Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it on spreadsheet QUESTION 3 Assume you are a professional manager of large stock portfolios and use computer models based on nonlinear programming

please do it on spreadsheet

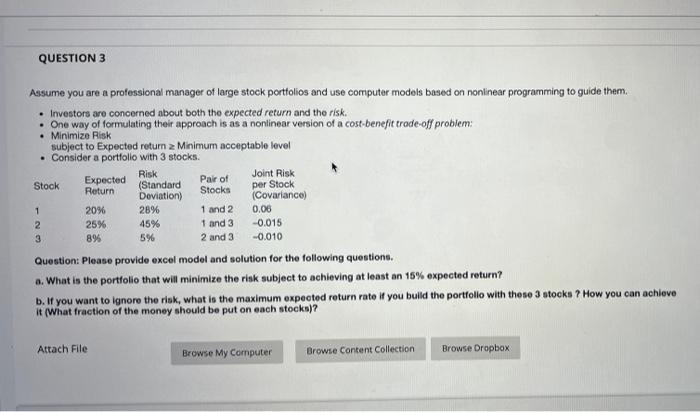

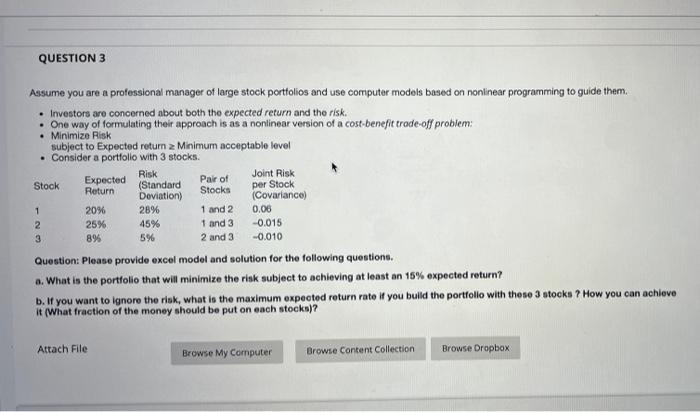

QUESTION 3 Assume you are a professional manager of large stock portfolios and use computer models based on nonlinear programming to guide them. Investors are concerned about both the expected return and the risk. One way of formulating their approach is as a nonlinear version of a cost-benefit trade-off problem: Minimize Risk subject to Expected return 2 Minimum acceptable level . Consider a portfolio with 3 stocks. Risk Joint Risk Expected Pair of Stock (Standard per Stock Return Stocks Deviation) (Covariance) 20% 28% 1 and 2 0.06 2 25% 45% 1 and 3 -0.015 3 896 5% 2 and 3 -0.010 Question: Please provide excel model and solution for the following questions. a. What is the portfolio that will minimize the risk subject to achieving at least an 15% expected return? b. If you want to ignore the risk, what is the maximum expected return rate if you build the portfolio with these 3 stocks 7 How you can achieve it (What fraction of the money should be put on each stocks)? 1 Attach File Browse My Computer Browse Content Collection Browse Dropbox

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started