Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in detail thank you QUESTION 1 Maju Bina Sdn Bhd (MBSB), is a manufacturing company since 2010. MBSB is a resident company

please do it in detail thank you

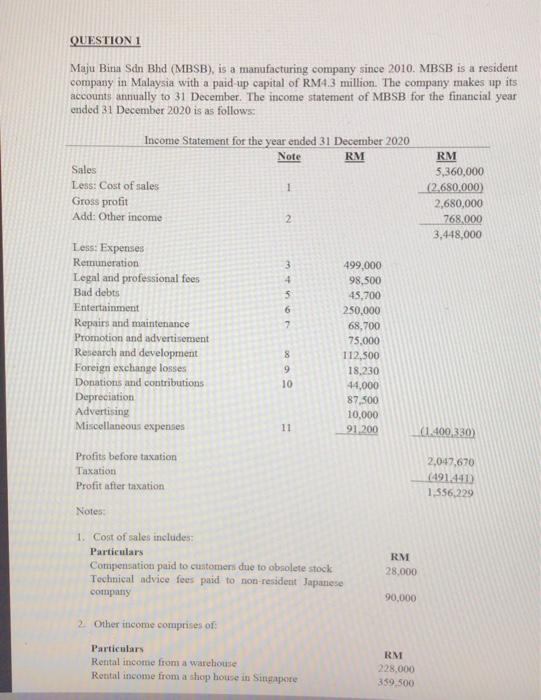

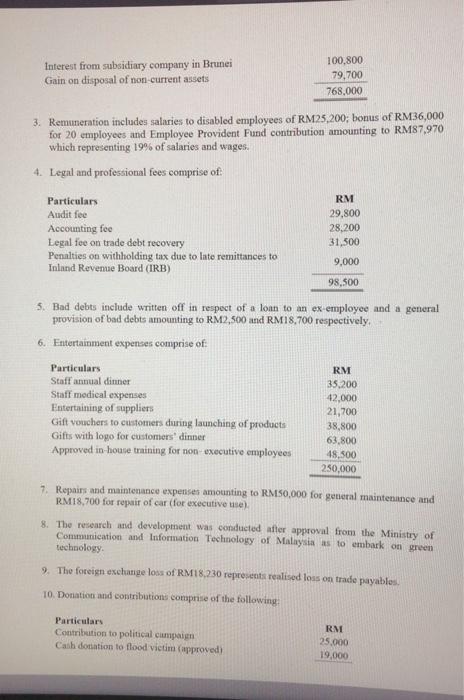

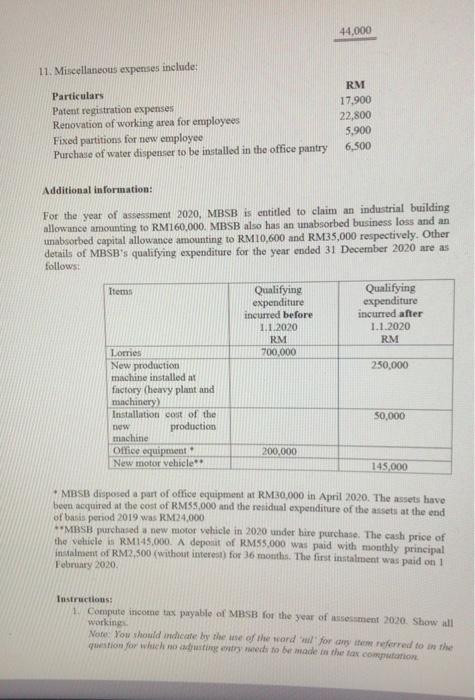

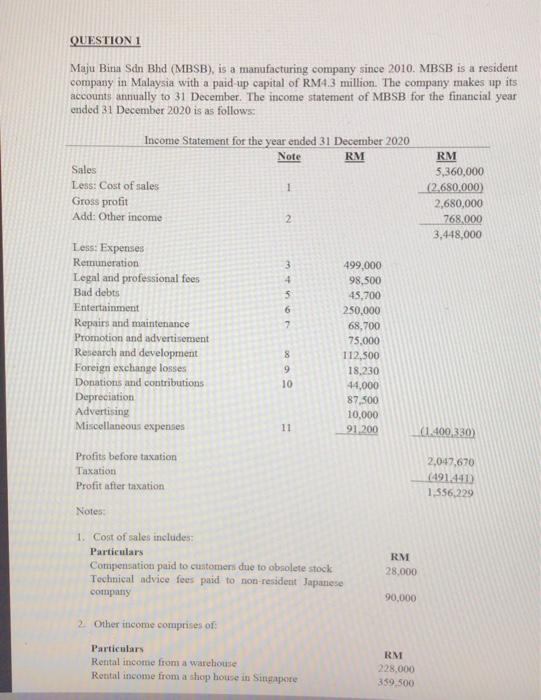

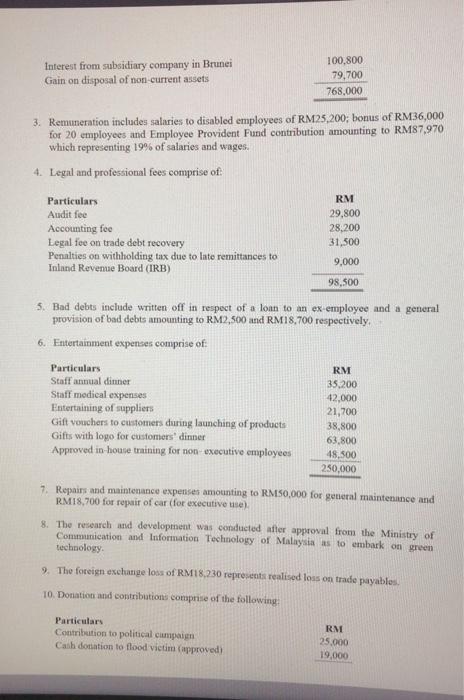

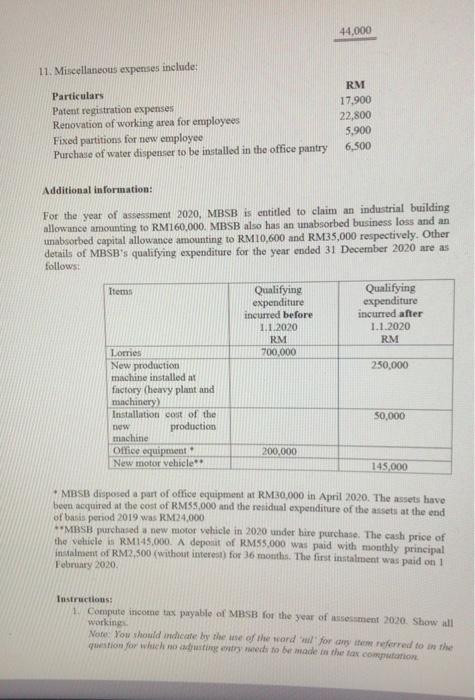

QUESTION 1 Maju Bina Sdn Bhd (MBSB), is a manufacturing company since 2010. MBSB is a resident company in Malaysia with a paid up capital of RM4,3 million. The company makes up its accounts annually to 31 December. The income statement of MBSB for the financial year ended 31 December 2020 is as follows: Income Statement for the year ended 31 December 2020 Note RM Sales Less: Cost of sales Gross profit Add: Other income 1 RM 5,360,000 (2.680,000) 2,680,000 1768.000 3,448,000 2 3 - 5 7 Less: Expenses Remuneration Legal and professional foes Bad debts Entertainment Repairs and maintenance Promotion and advertisement Research and development Foreign exchange losses Donations and contributions Depreciation Advertising Miscellaneous expenses 499,000 98,500 45,700 250,000 68,700 75,000 112,500 18.230 44,000 87.500 10,000 8 9 10 11 91,200 (1.400.330) Profits before taxation Taxation Profit after taxation 2,047,670 (491,441) 1,356,229 Notes: 1. Cost of sales includes Particulars Compensation paid to customers due to obsolete stock Technical advice fees paid to non-resident Japanese company RM 28.000 90,000 2. Other income comprises of: Particulars Rental income from a warehouse Renital income from a shop house in Singapore RM 228.000 359.500 Interest from subsidiary company in Brunei Gain on disposal of non-current assets 100.800 79,700 768,000 3. Remuneration includes salaries to disabled employees of RM25,200; bonus of RM36,000 for 20 employees and Employee Provident Fund contribution amounting to RM87.970 which representing 19% of salaries and wages. 4. Legal and professional fees comprise of Particulars RM Audit fee 29,800 Accounting fee 28,200 Legal fee on trade debt recovery 31,500 Penalties on withholding tax due to Inte remittances to Inland Revenue Board (IRB) 9,000 98,500 5. Bad debts include written off in respect of a loan to an ex employee and a general provision of bad debts amounting to RM2,500 and RM18.700 respectively, 6. Entertainment expenses comprise of Particulars Staff annual