please do it in the same format as provides or at least similar so its easier to read and understand.

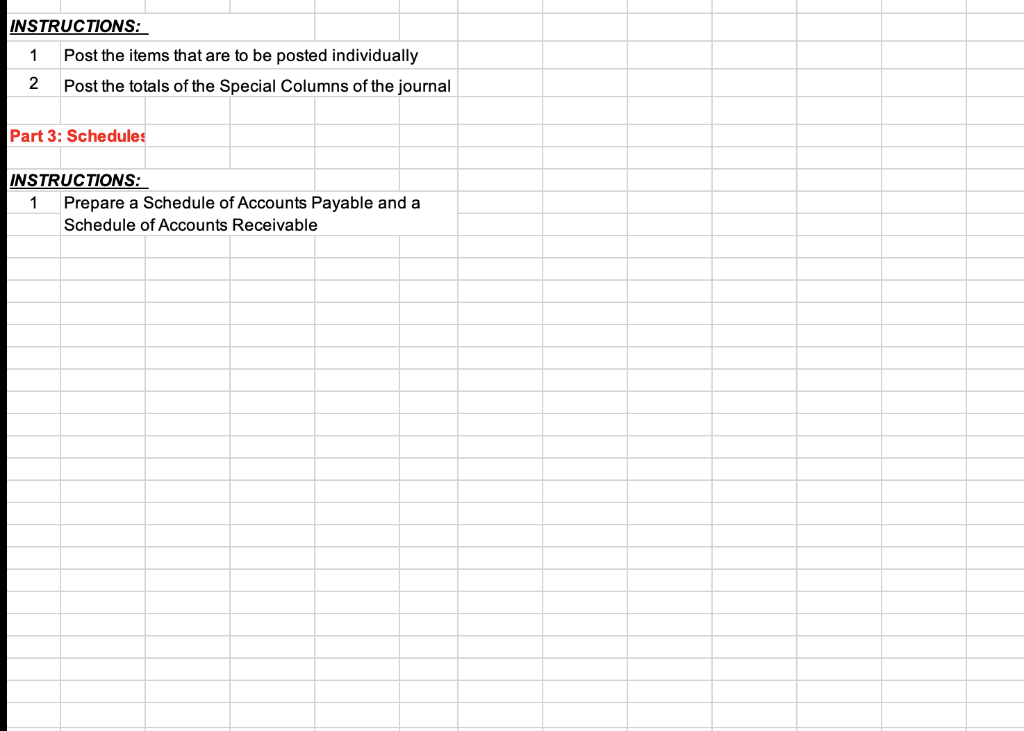

Part 2

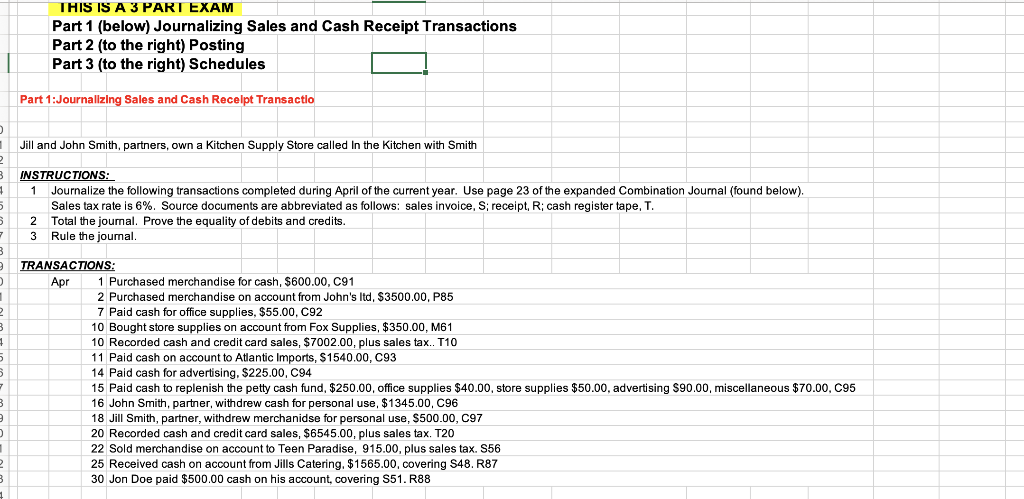

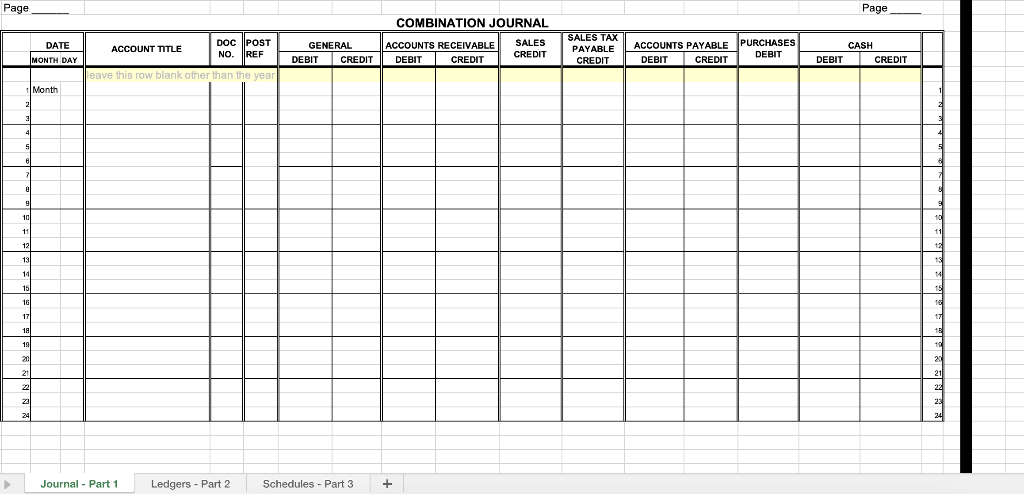

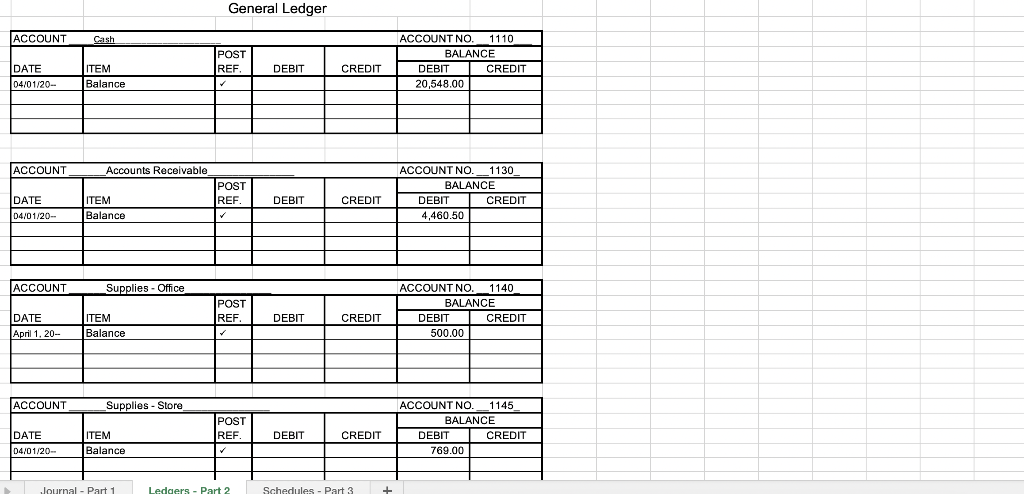

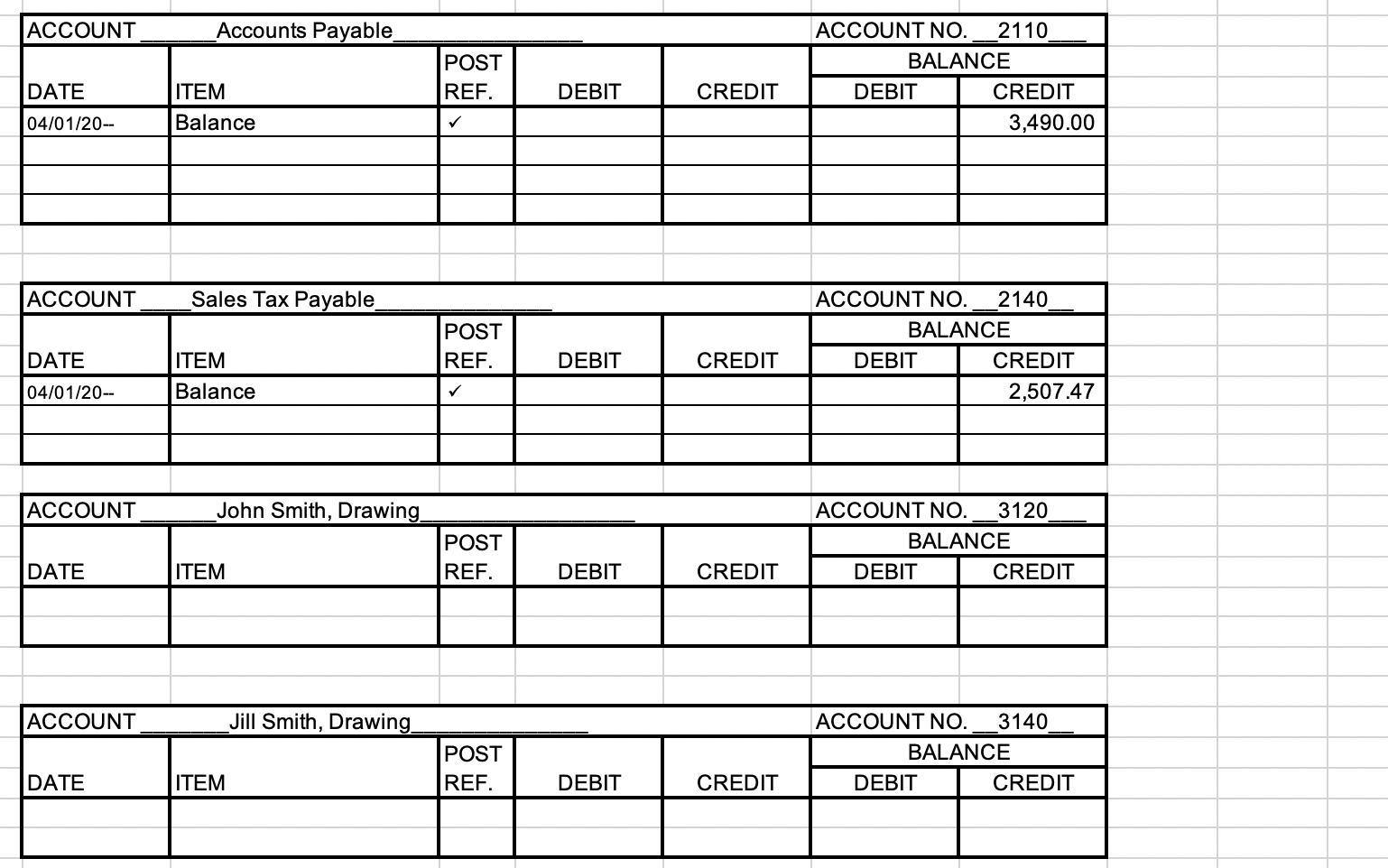

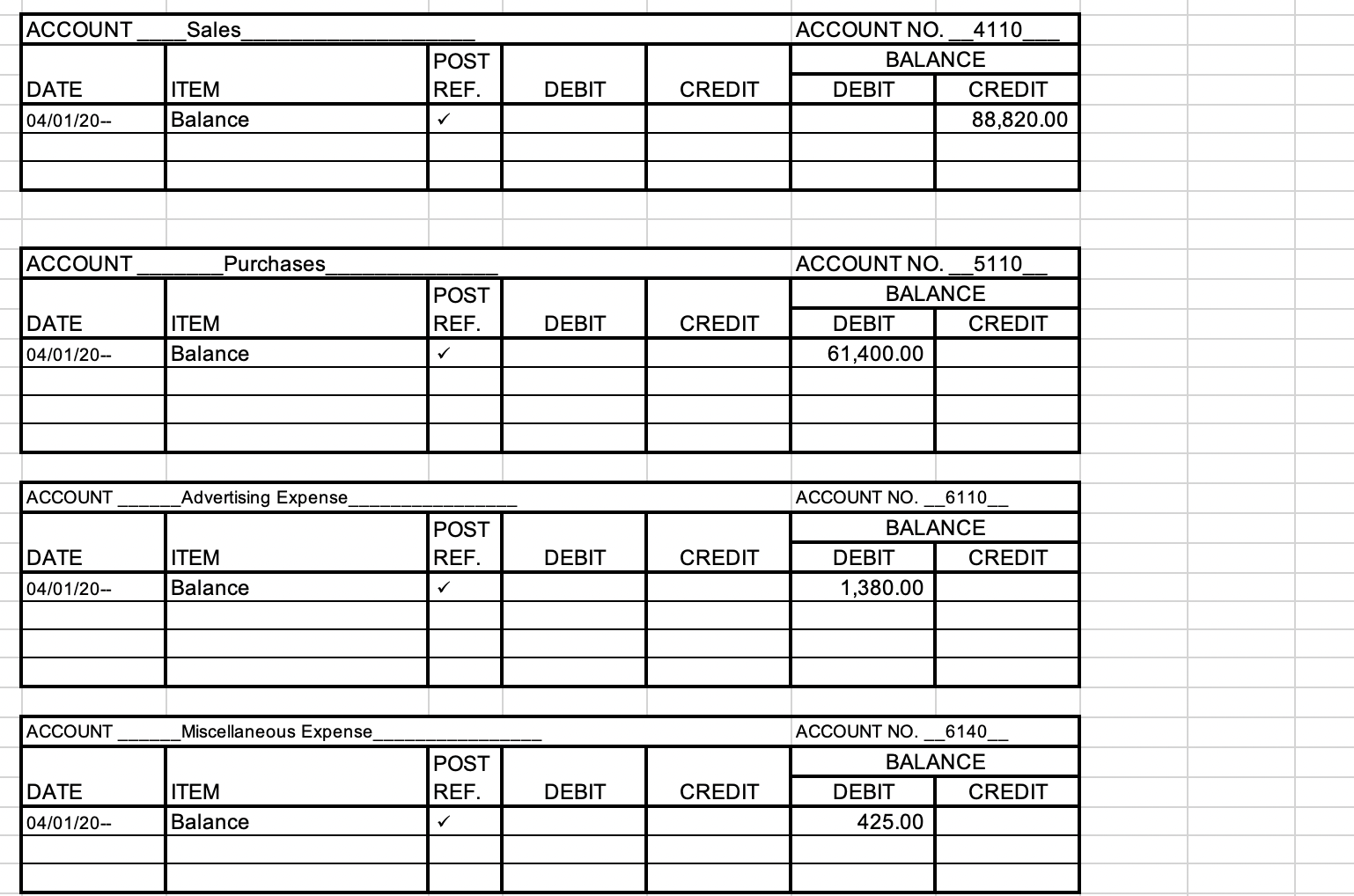

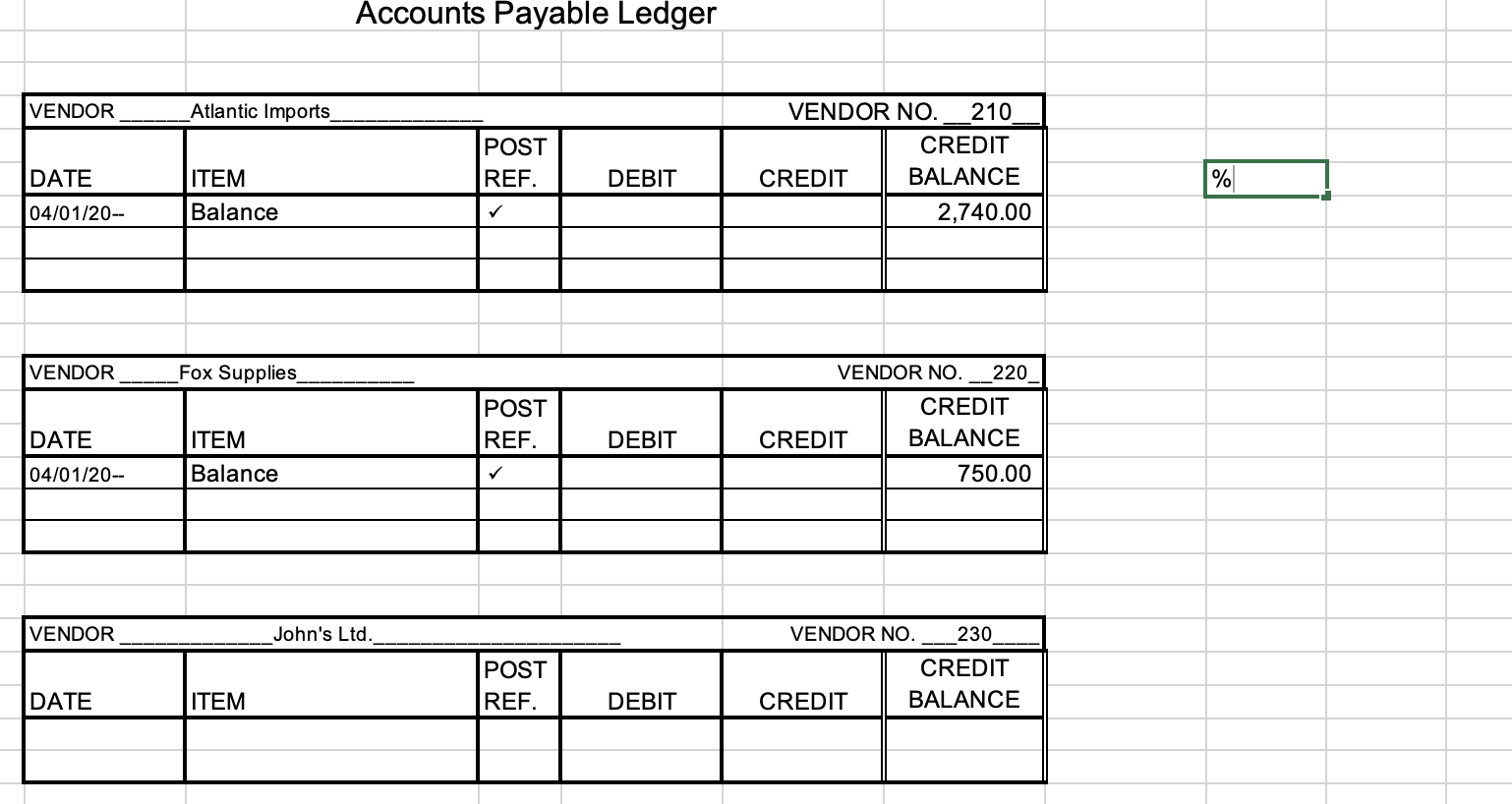

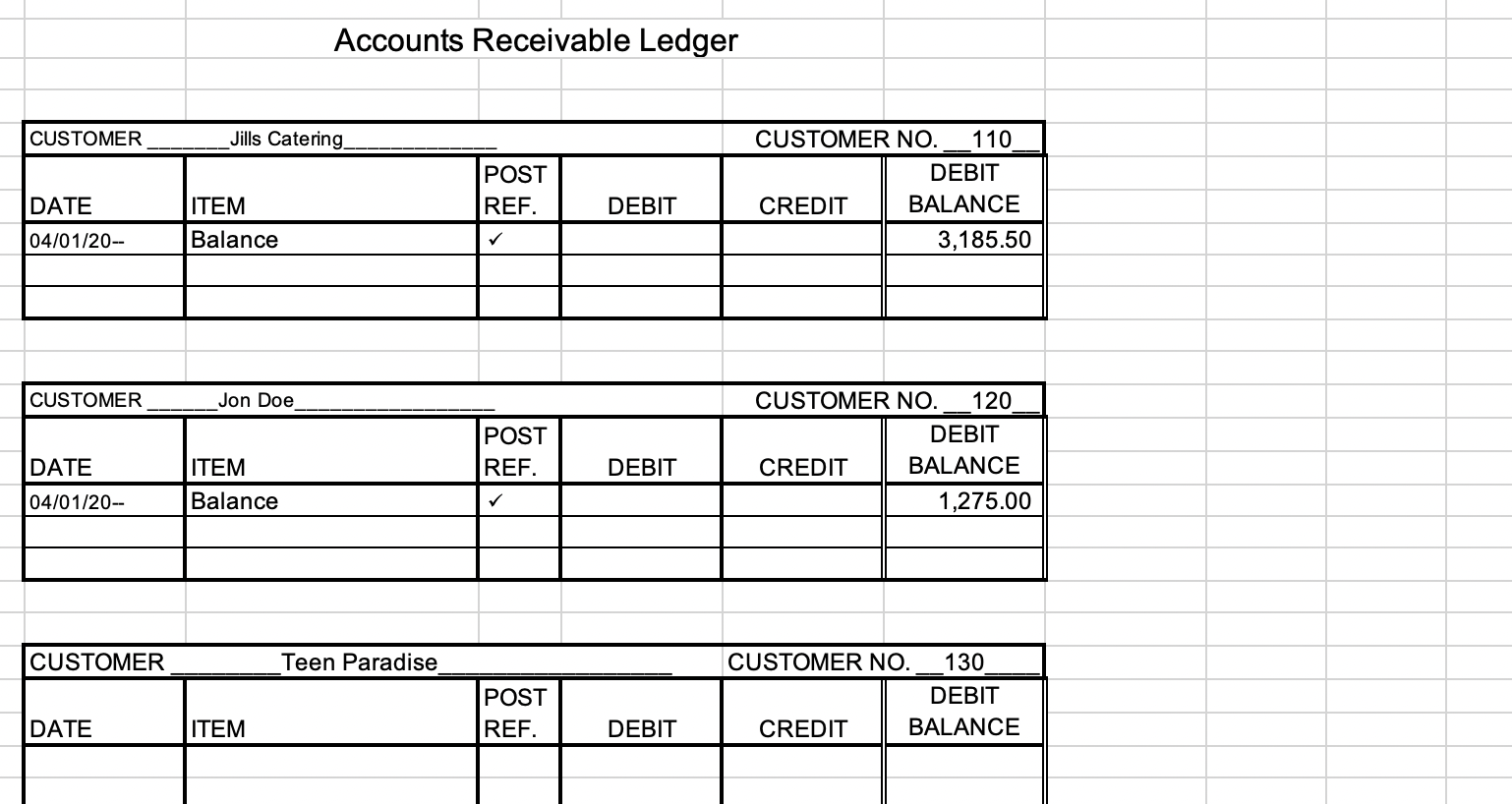

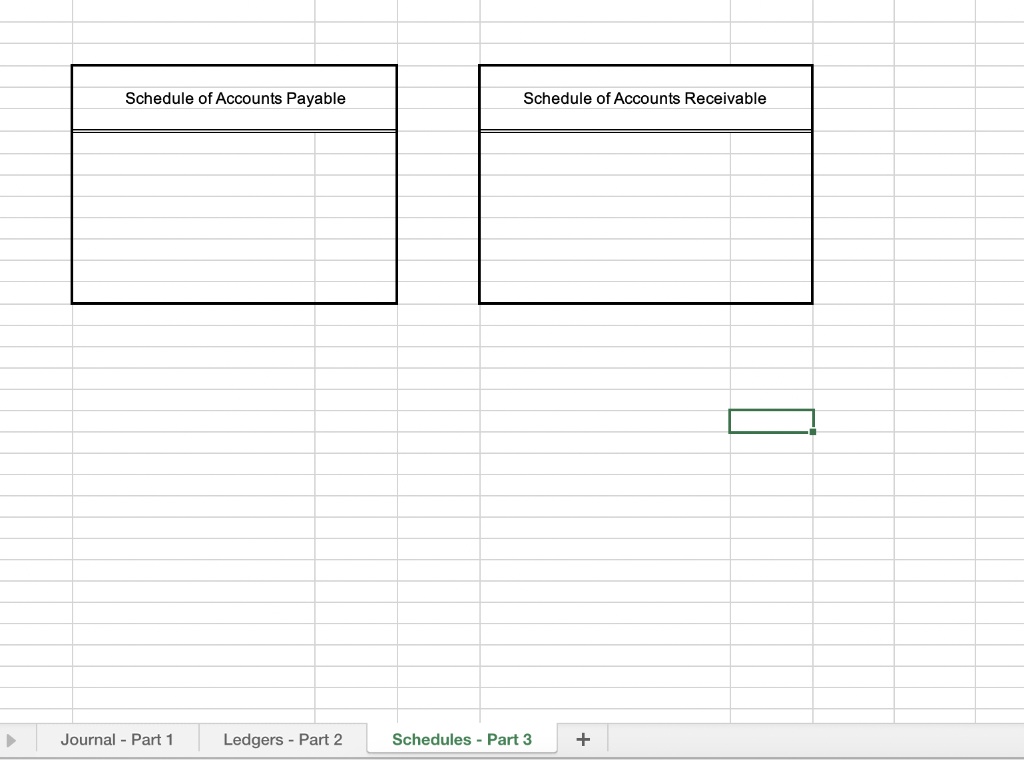

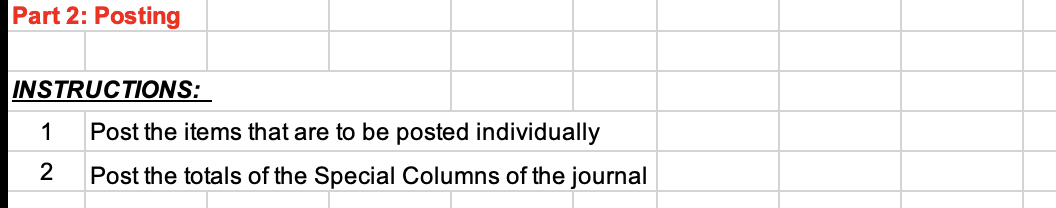

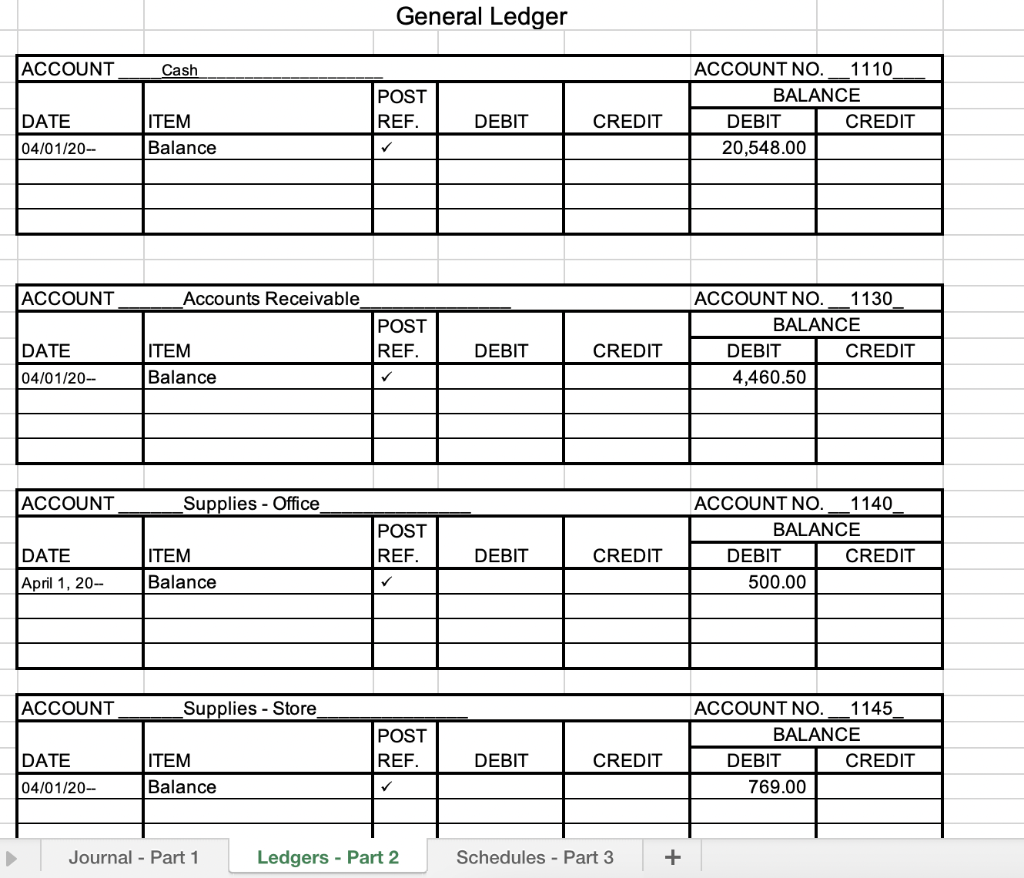

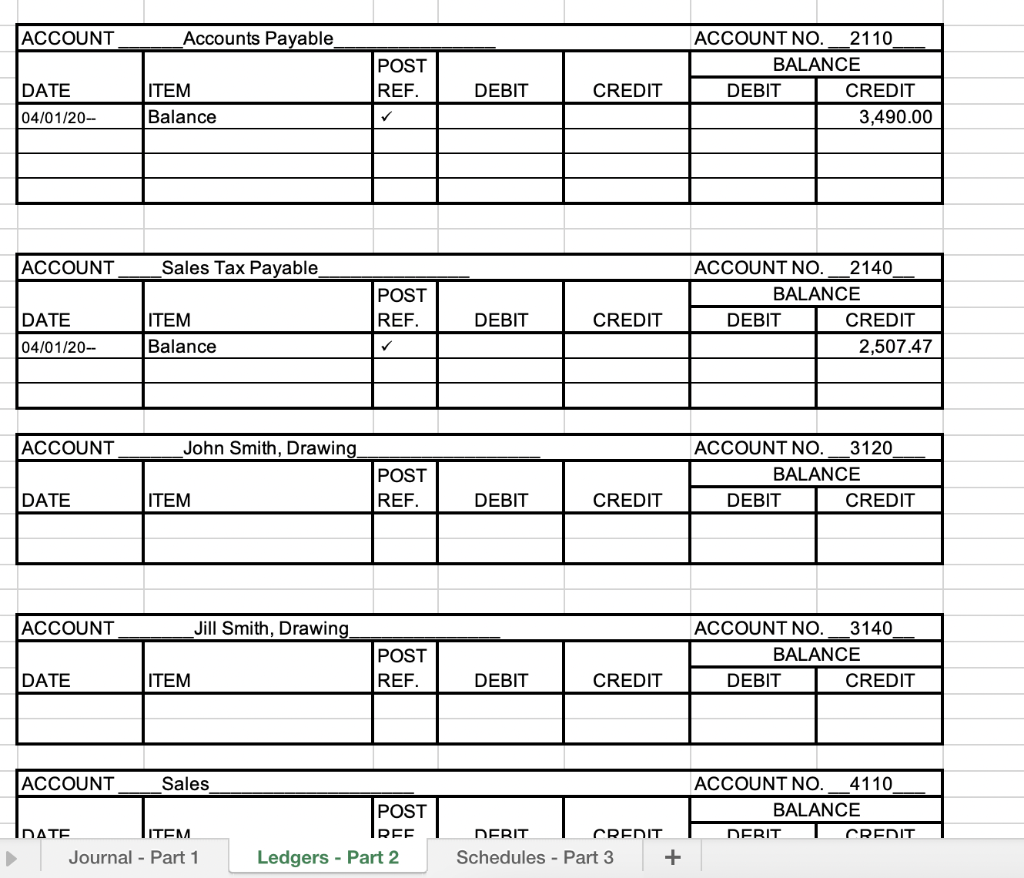

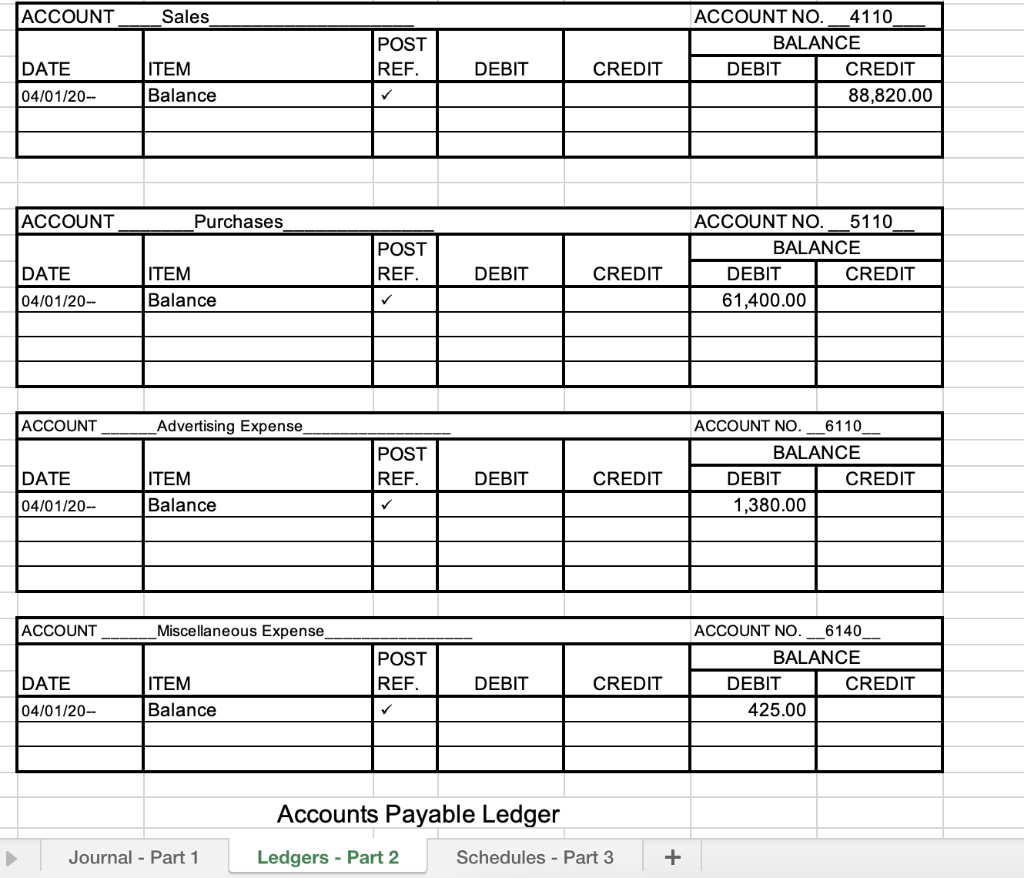

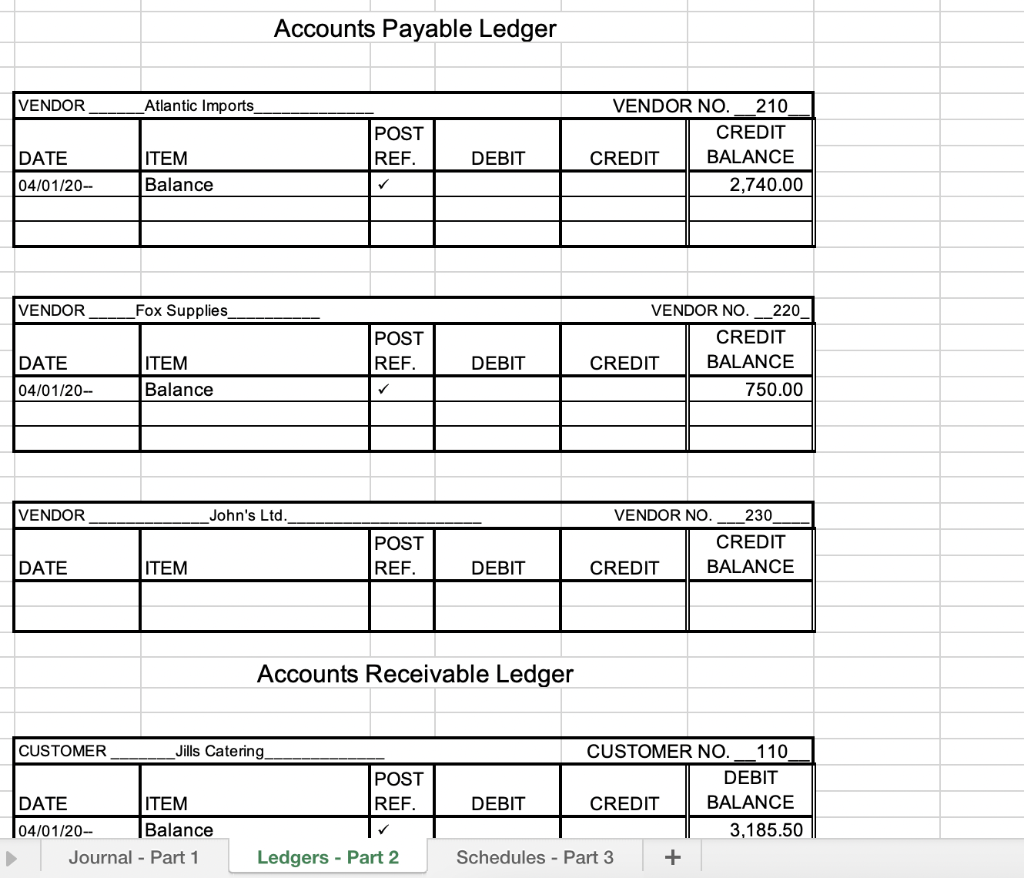

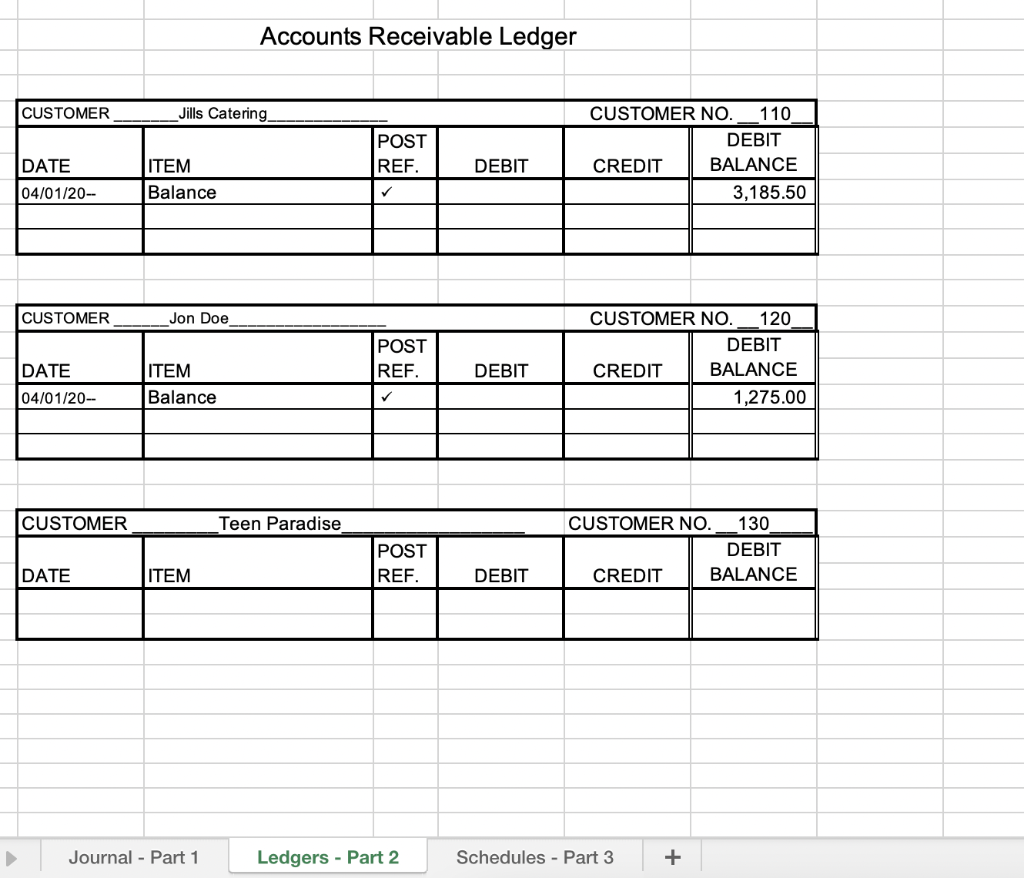

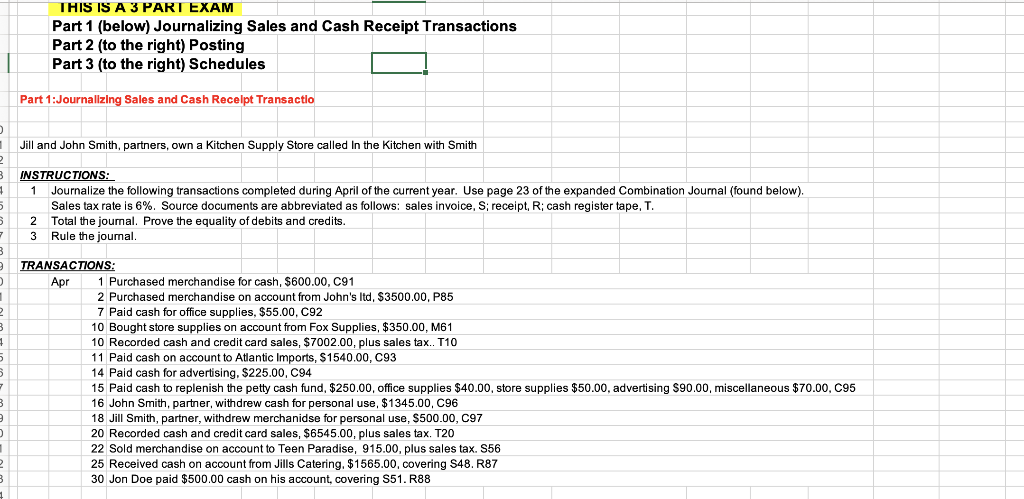

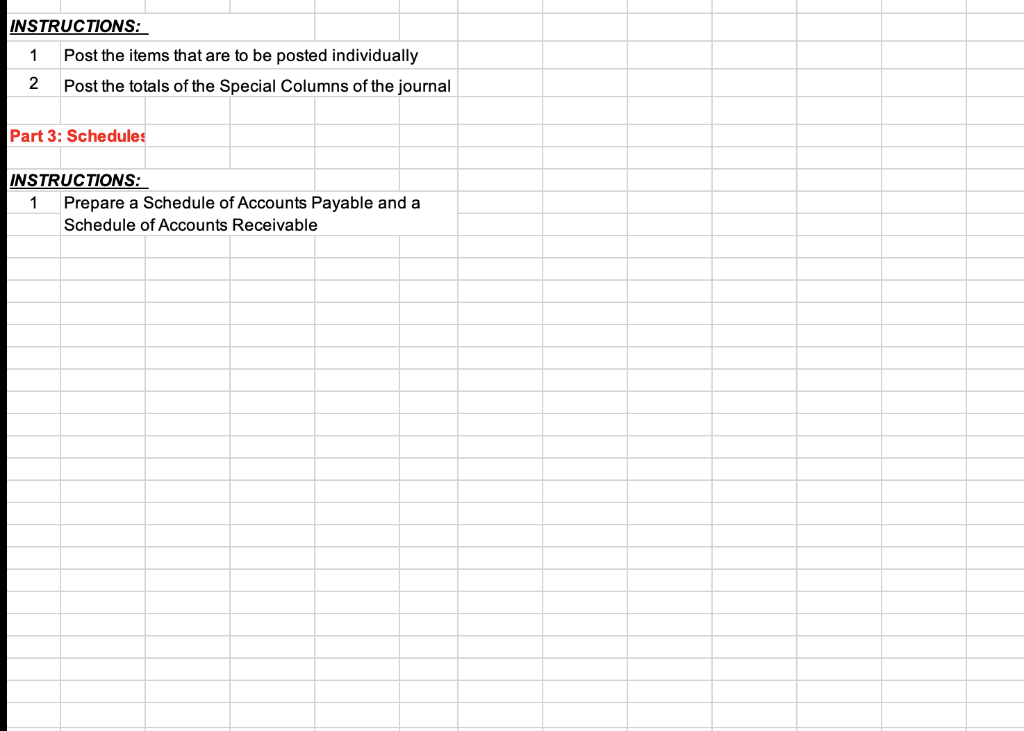

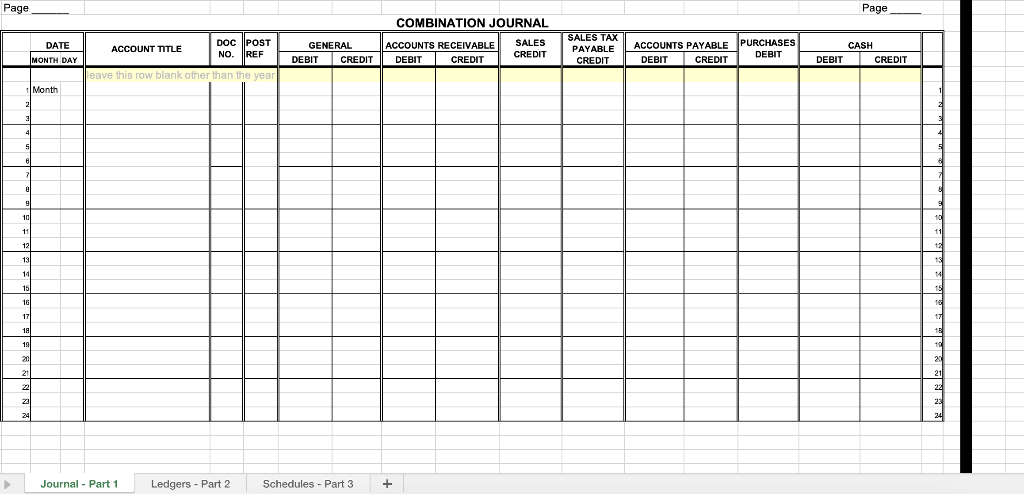

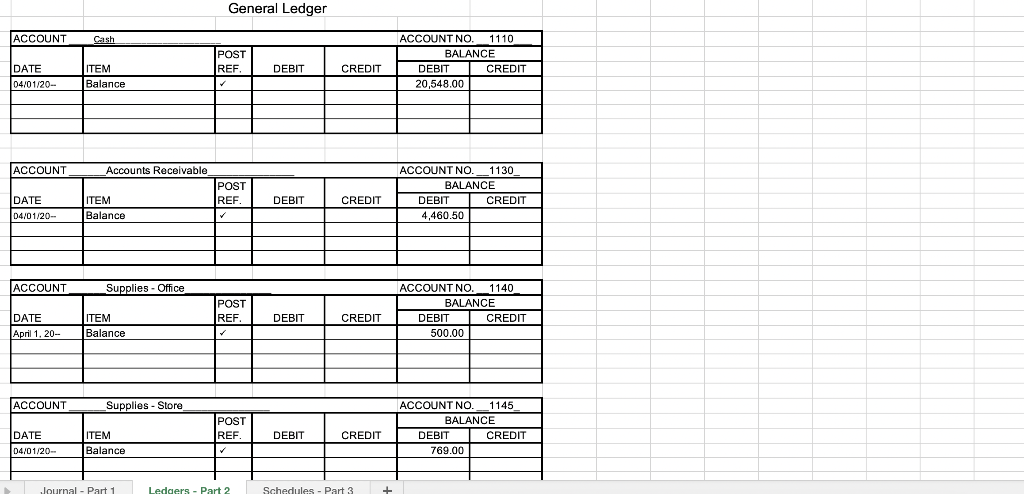

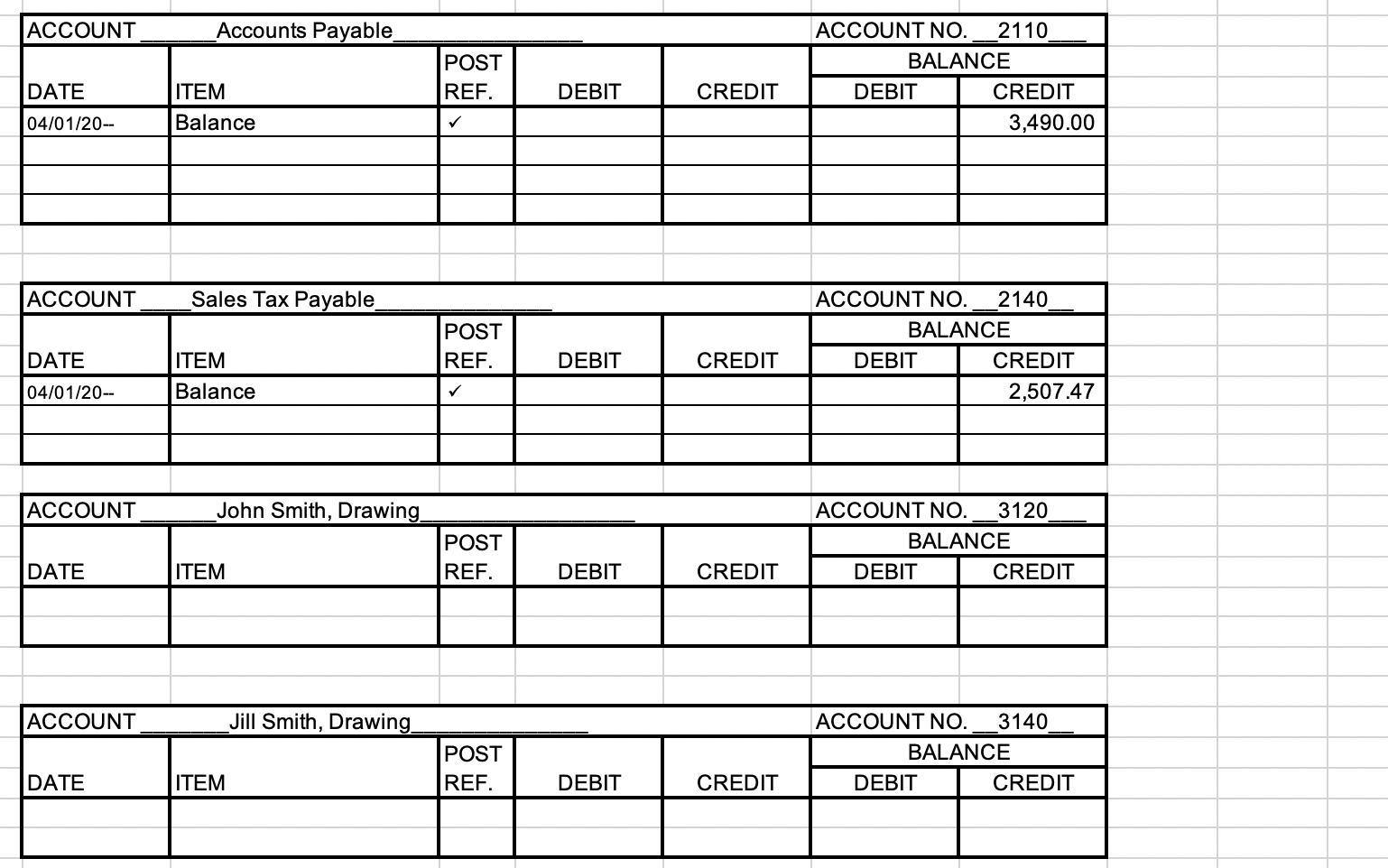

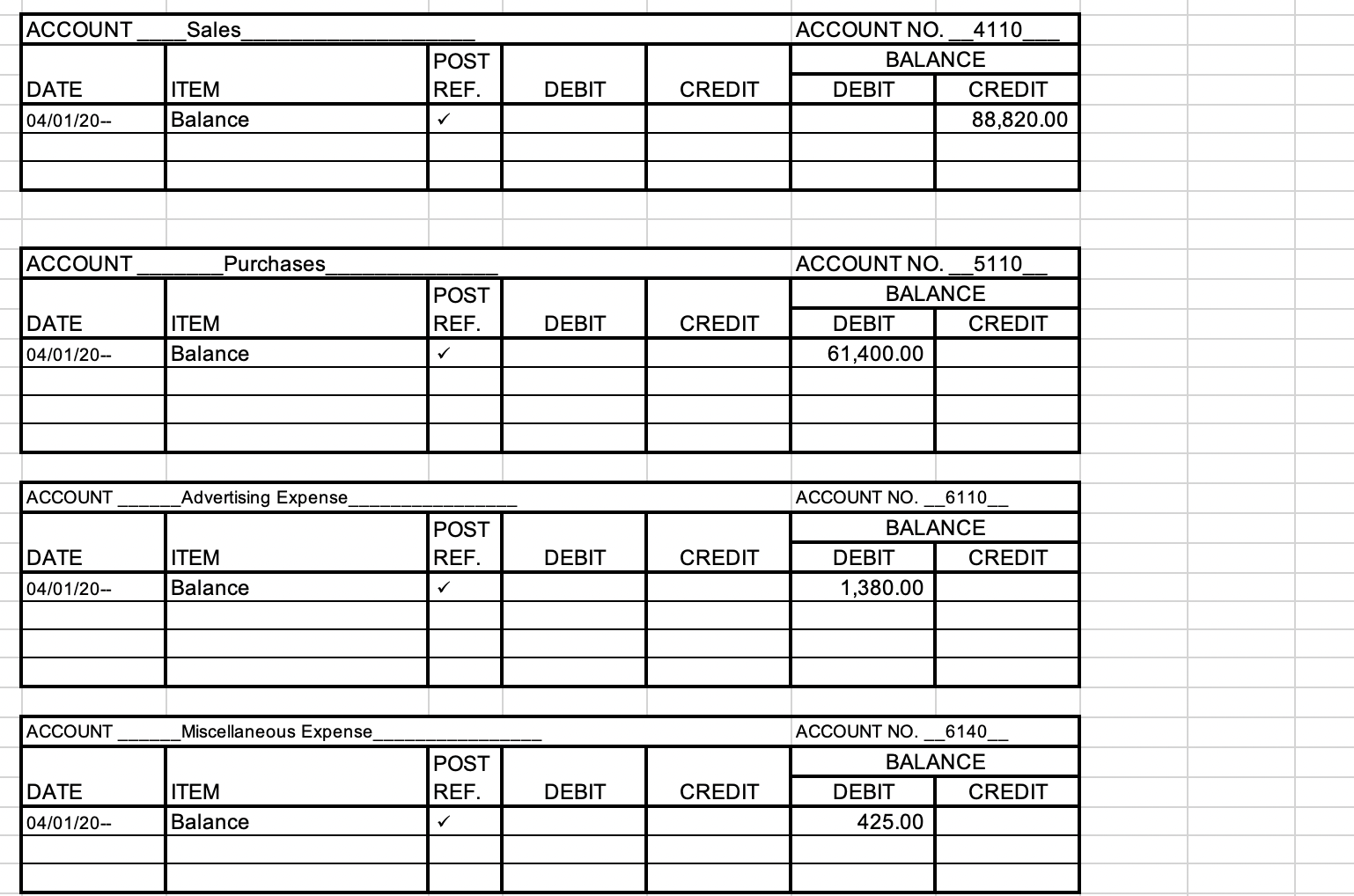

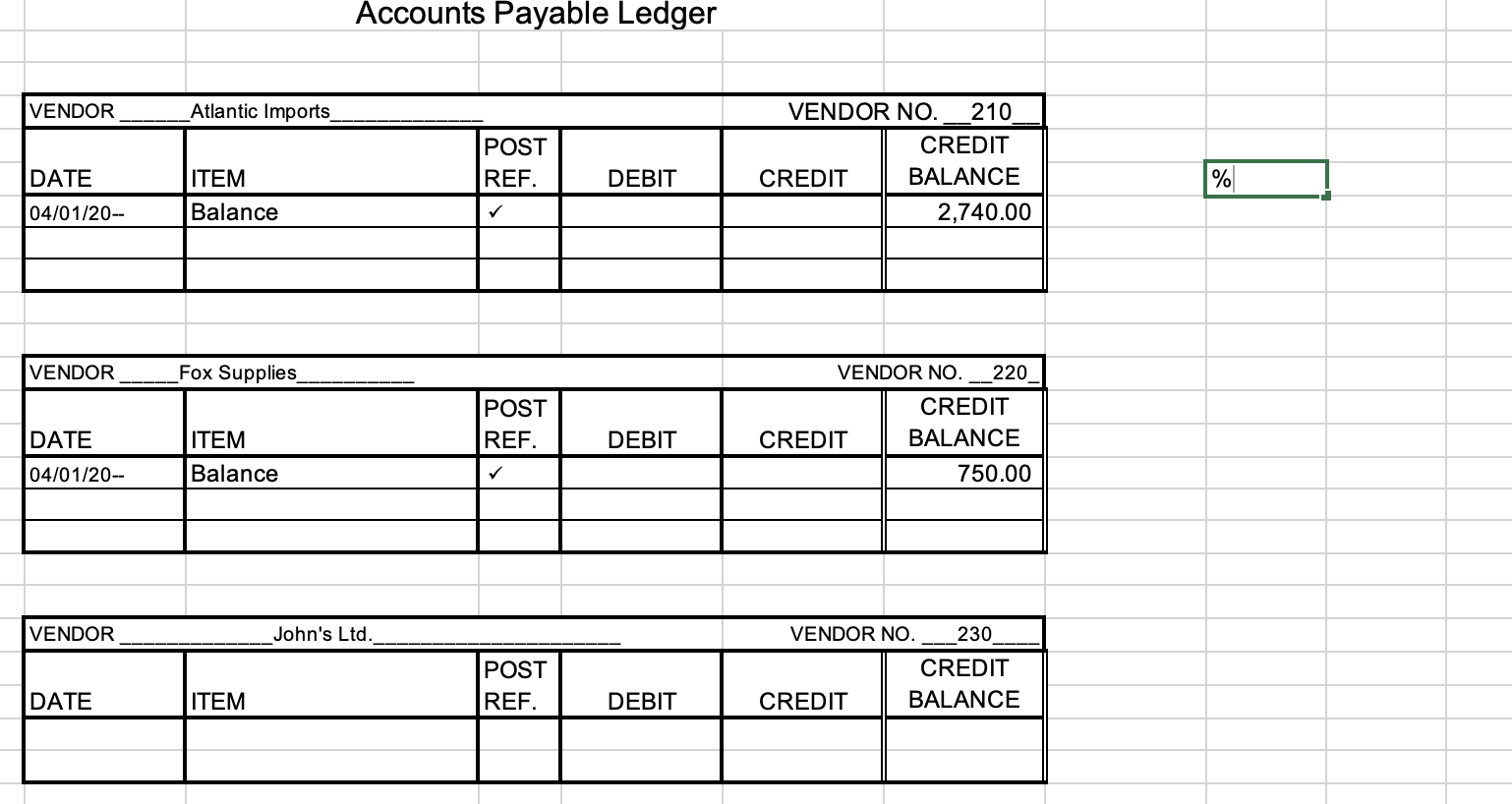

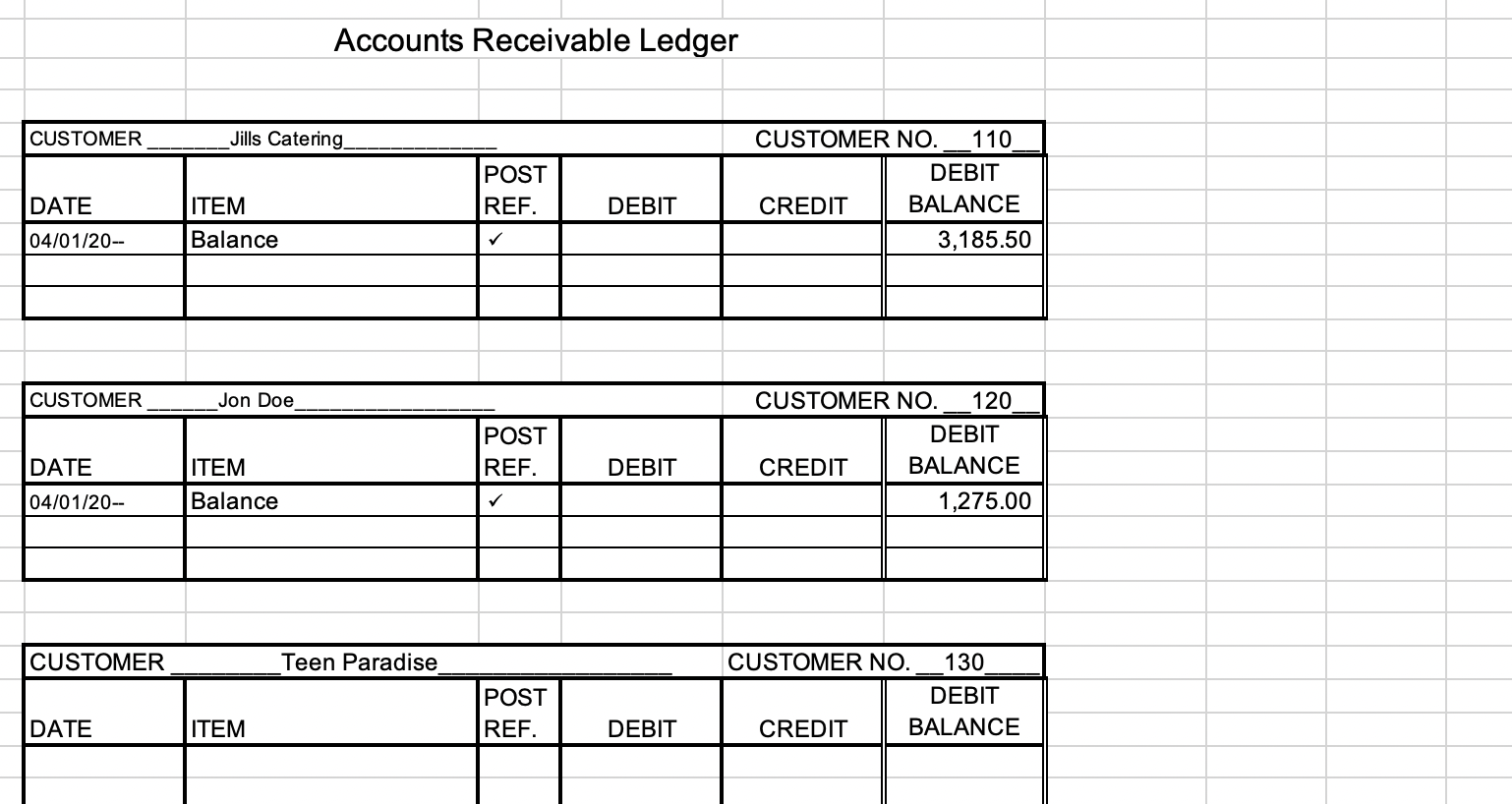

