please do all the t accounts...

all the journal entried are correct so use that to do the t accounts.

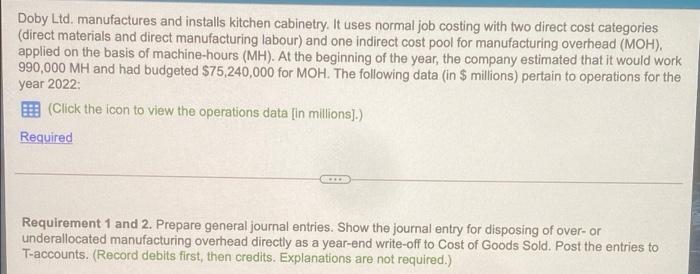

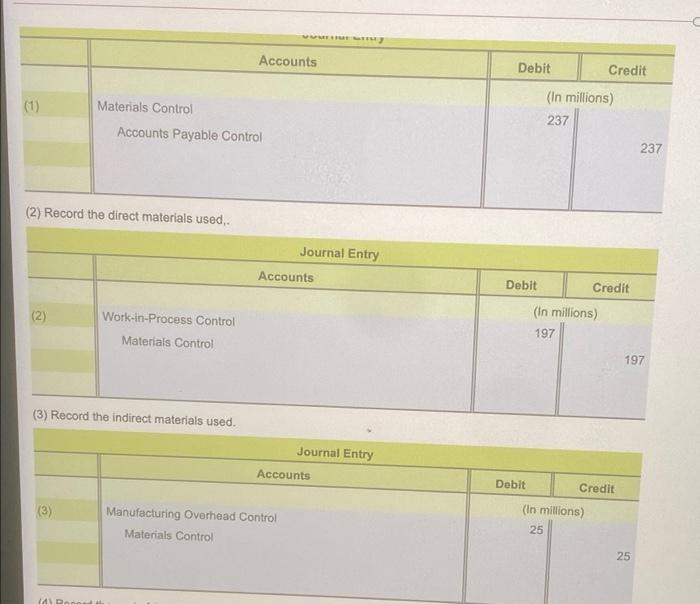

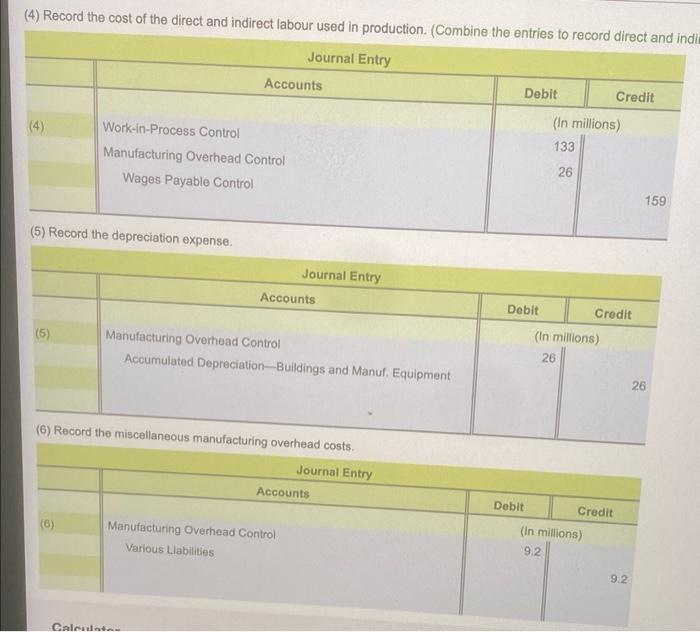

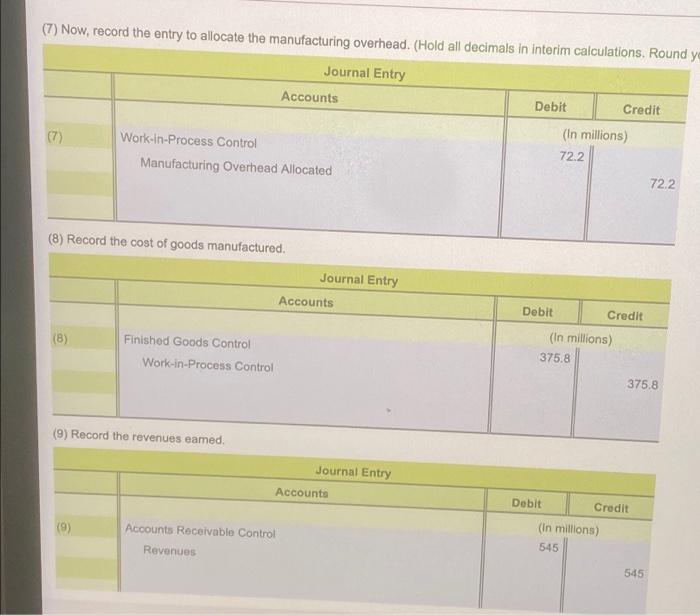

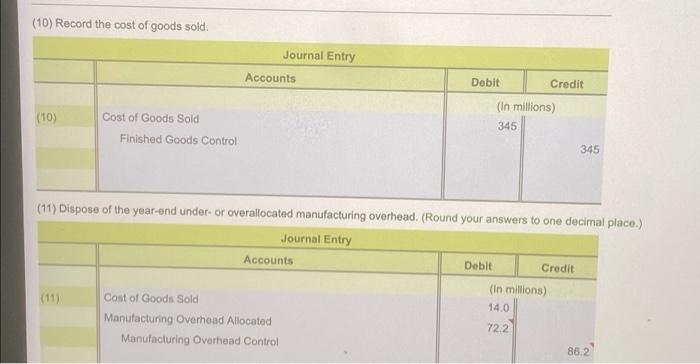

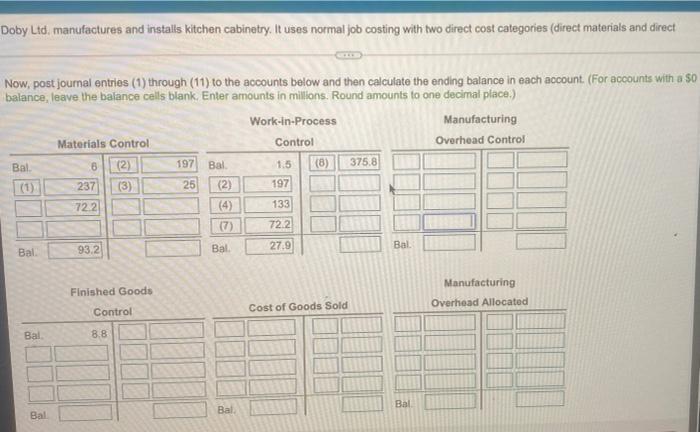

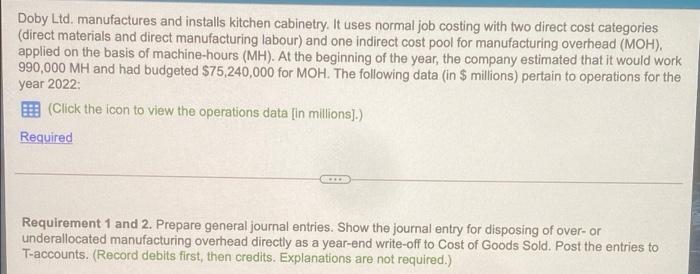

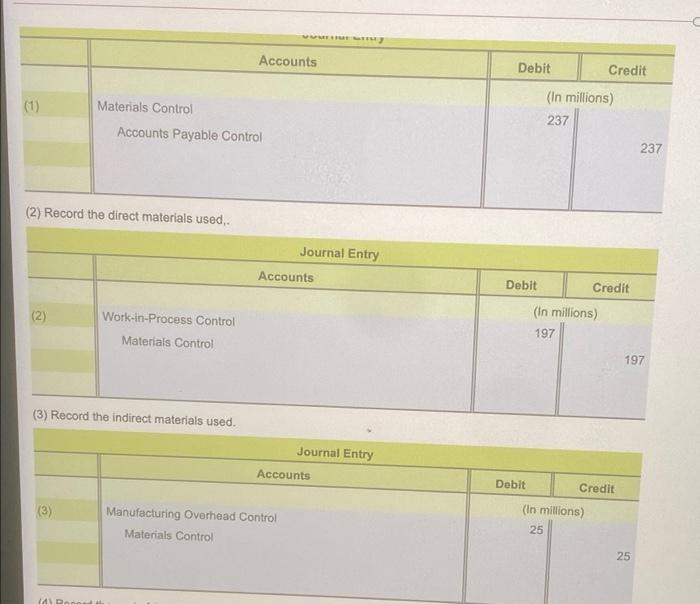

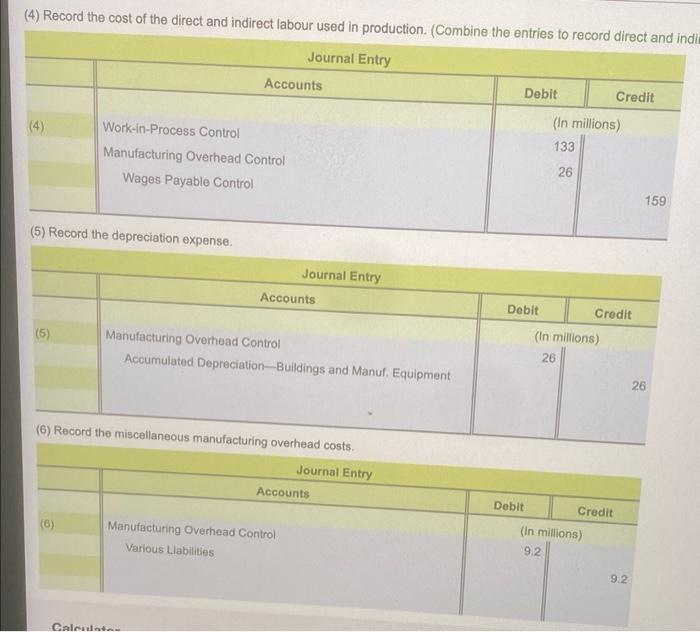

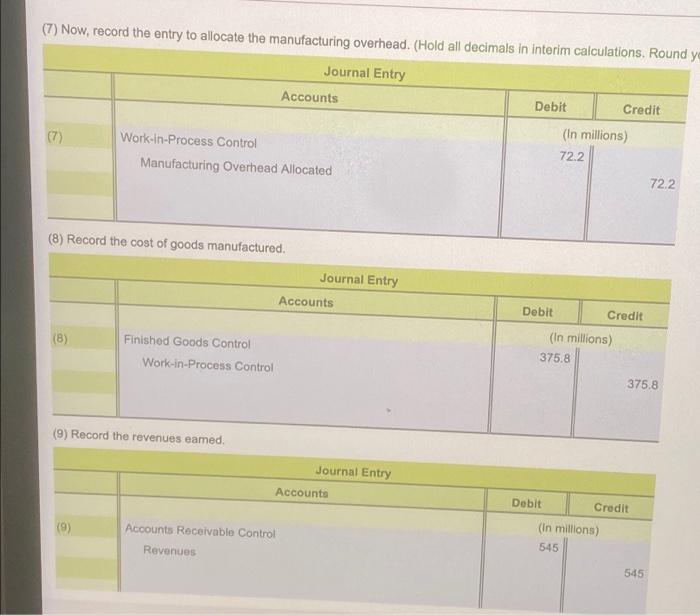

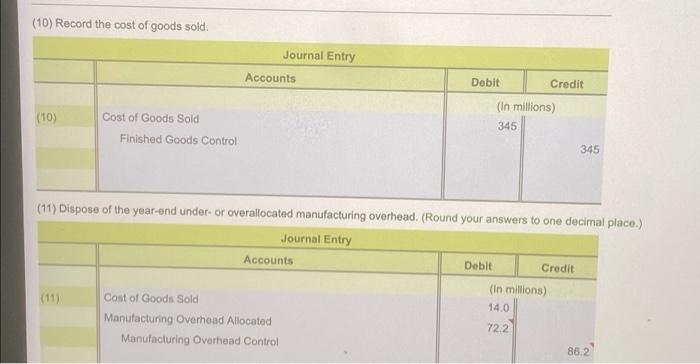

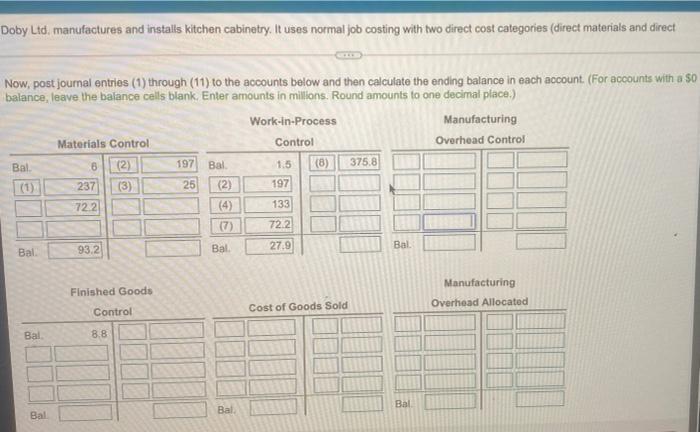

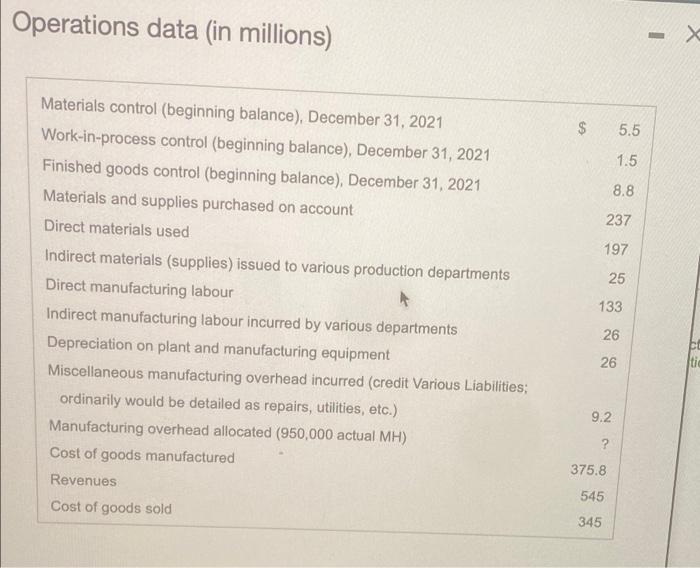

Doby Ltd. manufactures and installs kitchen cabinetry. It uses normal job costing with two direct cost categories (direct materials and direct manufacturing labour) and one indirect cost pool for manufacturing overhead (MOH), applied on the basis of machine-hours (MH). At the beginning of the year , the company estimated that it would work 990,000 MH and had budgeted $75,240,000 for MOH. The following data (in $ millions) pertain to operations for the year 2022 E (Click the icon to view the operations data (in millions).) Required Requirement 1 and 2. Prepare