dinner Staff medical expenses Entertaining of suppliers Gift vouchers to customers during launching of products Gifts with logo for customers' dinner Approved in house training for non executive employees RM 35.200 42,000 21,700 38,800 63.800 48.500 250,000 7. Repairs and maintenance expenses amounting to RM50,000 for general maintenance and RM18,700 for repair of car (for executive use) 8. The research and development was conducted after approval from the Ministry of Communication and Information Technology of Malaysia as to embark on green technology 9. The foreign exchange loss of RM18.230 represents realised loss on trade payables 10. Doriation and contributions comprise of the following RM Particulars Contribution to political campaign Canh donation to flood victim (approved) 25.000 19,000 44,000 11. Miscellaneous expenses include: Particulars Patent registration expenses Renovation of working area for employees Fixed partitions for new employee Purchase of water dispenser to be installed in the office pantry RM 17.900 22,800 5,900 6,500 Additional information: For the year of assessment 2020, MBSB is entitled to claim an industrial building allowance amounting to RM160,000. MBSB also has an unabsorbed business loss and an unabsorbed capital allowance amounting to RM10,600 and RM35,000 respectively. Other details of MBSB's qualifying expenditure for the year ended 31 December 2020 are as follows: Items Qualifying expenditure incurred before 1.1.2020 RM 700,000 Qualifying expenditure incurred after 1.1.2020 RM 250,000 Lories New production machine installed at factory (heavy plant and machinery) Installation cost of the new production machine Office equipment New motor vehicle. 50.000 200.000 145,000 * MBSB disposed a part of office equipment at RM30,000 in April 2020. The assets have been acquired at the cost of RM55.000 and the residual expenditure of the assets at the end of basis period 2019 was RM24,000 **MBSB purchased a new motor vehicle in 2020 under hire purchase. The cash price of the voluicle is RM145.000. A deposit of RM55.000 was paid with monthly principal instalment of RM2,500 (without interest) for 36 months. The first instalment was paid on 1 February 2020. Instructions: 1. Compute income tax payable of MASB for the year of assessment 2020. Show all working Note: You should indicate by the line of the word for any referred to in the question for which tog entry wed to be made in the for computation. 