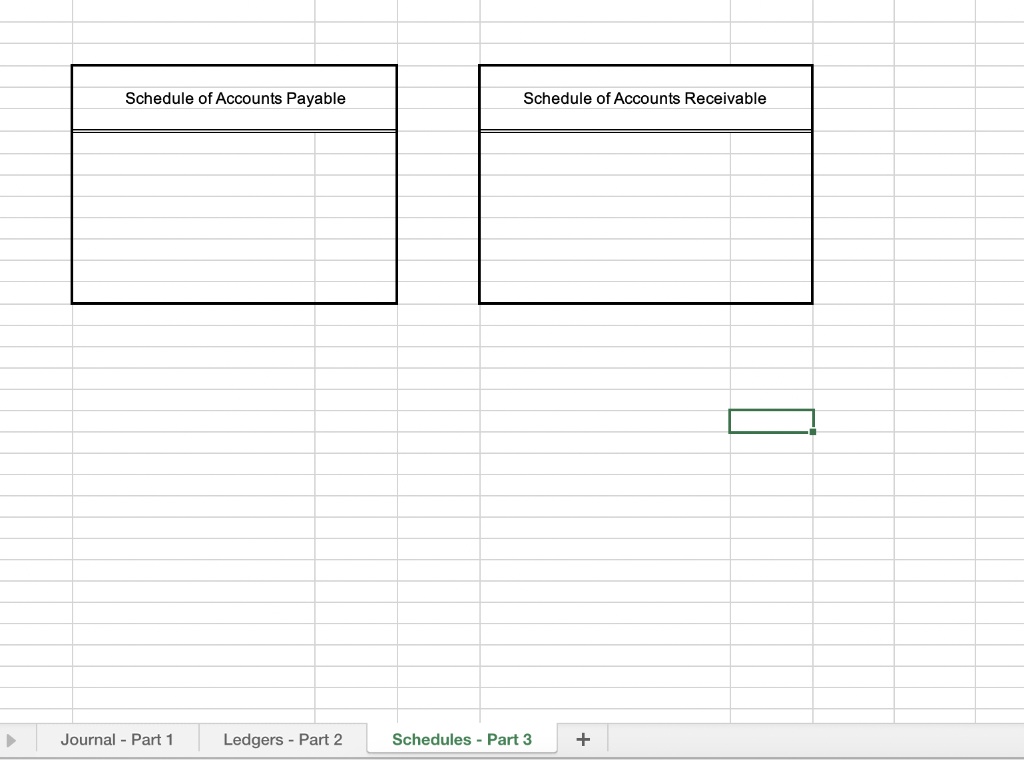

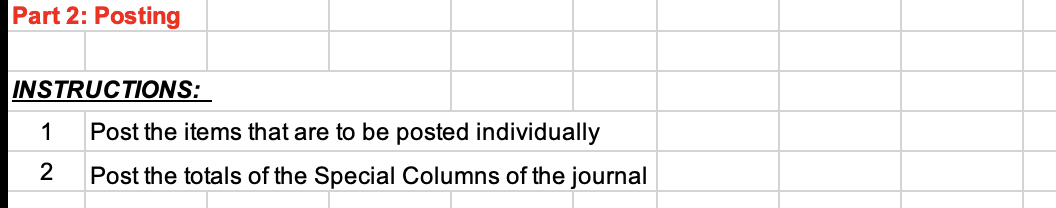

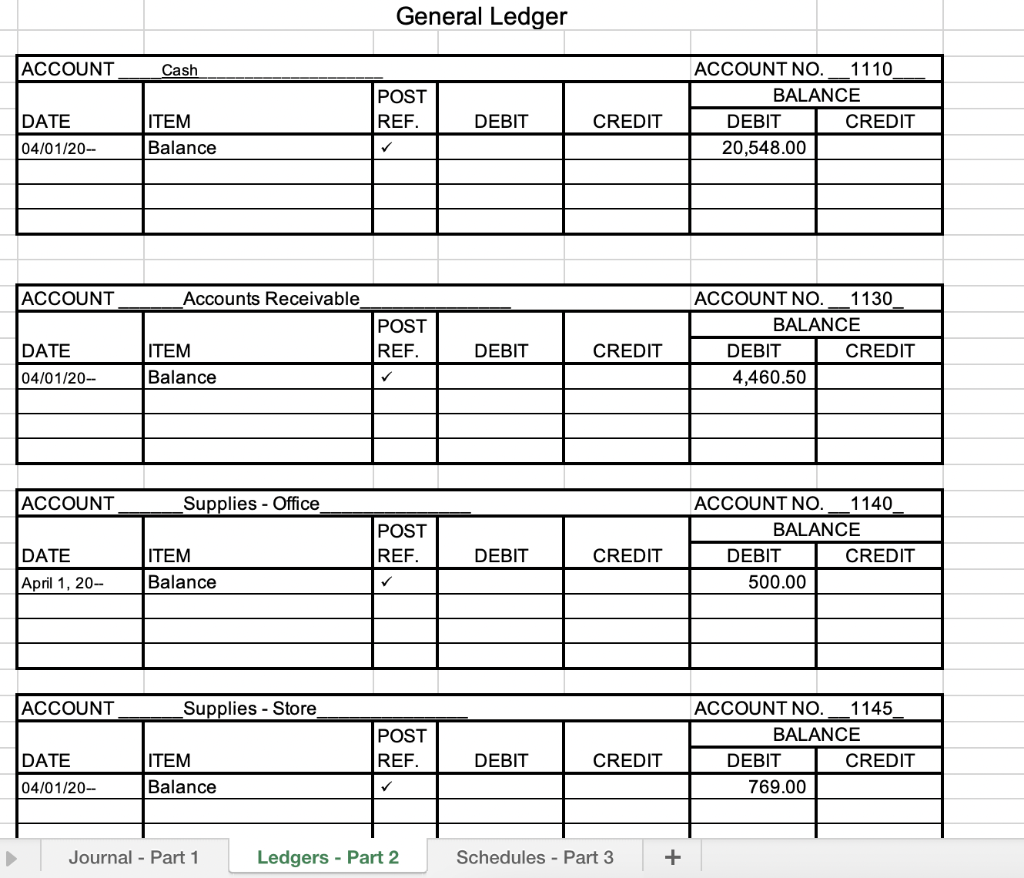

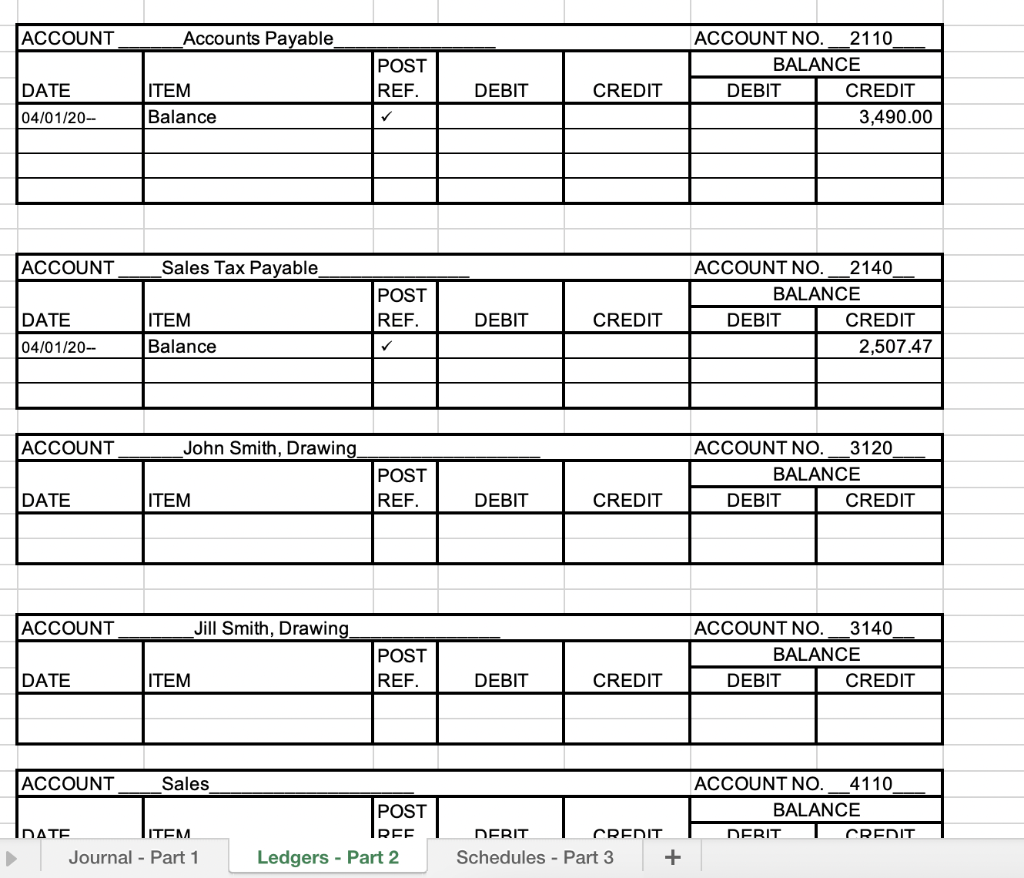

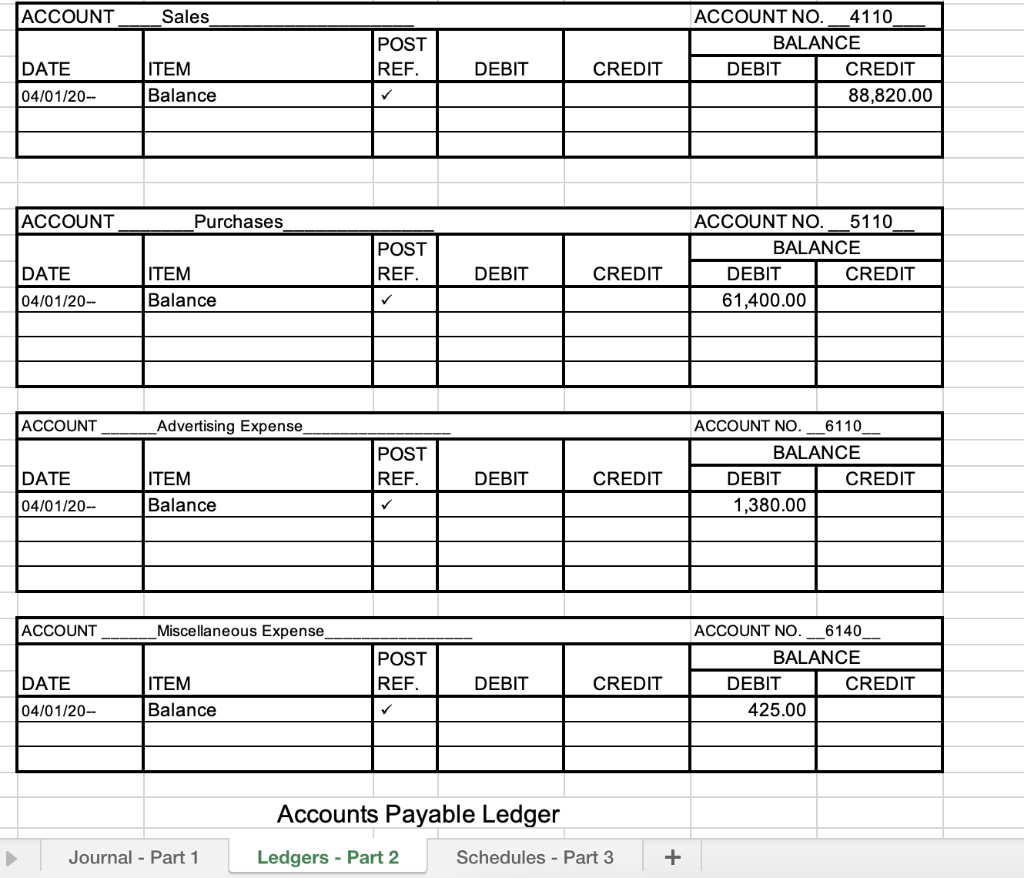

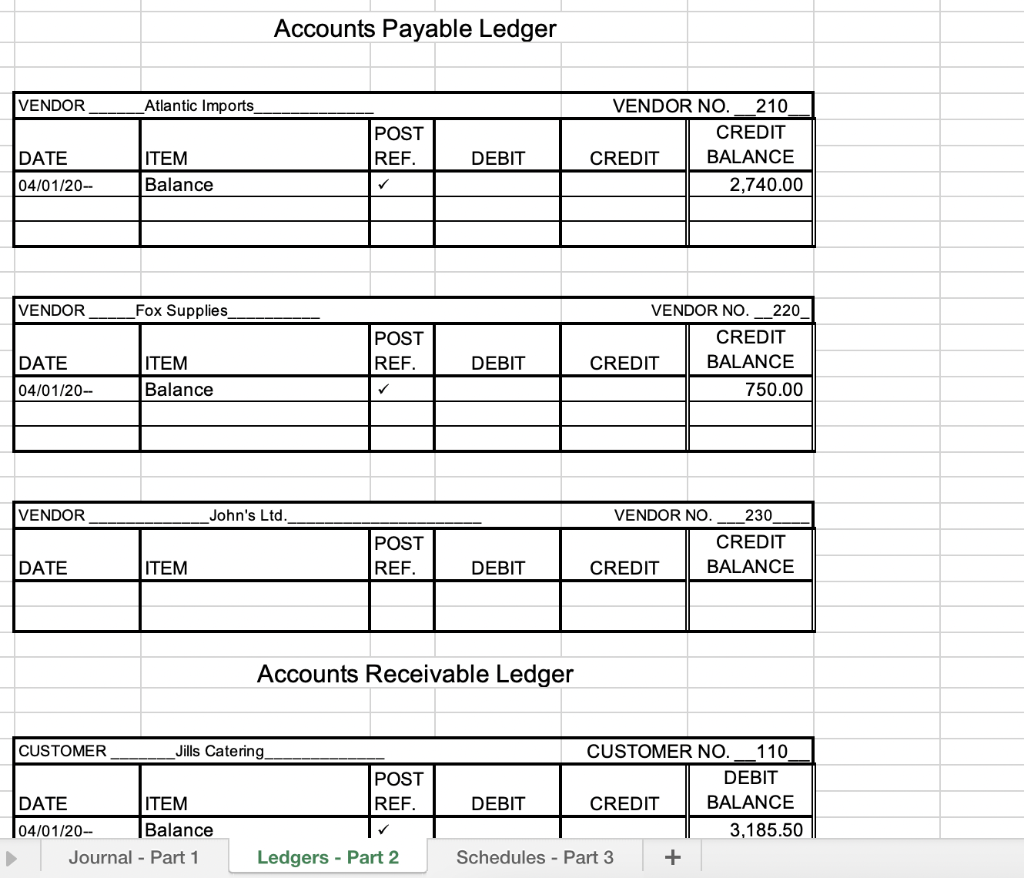

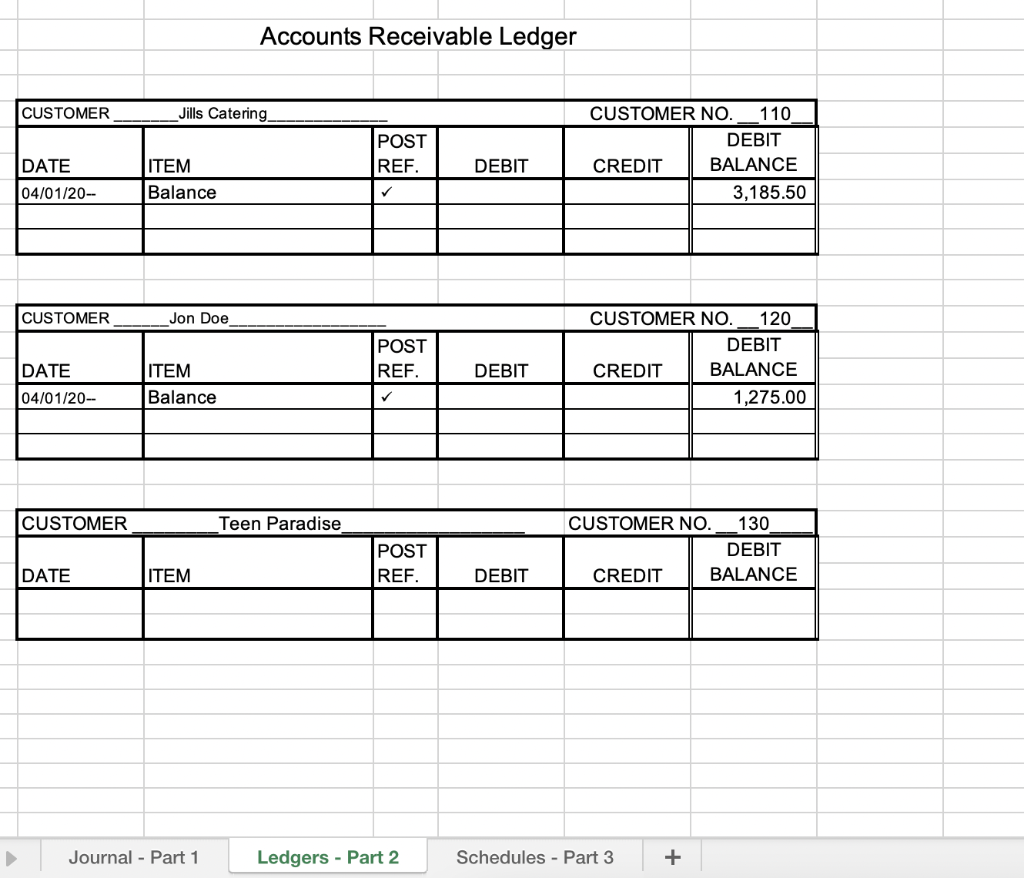

5 6 = 7 B 9 2 J 3 THIS IS A 3 PART EXAM Part 1 (below) Journalizing Sales and Cash Receipt Transactions Part 2 (to the right) Posting Part 3 (to the right) Schedules Part 1: Journalizing Sales and Cash Receipt Transactio Jill and John Smith, partners, own Kitchen Supply Store called in the Kitchen with Smith INSTRUCTIONS: 1 Journalize the following transactions completed during April of the current year. Use page 23 of the expanded Combination Journal (found below). Sales tax rate is 6%. Source documents are abbreviated as follows: sales invoice, S; receipt, R; cash register tape, T. Total the journal. Prove the equality of debits and credits. 