please do all the cases

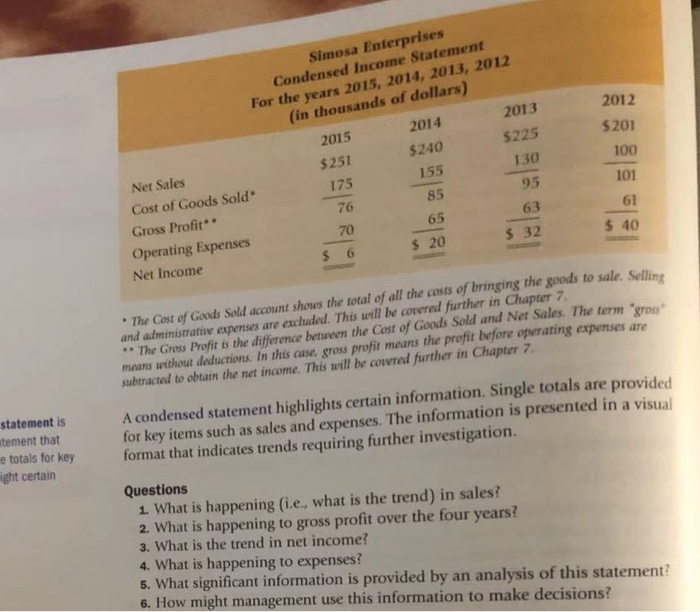

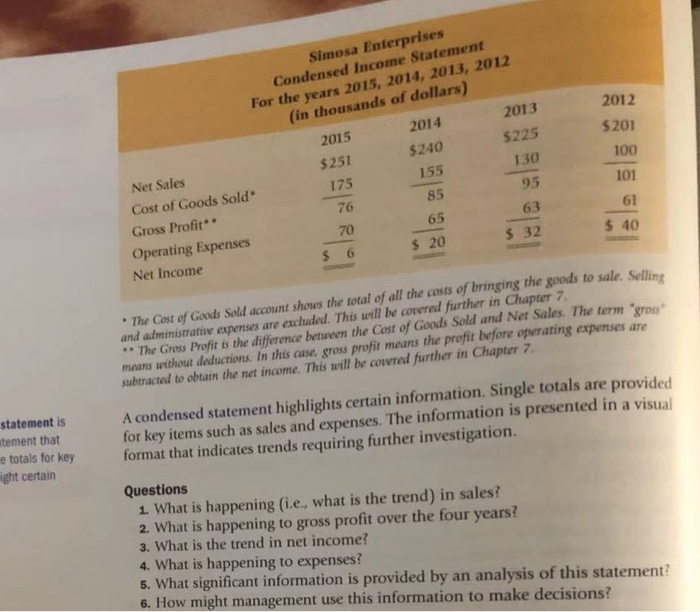

CASE 1 Ethics Case-Recording Transactions National Products is a very large manufacturer of household products. It has several factories that produce items sold by 45 branch offices located throughout the country. As an incentive for the branch managers, a bonus is offered if yearly budgeted net income figures are exceeded. You are the accountant for a branch office of National Products. The branch manager is Suzanne Dorelle. You are aware that Suzanne has obtained a new posi tion and plans to leave National Products early in January. Late in December, she instructs you to omit from your records several large expenses, including insurance overtime pay for December, and fuel and hydro costs. She tells you to pay these expenses as usual in December, but to delay recording the items until some time in the new year Questions 1 What will be the effect of not recording the expenses in December? 2. What would you do? What are your alternatives? What are the consequences of each alternative? 3. Which standard is involved in this case? CASE 2 Accounting Standards-Income Statement Analysis You are the loan manager for a bank. A business customer, Wireless Network Devices, has applied for a loan to expand its business. In support of the loan appli cation, the company has supplied an income statement for the last six months that shows a net income of $12 000. The following factors were not considered in the preparation of the income statement Salaries of $3000 are owed to workers for last month but have not been paid or recorded as an expense. Interest of $1000 is owed to another bank and has not been recorded. Questions 1 What effect does the omission of these two items have on the firm's net income? 2. What is the correct net income? 3. What accounting standard has not been followed? CASE 3 Interpreting Accounting Data One of the purposes of accounting is to provide information for decision making Having knowledge of accounting is important for other users besides accountants. Others who benefit from having a background in accounting are bankers, inves. tors, credit managers, business managers, owners, and government employees such as taxation workers. They all use their knowledge of accounting to analyze data and then make decisions about the business. Assume you are the manager of this company. Simosa Enterprises' condensed income statements for four years are shown on the next page. Simosa Enterprises Condensed Income Statement For the years 2015, 2014, 2013, 2012 (in thousands of dollars) 2012 2013 $201 2015 2014 $240 155 $225 130 $251 100 101 175 95 76 Net Sales Cost of Goods Sold Gross Profit Operating Expenses Net Income 65 $ 20 $ 32 $ 40 $ 6 The Cost of Goods Sold account shows the total of all the costs of bringing the goods to sale. Selline and administrative expenses are excluded. This will be covered further in Chapter 7. *The Gross Profit is the difference between the Cost of Goods Sold and Ner Sales. The term gros maarts without deductions. In this case, gross profit means the profit before operating expenses are subtracted to obtain the net income. This will be covered further in Chapter 7 statement is utement that e totals for key ight certain A condensed statement highlights certain information. Single totals are provided for key items such as sales and expenses. The information is presented in a visual format that indicates trends requiring further investigation. Questions 1. What is happening (i.e., what is the trend) in sales?! 2. What is happening to gross profit over the four years? 3. What is the trend in net income? 4. What is happening to expenses? 5. What significant information is provided by an analysis of this statement? 6. How might management use this information to make decisions

please do all the cases

please do all the cases