2. Download Form C (sample copy/reference copy) for 2020 from the Inland Revenue Board website. 3. Complete Basic Particulars and Part A until Part C only (whichever is relevant) of Form C using the answer in (1). (30 marks) QUESTION 1 Maju Bina Sdn Bhd (MBSB), is a manufacturing company since 2010. MBSB is a resident company in Malaysia with a paid up capital of RM4,3 million. The company makes up its accounts annually to 31 December. The income statement of MBSB for the financial year ended 31 December 2020 is as follows: Income Statement for the year ended 31 December 2020 Note RM Sales Less: Cost of sales Gross profit Add: Other income 1 RM 5,360,000 (2.680,000) 2,680,000 1768.000 3,448,000 2 3 - 5 7 Less: Expenses Remuneration Legal and professional foes Bad debts Entertainment Repairs and maintenance Promotion and advertisement Research and development Foreign exchange losses Donations and contributions Depreciation Advertising Miscellaneous expenses 499,000 98,500 45,700 250,000 68,700 75,000 112,500 18.230 44,000 87.500 10,000 8 9 10 11 91,200 (1.400.330) Profits before taxation Taxation Profit after taxation 2,047,670 (491,441) 1,356,229 Notes: 1. Cost of sales includes Particulars Compensation paid to customers due to obsolete stock Technical advice fees paid to non-resident Japanese company RM 28.000 90,000 2. Other income comprises of: Particulars Rental income from a warehouse Renital income from a shop house in Singapore RM 228.000 359.500 Interest from subsidiary company in Brunei Gain on disposal of non-current assets 100.800 79,700 768,000 3. Remuneration includes salaries to disabled employees of RM25,200; bonus of RM36,000 for 20 employees and Employee Provident Fund contribution amounting to RM87.970 which representing 19% of salaries and wages. 4. Legal and professional fees comprise of Particulars RM Audit fee 29,800 Accounting fee 28,200 Legal fee on trade debt recovery 31,500 Penalties on withholding tax due to Inte remittances to Inland Revenue Board (IRB) 9,000 98,500 5. Bad debts include written off in respect of a loan to an ex employee and a general provision of bad debts amounting to RM2,500 and RM18.700 respectively, 6. Entertainment expenses comprise of Particulars Staff annual dinner Staff medical expenses Entertaining of suppliers Gift vouchers to customers during launching of products Gifts with logo for customers' dinner Approved in house training for non executive employees RM 35.200 42,000 21,700 38,800 63.800 48.500 250,000 