Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do help me to answer all of this question. Thanks in advance QUESTION 3 (20 MARKS) Following are Zham Group Consolidated Financial Statements: Zham

please do help me to answer all of this question. Thanks in advance

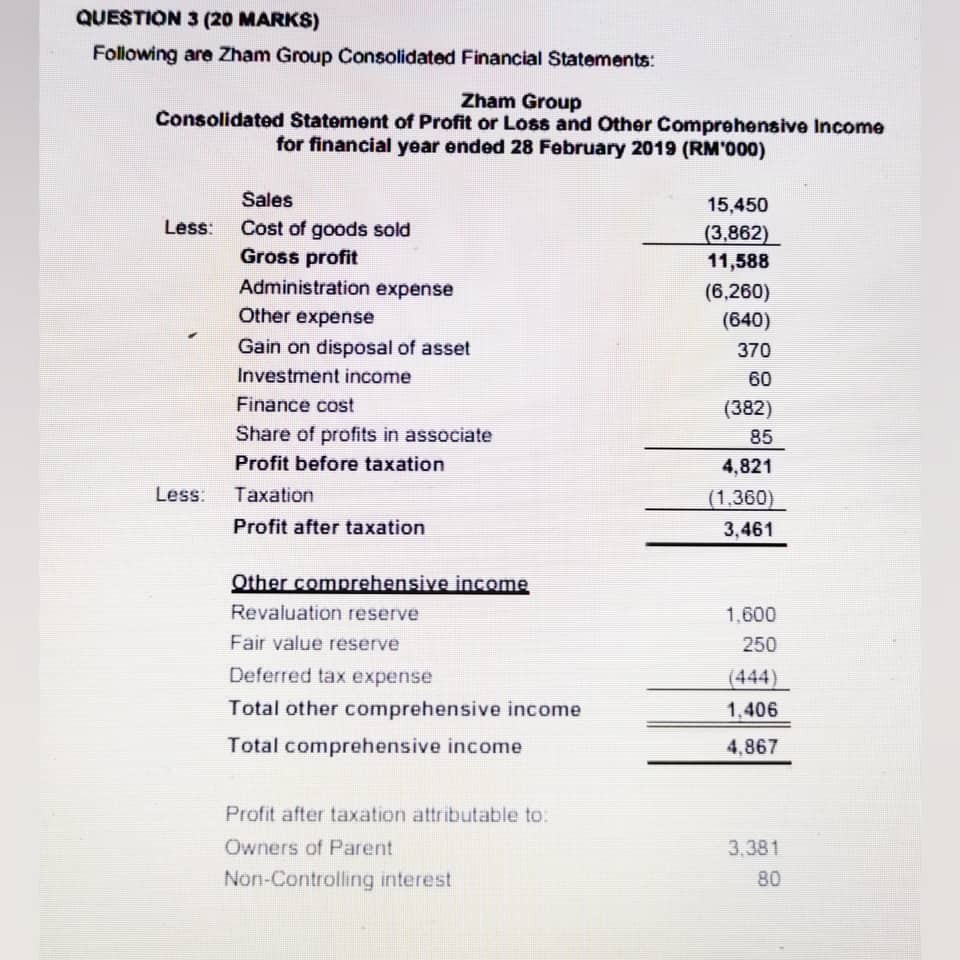

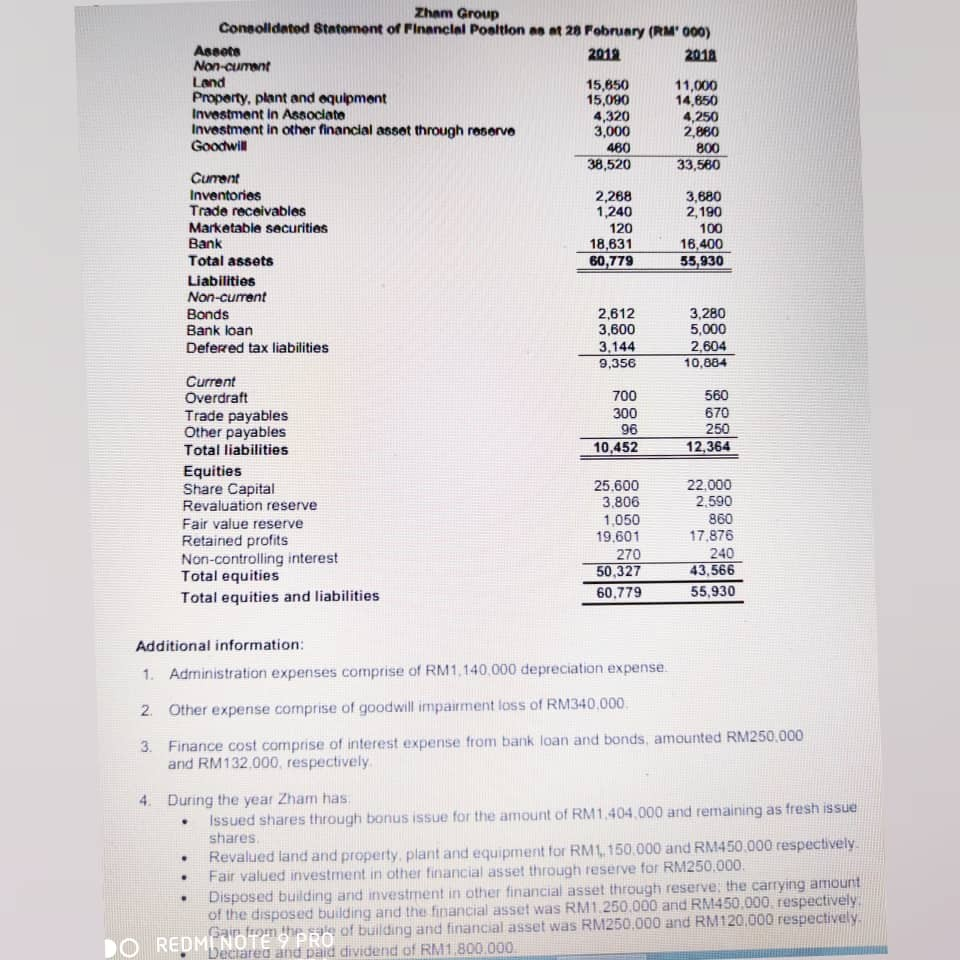

QUESTION 3 (20 MARKS) Following are Zham Group Consolidated Financial Statements: Zham Group Consolidated Statement of Profit or Loss and Other Comprehensive Income for financial year ended 28 February 2019 (RM"000) Less: Sales Cost of goods sold Gross profit Administration expense Other expense Gain on disposal of asset Investment income Finance cost Share of profits in associate Profit before taxation Taxation Profit after taxation 15,450 (3,862) 11,588 (6,260) (640) 370 60 (382) 85 4,821 (1.360) 3,461 Less Other comprehensive income Revaluation reserve Fair value reserve Deferred tax expense Total other comprehensive income Total comprehensive income 1.600 250 (444) 1.406 4.867 Profit after taxation attributable to Owners of Parent Non-Controlling interest 3.381 80 Zham Group Consolidated Statement of Financial Poaltion as at 28 February (RM' 000) Assets 2014 2018 Non-cumant Land 15,850 11,000 Property, plant and equipment 15,090 14,850 Investment in Associate 4,320 4,250 Investment in other financial asset through reservo 3,000 2,880 Goodwill 480 800 38,520 33,560 Cumant Inventories 2,268 3,880 Trade receivables 1,240 2,190 Marketable securities 120 100 Bank 18,631 16,400 Total assets 60,779 55,930 Liabilities Non-currant Bonds 2,612 3,280 Bank loan 3,600 5,000 Defered tax liabilities 3.144 2,604 9,356 10,884 Current Overdraft 700 560 Trade payables 300 670 Other payables 96 250 