Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do an example of each and show me how you get your answer so I can figure out how to do the rest. For

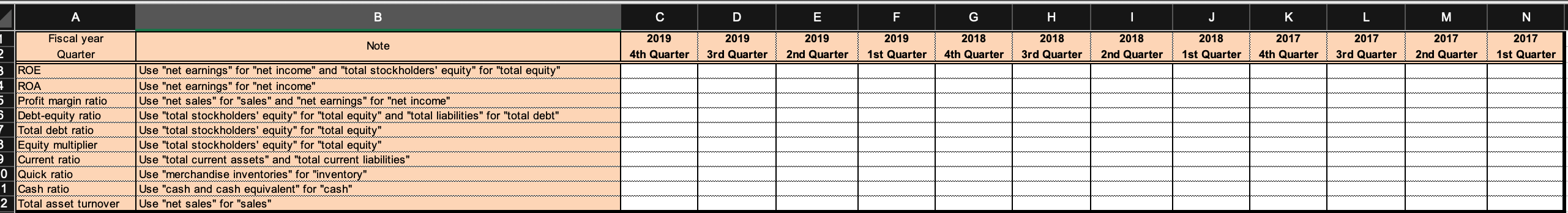

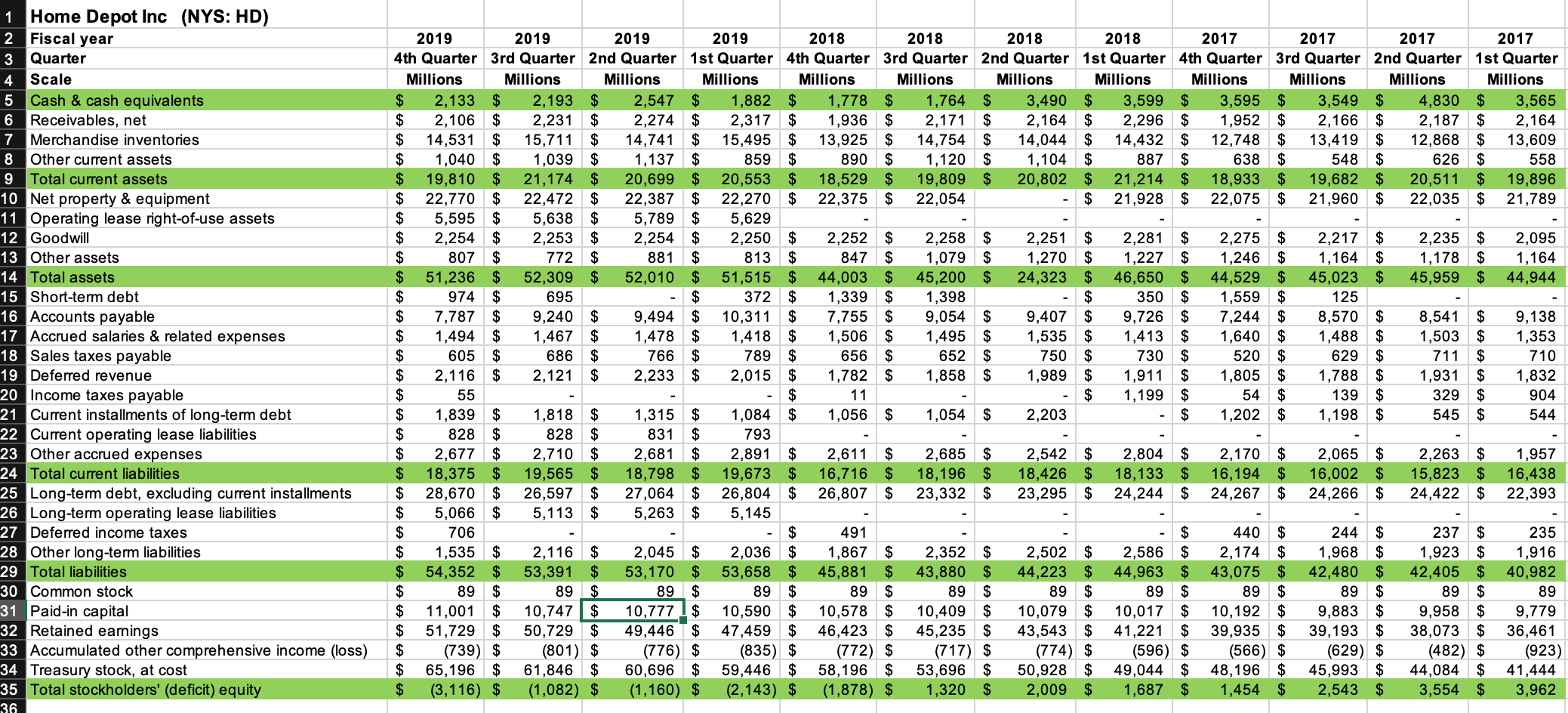

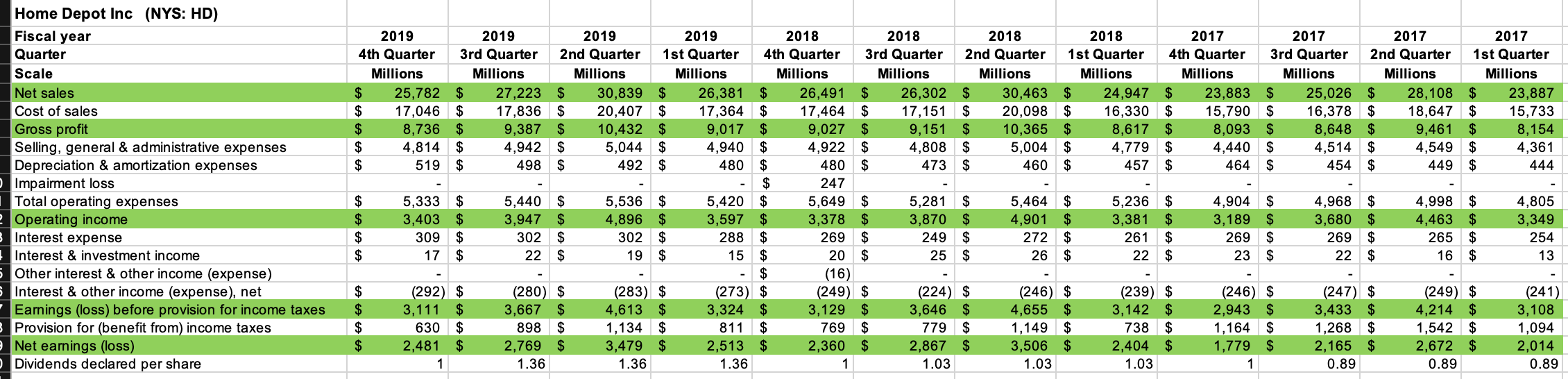

Please do an example of each and show me how you get your answer so I can figure out how to do the rest. For example, just stay in 2019 4th Quarter column and find ROE, ROA, Profit margin ratio, debt-equity ratio, total debt ratio, equity multiplier, current ratio, quick ratio, cash ratio, and total asset turnover. Thanks!

A - B C D E F G H J L M N Note 2019 4th Quarter 2019 3rd Quarter 2019 2nd Quarter 2019 1st Quarter 2018 4th Quarter 2018 3rd Quarter 2018 2nd Quarter 2018 1st Quarter 2017 4th Quarter 2017 3rd Quarter 2017 2nd Quarter 2017 1st Quarter 10 3 UI Fiscal year Quarter ROE ROA Profit margin ratio 5 Debt-equity ratio Total debt ratio 3 Equity multiplier Current ratio 0 Quick ratio 1 Cash ratio 2 Total asset turnover Use "net earnings" for "net income" and "total stockholders' equity" for "total equity" Use "net earnings" for "net income" Use "net sales" for "sales" and "net earnings" for "net income" Use "total stockholders' equity" for "total equity" and "total liabilities" for "total debt". Use "total stockholders' equity" for "total equity" Use "total stockholders' equity" for "total equity". Use "total current assets" and "total current liabilities" Use "merchandise inventories" for "inventory" Use "cash and cash equivalent" for "cash" Use "net sales" for "sales" $ 1 Home Depot Inc (NYS: HD) 2 Fiscal year 3 Quarter 4 Scale 5 Cash & cash equivalents 6 Receivables, net 7 Merchandise inventories 8 Other current assets 9 Total current assets 10 Net property & equipment 11 Operating lease right-of-use assets 12 Goodwill 13 Other assets 14 Total assets 15 Short-term debt 