2 3 Rule the journal. TRANSACTIONS: Apr 1 Purchased merchandise for cash, $600.00, C91 2 Purchased merchandise on account from John's Itd, $3500.00, P85 7 Paid cash for office supplies, $55.00, C92 10 Bought store supplies on account from Fox Supplies, $350.00, M61 10 Recorded cash and credit card sales, $7002.00, plus sales tax.. T10 11 Paid cash on account to Atlantic Imports, $1540.00, C93 14 Paid cash for advertising, $225.00, C94 15 Paid cash to replenish the petty cash fund, $250.00, office supplies $40.00, store supplies $50.00, advertising $90.00, miscellaneous $70.00, C95 16 John Smith, partner, withdrew cash for personal use, $1345.00, C96 18 Jill Smith, partner, withdrew merchanidse for personal use, $500.00, C97 20 Recorded cash and credit card sales, $6545.00, plus sales tax. T20 22 Sold merchandise on account to Teen Paradise, 915.00, plus sales tax. S56 25 Received cash on account from Jills Catering, $1565.00, covering $48. R87 30 Jon Doe paid $500.00 cash on his account, covering S51. R88 INSTRUCTIONS: 1 Post the items that are to be posted individually 2 Post the totals of the Special Columns of the journal Part 3: Schedules INSTRUCTIONS: 1 Prepare a Schedule of Accounts Payable and a Schedule of