Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in detail Part B The following are the statement of profit or loss and statement of changes in equity of Begonia Manufacturing

please do it in detail

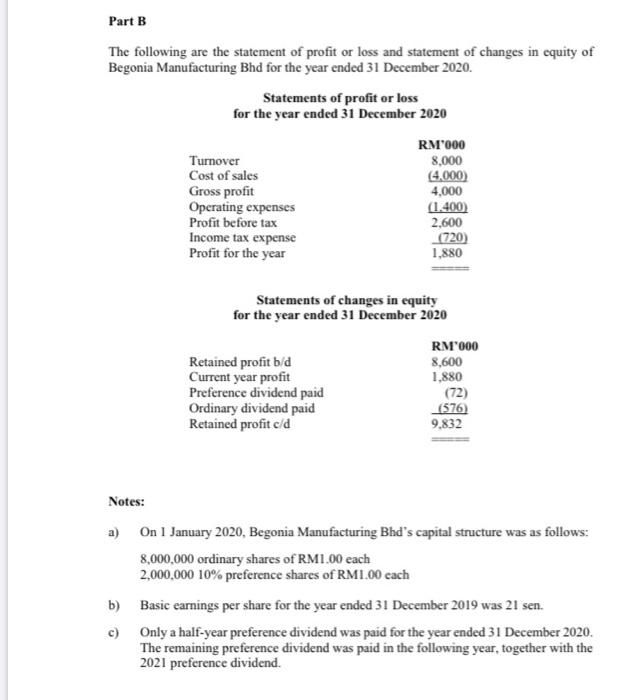

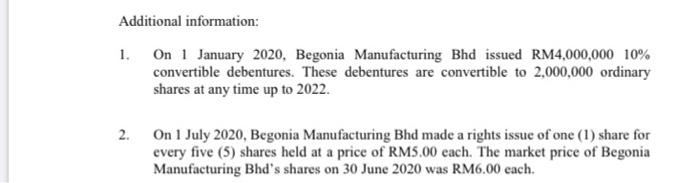

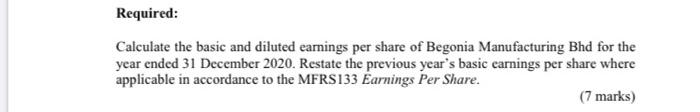

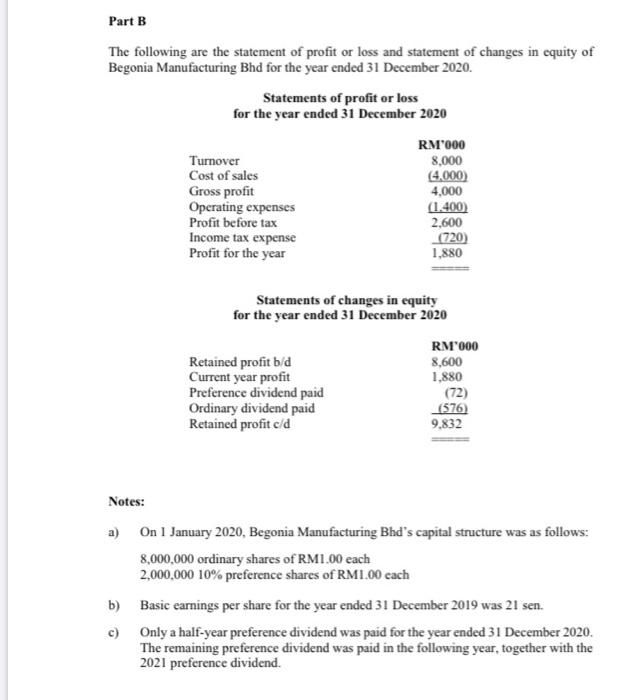

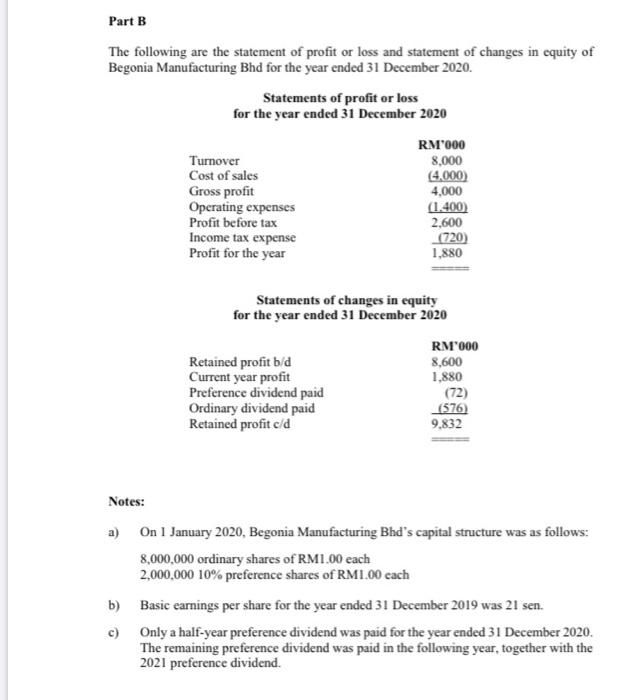

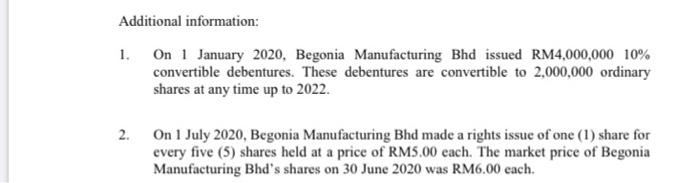

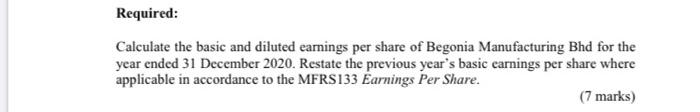

Part B The following are the statement of profit or loss and statement of changes in equity of Begonia Manufacturing Bhd for the year ended 31 December 2020. Statements of profit or loss for the year ended 31 December 2020 Turnover Cost of sales Gross profit Operating expenses Profit before tax Income tax expense Profit for the year RM'000 8,000 4,000) 4,000 (1.400) 2,600 (720) 1.880 Statements of changes in equity for the year ended 31 December 2020 Retained profit bd Current year profit Preference dividend paid Ordinary dividend paid Retained profit c/d RM'000 8,600 1,880 (72) (576) 9,832 Notes: a) On 1 January 2020, Begonia Manufacturing Bhd's capital structure was as follows: 8,000,000 ordinary shares of RM1.00 each 2,000,000 10% preference shares of RM1.00 each b) Basic earnings per share for the year ended 31 December 2019 was 21 sen. c) Only a half-year preference dividend was paid for the year ended 31 December 2020. The remaining preference dividend was paid in the following year, together with the 2021 preference dividend. Additional information: 1. On 1 January 2020, Begonia Manufacturing Bhd issued RM4,000,000 10% convertible debentures. These debentures are convertible to 2,000,000 ordinary shares at any time up to 2022. 2. On 1 July 2020, Begonia Manufacturing Bhd made a rights issue of one (1) share for every five (5) shares held at a price of RM5.00 each. The market price of Begonia Manufacturing Bhd's shares on 30 June 2020 was RM6.00 each. Required: Calculate the basic and diluted earnings per share of Begonia Manufacturing Bhd for the year ended 31 December 2020. Restate the previous year's basic earnings per share where applicable in accordance to the MFRS133 Earnings Per Share. (7 marks)