16 Accounts payable 17 Accrued salaries & related expenses 18 Sales taxes payable 19 Deferred revenue 20 Income taxes payable 21 Current installments of long-term debt 22 Current operating lease liabilities 23 Other accrued expenses 24 Total current liabilities 25 Long-term debt, excluding current installments 26 Long-term operating lease liabilities 27 Deferred income taxes 28 Other long-term liabilities 29 Total liabilities 30 Common stock 31 Paid-in capital 32 Retained earnings 33 Accumulated other comprehensive income (loss) 34 Treasury stock, at cost 35 Total stockholders' (deficit) equity 36 A A 2019 2019 2019 2019 2018 2018 2018 2018 2017 2017 2017 2017 4th Quarter 3rd Quarter 2nd Quarter 1st Quarter 4th Quarter 3rd Quarter 2nd Quarter 1st Quarter 4th Quarter 3rd Quarter 2nd Quarter 1st Quarter Millions Millions Millions Millions Millions Millions Millions Millions Millions Millions Millions Millions $ 2,133 $ 2,193 $ 2,547 $ 1,882 $ 1,778 $ 1,764 $ 3,490 $ 3,599 $ 3,595 $ 3,549 $ 4,830 $ 3,565 $ 2,106 $ 2,231 $ 2,274 $ 2,317 $ 1,936 $ 2,171 $ 2,164 $ 2,296 $ 1,952 $ 2,166 $ 2,187 $ 2,164 $ 14,531 $ 15,711 $ 14,741 $ 15,495 $ 13,925 $ 14,754 $ 14,044 $ 14,432 $ 12,748 $ 13,419 $ 12,868 $ 13,609 $ 1,040 $ 1,039 $ 1,137 $ 859 $ 890 $ 1,120 $ 1,104 $ 887 $ 638 $ 548 $ 626 $ 558 $ 19,810 $ 21,174 $ 20,699 $ 20,553 $ 18,529 $ 19,809 $ 20,802 $ 21,214 $ 18,933 $ 19,682 $ 20,511 $ 19,896 $ 22,770 $ 22,472 $ 22,387 $ 22,270 $ 22,375 $ 22,054 $ 21,928 $ 22,075 $ 21,960 $ 22,035 $ 21,789 $ 5,595 $ 5,638 $ 5,789 $ 5,629 $ 2,254 $ 2,253 $ 2,254 $ 2,250 $ 2,252 2,258 $ 2,251 $ 2,281 $ 2,275 $ 2,217 $ 2,235 $ 2,095 $ 807 $ 772 $ 881 $ 813 $ 847 $ 1,079 $ 1,270 $ 1,227 $ 1,246 $ 1,164 $ 1,178 $ 1,164 $ 51,236 $ 52,309 $ 52,010 $ 51,515 $ 44,003 45,200 $ 24,323 $ 46,650 $ 44,529 $ 45,023 $ 45,959 $ 44,944 $ 974 $ 695 $ 372 $ 1,339 1,398 350 $ 1,559 $ 125 $ 7,787 $ 