7. Repairs and maintenance expenses amounting to RM50,000 for general maintenance and RM18,700 for repair of car (for executive use) 8. The research and development was conducted after approval from the Ministry of Communication and Information Technology of Malaysia as to embark on green technology 9. The foreign exchange loss of RM18.230 represents realised loss on trade payables 10. Doriation and contributions comprise of the following RM Particulars Contribution to political campaign Canh donation to flood victim (approved) 25.000 19,000 44,000 11. Miscellaneous expenses include: Particulars Patent registration expenses Renovation of working area for employees Fixed partitions for new employee Purchase of water dispenser to be installed in the office pantry RM 17.900 22,800 5,900 6,500 Additional information: For the year of assessment 2020, MBSB is entitled to claim an industrial building allowance amounting to RM160,000. MBSB also has an unabsorbed business loss and an unabsorbed capital allowance amounting to RM10,600 and RM35,000 respectively. Other details of MBSB's qualifying expenditure for the year ended 31 December 2020 are as follows: Items Qualifying expenditure incurred before 1.1.2020 RM 700,000 Qualifying expenditure incurred after 1.1.2020 RM 250,000 Lories New production machine installed at factory (heavy plant and machinery) Installation cost of the new production machine Office equipment New motor vehicle. 50.000 200.000 145,000 * MBSB disposed a part of office equipment at RM30,000 in April 2020. The assets have been acquired at the cost of RM55.000 and the residual expenditure of the assets at the end of basis period 2019 was RM24,000 **MBSB purchased a new motor vehicle in 2020 under hire purchase. The cash price of the voluicle is RM145.000. A deposit of RM55.000 was paid with monthly principal instalment of RM2,500 (without interest) for 36 months. The first instalment was paid on 1 February 2020. Instructions: 1. Compute income tax payable of MASB for the year of assessment 2020. Show all working Note: You should indicate by the line of the word for any referred to in the question for which tog entry wed to be made in the for computation. 2. Download Form C (sample copy/reference copy) for 2020 from the Inland Revenue Board website. 3. Complete Basic Particulars and Part A until Part C only (whichever is relevant) of Form C using the answer in (1). (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started