Answered step by step

Verified Expert Solution

Question

1 Approved Answer

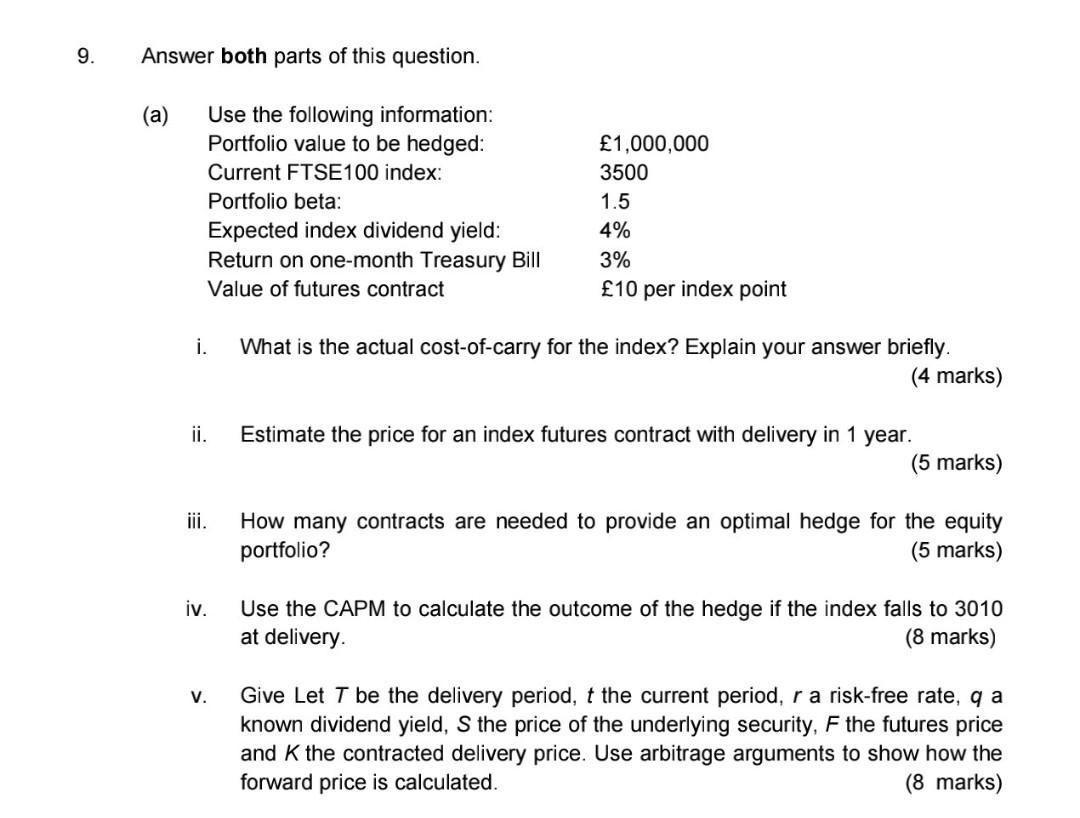

please do IV and V in 16 minutes will upvote 9. Answer both parts of this question. (a) 1,000,000 Use the following information: Portfolio value

please do IV and V in 16 minutes will upvote

9. Answer both parts of this question. (a) 1,000,000 Use the following information: Portfolio value to be hedged: Current FTSE100 index: Portfolio beta: 3500 1.5 Expected index dividend yield: 4% Return on one-month Treasury Bill 3% Value of futures contract 10 per index point i. What is the actual cost-of-carry for the index? Explain your answer briefly. (4 marks) ii. Estimate the price for an index futures contract with delivery in 1 year. (5 marks) iii. How many contracts are needed to provide an optimal hedge for the equity portfolio? (5 marks) iv. Use the CAPM to calculate the outcome of the hedge if the index falls to 3010 at delivery. (8 marks) V. Give Let T be the delivery period, t the current period, r a risk-free rate, q a known dividend yield, S the price of the underlying security, F the futures price and K the contracted delivery price. Use arbitrage arguments to show how the forward price is calculated. (8 marks) 9. Answer both parts of this question. (a) 1,000,000 Use the following information: Portfolio value to be hedged: Current FTSE100 index: Portfolio beta: 3500 1.5 Expected index dividend yield: 4% Return on one-month Treasury Bill 3% Value of futures contract 10 per index point i. What is the actual cost-of-carry for the index? Explain your answer briefly. (4 marks) ii. Estimate the price for an index futures contract with delivery in 1 year. (5 marks) iii. How many contracts are needed to provide an optimal hedge for the equity portfolio? (5 marks) iv. Use the CAPM to calculate the outcome of the hedge if the index falls to 3010 at delivery. (8 marks) V. Give Let T be the delivery period, t the current period, r a risk-free rate, q a known dividend yield, S the price of the underlying security, F the futures price and K the contracted delivery price. Use arbitrage arguments to show how the forward price is calculated. (8 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started