Answered step by step

Verified Expert Solution

Question

1 Approved Answer

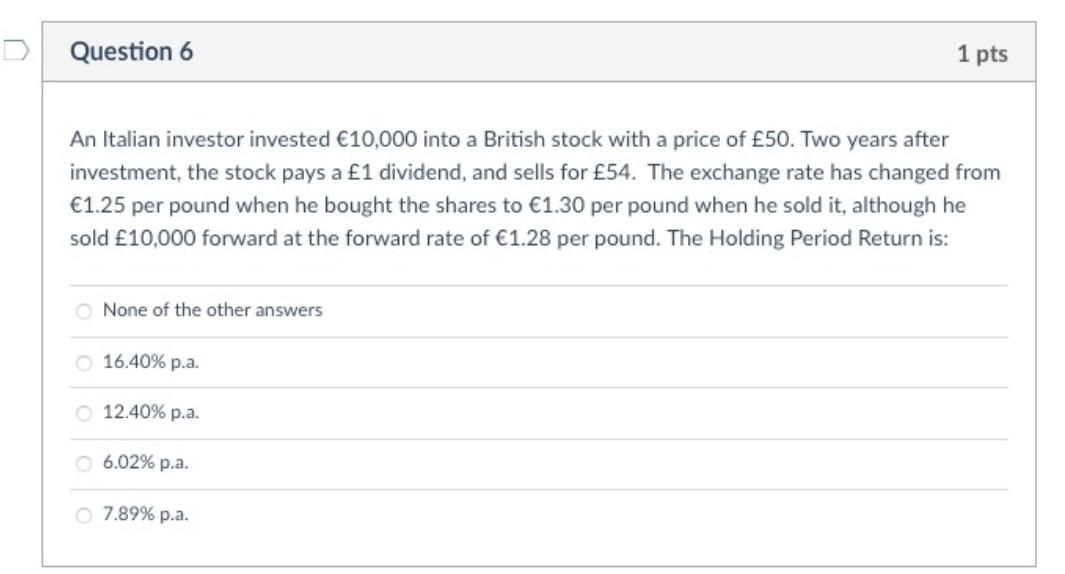

please do it in 25 minutes please urgently... I'll give you up thumb definitely An Italian investor invested 10,000 into a British stock with a

please do it in 25 minutes please urgently... I'll give you up thumb definitely

An Italian investor invested 10,000 into a British stock with a price of 50. Two years after investment, the stock pays a 1 dividend, and sells for 54. The exchange rate has changed from 1.25 per pound when he bought the shares to 1.30 per pound when he sold it, although he sold 10,000 forward at the forward rate of 1.28 per pound. The Holding Period Return is: None of the other answers 16.40%p.a. 12.40%p.a.6.02%p.a. 7.89%p.aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started