9,240 $ 9,494 $ 10,311 $ 7,755 $ 9,054 $ 9,407 $ 9,726 $ 7,244 $ 8,570 $ 8,541 $ 9,138 $ 1,494 $ 1,467 $ 1,478 $ 1,418 $ 1,506 1,495 $ 1,535 $ 1,413 $ 1,640 $ 1,488 $ 1,503 $ 1,353 $ 605 $ 686 $ 766 $ 789 $ 656 652 $ 750 $ 730 $ 520 629 $ 711 $ 710 $ 2,116 $ 2,121 $ 2,233 $ 2,015 $ 1,782 $ 1,858 $ 1,989 $ 1,911 $ 1,805 $ 1,788 $ 1,931 $ 1,832 $ 55 $ 11 $ 1,199 $ 54 $ 139 $ 329 $ 904 $ 1,839 $ 1,818 $ 1,315 $ 1,084 $ 1,056 $ 1,054 $ 2,203 $ 1,202 $ 1,198 $ 545 $ 544 $ 828 $ 828 $ 831 $ 793 $ 2,677 $ 2,710 $ 2,681 $ 2,891 $ 2,611 $ 2,685 $ 2,542 $ 2,804 $ 2,170 $ 2,065 $ 2,263 $ 1,957 $ 18,375 $ 19,565 $ 18,798 $ 19,673 $ 16,716 $ 18,196 $ 18,426 $ 18,133 $ 16,194 $ 16,002 $ 15,823 $ 16,438 $ 28,670 $ 26,597 $ 27,064 $ 26,804 26,807 $ 23,332 $ 23,295 $ 24,244 $ 24,267 $ 24,266 $ 24,422 $ 22,393 $ 5,066 $ 5,113 $ 5,263 $ 5,145 $ 706 491 $ 440 $ 244 $ 237 $ 235 $ 1,535 $ 2,116 $ 2,045 $ 2,036 1,867 $ 2,352 $ 2,502 $ 2,586 $ 2,174 $ 1,968 $ 1,923 $ 1,916 $ 54,352 $ 53,391 $ 53,170 $ 53,658 45,881 $ 43,880 $ 44,223 $ 44,963 43,075 42,480 $ 42,405 $ 40,982 $ 89 $ 89 $ 89 $ 89 89 $ 89 $ 89 $ 89 $ 89 89 $ 89 $ 89 $ 11,001 $ 10,747 $ 10,777 $ 10,590 10,578 $ 10,409 $ 10,079 $ 10,017 $ 10,192 $ 9,883 $ 9,958 $ 9,779 $ 51,729 $ 50,729 $ 49,446 $ 47,459 $ 46,423 $ 45,235 $ 43,543 $ 41,221 $ 39,935 $ 39,193 $ 38,073 $ 36,461 $ (739) $ (801) $ (776) $ (835) $ (772) $ (717) $ (774) $ (596) $ (566) $ (629) $ (482) $ (923) $ 65,196 $ 61,846 $ 60,696 $ 59,446 $ 58, 196 $ 53,696 $ 50,928 $ 49,044 $ 48, 196 $ 45,993 $ 44,084 $ 41,444 $ (3,116) $ (1,082) $ (1,160) $ (2,143) $ (1,878) $ 1,320 $ 2,009 $ 1,687 $ 1,454 $ 2,543 $ 3,554 3,962 $ $ $ HA HA HA HA HA EA EA 64 A A EA $ Home Depot Inc (NYS: HD) Fiscal year Quarter Scale Net sales Cost of sales Gross profit Selling, general & administrative expenses Depreciation & amortization expenses Impairment loss Total operating expenses 