Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE DO NOT ASK FOR MORE INFO, ALL INFO NEEDED TO COMPLETE IT IS IN THE PICTURES. I need Kara and Brandon's 2020 Form 1040,

PLEASE DO NOT ASK FOR MORE INFO, ALL INFO NEEDED TO COMPLETE IT IS IN THE PICTURES.

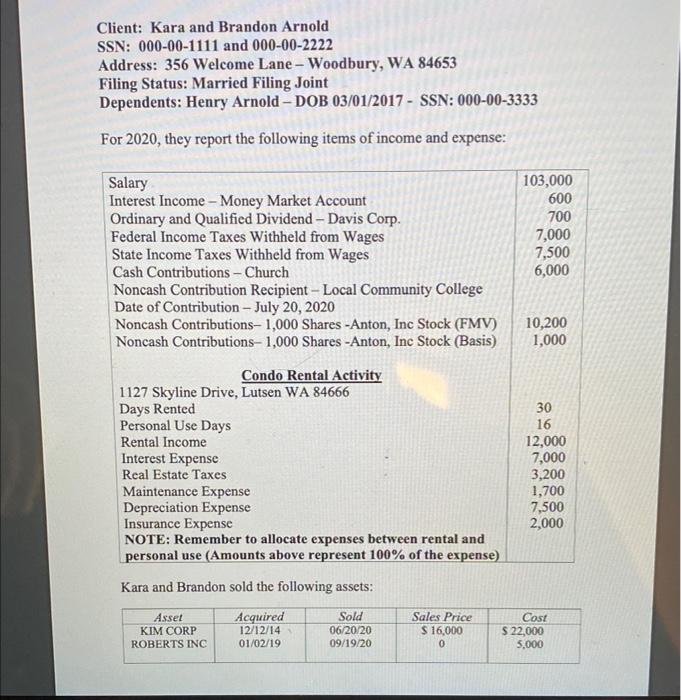

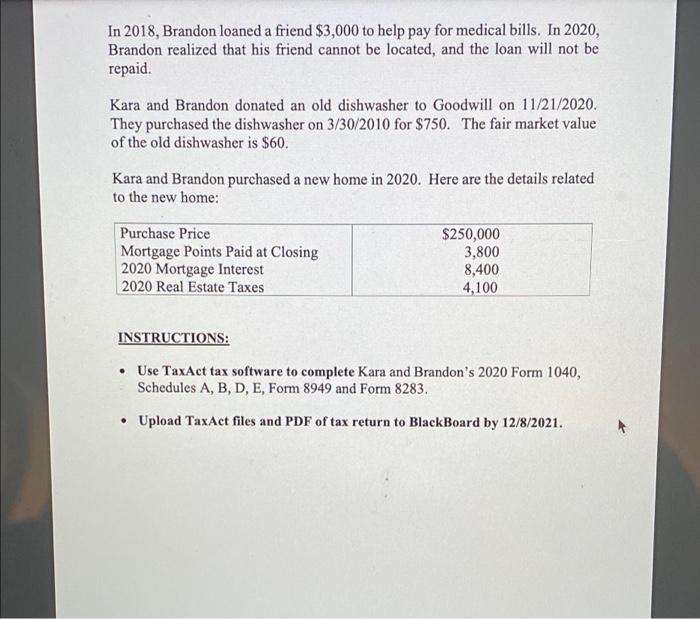

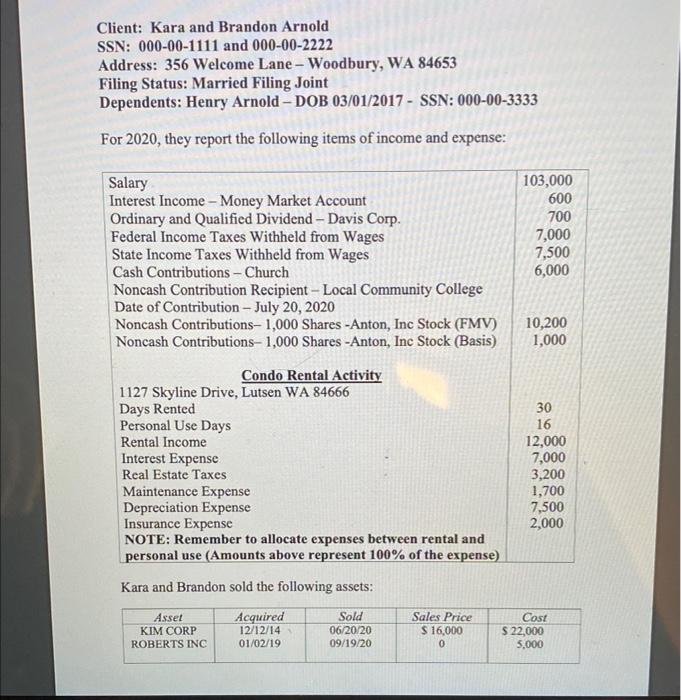

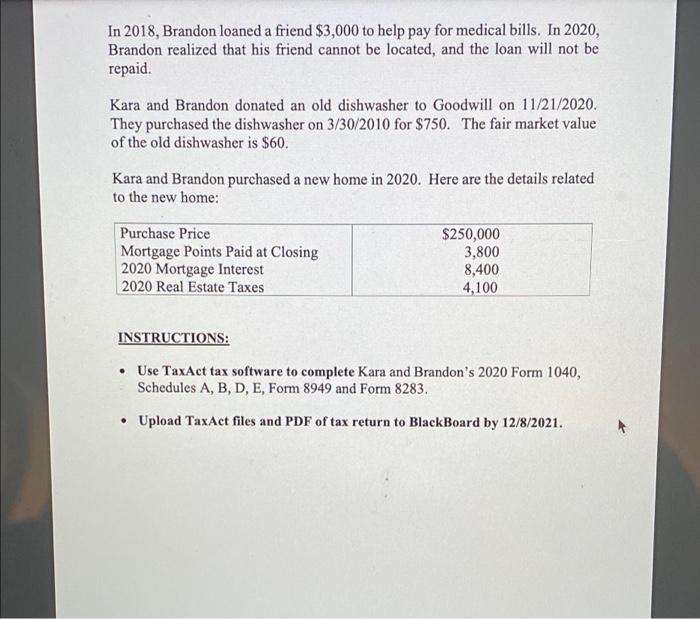

Client: Kara and Brandon Arnold SSN: 000-00-1111 and 000-00-2222 Address: 356 Welcome Lane - Woodbury, WA 84653 Filing Status: Married Filing Joint Dependents: Henry Arnold - DOB 03/01/2017 - SSN: 000-00-3333 For 2020, they report the following items of income and expense: Salary Interest Income - Money Market Account Ordinary and Qualified Dividend - Davis Corp. Federal Income Taxes Withheld from Wages State Income Taxes Withheld from Wages Cash Contributions - Church Noncash Contribution Recipient - Local Community College Date of Contribution - July 20, 2020 Noncash Contributions- 1,000 Shares -Anton, Inc Stock (FMV) Noncash Contributions- 1,000 Shares -Anton, Inc Stock (Basis) 103,000 600 700 7,000 7,500 6,000 10,200 1,000 Condo Rental Activity 1127 Skyline Drive, Lutsen WA 84666 Days Rented Personal Use Days Rental Income Interest Expense Real Estate Taxes Maintenance Expense Depreciation Expense Insurance Expense NOTE: Remember to allocate expenses between rental and personal use (Amounts above represent 100% of the expense) 30 16 12,000 7,000 3,200 1,700 7,500 2,000 Kara and Brandon sold the following assets: Asset KIM CORP ROBERTS INC Acquired 12/12/14 01/02/19 Sold 06/20/20 09/19/20 Sales Price $ 16,000 0 Cost $ 22,000 5.000 In 2018, Brandon loaned a friend $3,000 to help pay for medical bills. In 2020, Brandon realized that his friend cannot be located, and the loan will not be repaid. Kara and Brandon donated an old dishwasher to Goodwill on 11/21/2020. They purchased the dishwasher on 3/30/2010 for $750. The fair market value of the old dishwasher is $60. Kara and Brandon purchased a new home in 2020. Here are the details related to the new home: Purchase Price Mortgage Points Paid at Closing 2020 Mortgage Interest 2020 Real Estate Taxes $250,000 3,800 8,400 4,100 INSTRUCTIONS: Use TaxAct tax software to complete Kara and Brandon's 2020 Form 1040, Schedules A, B, D, E, Form 