general journal entries. Show the journal entry for disposing of over-or underallocated manufacturing overhead directly as a year-end write-off to Cost of Goods Sold. Post the entries to T-accounts. (Record debits first, then credits. Explanations are not required.) Accounts Debit Credit (1) Materials Control Accounts Payable Control (In millions) 237 237 (2) Record the direct materials used, Journal Entry Accounts Debit Credit (In millions) 197 (2) Work-in-Process Control Materials Control 197 (3) Record the indirect materials used. Journal Entry Accounts (3) Manufacturing Overhead Control Materials Control Debit Credit (In millions) 25 25 ID (4) Record the cost of the direct and indirect labour used in production. (Combine the entries to record direct and indi Journal Entry Accounts Debit Credit (In millions) (4) Work-in-Process Control 133 Manufacturing Overhead Control 26 Wages Payable Control 159 (5) Record the depreciation expense. Journal Entry Accounts Debit Credit (5) Manufacturing Overhead Control Accumulated Depreciation-Buildings and Manul Equipment (In millions) 26 26 (6) Record the miscellaneous manufacturing overhead costs Journal Entry Accounts Debit Credit (6) Manufacturing Overhead Control Various Llabilities (In millions) 9.2 9.2 Calculate (7) Now, record the entry to allocate the manufacturing overhead. (Hold all decimals in interim calculations, Round y Journal Entry Accounts Debit Credit (In millions) (7) Work-in-Process Control 72.2 Manufacturing Overhead Allocated 722 (8) Record the cost of goods manufactured, Journal Entry Accounts Debit Credit (8) Finished Goods Control Work-in-Process Control (In millions) 375.8 375.8 (9) Record the revenues eamed. Journal Entry Accounts (9) Accounts Receivable Control Revenues Dobit Credit (In millions) 545 545 (10) Record the cost of goods sold. Journal Entry Accounts Dobit Credit (10) Cost of Goods Sold (In millions) 345 Finished Goods Control 345 (11) Dispose of the year-end under-or overallocated manufacturing overhead. (Round your answers to one decimal place.) Journal Entry Accounts Debit Credit (In millions) Cost of Goods Sold 14.0 Manufacturing Overhead Allocated 722 Manufacturing Overhead Control 86.2 Doby Ltd, manufactures and installs kitchen cabinetry. It uses normal job costing with two direct cost categories (direct materials and direct Now, post journal entries (1) through (11) to the accounts below and then calculate the ending balance in each account. (For accounts with a 50 balance, leave the balance cells blank Enter amounts in millions. Round amounts to one decimal place) Work-in-Process Manufacturing Materials Control Control Overhead Control Bal (2) 197 Bal 1.5 (8) 375.8 237 (3) 25 (2) 197 8 722 (4) 133 (7) 72.2 Bal 93.2 Bal Bal 27.9 Finished Goods Manufacturing Overhead Allocated Control Cost of Goods Sold Bal 8.8 Bal Bal Bal Operations data (in millions) X CA $ 5.5 1.5 8.8 237 197 25 Materials control (beginning balance), December 31, 2021 Work-in-process control (beginning balance), December 31, 2021 Finished goods control (beginning balance), December 31, 2021 Materials and supplies purchased on account Direct materials used Indirect materials (supplies) issued to various production departments Direct manufacturing labour Indirect manufacturing labour incurred by various departments Depreciation on plant and manufacturing equipment Miscellaneous manufacturing overhead incurred (credit Various Liabilities: ordinarily would be detailed as repairs, utilities, etc.) Manufacturing overhead allocated (950,000 actual MH) Cost of goods manufactured Revenues Cost of goods sold 133 26 26 9.2 ? 375.8 545 345