Please do Cost of Goods sold budget, Budgeted Income statement, and cash budget PLEASE

Please do Cost of Goods sold budget, Budgeted Income statement, and cash budget PLEASE

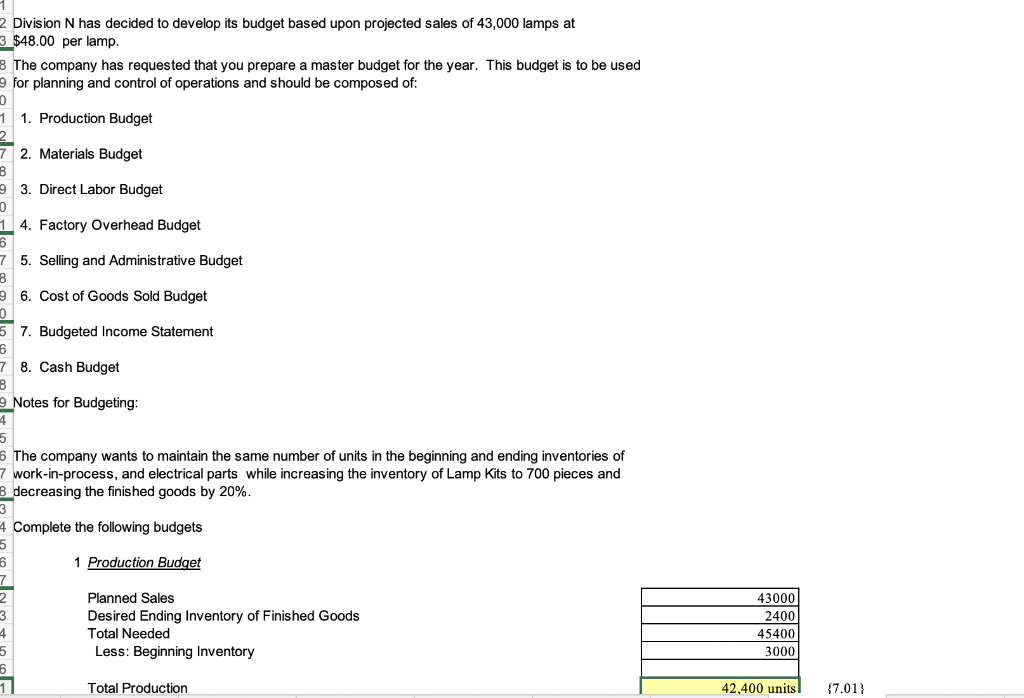

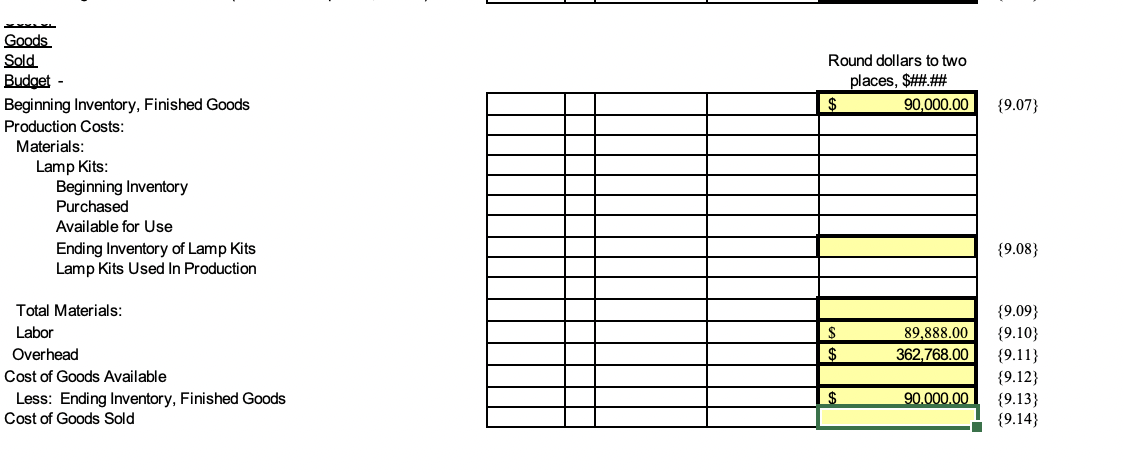

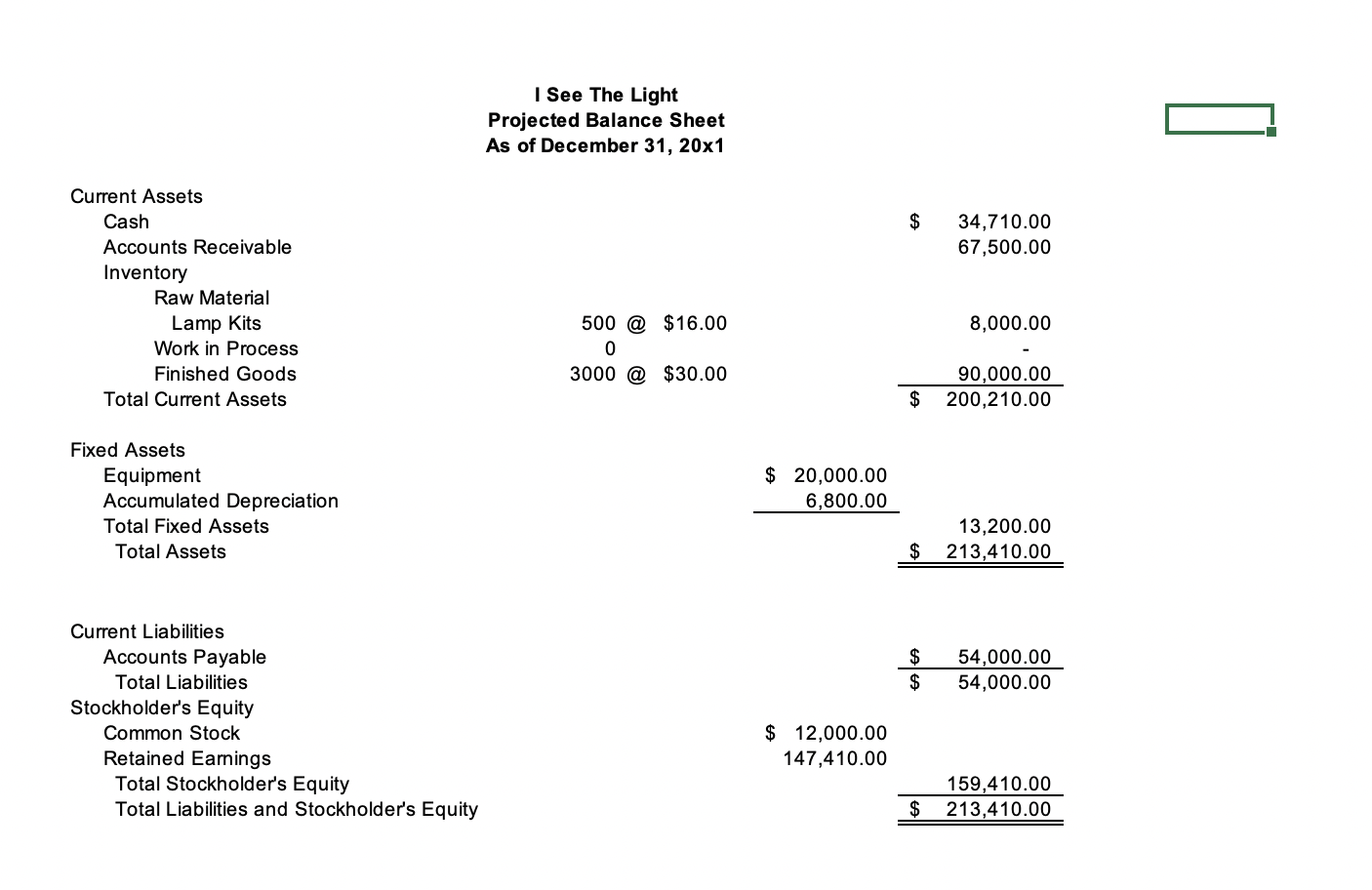

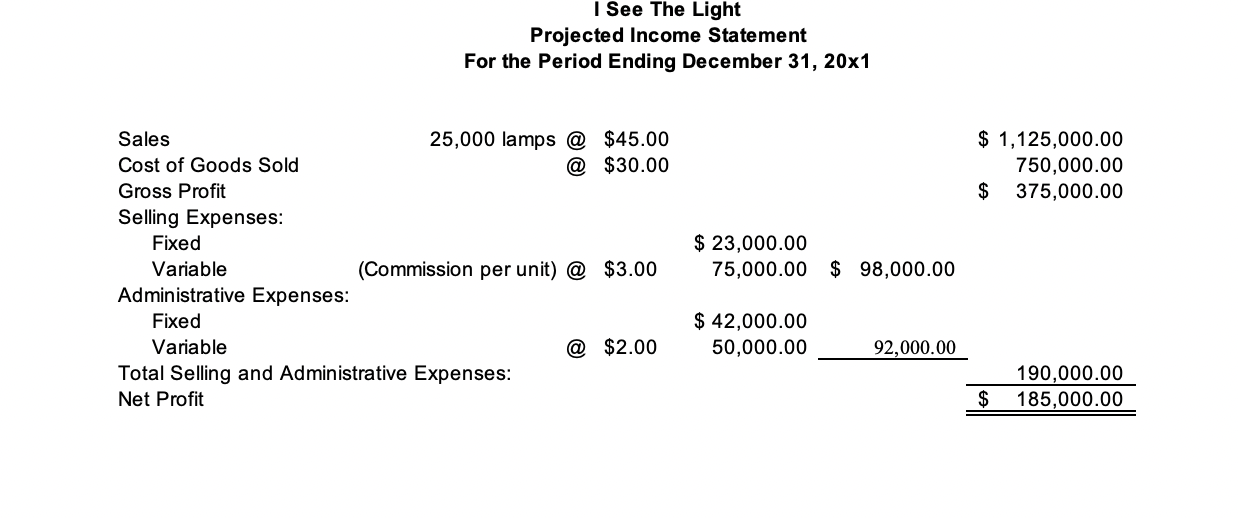

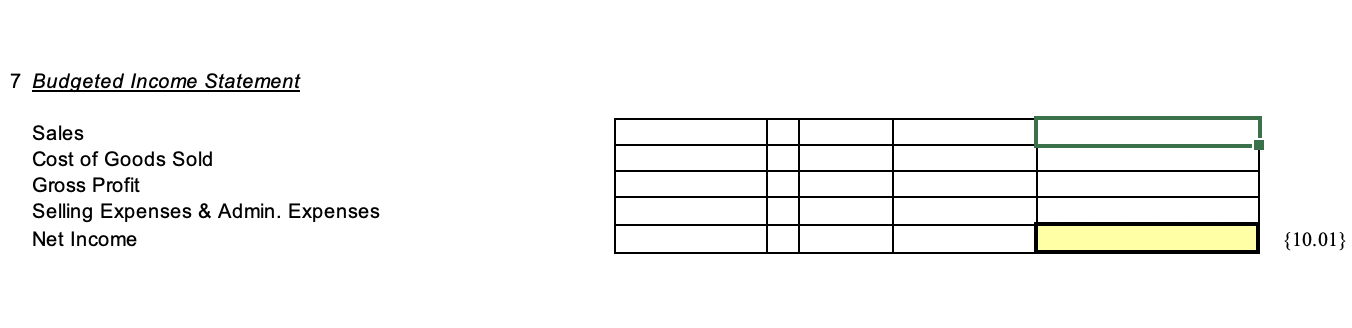

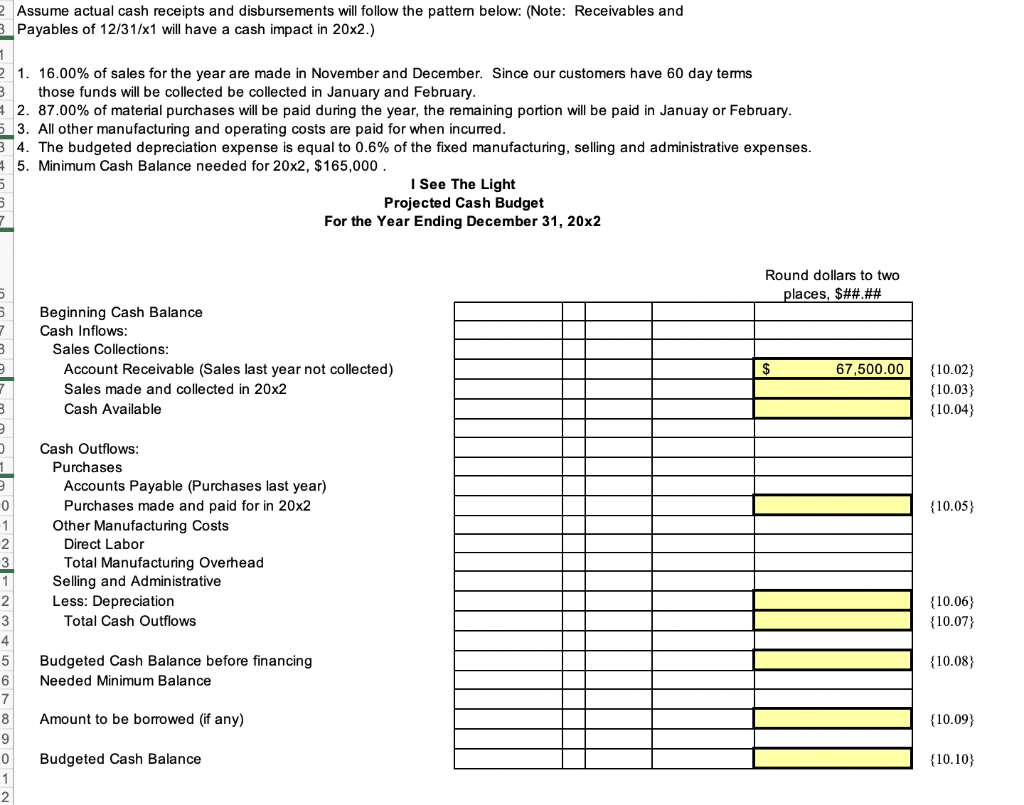

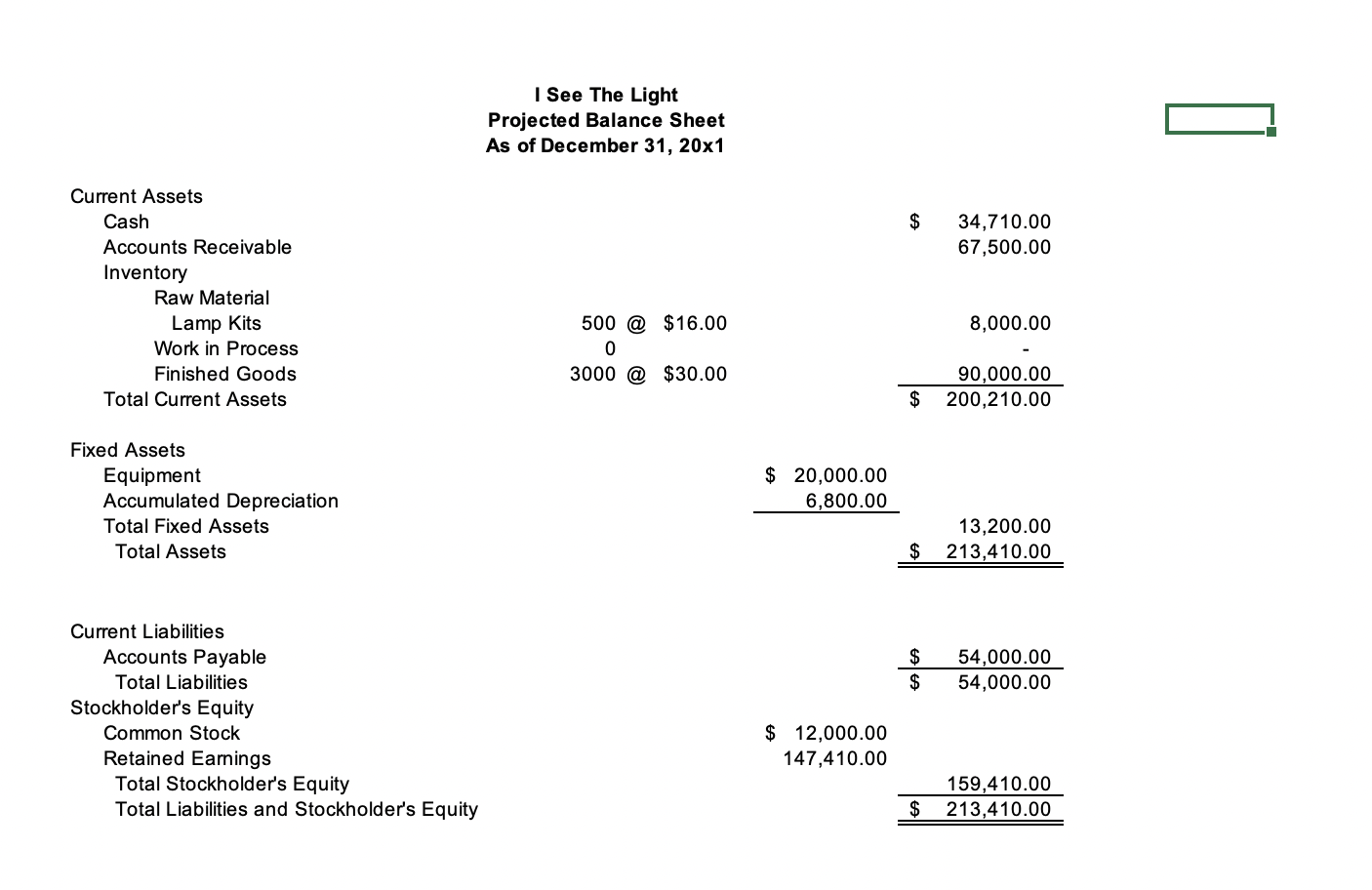

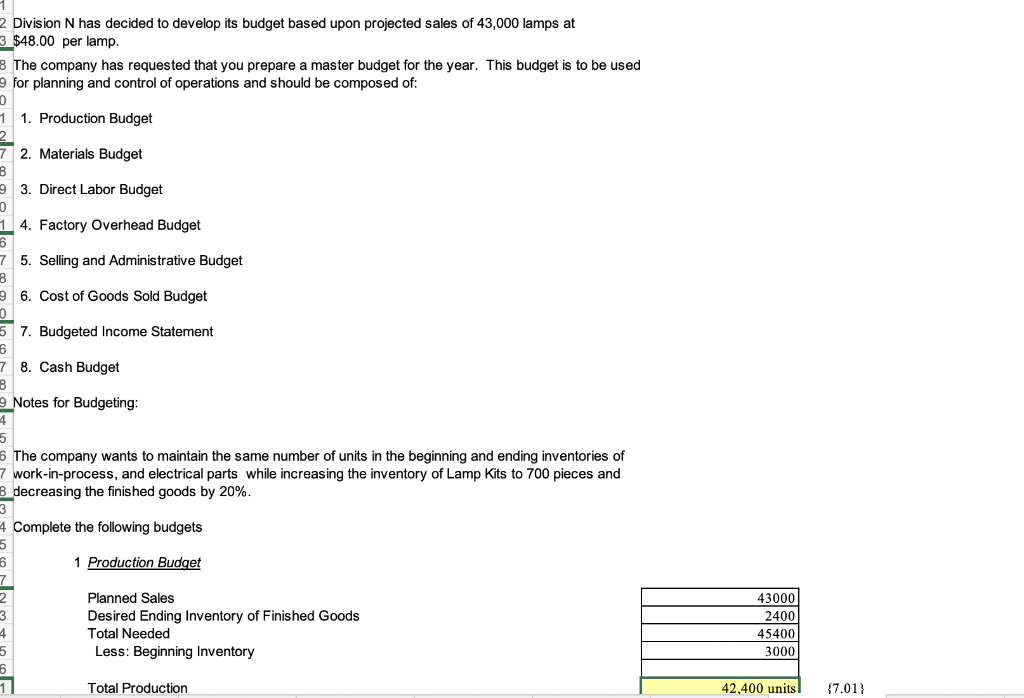

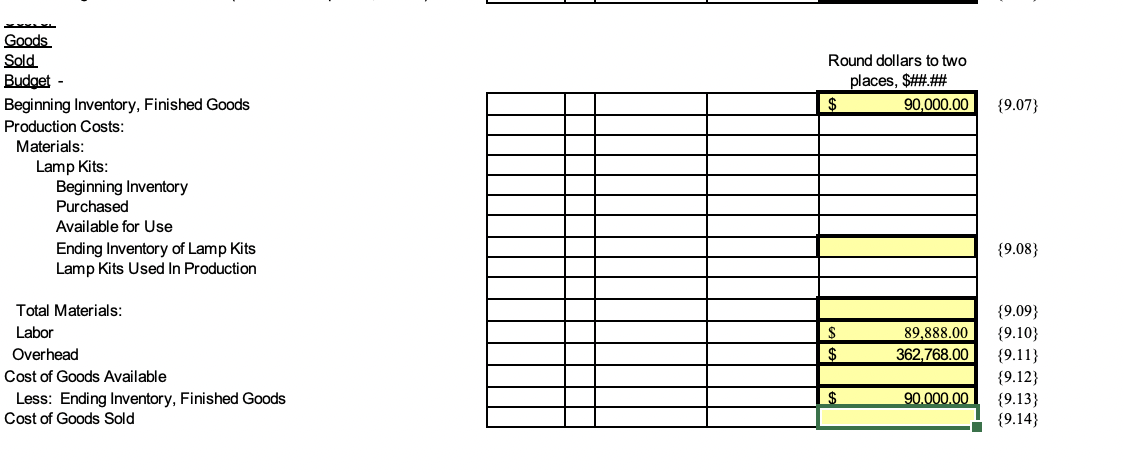

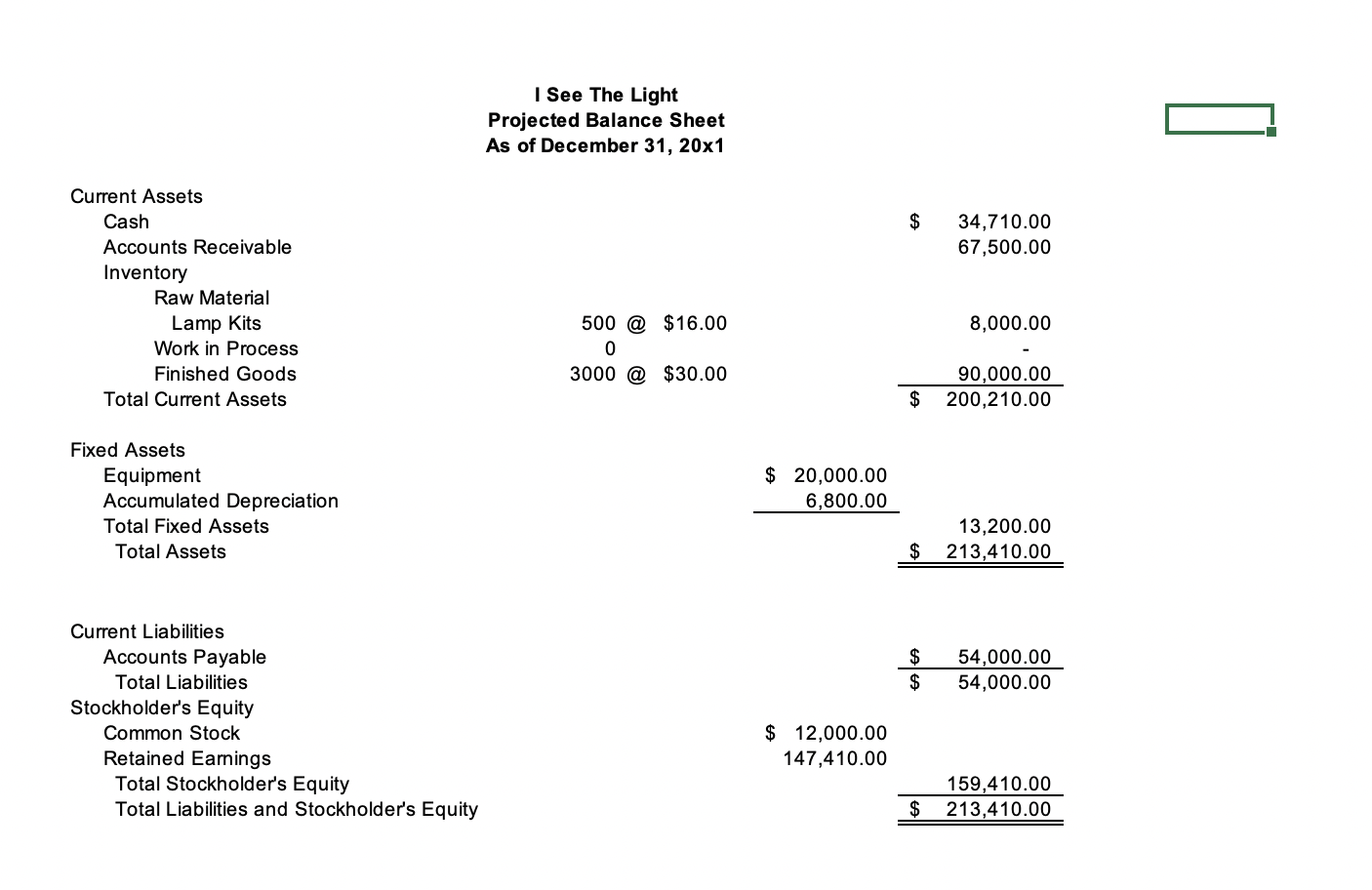

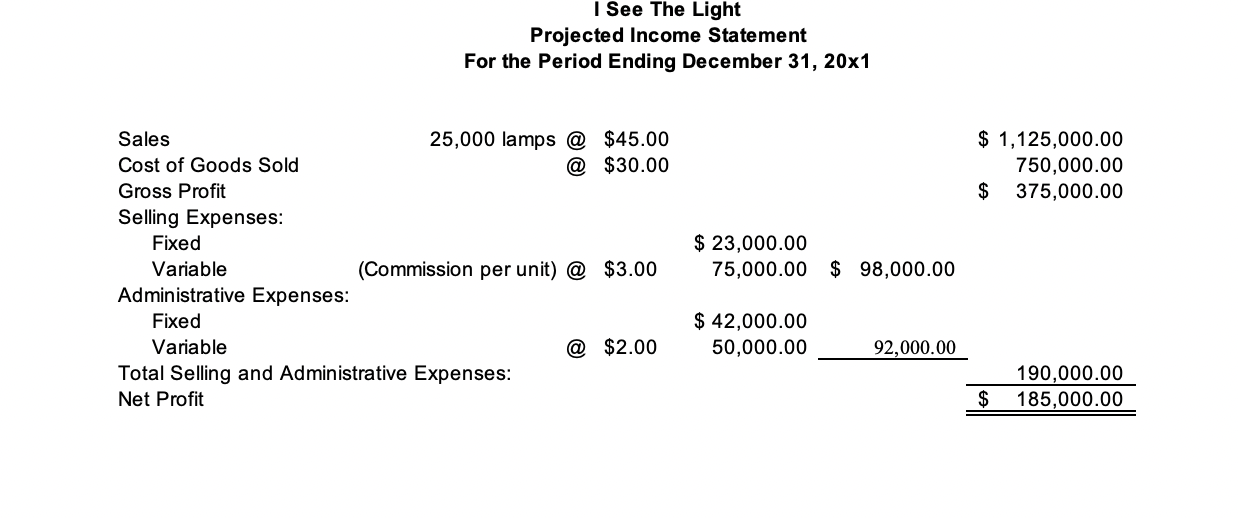

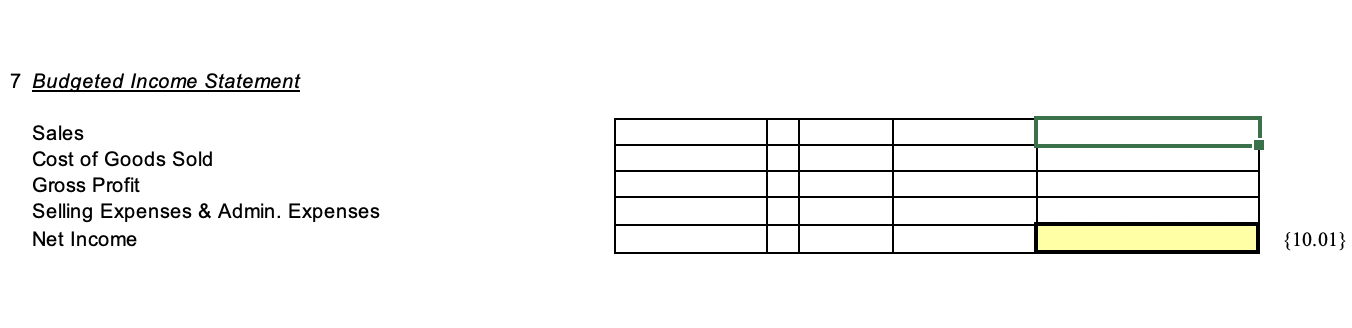

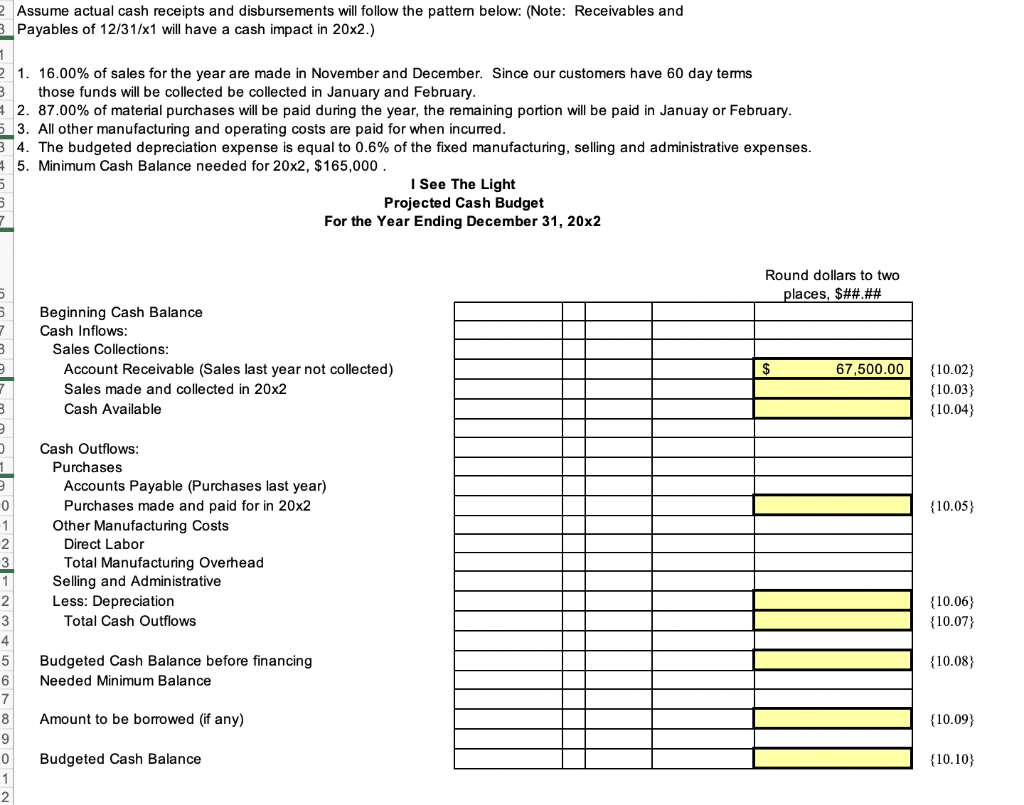

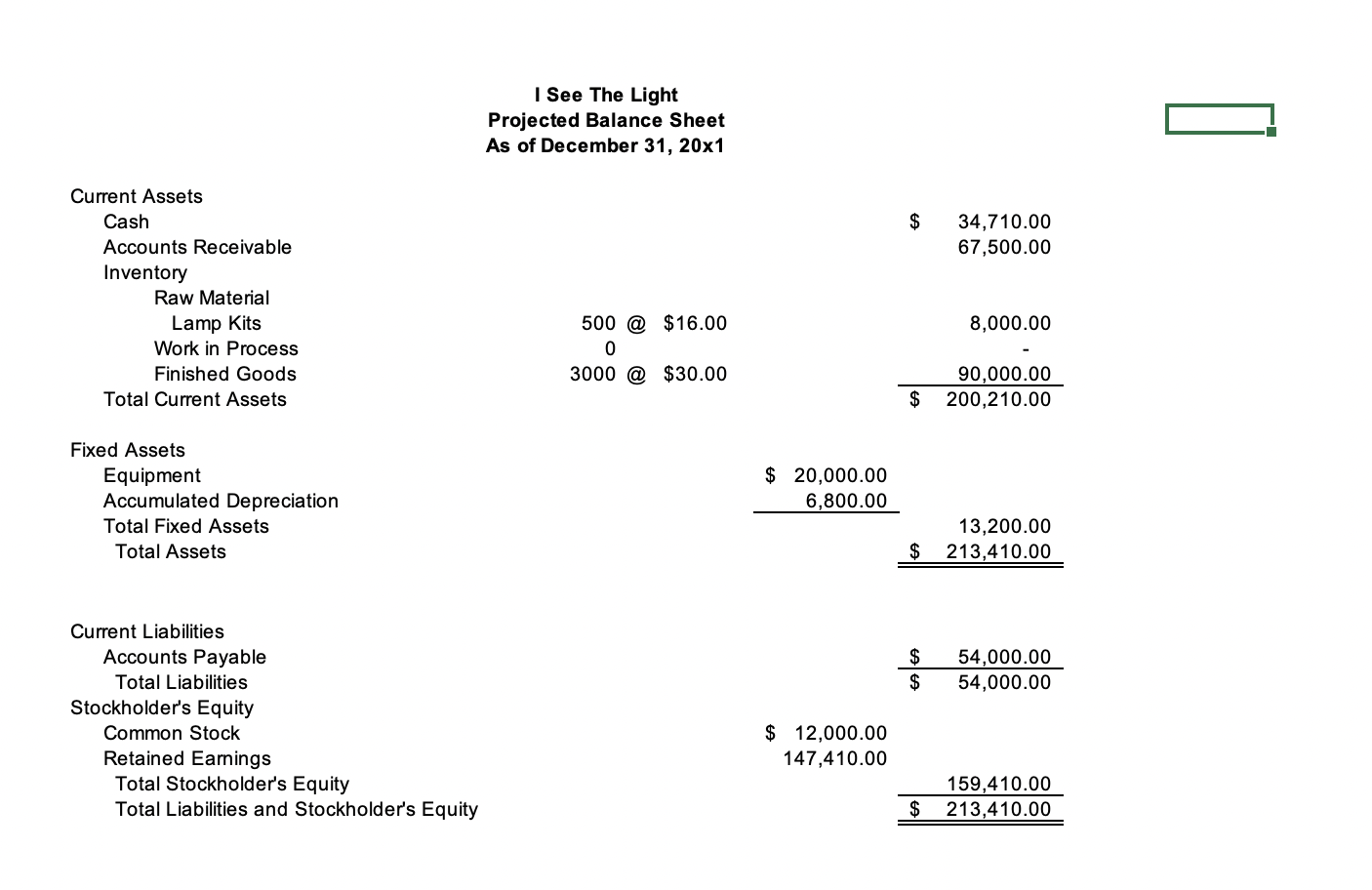

