Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 25 minutes please urgently... I'll give you up thumb definitely An Australian firm holds an asset in France and faces the

please do it in 25 minutes please urgently... I'll give you up thumb definitely

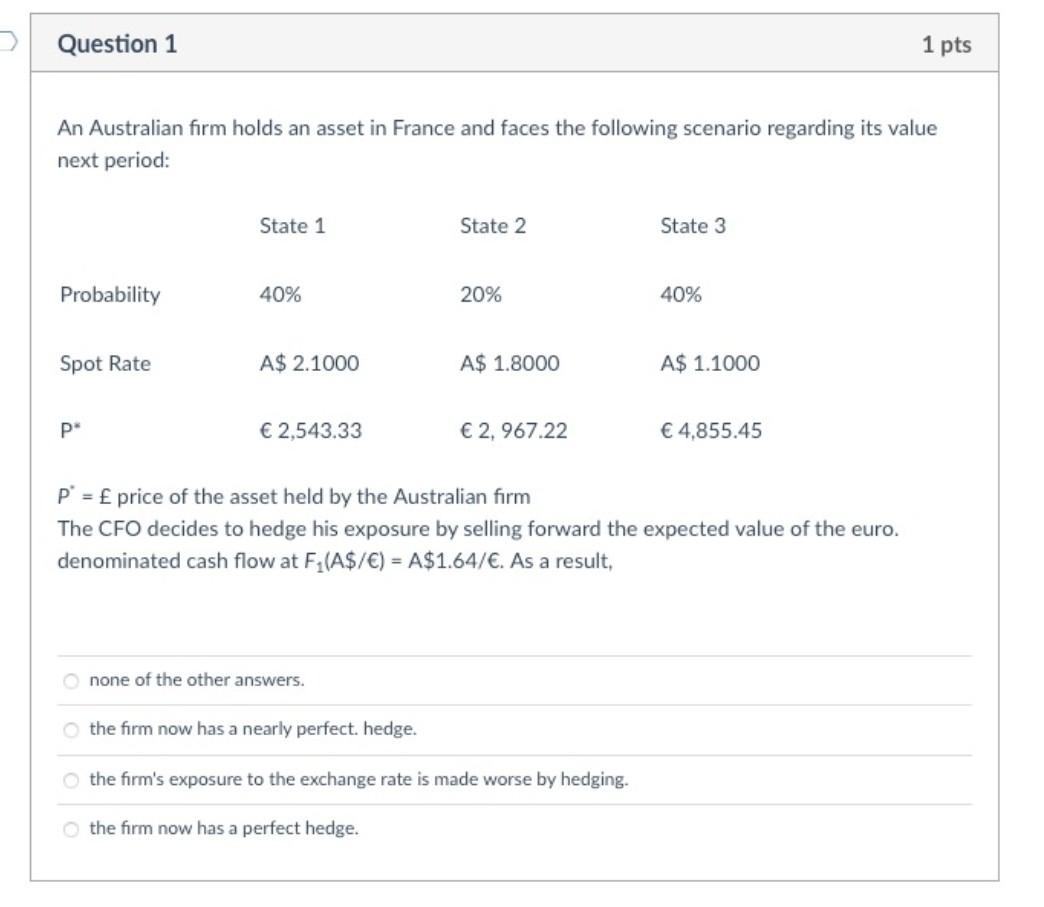

An Australian firm holds an asset in France and faces the following scenario regarding its value next period: P= price of the asset held by the Australian firm The CFO decides to hedge his exposure by selling forward the expected value of the euro. denominated cash flow at F1(A$/)=A$1.64/. As a result, none of the other answers. the firm now has a nearly perfect. hedge. the firm's exposure to the exchange rate is made worse by hedging. the firm now has a perfect hedgeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started