Answered step by step

Verified Expert Solution

Question

1 Approved Answer

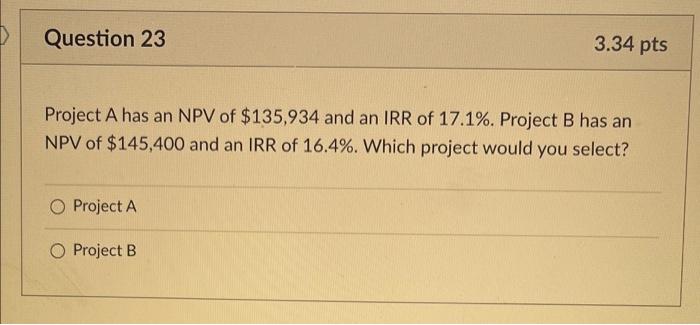

please do all thank you Question 23 3.34 pts Project A has an NPV of $135,934 and an IRR of 17.1%. Project B has an

please do all thank you

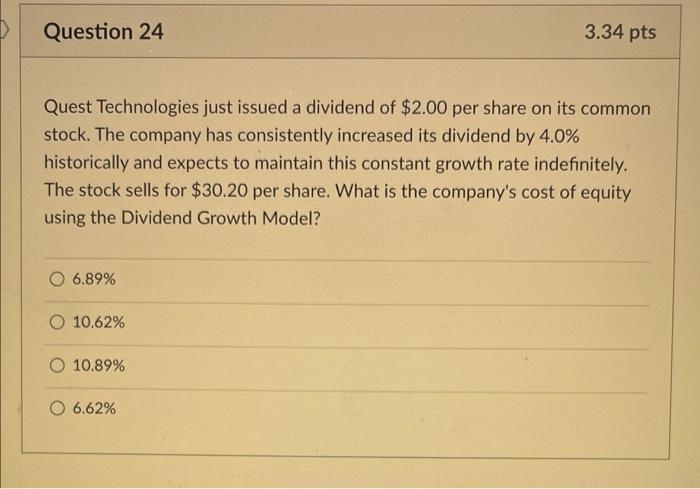

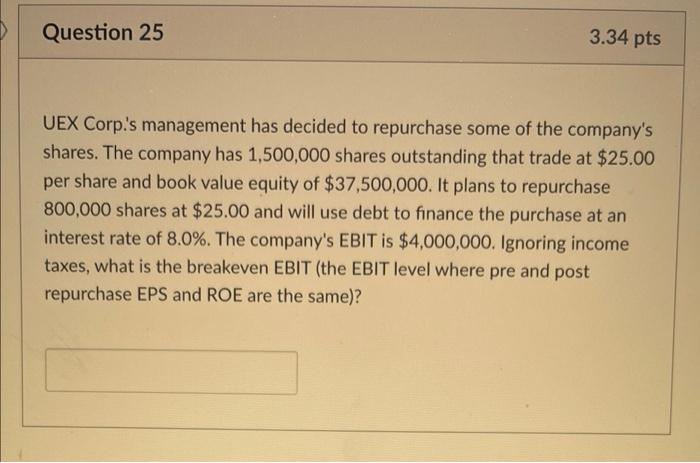

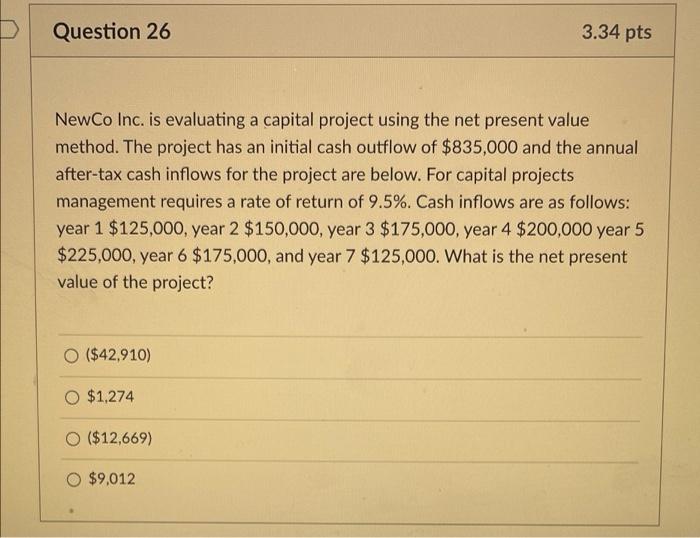

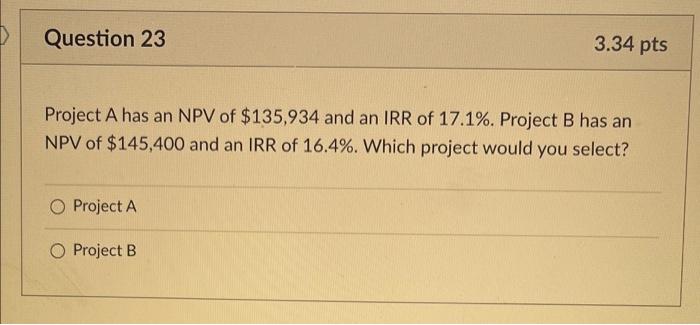

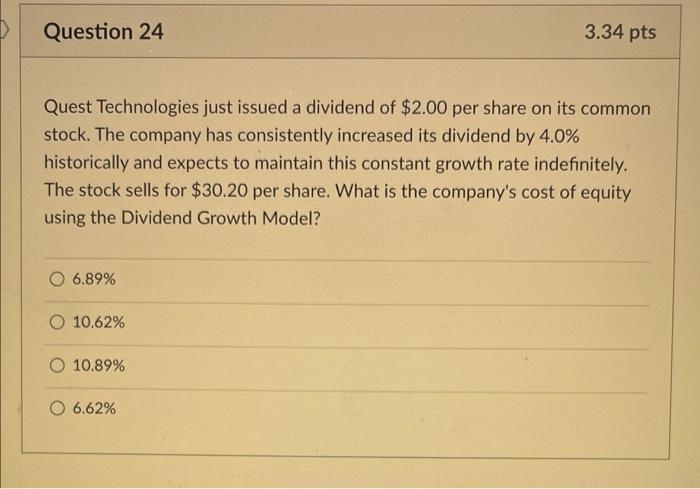

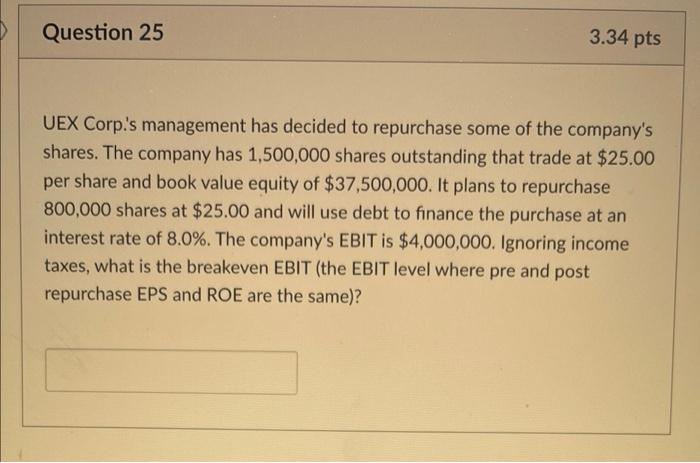

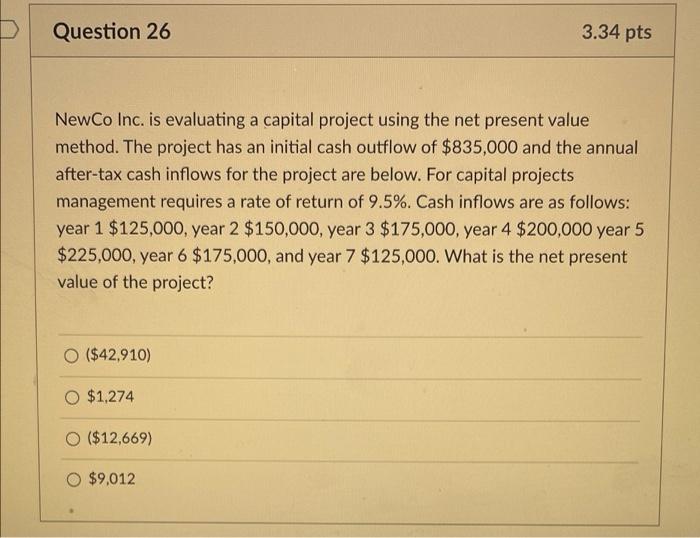

Question 23 3.34 pts Project A has an NPV of $135,934 and an IRR of 17.1%. Project B has an NPV of $145,400 and an IRR of 16.4%. Which project would you select? O Project A O Project B Question 24 3.34 pts Quest Technologies just issued a dividend of $2.00 per share on its common stock. The company has consistently increased its dividend by 4.0% historically and expects to maintain this constant growth rate indefinitely. The stock sells for $30.20 per share. What is the company's cost of equity using the Dividend Growth Model? O 6.89% 10.62% O 10.89% O 6.62% Question 25 3.34 pts UEX Corp.'s management has decided to repurchase some of the company's shares. The company has 1,500,000 shares outstanding that trade at $25.00 per share and book value equity of $37,500,000. It plans to repurchase 800,000 shares at $25.00 and will use debt to finance the purchase at an interest rate of 8.0%. The company's EBIT is $4,000,000. Ignoring income taxes, what is the breakeven EBIT (the EBIT level where pre and post repurchase EPS and ROE are the same)? > Question 26 3.34 pts NewCo Inc. is evaluating a capital project using the net present value method. The project has an initial cash outflow of $835,000 and the annual after-tax cash inflows for the project are below. For capital projects management requires a rate of return of 9.5%. Cash inflows are as follows: year 1 $125,000, year 2 $150,000, year 3 $175,000, year 4 $200,000 year 5 $225,000, year 6 $175,000, and year 7 $125,000. What is the net present value of the project? O ($42,910) $1,274 O ($12,669) $9,012 Question 23 3.34 pts Project A has an NPV of $135,934 and an IRR of 17.1%. Project B has an NPV of $145,400 and an IRR of 16.4%. Which project would you select? O Project A O