Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do consider answering more than one 23) To convince investors to accept rester voyyou A) decrease the risk-free rate y case the risk-free mate

please do consider answering more than one

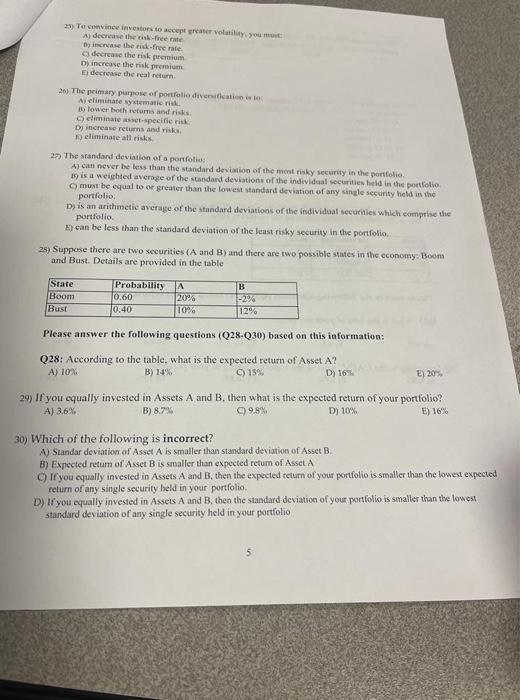

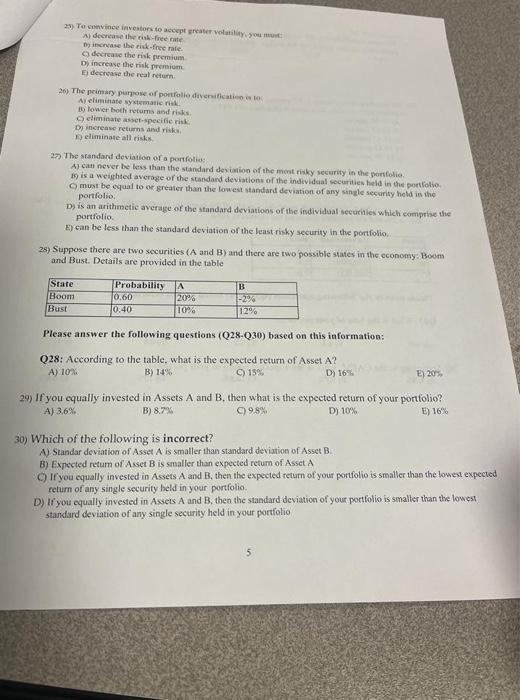

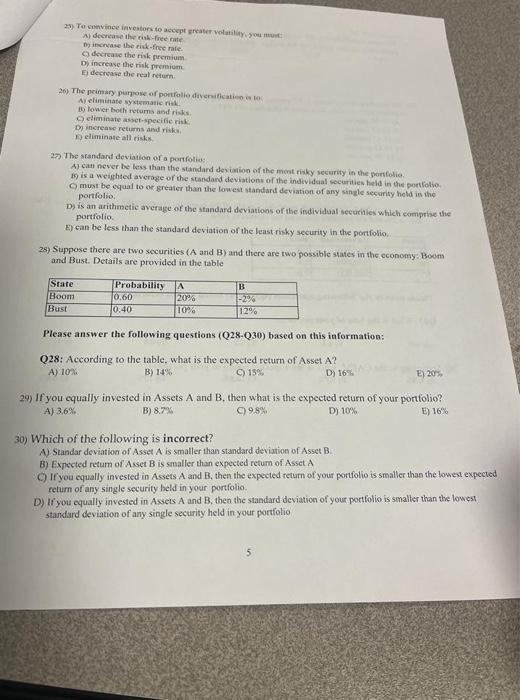

23) To convince investors to accept rester voyyou A) decrease the risk-free rate y case the risk-free mate decrease the risk premium D) increase the risk premium E) decrease the real return 2.) The primary purpose of portfoliodiversitatis Ay eliminate systematic By lower both returns and risks o eliminate specifie risk Dy increase returns and risk eliminate all risks 27) The standard deviation of a portfolio Ay can never be less than the standard deviation of the most risky Security in the portfolio 19 is a weighted average of the standard deviations of the individual securities held in the portfolio must be equal to or greater than the lowest standard deviation of any single security held in the portfolio D) is an arithmetic average of the standard deviations of the individual securities which comprise the portfolio E) can be less than the standard deviation of the least risky security in the portfolio 29) Suppose there are two securities (A and B) and there are two possible states in the economy: Boom and Bust. Details are provided in the table Stare Boom Bust Probability 0.60 10.40 A 20% B 29 12% 10% Please answer the following questions (Q28-030) based on this information: Q28: According to the table. what is the expected return of Asset A? A) 10% B) 14% C) 15% D) 16% E) 20 29) If you cqually invested in Assets A and B. then what is the expected return of your portfolio? A) 3.6% B) 8.7% 098% D) 10% E) 16% 30) Which of the following is incorrect? A) Standar deviation of Asset A is smaller than standard deviation of Asset B B) Expected retum of Asset B is smaller than expected return of Asset A If you equally invested in Assets A and B, then the expected return of your portfolio is smaller than the lowest expected return of any single security held in your portfolio. D) If you equally invested in Assets A and B, then the standard deviation of your portfolio is smaller than the lowest standard deviation of any single security held in your portfolio 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started