Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 10 minutes will upvote QUESTION 9 Honduras is on a fixed exchange rate with the U.S. The exchange rate is 3.0

please do it in 10 minutes will upvote

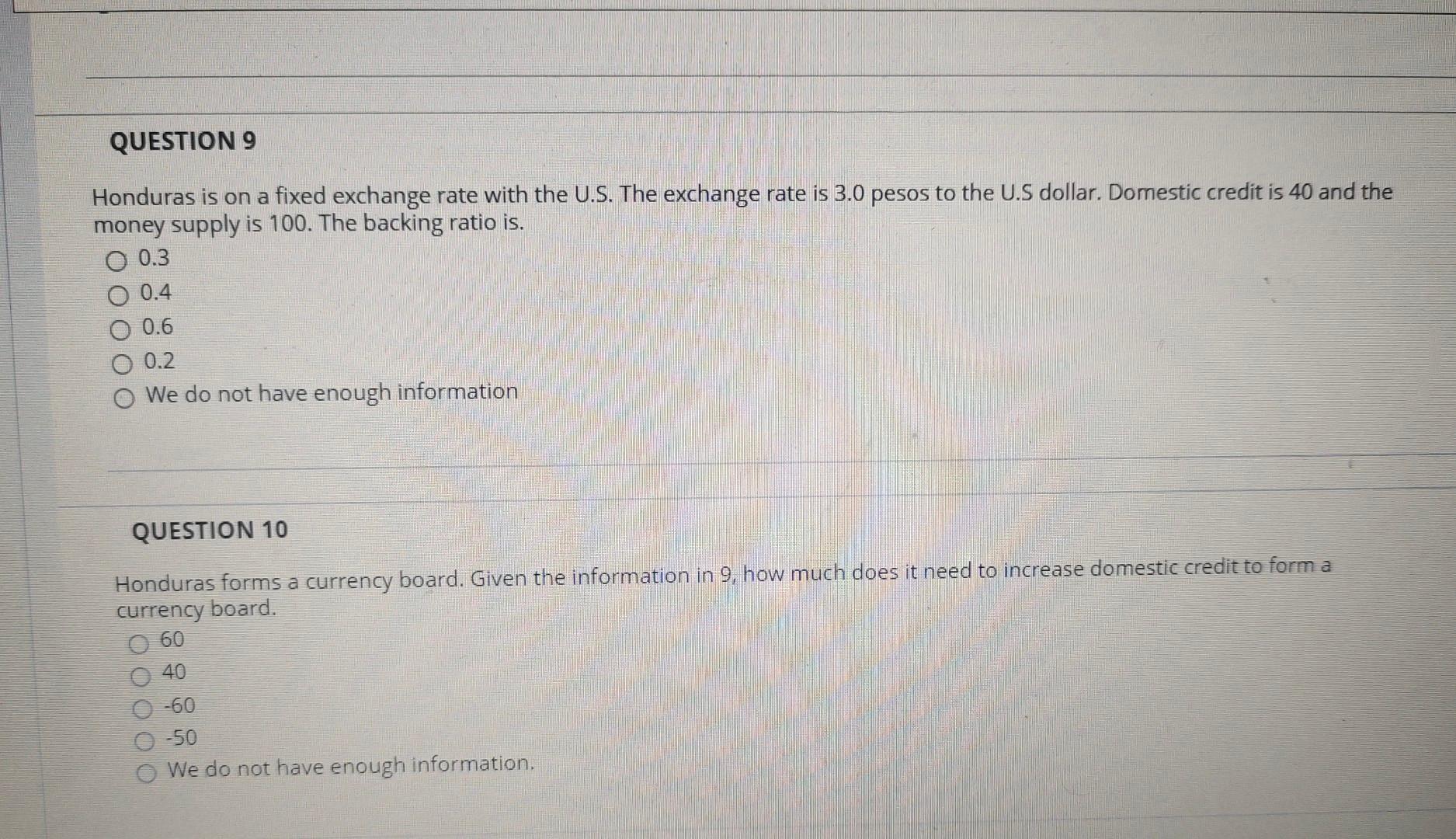

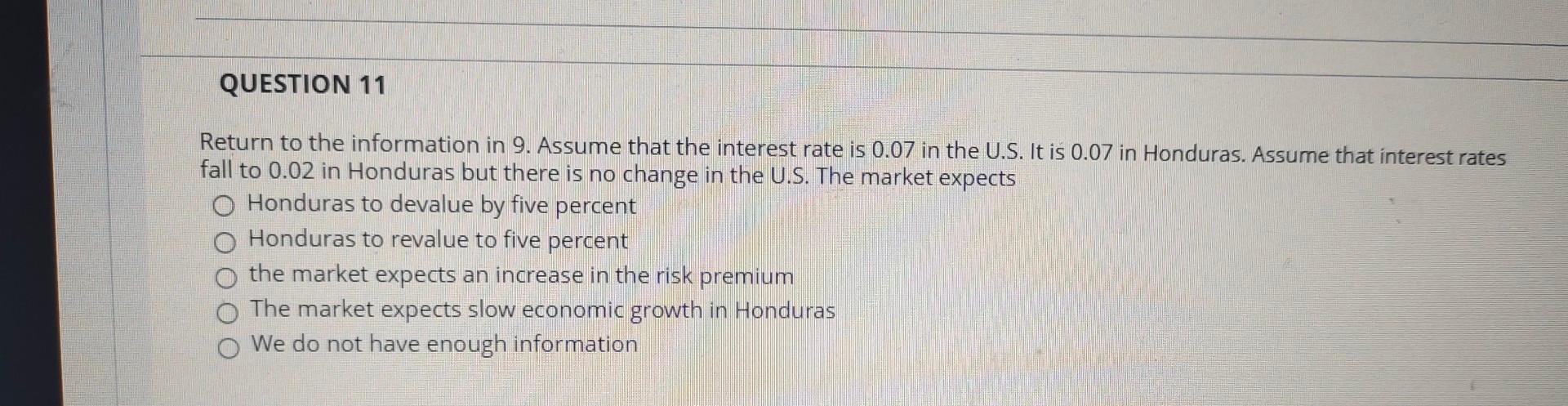

QUESTION 9 Honduras is on a fixed exchange rate with the U.S. The exchange rate is 3.0 pesos to the U.S dollar. Domestic credit is 40 and the money supply is 100. The backing ratio is. O 0.3 0.4 0.6 O 0.2 O We do not have enough information QUESTION 10 Honduras forms a currency board. Given the information in 9, how much does it need to increase domestic credit to form a currency board. 60 40 -60 -50 We do not have enough information, QUESTION 11 Return to the information in 9. Assume that the interest rate is 0.07 in the U.S. It is 0.07 in Honduras. Assume that interest rates fall to 0.02 in Honduras but there is no change in the U.S. The market expects Honduras to devalue by five percent Honduras to revalue to five percent the market expects an increase in the risk premium The market expects slow economic growth in Honduras O We do not have enough informationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started