I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets Cash Accounts Receivable $34,710.0067,500.00 Inventory Raw Material Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets 13,200.00$213,410.00 Current Liabilities Accounts Payable Total Liabilities \( \frac{\$ 54,000.00}{\hline \$ 54,000.00} \) Stockholder's Equity Common Stock $12,000.00 Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity 159,410.00$213,410.00 Division N has decided to develop its budget based upon projected sales of 43,000 lamps at $48.00 per lamp. The company has requested that you prepare a master budget for the year. This budget is to be used for planning and control of operations and should be composed of: 1. Production Budget 2. Materials Budget 3. Direct Labor Budget 4. Factory Overhead Budget 5. Selling and Administrative Budget 6. Cost of Goods Sold Budget 7. Budgeted Income Statement 8. Cash Budget Notes for Budgeting: The company wants to maintain the same number of units in the beginning and ending inventories of work-in-process, and electrical parts while increasing the inventory of Lamp Kits to 700 pieces and decreasing the finished goods by 20%. Complete the following budgets 1 Production Budget Planned Sales Desired Ending Inventory of Finished Goods Total Needed Less: Beginning Inventory Round dollars to two nlonne HHHH I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets Cash Accounts Receivable $34,710.0067,500.00 Inventory Raw Material Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets 13,200.00$213,410.00 Current Liabilities Accounts Payable Total Liabilities \( \frac{\$ 54,000.00}{\hline \$ 54,000.00} \) Stockholder's Equity Common Stock $12,000.00 Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity 159,410.00$213,410.00 I See The Light Projected Income Statement For the Period Ending December 31, 20x1 7 Budgeted Income Statement Sales Cost of Goods Sold Gross Profit Selling Expenses \& Admin. Expenses Net Income \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} {10.01} Assume actual cash receipts and disbursements will follow the pattem below: (Note: Receivables and Payables of 12/31/1 will have a cash impact in 202.) 1. 16.00% of sales for the year are made in November and December. Since our customers have 60 day terms those funds will be collected be collected in January and February. 2. 87.00% of material purchases will be paid during the year, the remaining portion will be paid in Januay or February. 3. All other manufacturing and operating costs are paid for when incurred. 4. The budgeted depreciation expense is equal to 0.6% of the fixed manufacturing, selling and administrative expenses. 5. Minimum Cash Balance needed for 202,$165,000. I See The Light Projected Cash Budget For the Year Ending December 31, 20x2 Round dollars to two I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets Cash Accounts Receivable $34,710.0067,500.00 Inventory Raw Material Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets 13,200.00$213,410.00 Current Liabilities Accounts Payable Total Liabilities \( \frac{\$ 54,000.00}{\hline \$ 54,000.00} \) Stockholder's Equity Common Stock $12,000.00 Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity 159,410.00$213,410.00 Division N has decided to develop its budget based upon projected sales of 43,000 lamps at $48.00 