Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do (e) and show me the process to calculate alpha ratio Q2 00: Portfolio theory ne following information concerning four equity portfolios, expressed in

please do (e) and show me the process to calculate alpha ratio

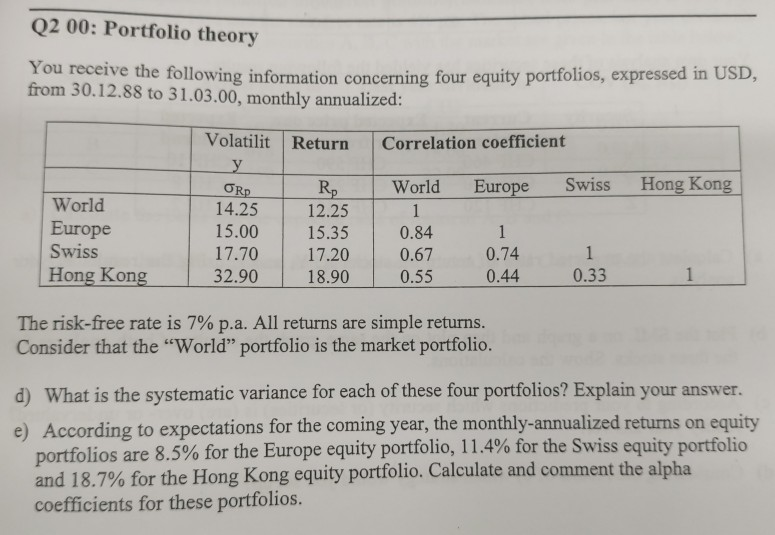

Q2 00: Portfolio theory ne following information concerning four equity portfolios, expressed in USD, from 30.12.88 to 31.03.00, monthly annualized: Volatilit Return Correlation coefficient I World Europe Swiss Hong Kong World Europe Swiss Hong Kong ORD 14.25 15.00 17.70 32.90 R 12.25 15.35 17.20 18.90 0.84 0.67 0.55 1 0.74 0.44 1 0.33 The risk-free rate is 7% p.a. All returns are simple returns. Consider that the World portfolio is the market portfolio. d) What is the systematic variance for each of these four portfolios? Explain your answer. e) According to expectations for the coming year, the monthly-annualized returns on equity portfolios are 8.5% for the Europe equity portfolio, 11.4% for the Swiss equity portfolio and 18.7% for the Hong Kong equity portfolio. Calculate and comment the alpha coefficients for these portfolios

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started