Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do all the forms Gross Income Exclusions and Deductions for ACI X CUMULATIVE PROBLEM 2 (CHAPTERS 1-4) Use the following information to prepare the

please do all the forms

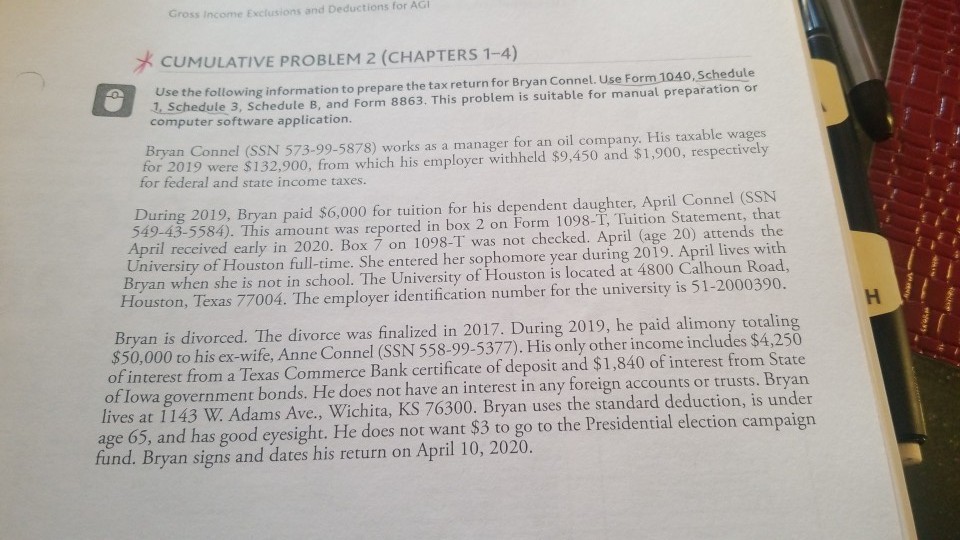

Gross Income Exclusions and Deductions for ACI X CUMULATIVE PROBLEM 2 (CHAPTERS 1-4) Use the following information to prepare the tax return for Bryan Connel. Use Form 1040, Schedule 7. Schedule 3, Schedule B, and Form 8863. This problem is suitable for manual preparation or computer software application. Bryan Connel (SSN 573-99-5878) works as a manager for an oil company. His taxable wages for 2019 were $132,900, from which his employer withheld $9,450 and $1,900, respectively for federal and state income taxes. During 2019, Bryan paid $6,000 for tuition for his dependent daughter, April Connel (SSN 549-43-5584). This amount was reported in box 2 on Form 1098-T, Tuition Statement, that April received early in 2020. Box 7 on 1098-T was not checked. April (age 20) attends the University of Houston full-time. She entered her sophomore year during 2019. April lives with Bryan when she is not in school. The University of Houston is located at 4800 Calhoun Road, Houston, Texas 77004. The employer identification number for the university is 51-2000390. Bryan is divorced. The divorce was finalized in 2017. During 2019, he paid alimony totaling $50,000 to his ex-wife, Anne Connel (SSN 558-99-5377). His only other income includes $4,250 of interest from a Texas Commerce Bank certificate of deposit and $1,840 of interest from State of Iowa government bonds. He does not have an interest in any foreign accounts or trusts. Bryan lives at 1143 W. Adams Ave., Wichita, KS 76300. Bryan uses the standard deduction, is under age 65, and has good eyesight. He does not want $3 to go to the Presidential election campaign fund. Bryan signs and dates his return on April 10, 2020. Gross Income Exclusions and Deductions for ACI X CUMULATIVE PROBLEM 2 (CHAPTERS 1-4) Use the following information to prepare the tax return for Bryan Connel. Use Form 1040, Schedule 7. Schedule 3, Schedule B, and Form 8863. This problem is suitable for manual preparation or computer software application. Bryan Connel (SSN 573-99-5878) works as a manager for an oil company. His taxable wages for 2019 were $132,900, from which his employer withheld $9,450 and $1,900, respectively for federal and state income taxes. During 2019, Bryan paid $6,000 for tuition for his dependent daughter, April Connel (SSN 549-43-5584). This amount was reported in box 2 on Form 1098-T, Tuition Statement, that April received early in 2020. Box 7 on 1098-T was not checked. April (age 20) attends the University of Houston full-time. She entered her sophomore year during 2019. April lives with Bryan when she is not in school. The University of Houston is located at 4800 Calhoun Road, Houston, Texas 77004. The employer identification number for the university is 51-2000390. Bryan is divorced. The divorce was finalized in 2017. During 2019, he paid alimony totaling $50,000 to his ex-wife, Anne Connel (SSN 558-99-5377). His only other income includes $4,250 of interest from a Texas Commerce Bank certificate of deposit and $1,840 of interest from State of Iowa government bonds. He does not have an interest in any foreign accounts or trusts. Bryan lives at 1143 W. Adams Ave., Wichita, KS 76300. Bryan uses the standard deduction, is under age 65, and has good eyesight. He does not want $3 to go to the Presidential election campaign fund. Bryan signs and dates his return on April 10, 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started