per lamp. The company has requested that you prepare a master budget for the year. This budget is to be used for planning and control of operations and should be composed of: 1. Production Budget 2. Materials Budget 3. Direct Labor Budget 4. Factory Overhead Budget 5. Selling and Administrative Budget 6. Cost of Goods Sold Budget 7. Budgeted Income Statement 8. Cash Budget Notes for Budgeting: The company wants to maintain the same number of units in the beginning and ending inventories of work-in-process, and electrical parts while increasing the inventory of Lamp Kits to 700 pieces and decreasing the finished goods by 20%. Complete the following budgets 1 Production Budget Planned Sales Desired Ending Inventory of Finished Goods Total Needed Less: Beginning Inventory Round dollars to two nlonne HHHH I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets Cash Accounts Receivable $34,710.0067,500.00 Inventory Raw Material Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets 13,200.00$213,410.00 Current Liabilities Accounts Payable Total Liabilities \( \frac{\$ 54,000.00}{\hline \$ 54,000.00} \) Stockholder's Equity Common Stock $12,000.00 Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity 159,410.00$213,410.00 I See The Light Projected Income Statement For the Period Ending December 31, 20x1 7 Budgeted Income Statement Sales Cost of Goods Sold Gross Profit Selling Expenses \& Admin. Expenses Net Income \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} {10.01} Assume actual cash receipts and disbursements will follow the pattem below: (Note: Receivables and Payables of 12/31/1 will have a cash impact in 202.) 1. 16.00% of sales for the year are made in November and December. Since our customers have 60 day terms those funds will be collected be collected in January and February. 2. 87.00% of material purchases will be paid during the year, the remaining portion will be paid in Januay or February. 3. All other manufacturing and operating costs are paid for when incurred. 4. The budgeted depreciation expense is equal to 0.6% of the fixed manufacturing, selling and administrative expenses. 5. Minimum Cash Balance needed for 202,$165,000. I See The Light Projected Cash Budget For the Year Ending December 31, 20x2 Round dollars to two

Please do Cost of Goods sold budget, Budgeted Income statement, and cash budget PLEASE

Please do Cost of Goods sold budget, Budgeted Income statement, and cash budget PLEASE