Accounts Receivable Page 10 13 14 16 17 18 10 20 24 DATE MONTH DAY Month ACCOUNT TITLE DOC POST NO. REF eave this row blank other than the year Ledgers - Part 2 Journal - Part 1 COMBINATION JOURNAL ACCOUNTS RECEIVABLE SALES CREDIT DEBIT CREDIT CREDIT + GENERAL DEBIT Schedules - Part 3 SALES TAX PAYABLE CREDIT ACCOUNTS PAYABLE PURCHASES DEBIT DEBIT CREDIT DEBIT Page CASH CREDIT . ACCOUNT Cash DATE 04/01/20- ITEM Balance ACCOUNT DATE 04/01/20-- ACCOUNT DATE April 1, 20- ACCOUNT DATE 04/01/20-- Accounts Receivable ITEM Balance Supplies - Office ITEM Balance Supplies - Store ITEM Balance Journal - Part 1 General Ledger DEBIT DEBIT DEBIT DEBIT Schedules - Part 3 POST REF. POST REF. POST REF. Ledgers - Part 2 POST REF. CREDIT CREDIT CREDIT CREDIT + ACCOUNT NO. 1110 BALANCE DEBIT 20,548.00 ACCOUNT NO. 1130 BALANCE DEBIT 4,460.50 ACCOUNT NO. 1140 BALANCE DEBIT 500.00 ACCOUNT NO. DEBIT 769.00 CREDIT CREDIT CREDIT 1145 CREDIT BALANCE Accounts Payable ACCOUNT DATE ITEM 04/01/20-- Balance ACCOUNT Sales Tax Payable_ DATE ITEM 04/01/20-- Balance ACCOUNT DATE ACCOUNT DATE John Smith, Drawing