Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it fast Layout References Mailings Review View Hei Enable Editing From the Internet can contain Viruses. Unless you need to edit it's safer

please do it fast

please do it fast

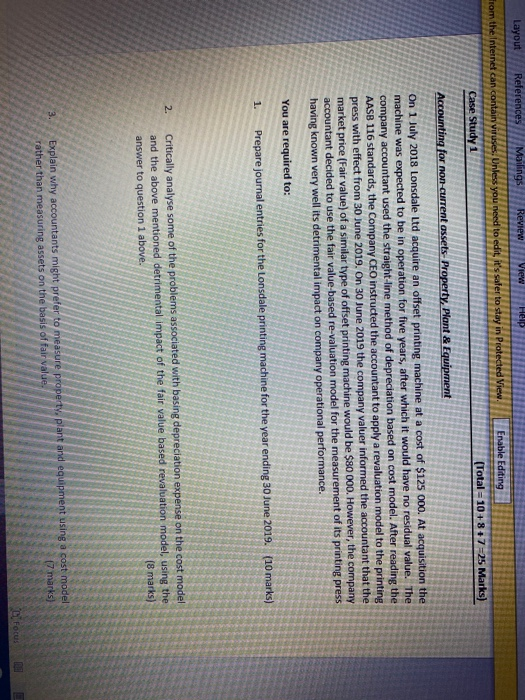

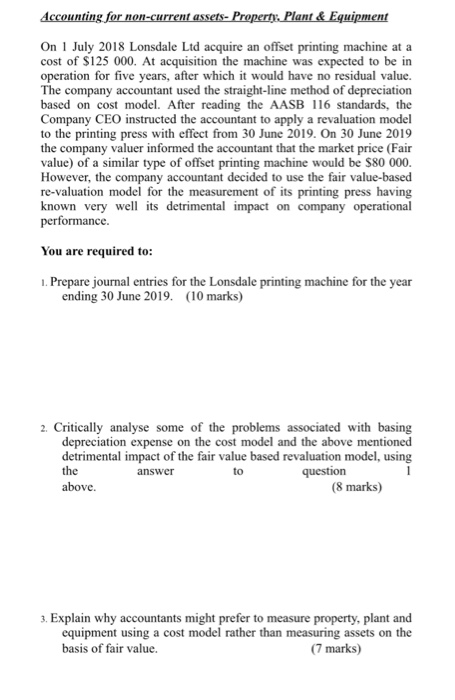

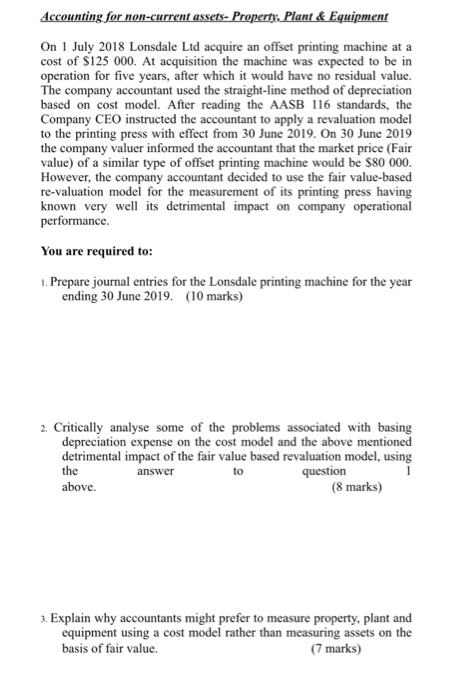

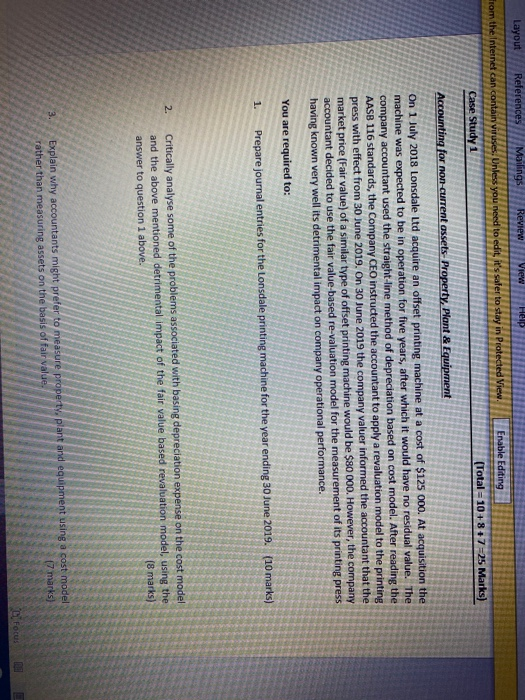

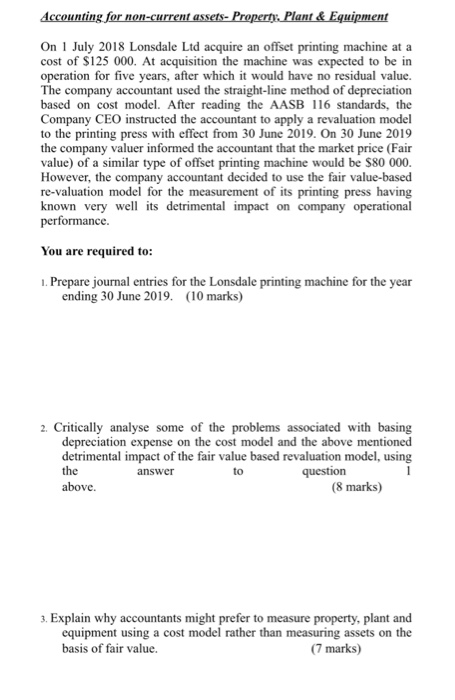

Layout References Mailings Review View Hei Enable Editing From the Internet can contain Viruses. Unless you need to edit it's safer to stay in Protected View (Total = 10+8+7=25 Marks) Case Study 1 Accounting for non-current assets Property, Plant & Equipment On 1 July 2018 Lonsdale Ltd acquire an offset printing machine at a cost of $125 000. At acquisition the machine was expected to be in operation for five years, after which it would have no residual value. The company accountant used the straight-line method of depreciation based on cost model. After reading the AASB 116 standards, the Company CEO instructed the accountant to apply a revaluation model to the printing press with effect from 30 June 2019. On 30 June 2019 the company valuer informed the accountant that the market price (Fair value) of a similar type of offset printing machine would be $80 000. However, the company accountant decided to use the fair value-based re-valuation model for the measurement of its printing press having known very well its detrimental impact on company operational performance. You are required to: 1. Prepare journal entries for the Lonsdale printing machine for the year ending 30 June 2019. (10 marks) 2. Critically analyse some of the problems associated with basing depreciation expense on the cost model and the above mentioned detrimental impact of the fair value based revaluation model, using the answer to question 1 above. (8 marks) 3. Explain why accountants might prefer to measure property, plant and equipment using a cost model rather than measuring assets on the basis of fair value. (7 marks) Focus Accounting for non-current assets- Property. Plant & Equipment On 1 July 2018 Lonsdale Ltd acquire an offset printing machine at a cost of $125 000. At acquisition the machine was expected to be in operation for five years, after which it would have no residual value. The company accountant used the straight-line method of depreciation based on cost model. After reading the AASB 116 