Part B The following are the statement of profit or loss and statement of changes in equity of Begonia Manufacturing Bhd for the year ended 31 December 2020. Statements of profit or loss for the year ended 31 December 2020 Turnover Cost of sales Gross profit Operating expenses Profit before tax Income tax expense Profit for the year RM'000 8,000 4,000) 4,000 (1.400) 2,600 (720) 1.880 Statements of changes in equity for the year ended 31 December 2020 Retained profit bd Current year profit Preference dividend paid Ordinary dividend paid Retained profit c/d RM'000 8,600 1,880 (72) (576) 9,832 Notes: a) On 1 January 2020, Begonia Manufacturing Bhd's capital structure was as follows: 8,000,000 ordinary shares of RM1.00 each 2,000,000 10% preference shares of RM1.00 each b) Basic earnings per share for the year ended 31 December 2019 was 21 sen. c) Only a half-year preference dividend was paid for the year ended 31 December 2020. The remaining preference dividend was paid in the following year, together with the 2021 preference dividend. Additional information: 1. On 1 January 2020, Begonia Manufacturing Bhd issued RM4,000,000 10% convertible debentures. These debentures are convertible to 2,000,000 ordinary shares at any time up to 2022. 2. On 1 July 2020, Begonia Manufacturing Bhd made a rights issue of one (1) share for every five (5) shares held at a price of RM5.00 each. The market price of Begonia Manufacturing Bhd's shares on 30 June 2020 was RM6.00 each. Required: Calculate the basic and diluted earnings per share of Begonia Manufacturing Bhd for the year ended 31 December 2020. Restate the previous year's basic earnings per share where applicable in accordance to the MFRS133 Earnings Per Share. (7 marks)

please do it in detail

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started