Please do it quickly!

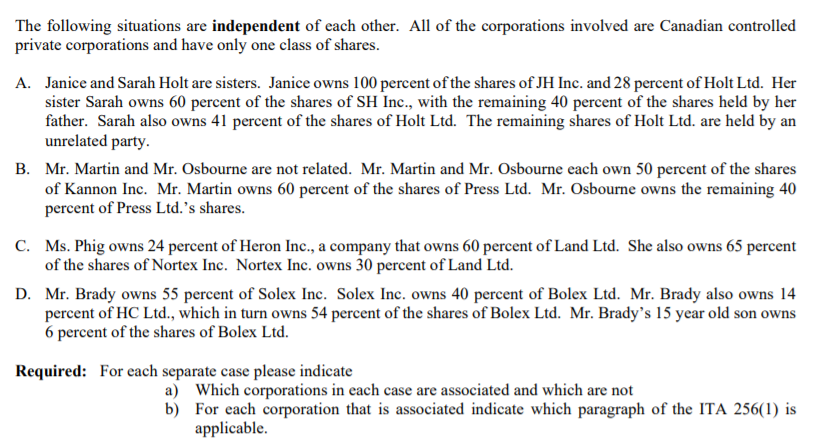

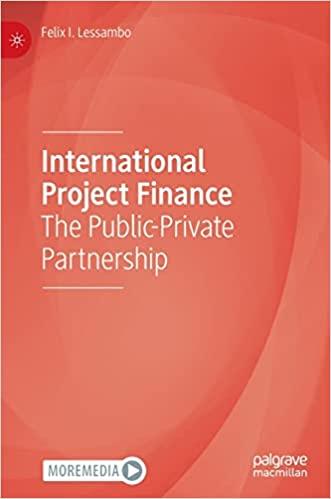

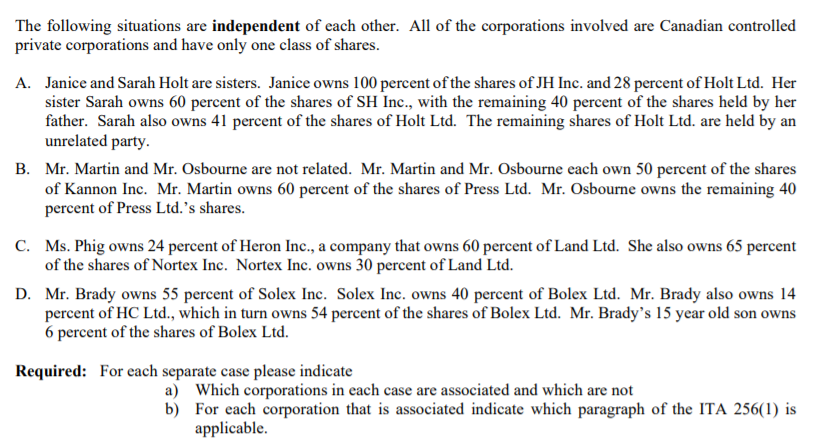

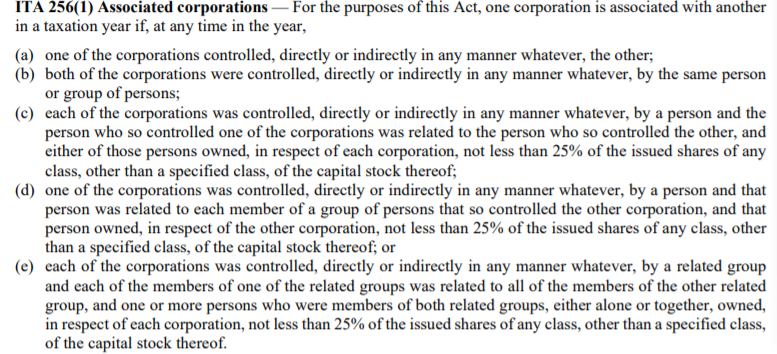

The following situations are independent of each other. All of the corporations involved are Canadian controlled private corporations and have only one class of shares. A. Janice and Sarah Holt are sisters. Janice owns 100 percent of the shares of JH Inc. and 28 percent of Holt Ltd. Her sister Sarah owns 60 percent of the shares of SH Inc., with the remaining 40 percent of the shares held by her father. Sarah also owns 41 percent of the shares of Holt Ltd. The remaining shares of Holt Ltd. are held by an unrelated party. B. Mr. Martin and Mr. Osbourne are not related. Mr. Martin and Mr. Osbourne each own 50 percent of the shares of Kannon Inc. Mr. Martin owns 60 percent of the shares of Press Ltd. Mr. Osbourne owns the remaining 40 percent of Press Ltd.'s shares. C. Ms. Phig owns 24 percent of Heron Inc., a company that owns 60 percent of Land Ltd. She also owns 65 percent of the shares of Nortex Inc. Nortex Inc. owns 30 percent of Land Ltd. D. Mr. Brady owns 55 percent of Solex Inc. Solex Inc. owns 40 percent of Bolex Ltd. Mr. Brady also owns 14 percent of HC Ltd., which in turn owns 54 percent of the shares of Bolex Ltd. Mr. Brady's 15 year old son owns 6 percent of the shares of Bolex Ltd. Required: For each separate case please indicate a) Which corporations in each case are associated and which are not b) For each corporation that is associated indicate which paragraph of the ITA 256(1) is applicable. ITA 256(1) Associated corporations - For the purposes of this Act, one corporation is associated with another in a taxation year if, at any time in the year, (a) one of the corporations controlled, directly or indirectly in any manner whatever, the other; (b) both of the corporations were controlled, directly or indirectly in any manner whatever, by the same person or group of persons; (c) each of the corporations was controlled, directly or indirectly in any manner whatever, by a person and the person who so controlled one of the corporations was related to the person who so controlled the other, and either of those persons owned, in respect of each corporation, not less than 25% of the issued shares of any class, other than a specified class, of the capital stock thereof; (d) one of the corporations was controlled, directly or indirectly in any manner whatever, by a person and that person was related to each member of a group of persons that so controlled the other corporation, and that person owned, in respect of the other corporation, not less than 25% of the issued shares of any class, other than a specified class, of the capital stock thereof; or (e) each of the corporations was controlled, directly or indirectly in any manner whatever, by a related group and each of the members of one of the related groups was related to all of the members of the other related group, and one or more persons who were members of both related groups, either alone or together, owned, in respect of each corporation, not less than 