8949 and Form 8283. . Upload Tax Act files and PDF of tax return to BlackBoard by 12/8/2021. Client: Kara and Brandon Arnold SSN: 000-00-1111 and 000-00-2222 Address: 356 Welcome Lane - Woodbury, WA 84653 Filing Status: Married Filing Joint Dependents: Henry Arnold - DOB 03/01/2017 - SSN: 000-00-3333 For 2020, they report the following items of income and expense: Salary Interest Income - Money Market Account Ordinary and Qualified Dividend - Davis Corp. Federal Income Taxes Withheld from Wages State Income Taxes Withheld from Wages Cash Contributions - Church Noncash Contribution Recipient - Local Community College Date of Contribution - July 20, 2020 Noncash Contributions- 1,000 Shares -Anton, Inc Stock (FMV) Noncash Contributions- 1,000 Shares -Anton, Inc Stock (Basis) 103,000 600 700 7,000 7,500 6,000 10,200 1,000 Condo Rental Activity 1127 Skyline Drive, Lutsen WA 84666 Days Rented Personal Use Days Rental Income Interest Expense Real Estate Taxes Maintenance Expense Depreciation Expense Insurance Expense NOTE: Remember to allocate expenses between rental and personal use (Amounts above represent 100% of the expense) 30 16 12,000 7,000 3,200 1,700 7,500 2,000 Kara and Brandon sold the following assets: Asset KIM CORP ROBERTS INC Acquired 12/12/14 01/02/19 Sold 06/20/20 09/19/20 Sales Price $ 16,000 0 Cost $ 22,000 5.000 In 2018, Brandon loaned a friend $3,000 to help pay for medical bills. In 2020, Brandon realized that his friend cannot be located, and the loan will not be repaid. Kara and Brandon donated an old dishwasher to Goodwill on 11/21/2020. They purchased the dishwasher on 3/30/2010 for $750. The fair market value of the old dishwasher is $60. Kara and Brandon purchased a new home in 2020. Here are the details related to the new home: Purchase Price Mortgage Points Paid at Closing 2020 Mortgage Interest 2020 Real Estate Taxes $250,000 3,800 8,400 4,100 INSTRUCTIONS: Use TaxAct tax software to complete Kara and Brandon's 2020 Form 1040, Schedules A, B, D, E, Form 8949 and Form 8283. . Upload Tax Act files and PDF of tax return to BlackBoard by 12/8/2021 I need Kara and Brandon's 2020 Form 1040, Schedules A, B, D, E, Form 8949, and Form 8283. Once again, all the information needed to complete the forms is in the picture.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started