Jill Smith, Drawing ITEM ITEM POST REF. POST REF. POST REF. POST REF. DEBIT DEBIT DEBIT DEBIT CREDIT CREDIT CREDIT CREDIT ACCOUNT NO. 2110 BALANCE DEBIT ACCOUNT NO. 2140 BALANCE DEBIT ACCOUNT NO. 3120 BALANCE DEBIT ACCOUNT NO. 3140 BALANCE DEBIT CREDIT 3,490.00 CREDIT 2,507.47 CREDIT CREDIT ACCOUNT DATE 04/01/20-- ACCOUNT DATE 04/01/20-- ACCOUNT DATE 04/01/20-- ACCOUNT DATE 04/01/20-- Sales ITEM Balance Purchases ITEM Balance Advertising Expense ITEM Balance Miscellaneous Expense_ ITEM Balance POST REF. POST REF. POST REF. POST REF. DEBIT DEBIT DEBIT DEBIT CREDIT CREDIT CREDIT CREDIT ACCOUNT NO. 4110 BALANCE DEBIT CREDIT 88,820.00 ACCOUNT NO. 5110 DEBIT CREDIT 61,400.00 ACCOUNT NO. 6110 BALANCE DEBIT 1,380.00 ACCOUNT NO. 6140 BALANCE DEBIT BALANCE 425.00 CREDIT CREDIT VENDOR DATE 04/01/20-- VENDOR DATE 04/01/20-- VENDOR DATE Atlantic Imports_ ITEM Balance Fox Supplies ITEM Balance ITEM Accounts Payable Ledger POST REF. DEBIT POST REF. DEBIT POST REF. DEBIT John's Ltd. VENDOR NO. 210 CREDIT BALANCE CREDIT 2,740.00 VENDOR NO.