standards, the Company CEO instructed the accountant to apply a revaluation model to the printing press with effect from 30 June 2019. On 30 June 2019 the company valuer informed the accountant that the market price (Fair value) of a similar type of offset printing machine would be $80 000. However, the company accountant decided to use the fair value-based re-valuation model for the measurement of its printing press having known very well its detrimental impact on company operational performance. You are required to: 1. Prepare journal entries for the Lonsdale printing machine for the year ending 30 June 2019. (10 marks) 2. Critically analyse some of the problems associated with basing depreciation expense on the cost model and the above mentioned detrimental impact of the fair value based revaluation model, using the answer to question above. (8 marks) 3. Explain why accountants might prefer to measure property, plant and equipment using a cost model rather than measuring assets on the basis of fair value. (7 marks) Accounting for non-current assets- Property. Plant & Equipment On 1 July 2018 Lonsdale Ltd acquire an offset printing machine at a cost of $125 000. At acquisition the machine was expected to be in operation for five years, after which it would have no residual value. The company accountant used the straight-line method of depreciation based on cost model. After reading the AASB 116 standards, the Company CEO instructed the accountant to apply a revaluation model to the printing press with effect from 30 June 2019. On 30 June 2019 the company valuer informed the accountant that the market price (Fair value) of a similar type of offset printing machine would be $80 000. However, the company accountant decided to use the fair value-based re-valuation model for the measurement of its printing press having known very well its detrimental impact on company operational performance. You are required to: 1. Prepare journal entries for the Lonsdale printing machine for the year ending 30 June 2019. (10 marks) 2. Critically analyse some of the problems associated with basing depreciation expense on the cost model and the above mentioned detrimental impact of the fair value based revaluation model, using the answer to question above. (8 marks) 3. Explain why accountants might prefer to measure property, plant and equipment using a cost model rather than measuring assets on the basis of fair value. (7 marks)

