Answered step by step

Verified Expert Solution

Question

1 Approved Answer

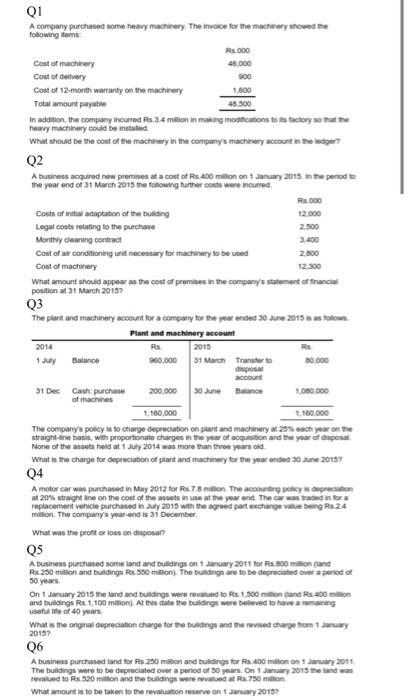

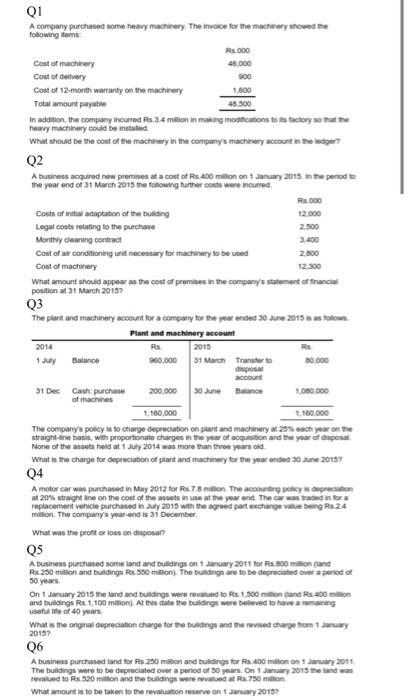

please do handwritten Q1 A company purchased some heavy machinery. The invoice for the macharery showed the folerwing tems: in addition, the company incurred Rs.

