Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do (c). As production manager, David noticed that several recent production runs generated a decent-sized collection of scrap pieces in the designated scrap bin.

Please do (c).

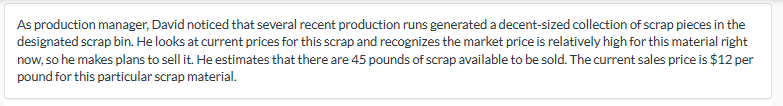

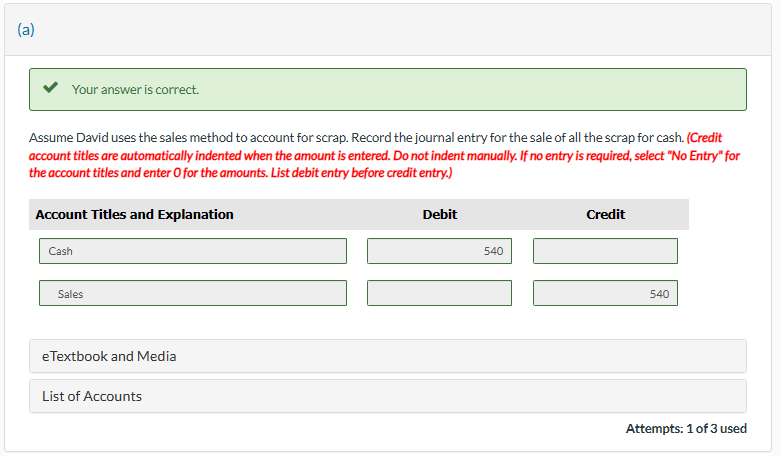

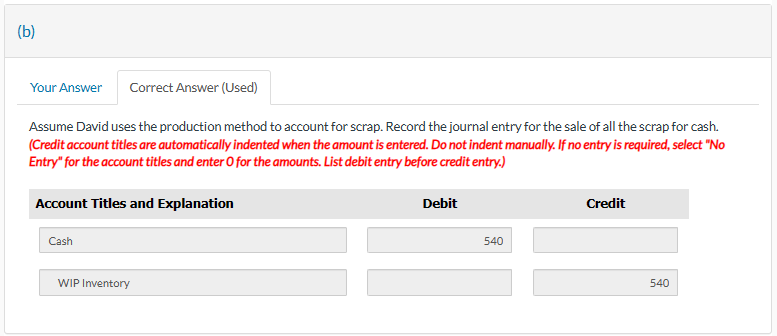

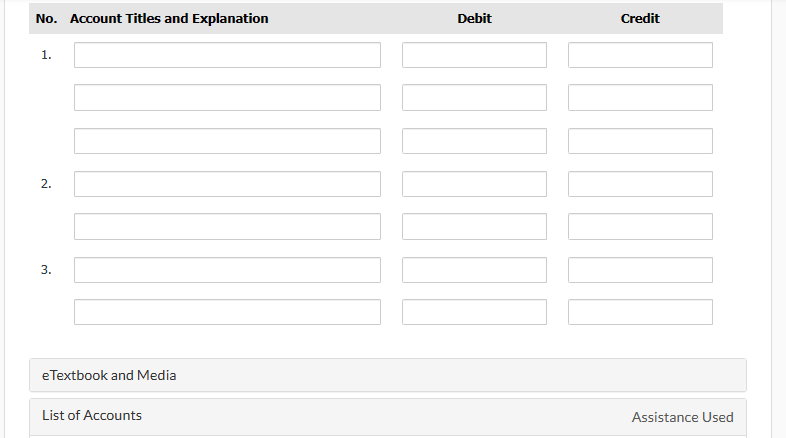

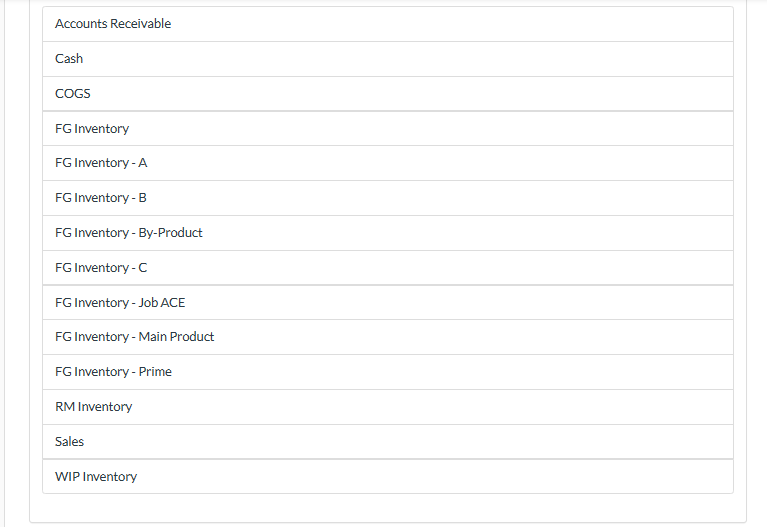

As production manager, David noticed that several recent production runs generated a decent-sized collection of scrap pieces in the designated scrap bin. He looks at current prices for this scrap and recognizes the market price is relatively high for this material right now, so he makes plans to sell it. He estimates that there are 45 pounds of scrap available to be sold. The current sales price is $12 per pound for this particular scrap material. Assume David uses the sales method to account for scrap. Record the journal entry for the sale of all the scrap for cash. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Assume David uses the production method to account for scrap. Record the journal entry for the sale of all the scrap for cash. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Assume David uses the production method to account for scrap. Further, David finds several pieces of scrap that can be used in other projects. He estimates the reusable scrap quantity to be 15 pounds; the remaining scrap will be sold as is. 1. Record the journal entry (entries) to recognize the planned reuse of some of the scrap and the sale of the rest of it for cash. 2. Assume that the 15 pounds of scrap that David planned to reuse could not be reused after all. Record the journal entry for the sale of this scrap for cash at a later date when the market price returns to $12 per pound. 3. Assume that the 15 pounds of scrap that David planned to reuse were reused in a another project. Record the journal entry for the subsequent use of this scrap. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) No. Account Titles and Explanation Debit Credit 1. 2. 