Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do it in excel and show the formulas Suppose a firm's asset is $8 billion, while the upcoming debt amount to be paid is

Please do it in excel and show the formulas

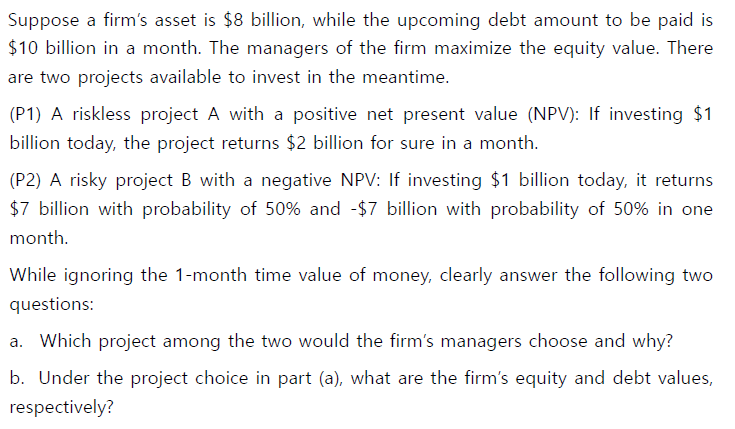

Suppose a firm's asset is $8 billion, while the upcoming debt amount to be paid is $10 billion in a month. The managers of the firm maximize the equity value. There are two projects available to invest in the meantime. (P1) A riskless project A with a positive net present value (NPV): If investing $1 billion today, the project returns $2 billion for sure in a month. (P2) A risky project B with a negative NPV: If investing $1 billion today, it returns $7 billion with probability of 50% and $7 billion with probability of 50% in one month. While ignoring the 1-month time value of money, clearly answer the following two questions: a. Which project among the two would the firm's managers choose and why? b. Under the project choice in part (a), what are the firm's equity and debt values, respectivelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started