Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do all three parts. Trompa Plc is a large UK-based company and deals with a variety of suppliers in India (where the currency is

please do all three parts.

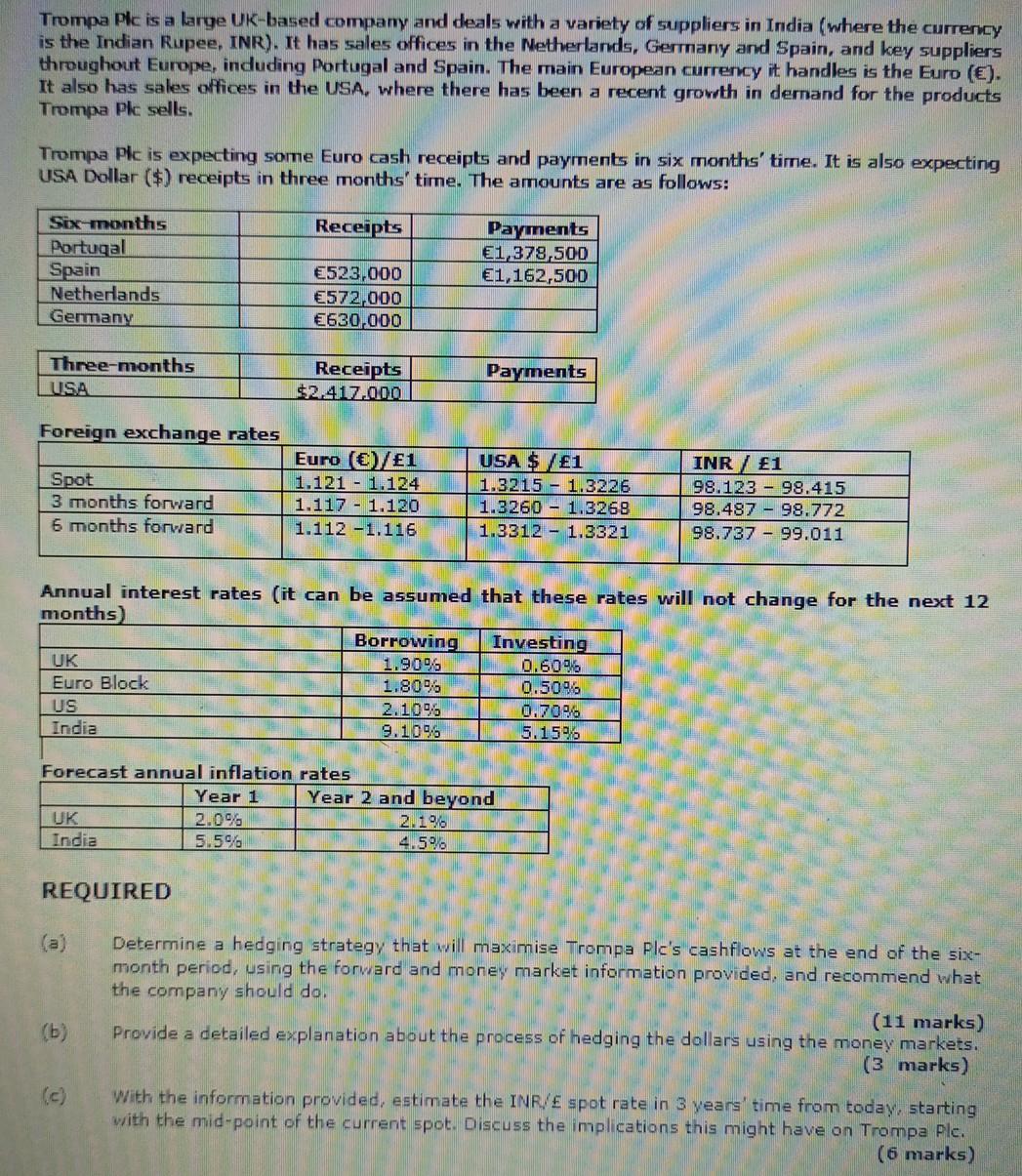

Trompa Plc is a large UK-based company and deals with a variety of suppliers in India (where the currency is the Indian Rupee, INR). It has sales offices in the Netherlands, Germany and Spain, and key suppliers throughout Europe, induding Portugal and Spain. The main European currency it handles is the Euro (). It also has sales offices in the USA, where there has been a recent growth in demand for the products Trompa Plc sells. Trompa Plc is expecting some Euro cash receipts and payments in six months' time. It USA Dollar ($) receipts in three months' time. The amounts are as follows: also expecting Receipts Six months Portugal Spain Netherlands Germany Payments 1,379,500 1,162,500 523,000 572,000 630,000 Three-months USA Receipts $2,417.000 Payments Foreign exchange rates Spot 3 months forward 6 months forward Euro 1 1.121 - 1.124 1.117 - 1.120 1.112 -1.116 USA $ /1 1.3215 1.3226 1.3260 - 1.3269 1.3312 - 1.3321 INR 1 98.123 - 98.415 98.487 - 98.772 98.737 - 99.011 Annual interest rates (it can be assumed that these rates will not change for the next 12 months) Borrowing Investing UK 1.900. 0.60% Euro Block 1.8096 0.5096 US 2.10% 0.70% India 9.106 5.15% Forecast annual inflation rates Year 1 Year 2 and beyond UK 2.0 2.1% India 5.5% 4.5% REQUIRED (b) Determine a hedging strategy that will maximise Trompa Plc's cashflows at the end of the six- month period, using the forward and money market information provided, and recommend what the company should do. (11 marks) Provide a detailed explanation about the process of hedging the dollars using the money markets. (3 marks) With the information provided, estimate the INR/E spot rate in 3 years' time from today, starting with the mid-point of the current spot. Discuss the implications this might have on Trompa Ple. (6 marks) Trompa Plc is a large UK-based company and deals with a variety of suppliers in India (where the currency is the Indian Rupee, INR). It has sales offices in the Netherlands, Germany and Spain, and key suppliers throughout Europe, induding Portugal and Spain. The main European currency it handles is the Euro (). It also has sales offices in the USA, where there has been a recent growth in demand for the products Trompa Plc sells. Trompa Plc is expecting some Euro cash receipts and payments in six months' time. It USA Dollar ($) receipts in three months' time. The amounts are as follows: also expecting Receipts Six months Portugal Spain Netherlands Germany Payments 1,379,500 1,162,500 523,000 572,000 630,000 Three-months USA Receipts $2,417.000 Payments Foreign exchange rates Spot 3 months forward 6 months forward Euro 1 1.121 - 1.124 1.117 - 1.120 1.112 -1.116 USA $ /1 1.3215 1.3226 1.3260 - 1.3269 1.3312 - 1.3321 INR 1 98.123 - 98.415 98.487 - 98.772 98.737 - 99.011 Annual interest rates (it can be assumed that these rates will not change for the next 12 months) Borrowing Investing UK 1.900. 0.60% Euro Block 1.8096 0.5096 US 2.10% 0.70% India 9.106 5.15% Forecast annual inflation rates Year 1 Year 2 and beyond UK 2.0 2.1% India 5.5% 4.5% REQUIRED (b) Determine a hedging strategy that will maximise Trompa Plc's cashflows at the end of the six- month period, using the forward and money market information provided, and recommend what the company should do. (11 marks) Provide a detailed explanation about the process of hedging the dollars using the money markets. (3 marks) With the information provided, estimate the INR/E spot rate in 3 years' time from today, starting with the mid-point of the current spot. Discuss the implications this might have on Trompa Ple. (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started