Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please, do it in excel with the explanation. As financial adviser, you have access to very detailed forecasts about a number of assets. In particular,

Please, do it in excel with the explanation.

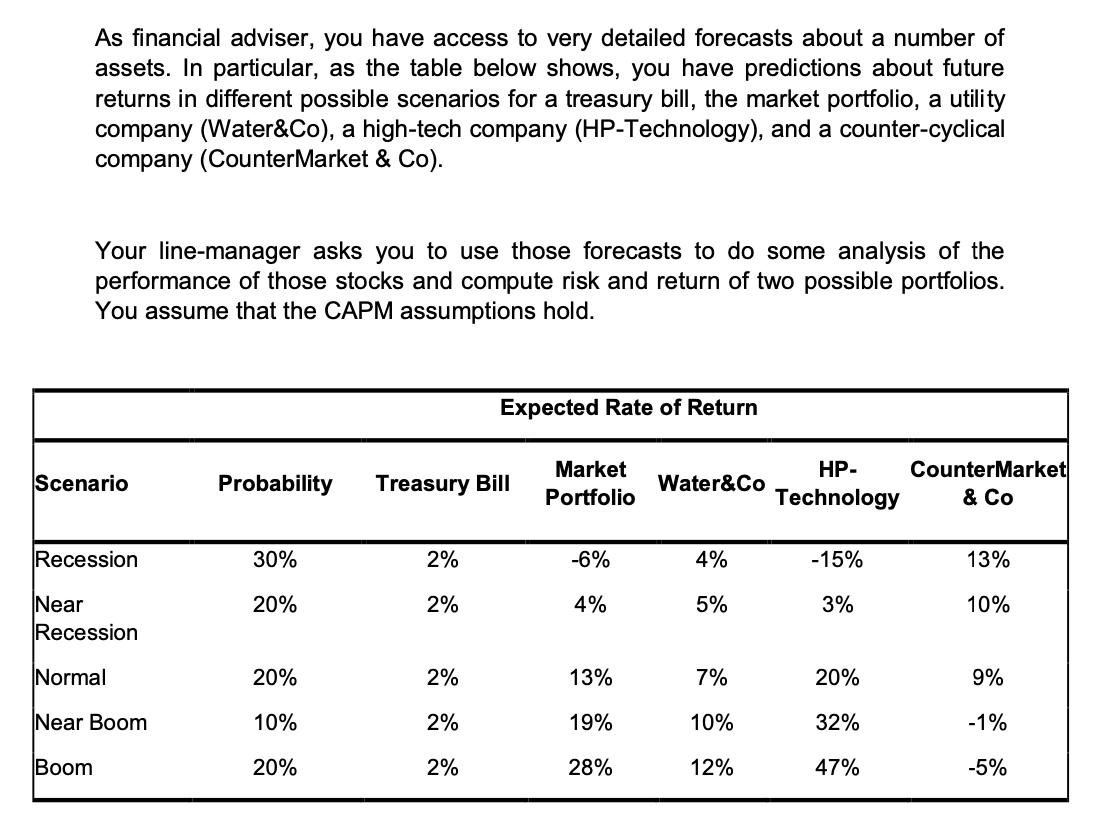

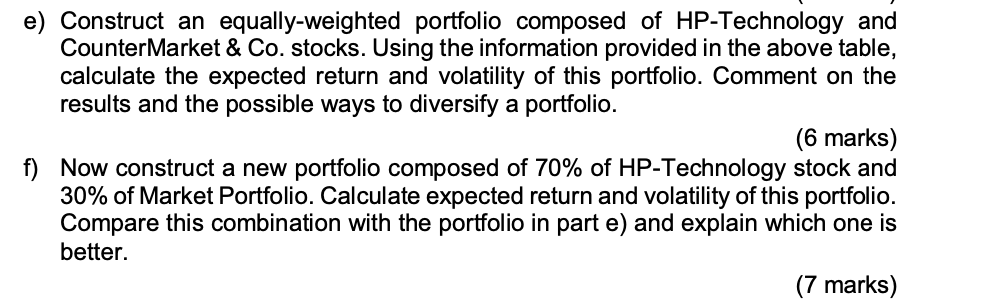

As financial adviser, you have access to very detailed forecasts about a number of assets. In particular, as the table below shows, you have predictions about future returns in different possible scenarios for a treasury bill, the market portfolio, a utility company (Water&Co), a high-tech company (HP-Technology), and a counter-cyclical company (CounterMarket & Co). Your line-manager asks you to use those forecasts to do some analysis of the performance of those stocks and compute risk and return of two possible portfolios. You assume that the CAPM assumptions hold. Expected Rate of Return Scenario Probability Treasury Bill Market Portfolio Water&Co HP- Technology CounterMarket & Co Recession 30% 2% -6% 4% -15% 13% Near 20% 2% 4% 5% 3% 10% Recession Normal 20% 2% 13% 7% 20% 9% Near Boom 10% 2% 19% 10% 32% -1% Boom 20% 2% 28% 12% 47% -5% e) Construct an equally-weighted portfolio composed of HP-Technology and CounterMarket & Co. stocks. Using the information provided in the above table, calculate the expected return and volatility of this portfolio. Comment on the results and the possible ways to diversify a portfolio. (6 marks) f) Now construct a new portfolio composed of 70% of HP-Technology stock and 30% of Market Portfolio. Calculate expected return and volatility of this portfolio. Compare this combination with the portfolio in part e) and explain which one is better. (7 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started