3. eTextbook and Media List of Accounts Assistance Used Accounts Receivable Cash COGS FG Inventory FG Inventory - A FG Inventory - B FG Inventory - By-Product FG Inventory - C FG Inventory - Job ACE FG Inventory - Main Product FG Inventory - Prime RM Inventory Sales WIP Inventory As production manager, David noticed that several recent production runs generated a decent-sized collection of scrap pieces in the designated scrap bin. He looks at current prices for this scrap and recognizes the market price is relatively high for this material right now, so he makes plans to sell it. He estimates that there are 45 pounds of scrap available to be sold. The current sales price is $12 per pound for this particular scrap material. Assume David uses the sales method to account for scrap. Record the journal entry for the sale of all the scrap for cash. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Assume David uses the production method to account for scrap. Record the journal entry for the sale of all the scrap for cash. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Assume David uses the production method to account for scrap. Further, David finds several pieces of scrap that can be used in other projects. He estimates the reusable scrap quantity to be 15 pounds; the remaining scrap will be sold as is. 1. Record the journal entry (entries) to recognize the planned reuse of some of the scrap and the sale of the rest of it for cash. 2. Assume that the 15 pounds of scrap that David planned to reuse could not be reused after all. Record the journal entry for the sale of this scrap for cash at a later date when the market price returns to $12 per pound. 3. Assume that the 15 pounds of scrap that David planned to reuse were reused in a another project. Record the journal entry for the subsequent use of this scrap. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) No. Account Titles and Explanation Debit Credit 1. 2. 3. eTextbook and Media List of Accounts Assistance Used Accounts Receivable Cash COGS FG Inventory FG Inventory - A FG Inventory - B FG Inventory - By-Product FG Inventory - C FG Inventory - Job ACE FG Inventory - Main Product FG Inventory - Prime RM Inventory Sales WIP InventoryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started