PLEASE DO IT ON EXCEL AND SHOW ME ALL YOUR WORKINGS! BOTH 13 AND 14, PLEASE!

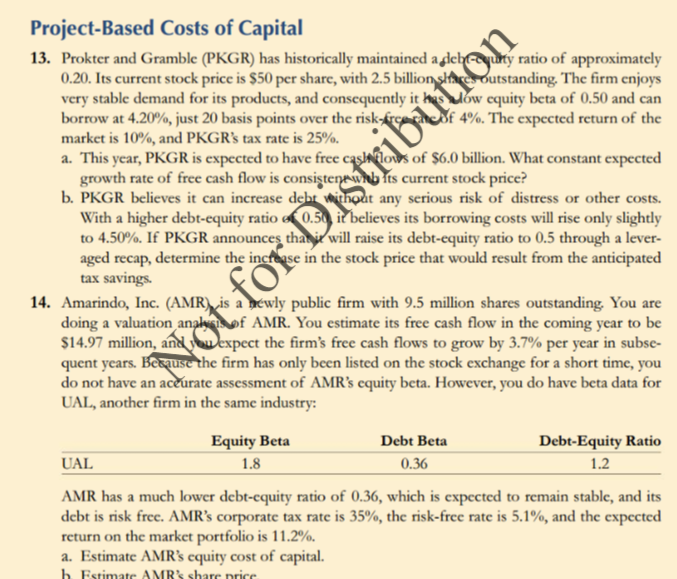

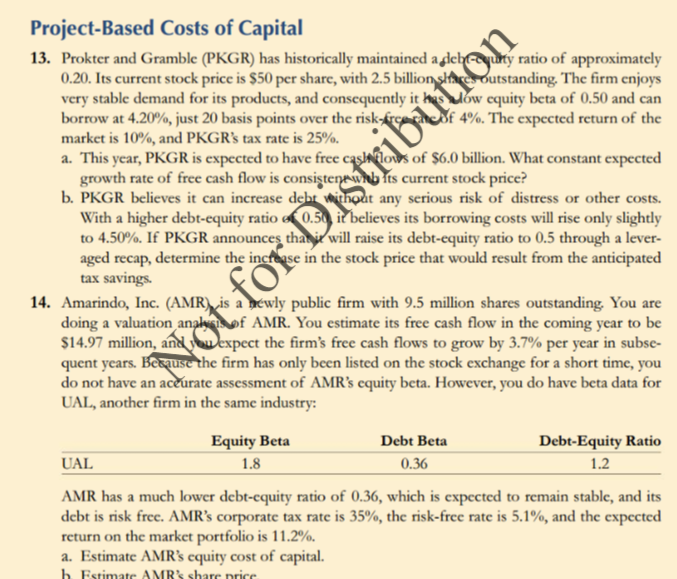

Project-Based Costs of Capital 13. Prokter and Gramble (PKGR) has historically maintained a plebaunty ratio of approximately 0.20. Its current stock price is $50 per share, with 2.5 billions! Outstanding. The firm enjoys very stable demand for its products, and consequently it How equity beta of 0.50 and can borrow at 4.20%, just 20 basis points over the risk-free of 4%. The expected return of the market is 10%, and PKGR's tax rate is 25%. a. This year, PKGR is expected to have free casinflows of $6.0 billion. What constant expected growth rate of free cash flow is consistent who its current stock price? b. PKGR believes it can increase debt without any serious risk of distress or other costs. With a higher debt-equity ratio of 0.50 it believes its borrowing costs will rise only slightly to 4.50%. If PKGR announces that it will raise its debt-equity ratio to 0.5 through a lever- aged recap, determine the increase in the stock price that would result from the anticipated tax savings. 14. Amarindo, Inc. (AMR) is a newly public firm with 9.5 million shares outstanding. You are doing a valuation analysis of AMR. You estimate its free cash flow in the coming year to be $14.97 million, and Dexpect the firm's free cash flows to grow by 3.7% per year in subse- quent years. Begause the firm has only been listed on the stock exchange for a short time, you do not have an ac&urate assessment of AMR's equity beta. However, you do have beta data for UAL, another firm in the same industry: Equity Beta Debt Beta Debt-Equity Ratio UAL 1.8 0.36 1.2 AMR has a much lower debt-cquity ratio of 0.36, which is expected to remain stable, and its debt is risk free. AMR's corporate tax rate is 35%, the risk-free rate is 5.1%, and the expected return on the market portfolio is 11.2%. a. Estimate AMR's equity cost of capital. h Estimate AMR's share nice Project-Based Costs of Capital 13. Prokter and Gramble (PKGR) has historically maintained a plebaunty ratio of approximately 0.20. Its current stock price is $50 per share, with 2.5 billions! Outstanding. The firm enjoys very stable demand for its products, and consequently it How equity beta of 0.50 and can borrow at 4.20%, just 20 basis points over the risk-free of 4%. The expected return of the market is 10%, and PKGR's tax rate is 25%. a. This year, PKGR is expected to have free casinflows of $6.0 billion. What constant expected growth rate of free cash flow is consistent who its current stock price? b. PKGR believes it can increase debt without any serious risk of distress or other costs. With a higher debt-equity ratio of 0.50 it believes its borrowing costs will rise only slightly to 4.50%. If PKGR announces that it will raise its debt-equity ratio to 0.5 through a lever- aged recap, determine the increase in the stock price that would result from the anticipated tax savings. 14. Amarindo, Inc. (AMR) is a newly public firm with 9.5 million shares outstanding. You are doing a valuation analysis of AMR. You estimate its free cash flow in the coming year to be $14.97 million, and Dexpect the firm's free cash flows to grow by 3.7% per year in subse- quent years. Begause the firm has only been listed on the stock exchange for a short time, you do not have an ac&urate assessment of AMR's equity beta. However, you do have beta data for UAL, another firm in the same industry: Equity Beta Debt Beta Debt-Equity Ratio UAL 1.8 0.36 1.2 AMR has a much lower debt-cquity ratio of 0.36, which is expected to remain stable, and its debt is risk free. AMR's corporate tax rate is 35%, the risk-free rate is 5.1%, and the expected return on the market portfolio is 11.2%. a. Estimate AMR's equity cost of capital. h Estimate AMR's share nice