25% of the issued shares of any class, other than a specified class, of the capital stock thereof. The following situations are independent of each other. All of the corporations involved are Canadian controlled private corporations and have only one class of shares. A. Janice and Sarah Holt are sisters. Janice owns 100 percent of the shares of JH Inc. and 28 percent of Holt Ltd. Her sister Sarah owns 60 percent of the shares of SH Inc., with the remaining 40 percent of the shares held by her father. Sarah also owns 41 percent of the shares of Holt Ltd. The remaining shares of Holt Ltd. are held by an unrelated party. B. Mr. Martin and Mr. Osbourne are not related. Mr. Martin and Mr. Osbourne each own 50 percent of the shares of Kannon Inc. Mr. Martin owns 60 percent of the shares of Press Ltd. Mr. Osbourne owns the remaining 40 percent of Press Ltd.'s shares. C. Ms. Phig owns 24 percent of Heron Inc., a company that owns 60 percent of Land Ltd. She also owns 65 percent of the shares of Nortex Inc. Nortex Inc. owns 30 percent of Land Ltd. D. Mr. Brady owns 55 percent of Solex Inc. Solex Inc. owns 40 percent of Bolex Ltd. Mr. Brady also owns 14 percent of HC Ltd., which in turn owns 54 percent of the shares of Bolex Ltd. Mr. Brady's 15 year old son owns 6 percent of the shares of Bolex Ltd. Required: For each separate case please indicate a) Which corporations in each case are associated and which are not b) For each corporation that is associated indicate which paragraph of the ITA 256(1) is applicable. ITA 256(1) Associated corporations - For the purposes of this Act, one corporation is associated with another in a taxation year if, at any time in the year, (a) one of the corporations controlled, directly or indirectly in any manner whatever, the other; (b) both of the corporations were controlled, directly or indirectly in any manner whatever, by the same person or group of persons; (c) each of the corporations was controlled, directly or indirectly in any manner whatever, by a person and the person who so controlled one of the corporations was related to the person who so controlled the other, and either of those persons owned, in respect of each corporation, not less than 25% of the issued shares of any class, other than a specified class, of the capital stock thereof; (d) one of the corporations was controlled, directly or indirectly in any manner whatever, by a person and that person was related to each member of a group of persons that so controlled the other corporation, and that person owned, in respect of the other corporation, not less than 25% of the issued shares of any class, other than a specified class, of the capital stock thereof; or (e) each of the corporations was controlled, directly or indirectly in any manner whatever, by a related group and each of the members of one of the related groups was related to all of the members of the other related group, and one or more persons who were members of both related groups, either alone or together, owned, in respect of each corporation, not less than 25% of the issued shares of any class, other than a specified class, of the capital stock thereof