Layout References Mailings Review View Hei Enable Editing From the Internet can contain Viruses. Unless you need to edit it's safer to stay in Protected View (Total = 10+8+7=25 Marks) Case Study 1 Accounting for non-current assets Property, Plant & Equipment On 1 July 2018 Lonsdale Ltd acquire an offset printing machine at a cost of $125 000. At acquisition the machine was expected to be in operation for five years, after which it would have no residual value. The company accountant used the straight-line method of depreciation based on cost model. After reading the AASB 116 standards, the Company CEO instructed the accountant to apply a revaluation model to the printing press with effect from 30 June 2019. On 30 June 2019 the company valuer informed the accountant that the market price (Fair value) of a similar type of offset printing machine would be $80 000. However, the company accountant decided to use the fair value-based re-valuation model for the measurement of its printing press having known very well its detrimental impact on company operational performance. You are required to: 1. Prepare journal entries for the Lonsdale printing machine for the year ending 30 June 2019. (10 marks) 2. Critically analyse some of the problems associated with basing depreciation expense on the cost model and the above mentioned detrimental impact of the fair value based revaluation model, using the answer to question 1 above. (8 marks) 3. Explain why accountants might prefer to measure property, plant and equipment using a cost model rather than measuring assets on the basis of fair value. (7 marks) Focus Accounting for non-current assets- Property. Plant & Equipment On 1 July 2018 Lonsdale Ltd acquire an offset printing machine at a cost of $125 000. At acquisition the machine was expected to be in operation for five years, after which it would have no residual value. The company accountant used the straight-line method of depreciation based on cost model. After reading the AASB 116 standards, the Company CEO instructed the accountant to apply a revaluation model to the printing press with effect from 30 June 2019. On 30 June 2019 the company valuer informed the accountant that the market price (Fair value) of a similar type of offset printing machine would be $80 000. However, the company accountant decided to use the fair value-based re-valuation model for the measurement of its printing press having known very well its detrimental impact on company operational performance. You are required to: 1. Prepare journal entries for the Lonsdale printing machine for the year ending 30 June 2019. (10 marks) 2. Critically analyse some of the problems associated with basing depreciation expense on the cost model and the above mentioned detrimental impact of the fair value based revaluation model, using the answer to question above. (8 marks) 3. Explain why accountants might prefer to measure property, plant and equipment using a cost model rather than measuring assets on the basis of fair value. (7 marks) Accounting for non-current assets- Property. Plant & Equipment On 1 July 2018 Lonsdale Ltd acquire an offset printing machine at a cost of $125 000. At acquisition the machine was expected to be in operation for five years, after which it would have no residual value. The company accountant used the straight-line method of depreciation based on cost model. After reading the AASB 116 standards, the Company CEO instructed the accountant to apply a revaluation model to the printing press with effect from 30 June 2019. On 30 June 2019 the company valuer informed the accountant that the market price (Fair value) of a similar type of offset printing machine would be $80 000. However, the company accountant decided to use the fair value-based re-valuation model for the measurement of its printing press having known very well its detrimental impact on company operational performance. You are required to: 1. Prepare journal entries for the Lonsdale printing machine for the year ending 30 June 2019. (10 marks) 2. Critically analyse some of the problems associated with basing depreciation expense on the cost model and the above mentioned detrimental impact of the fair value based revaluation model, using the answer to question above. (8 marks) 3. Explain why accountants might prefer to measure property, plant and equipment using a cost model rather than measuring assets on the basis of fair value. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started