2 Operating income Interest expense Interest & investment income Other interest & other income (expense) s Interest & other income (expense), net Earnings (loss) before provision for income taxes Provision for (benefit from) income taxes Net earnings (loss) Dividends declared per share 2019 2019 2019 2019 2018 2018 2018 2018 2017 2017 2017 2017 4th Quarter 3rd Quarter 2nd Quarter 1st Quarter 4th Quarter 3rd Quarter 2nd Quarter 1st Quarter 4th Quarter 3rd Quarter 2nd Quarter 1st Quarter Millions Millions Millions Millions Millions Millions Millions Millions Millions Millions Millions Millions $ 25,782 $ 27,223 $ 30,839 $ 26,381 $ 26,491 $ 26,302 $ 30,463 $ 24,947 $ 23,883 $ 25,026 $ 28,108 $ 23,887 $ 17,046 $ 17,836 $ 20,407 $ 17,364 $ 17,464 $ 17,151 $ 20,098 $ 16,330 $ 15,790 $ 16,378 $ 18,647 $ 15,733 $ 8,736 $ 9,387 $ 10,432 $ 9,017 $ 9,027 $ 9,151 $ 10,365 $ 8,617 8,093 $ 8,648 $ 9,461 $ 8,154 $ 4,814 $ 4,942 $ 5,044 $ 4,940 $ 4,922 $ 4,808 $ 5,004 $ 4,779 $ 4,440 $ 4,514 $ 4,549 $ 4,361 $ 519 $ 498 $ 492 $ 480 $ 480 $ 473 $ 460 $ 457 464 $ 454 $ 449 $ 444 $ 247 $ 5,333 $ 5,440 $ 5,536 $ 5,420 $ 5,649 $ 5,281 $ 5,464 5,236 $ 4,904 $ 4,968 $ 4,998 4,805 $ 3,403 $ 3,947 $ 4,896 $ 3,597 $ 3,378 $ 3,870 $ 4,901 3,381 $ 3,189 $ 3,680 $ 4,463 $ 3,349 $ 309 $ 302 $ 302 $ 288 $ 269 $ 249 $ 272 $ 261 $ 269 $ 269 $ 265 $ 254 $ 17 $ 22 $ 19 $ 15 $ 20 $ 25 $ 26 22 $ 23 $ 22 $ 16 $ 13 $ (16) $ (292) $ (280) $ (283) $ (273) $ (249) $ (224) $ (246) $ (239) $ (246) $ (247) $ (249) $ (241) $ 3,111 $ 3,667 $ 4,613 $ 3,324 $ 3,129 $ 3,646 $ 4,655 $ 3,142 $ 2,943 $ 3,433 $ 4,214 $ 3,108 630 $ 898 $ 1,134 $ 811 $ 769 $ 779 $ 1,149 $ 738 $ 1,164 $ 1,268 $ 1,542 $ 1,094 $ 2,481 $ 2,769 $ 3,479 $ 2,513 $ 2,360 $ 2,867 $ 3,506 $ 2,404 $ 1,779 $ 2,165 $ 2,672 $ 2,014 1.36 1.36 1.36 1.03 1.03 1.03 0.89 0.89 0.89 EA 1 1 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started