Project B Question 24 3.34 pts Quest Technologies just issued a dividend of $2.00 per share on its common stock. The company has consistently increased its dividend by 4.0% historically and expects to maintain this constant growth rate indefinitely. The stock sells for $30.20 per share. What is the company's cost of equity using the Dividend Growth Model? O 6.89% 10.62% O 10.89% O 6.62% Question 25 3.34 pts UEX Corp.'s management has decided to repurchase some of the company's shares. The company has 1,500,000 shares outstanding that trade at $25.00 per share and book value equity of $37,500,000. It plans to repurchase 800,000 shares at $25.00 and will use debt to finance the purchase at an interest rate of 8.0%. The company's EBIT is $4,000,000. Ignoring income taxes, what is the breakeven EBIT (the EBIT level where pre and post repurchase EPS and ROE are the same)? > Question 26 3.34 pts NewCo Inc. is evaluating a capital project using the net present value method. The project has an initial cash outflow of $835,000 and the annual after-tax cash inflows for the project are below. For capital projects management requires a rate of return of 9.5%. Cash inflows are as follows: year 1 $125,000, year 2 $150,000, year 3 $175,000, year 4 $200,000 year 5 $225,000, year 6 $175,000, and year 7 $125,000. What is the net present value of the project? O ($42,910) $1,274 O ($12,669) $9,012

Question 23 3.34 pts Project A has an NPV of $135,934 and an IRR of 17.1%. Project B has an NPV of $145,400 and an IRR of 16.4%. Which project would you select? O Project A O Project B Question 24 3.34 pts Quest Technologies just issued a dividend of $2.00 per share on its common stock. The company has consistently increased its dividend by 4.0% historically and expects to maintain this constant growth rate indefinitely. The stock sells for $30.20 per share. What is the company's cost of equity using the Dividend Growth Model? O 6.89% 10.62% O 10.89% O 6.62% Question 25 3.34 pts UEX Corp.'s management has decided to repurchase some of the company's shares. The company has 1,500,000 shares outstanding that trade at $25.00 per share and book value equity of $37,500,000. It plans to repurchase 800,000 shares at $25.00 and will use debt to finance the purchase at an interest rate of 8.0%. The