Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 10 minutes will upvote Question 12 25 Points Part 1 20 Marks After winning a reasonable amount from the lottery, you

please do it in 10 minutes will upvote

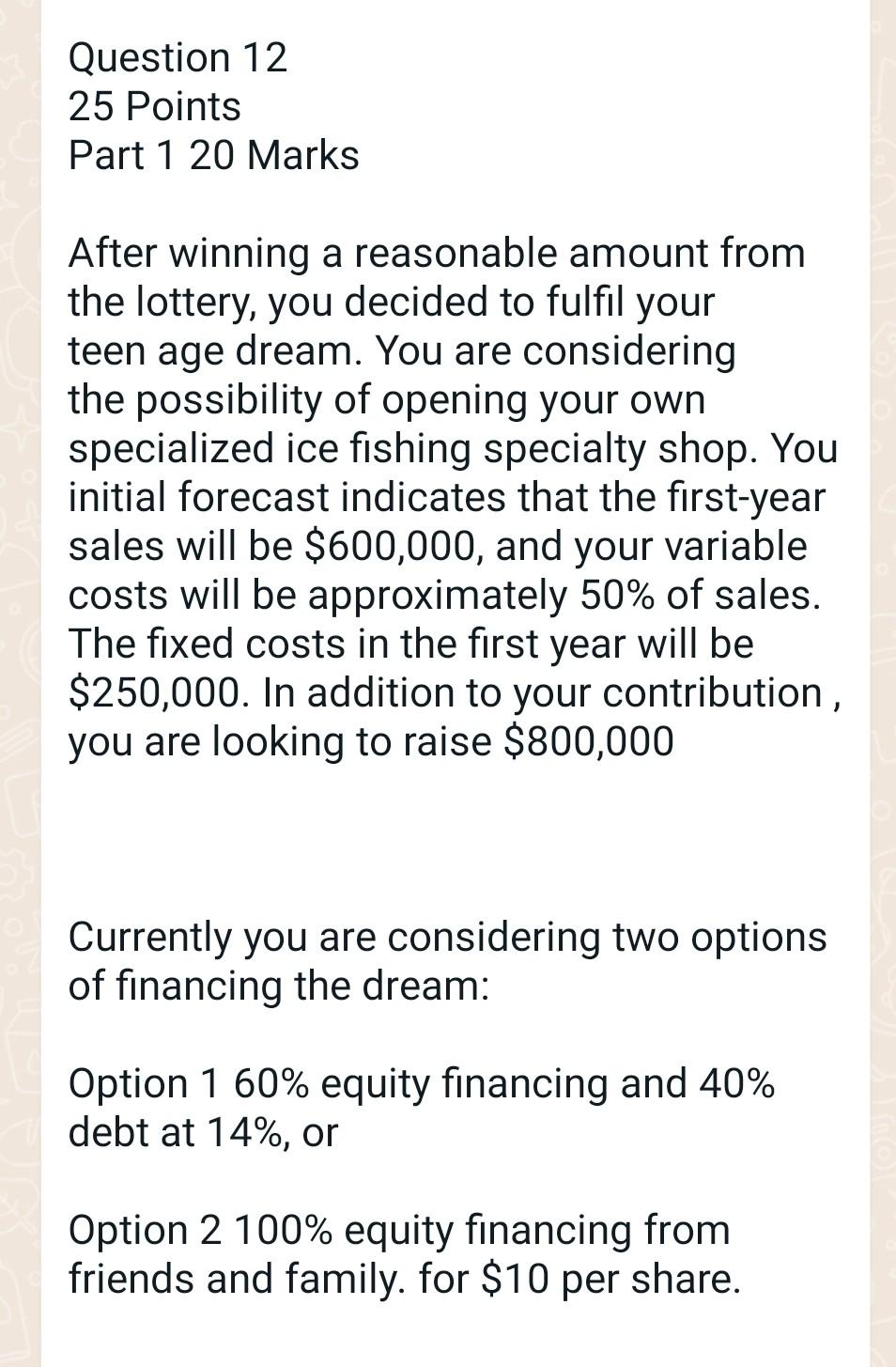

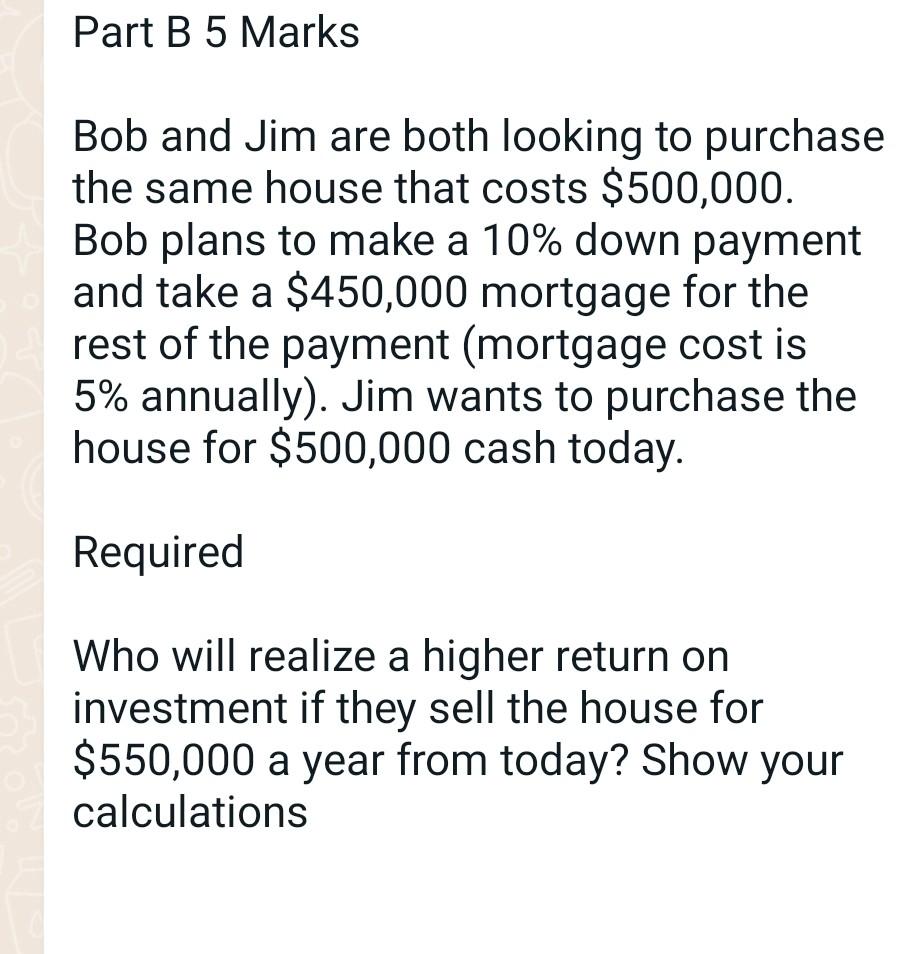

Question 12 25 Points Part 1 20 Marks After winning a reasonable amount from the lottery, you decided to fulfil your teen age dream. You are considering the possibility of opening your own specialized ice fishing specialty shop. You initial forecast indicates that the first-year sales will be $600,000, and your variable costs will be approximately 50% of sales. The fixed costs in the first year will be $250,000. In addition to your contribution, you are looking to raise $800,000 Currently you are considering two options of financing the dream: Option 1 60% equity financing and 40% debt at 14%, or Option 2 100% equity financing from friends and family. for $10 per share. Part B 5 Marks Bob and Jim are both looking to purchase the same house that costs $500,000. Bob plans to make a 10% down payment and take a $450,000 mortgage for the rest of the payment (mortgage cost is 5% annually). Jim wants to purchase the house for $500,000 cash today. Required Who will realize a higher return on investment if they sell the house for $550,000 a year from today? Show your calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started