___220_ CREDIT BALANCE 750.00 230 CREDIT BALANCE CREDIT VENDOR NO. CREDIT % CUSTOMER DATE 04/01/20-- CUSTOMER DATE 04/01/20-- CUSTOMER DATE Jills Catering ITEM Balance Jon Doe ITEM Balance Accounts Receivable Ledger POST REF. DEBIT POST REF. DEBIT POST REF. ITEM Teen Paradise DEBIT CUSTOMER NO. 110 DEBIT CREDIT BALANCE 3,185.50 CUSTOMER NO. 120 DEBIT CREDIT BALANCE CUSTOMER NO. CREDIT 1,275.00 130 DEBIT BALANCE Schedule of Accounts Payable Ledgers - Part 2 Journal - Part 1 Schedule of Accounts Receivable + Schedules - Part 3 Part 2: Posting INSTRUCTIONS: 1 Post the items that are to be posted individually 2 Post the totals of the Special Columns of the journal ACCOUNT DATE 04/01/20- ACCOUNT DATE 04/01/20-- ACCOUNT DATE April 1, 20- ACCOUNT DATE 04/01/20-- Cash ITEM Balance Accounts Receivable ITEM Balance Supplies - Office ITEM Balance Supplies - Store ITEM Balance Journal - Part 1 General Ledger DEBIT DEBIT DEBIT DEBIT Schedules - Part 3 POST REF. POST REF. POST REF. Ledgers - Part 2 POST REF. CREDIT CREDIT CREDIT CREDIT + ACCOUNT NO. 1110 BALANCE DEBIT 20,548.00 ACCOUNT NO. 1130 BALANCE DEBIT 4,460.50 ACCOUNT