired packages in ending inventory Total packages needed Less: Packages in beginning inventory June Total May 2,900 3,300 8,700 Budgeted packages to be produced Tremont, Inc. sells tire rims. Its sales budget for the nine months ended September 30, 2018, and additional information follow. (Click the icon to view the budget.) (Click the icon to view additional information. More Info Prepare an inventory, purchases, and cost of goods sold budget for each of the first three quarters - X Tremont, Inc. Inventory, Purchases, and Cost of Goods Sold Budget Nine Months Ended September 30, 2018 Quarter Ended In the past, cost of goods sold has been 40% of total sales. The director of marketing and the financial vice president agree that each quarter's ending inventory should not be below $10,000 plus 10% of cost of goods sold for the following quarter. The marketing director expects sales of $220,000 during the fourth quarter. The January 1 inventory was $16,000. March 31 Print Done 48000 Data Table Cost of goods sold Plus: Desired ending merchandise inventory Total merchandise inventory required Less: Beginning merchandise inventory Budgeted Purchases Quarter Ended Nine-Month March 31 June 30 September 30 Total $ 48,000 $ 68,000 $ 58,000 $ 174.000 72,000 102,000 87,000 261,000 Cash sales, 40% Credit sales, 60% $ 120,000 $ 170,000 $ Total sales 145,000 $ 435,000 Choose from any list or enter any number in the input fields and th Print Done n narts Steward Company prepared the following budgeted income statement for 2019: Click the icon to view the budgeted income statement.) Read the requirements Requirement 1. Prepare a budgeted income statement with columns for 1,300 units, 1,400 units, and 1,900 units sold. Steward Company Budgeted Income Statement For the Year Ended December 31, 2019 Data Table -X Unit sales 1,300 Sales Revenue Steward Company Budgeted Income Statement For the Year Ended December 31, 2019 Cost of Goods Sold Gross Profit Unit sales 1,400 Selling and Administrative Expenses $ Operating Income Sales Revenue ($300 per unit) Cost of Goods Sold (55% of sales) Gross Profit 420,000 231,000 189,000 84,000 Selling and Administrative Expenses (20% of sales) $ 105,000 Operating Income nter any number in the edit fields and then click Check Answer. Print Done parts

Please do all parts.Thanks

Please do all parts.Thanks