Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 20 minutes please urgently... I'll give you up thumb definitely please solve Q.15 only Part 1 After completing your project estimation,

please do it in 20 minutes please urgently... I'll give you up thumb definitely

please solve Q.15 only

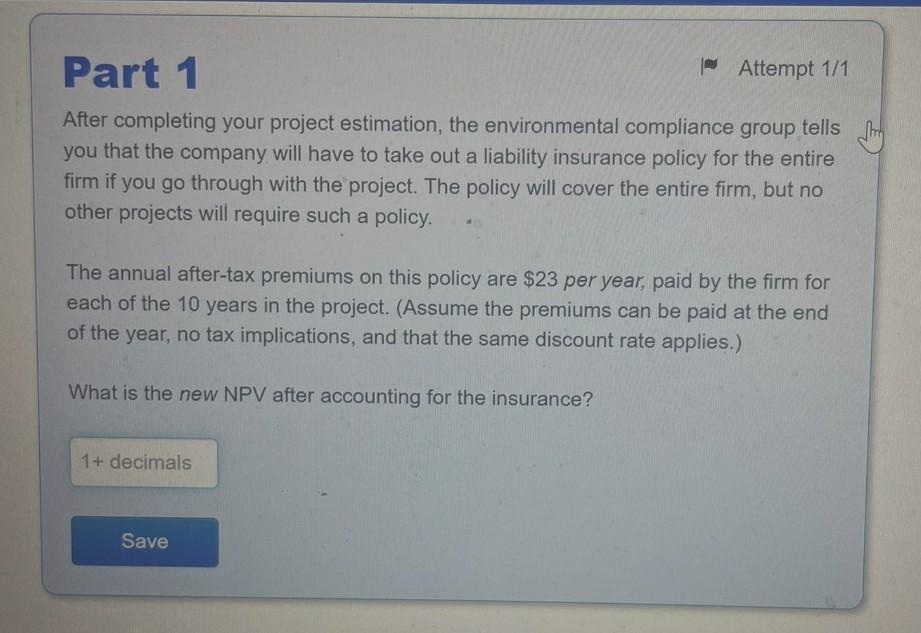

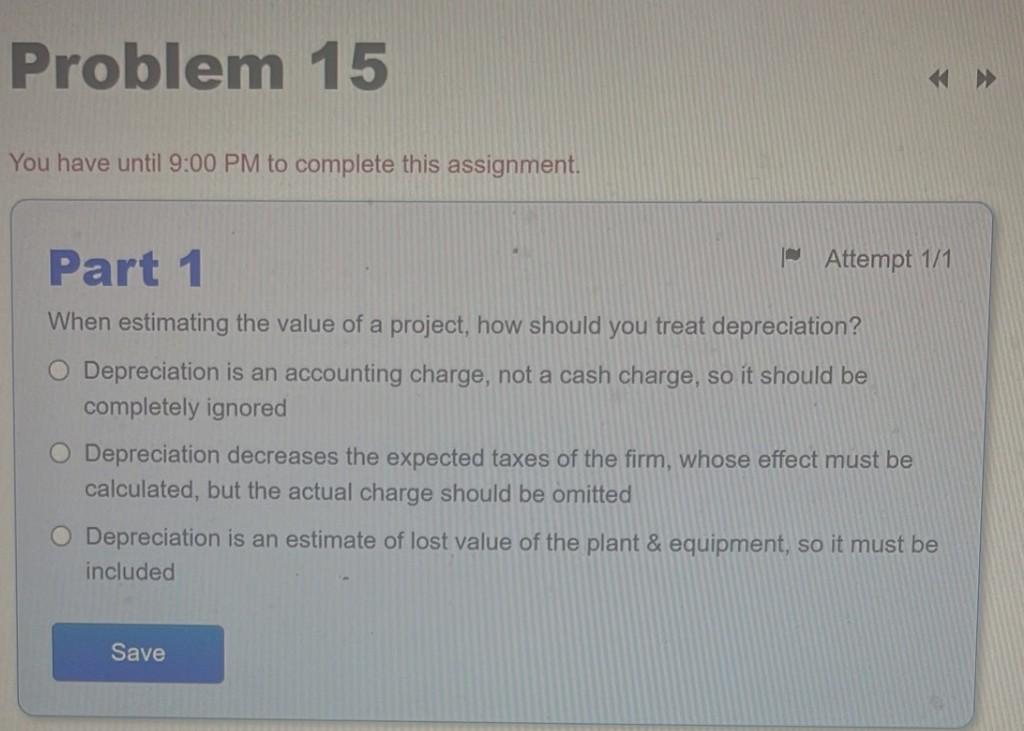

Part 1 After completing your project estimation, the environmental compliance group tells you that the company will have to take out a liability insurance policy for the entire firm if you go through with the project. The policy will cover the entire firm, but no other projects will require such a policy. The annual after-tax premiums on this policy are $23 per year, paid by the firm for each of the 10 years in the project. (Assume the premiums can be paid at the end of the year, no tax implications, and that the same discount rate applies.) What is the new NPV after accounting for the insurance? 1+ decimals Attempt 1/1 Save Problem 15 You have until 9:00 PM to complete this assignment. Part 1 When estimating the value of a project, how should you treat depreciation? O Depreciation is an accounting charge, not a cash charge, so it should be completely ignored Attempt 1/1 O Depreciation decreases the expected taxes of the firm, whose effect must be calculated, but the actual charge should be omitted >>> Save O Depreciation is an estimate of lost value of the plant & equipment, so it must be includedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started