Total liabilities 10,452 12,364 Equities Share Capital 25.600 22.000 Revaluation reserve 3.806 2.590 Fair value reserve 1.050 860 Retained profits 19,601 17.876 270 240 Non-controlling interest Total equities 50,327 43,566 Total equities and liabilities 60.779 55,930 Additional information: 1. Administration expenses comprise of RM1.140.000 depreciation expense 2. Other expense comprise of goodwill impairment loss of RM340.000 3. Finance cost comprise of interest expense from bank loan and bonds, amounted RM250,000 and RM132,000, respectively 4. During the year Zham has Issued shares through bonus issue for the amount of RM 1,404,000 and remaining as fresh issue shares Revalued land and property, plant and equipment for RM1,150,000 and RM450.000 respectively Fair valued investment in other financial asset through reserve for RM250,000 Disposed building and investment in other financial asset through reserve the carrying amount of the disposed building and the financial asset was RM1.250.000 and RM450.000 respectively O REDMI NOTE 9 PRO Sair on the sale of building and financial asset was RM250,000 and RM120,000 respectively Declared and paid dividend of RM1,800.000 . . . 5. The dividend paid to non-controlling interest was RM50,000. 6. Assume corporate tax rate of 24%. - Required: Prepare Zham Group Consolidated Statement of Cash Flows for financial year ended 28 February 2019. (Student can choose either to use Direct or Indirect Method). (16 Marks) ii. Comment on the performance of Zham Group's operating, investing and financing activities. (4 Marks) QUESTION 4 (20 MARKS) Discuss the importance of corporate reporting in spurring economic growth and society development. (20 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started