please do it ASAP I have limited time last 40 mins

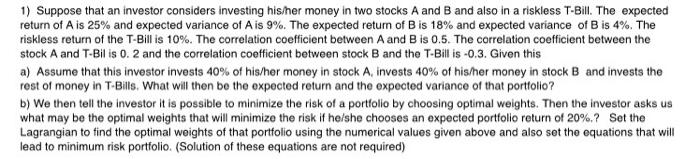

1) Suppose that an investor considers investing his/her money in two stocks A and B and also in a riskless T-Bill. The expected return of Ais 25% and expected variance of Ais 9%. The expected return of Bis 18% and expected variance of B is 4%. The riskless return of the T-Bill is 10%. The correlation coefficient between A and B is 0.5. The correlation coefficient between the stock A and T-Bil is 0.2 and the correlation coefficient between stock B and the T-Bill is -0.3. Given this a) Assume that this investor invests 40% of his/her money in stock A, invests 40% of his/her money in stock B and invests the rest of money in T-Bills. What will then be the expected return and the expected variance of that portfolio? b) We then tell the investor it is possible to minimize the risk of a portfolio by choosing optimal weights. Then the investor asks us what may be the optimal weights that will minimize the risk if he/she chooses an expected portfolio return of 20%.? Set the Lagrangian to find the optimal weights of that portfolio using the numerical values given above and also set the equations that will lead to minimum risk portfolio. (Solution of these equations are not required) 1) Suppose that an investor considers investing his/her money in two stocks A and B and also in a riskless T-Bill. The expected return of Ais 25% and expected variance of Ais 9%. The expected return of Bis 18% and expected variance of B is 4%. The riskless return of the T-Bill is 10%. The correlation coefficient between A and B is 0.5. The correlation coefficient between the stock A and T-Bil is 0.2 and the correlation coefficient between stock B and the T-Bill is -0.3. Given this a) Assume that this investor invests 40% of his/her money in stock A, invests 40% of his/her money in stock B and invests the rest of money in T-Bills. What will then be the expected return and the expected variance of that portfolio? b) We then tell the investor it is possible to minimize the risk of a portfolio by choosing optimal weights. Then the investor asks us what may be the optimal weights that will minimize the risk if he/she chooses an expected portfolio return of 20%.? Set the Lagrangian to find the optimal weights of that portfolio using the numerical values given above and also set the equations that will lead to minimum risk portfolio. (Solution of these equations are not required)