NO. DEBIT CREDIT CREDIT 1140 CREDIT BALANCE 769.00 500.00 ACCOUNT NO. 1145 BALANCE DEBIT CREDIT Accounts Payable ACCOUNT DATE ITEM 04/01/20-- Balance ACCOUNT Sales Tax Payable_ DATE ITEM 04/01/20-- Balance ACCOUNT DATE ACCOUNT DATE ACCOUNT IDATE John Smith, Drawing. Jill Smith, Drawing_ ITEM ITEM Sales ITEM Journal - Part 1 POST REF. POST REF. POST REF. POST REF. POST REF Ledgers - Part 2 CREDIT CREDIT CREDIT CREDIT CREDIT DEBIT DEBIT DEBIT DEBIT DERIT Schedules - Part 3 + ACCOUNT NO. 2110 BALANCE DEBIT ACCOUNT NO. 2140 BALANCE DEBIT ACCOUNT NO. 3120 BALANCE DEBIT ACCOUNT NO. 3140 BALANCE DEBIT ACCOUNT NO. 4110 BALANCE DERIT CREDIT 3,490.00 CREDIT 2,507.47 CREDIT CREDIT CREDIT ACCOUNT DATE 04/01/20-- ACCOUNT DATE 04/01/20-- ACCOUNT DATE 04/01/20-- ACCOUNT DATE 04/01/20-- Sales ITEM Balance POST REF. DEBIT POST REF. DEBIT POST REF. DEBIT POST REF. DEBIT Accounts Payable Ledger Ledgers - Part 2 Purchases ITEM Balance Advertising Expense ITEM Balance Miscellaneous Expense ITEM Balance Journal - Part 1 CREDIT CREDIT CREDIT CREDIT Schedules - Part 3 + ACCOUNT NO. 4110 