please do handwritten

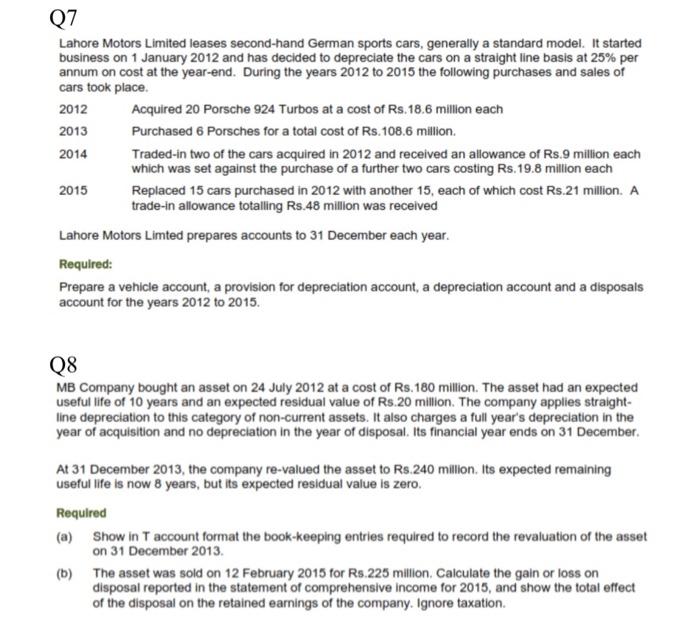

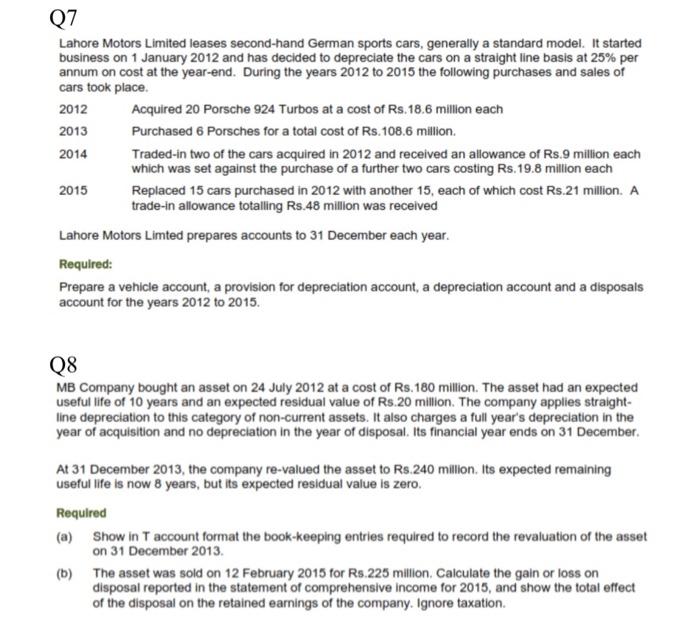

Q1 A company purchased some heavy machinery. The invoice for the macharery showed the folerwing tems: in addition, the company incurred Rs. 3.4 milion in makg modifications to its tactary so that the heavy machinery could be instaled. What should be the cost of the machinery in the company's machinery account in the leogert Q2 A busaress acquired new premises at a cost of Rs 400 milion on 1 danuary 2015 in fhe penod to the year end of 31 March 2015 the folowing futher cests were incurred. postion at 31 March 20157 Q3 The plart and machinery account for a company for the ywar ended 30 dune 2015 is as follon. The company's polcy is to charge depreciation on plart and machinery at 25% wach year on the straight-ine basit, with proportionate charges in the year of acquisifon and the yoar of digosat. None of the assets heid at 1 July 2014 was mone than thee years old. What in the charge for depreciation of plant acd machinery for the year ended 30 lune 20157. Q4 A moter car was purchased in Mary 2012 for Ris 7.8 mition. The accourting peicey is depreciation at 20%s straight ine on the cost of the assets in use at the year end. The car ass traded in for a replacemert vehicle purchased in July 2015 with the apreed pat exchange ratue being Ra 2.4 mition. The company's year-end is 31 December, What was the profit or ioss on disposar? Q5 A business purchased some land and buldings on 1 Jaruary 2011 for Rs soo milfon (aand Rs. 250 mifion and buldings Rss 550 milion). The bullings are to be depreciated over a period of 50 years. On 1 Jankary 2015 the land and bullings were revalued to Rs. 1.300 milion fand Fas 400 milion and buldings Rs 1,too mitionj. At this date the buldings were beleved to have a remairing usefur ile of 40 years. What is the onginal depreciation charge for the buldings and the revised tharge trom 1 axuay 20157 Q6 A business purchased land for fes 250 mition and buldings for Ras 400 mition on 1 aaruary 2011. The bulldings were to be degreciated over a period of 50 years. On 1 Jarnary 2015 the land was revalued to fis $20 mitfon and the builings wees revalued at Res.7\$o mifin What amourt is to be taken io the revaluation reserve on 7 Jarsary 2015?. Lahore Motors Limited leases second-hand German sports cars, generally a standard model. It started business on 1 January 2012 and has decided to depreciate the cars on a straight line basis at 25% per annum on cost at the year-end. During the years 2012 to 2015 the following purchases and sales of cars took place. 2012201320142015Replaced15carspurchasedin2012withanother15,eachofwhichcostRs.21million.Atrade-inallowancetotallingRs.48millionwasreceivedAcquired20Porsche924TurbosatacostofRs.18.6millioneachPurchased6PorschesforatotalcostofRs.108.6million.Traded-intwoofthecarsacquiredin2012andreceivedanallowanceofRs.9millioneachwhichwassetagainstthepurchaseofafurthertwocarscostingRs.19.8millioneach Lahore Motors Limted prepares accounts to 31 December each year. Required: Prepare a vehicle account, a provision for depreciation account, a depreciation account and a disposals account for the years 2012 to 2015. Q8 MB Company bought an asset on 24 July 2012 at a cost of Rs. 180 million. The asset had an expected useful life of 10 years and an expected residual value of Rs.20 million. The company applies straightline depreciation to this category of non-current assets. It also charges a full year's depreciation in the year of acquisition and no depreciation in the year of disposal. Its financial year ends on 31 December. At 31 December 2013, the company re-valued the asset to Rs. 240 million. Its expected remaining useful life is now 8 years, but its expected residual value is zero. Required (a) Show in T account format the book-keeping entries required to record the revaluation of the asset on 31 December 2013. (b) The asset was soid on 12 February 2015 for Rs. 225 million. Caiculate the gain or loss on disposal reported in the statement of comprehensive income for 2015, and show the total effect of the disposal on the retained earnings of the company. Ignore taxation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started