company's EBIT is $4,000,000. Ignoring income taxes, what is the breakeven EBIT (the EBIT level where pre and post repurchase EPS and ROE are the same)? > Question 26 3.34 pts NewCo Inc. is evaluating a capital project using the net present value method. The project has an initial cash outflow of $835,000 and the annual after-tax cash inflows for the project are below. For capital projects management requires a rate of return of 9.5%. Cash inflows are as follows: year 1 $125,000, year 2 $150,000, year 3 $175,000, year 4 $200,000 year 5 $225,000, year 6 $175,000, and year 7 $125,000. What is the net present value of the project? O ($42,910) $1,274 O ($12,669) $9,012 Question 23 3.34 pts Project A has an NPV of $135,934 and an IRR of 17.1%. Project B has an NPV of $145,400 and an IRR of 16.4%. Which project would you select? O Project A O Project B Question 24 3.34 pts Quest Technologies just issued a dividend of $2.00 per share on its common stock. The company has consistently increased its dividend by 4.0% historically and expects to maintain this constant growth rate indefinitely. The stock sells for $30.20 per share. What is the company's cost of equity using the Dividend Growth Model? O 6.89% 10.62% O 10.89% O 6.62% Question 25 3.34 pts UEX Corp.'s management has decided to repurchase some of the company's shares. The company has 1,500,000 shares outstanding that trade at $25.00 per share and book value equity of $37,500,000. It plans to repurchase 800,000 shares at $25.00 and will use debt to finance the purchase at an interest rate of 8.0%. The company's EBIT is $4,000,000. Ignoring income taxes, what is the breakeven EBIT (the EBIT level where pre and post repurchase EPS and ROE are the same)? > Question 26 3.34 pts NewCo Inc. is evaluating a capital project using the net present value method. The project has an initial cash outflow of $835,000 and the annual after-tax cash inflows for the project are below. For capital projects management requires a rate of return of 9.5%. Cash inflows are as follows: year 1 $125,000, year 2 $150,000, year 3 $175,000, year 4 $200,000 year 5 $225,000, year 6 $175,000, and year 7 $125,000. What is the net present value of the project? O ($42,910) $1,274 O ($12,669) $9,012

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started