BALANCE DEBIT ACCOUNT NO. DEBIT 61,400.00 ACCOUNT NO. 6110 BALANCE DEBIT 1,380.00 ACCOUNT NO. 6140 BALANCE DEBIT CREDIT 88,820.00 5110 CREDIT BALANCE 425.00 CREDIT CREDIT VENDOR DATE 04/01/20- VENDOR DATE 04/01/20- VENDOR DATE CUSTOMER DATE 04/01/20-- Atlantic Imports ITEM Balance Fox Supplies ITEM Balance ITEM Accounts Payable Ledger POST REF. DEBIT POST REF. DEBIT POST REF. DEBIT Accounts Receivable Ledger POST REF. DEBIT Schedules - Part 3 John's Ltd. Jills Catering ITEM Balance Journal - Part 1 Ledgers - Part 2 VENDOR NO. 210 CREDIT BALANCE CREDIT 2,740.00 VENDOR NO. 220 CREDIT BALANCE 750.00 230 CREDIT BALANCE CUSTOMER NO. 110 DEBIT CREDIT BALANCE 3,185.50 CREDIT VENDOR NO. CREDIT + CUSTOMER DATE 04/01/20-- CUSTOMER DATE 04/01/20-- CUSTOMER DATE Jills Catering ITEM Balance Jon Doe ITEM Balance Accounts Receivable Ledger POST REF. DEBIT POST REF. DEBIT ITEM Journal - Part 1 Teen Paradise POST REF. Ledgers - Part 2 CUSTOMER NO. 110 DEBIT CREDIT BALANCE 3,185.50 CUSTOMER NO 120 DEBIT CREDIT BALANCE CUSTOMER NO. CREDIT DEBIT Schedules - Part 3 + 1,275.00 130 DEBIT BALANCE