Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 10 minutes will upvote I SECTION A Answer ALL questions Your task is to estimate the equity value of company A

please do it in 10 minutes will upvote I

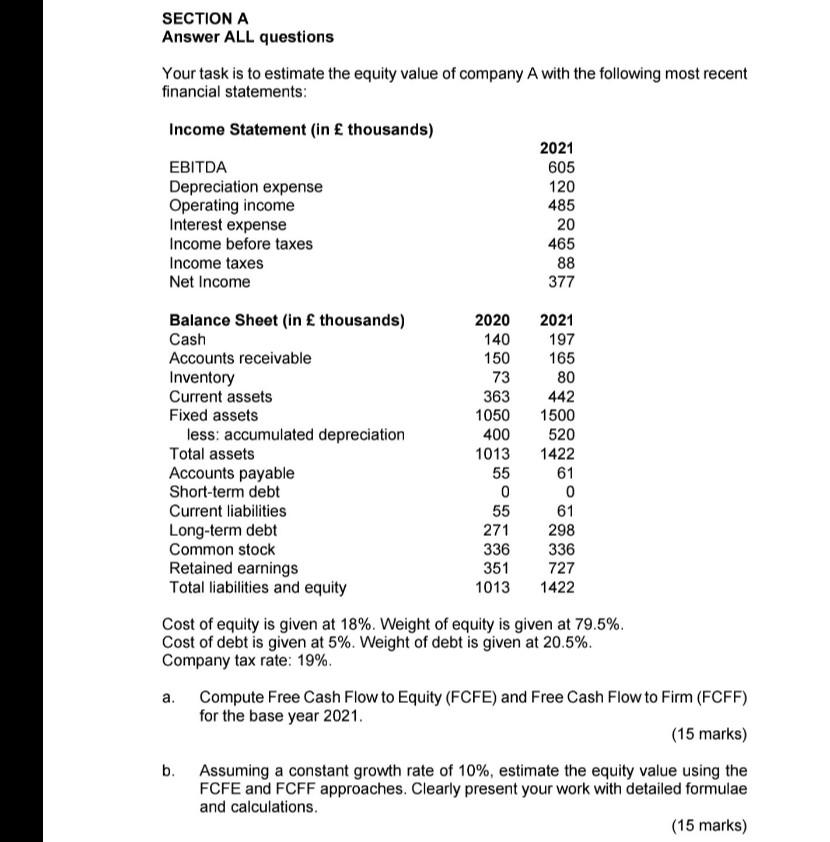

SECTION A Answer ALL questions Your task is to estimate the equity value of company A with the following most recent financial statements: Income Statement (in thousands) 2021 EBITDA 605 120 Depreciation expense Operating income 485 Interest expense 20 Income before taxes 465 Income taxes 88 Net Income 377 2020 2021 Balance Sheet (in thousands) Cash 140 197 Accounts receivable 150 165 Inventory 73 80 Current assets 363 442 Fixed assets 1050 1500 less: accumulated depreciation 400 520 Total assets 1013 1422 Accounts payable 55 61 Short-term debt 0 Current liabilities 55 61 Long-term debt 271 298 Common stock 336 336 Retained earnings 351 727 Total liabilities and equity 1013 1422 Cost of equity is given at 18%. Weight of equity is given at 79.5%. Cost of debt is given at 5%. Weight of debt is given at 20.5%. Company tax rate: 19%. a. Compute Free Cash Flow to Equity (FCFE) and Free Cash Flow to Firm (FCFF) for the base year 2021. (15 marks) b. Assuming a constant growth rate of 10%, estimate the equity value using the FCFE and FCFF approaches. Clearly present your work with detailed formulae and calculations. (15 marks) 0 SECTION A Answer ALL questions Your task is to estimate the equity value of company A with the following most recent financial statements: Income Statement (in thousands) 2021 EBITDA 605 120 Depreciation expense Operating income 485 Interest expense 20 Income before taxes 465 Income taxes 88 Net Income 377 2020 2021 Balance Sheet (in thousands) Cash 140 197 Accounts receivable 150 165 Inventory 73 80 Current assets 363 442 Fixed assets 1050 1500 less: accumulated depreciation 400 520 Total assets 1013 1422 Accounts payable 55 61 Short-term debt 0 Current liabilities 55 61 Long-term debt 271 298 Common stock 336 336 Retained earnings 351 727 Total liabilities and equity 1013 1422 Cost of equity is given at 18%. Weight of equity is given at 79.5%. Cost of debt is given at 5%. Weight of debt is given at 20.5%. Company tax rate: 19%. a. Compute Free Cash Flow to Equity (FCFE) and Free Cash Flow to Firm (FCFF) for the base year 2021. (15 marks) b. Assuming a constant growth rate of 10%, estimate the equity value using the FCFE and FCFF approaches. Clearly present your work with detailed formulae and calculations. (15 marks) 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started