Please do not comment "missing information or incomplete question"

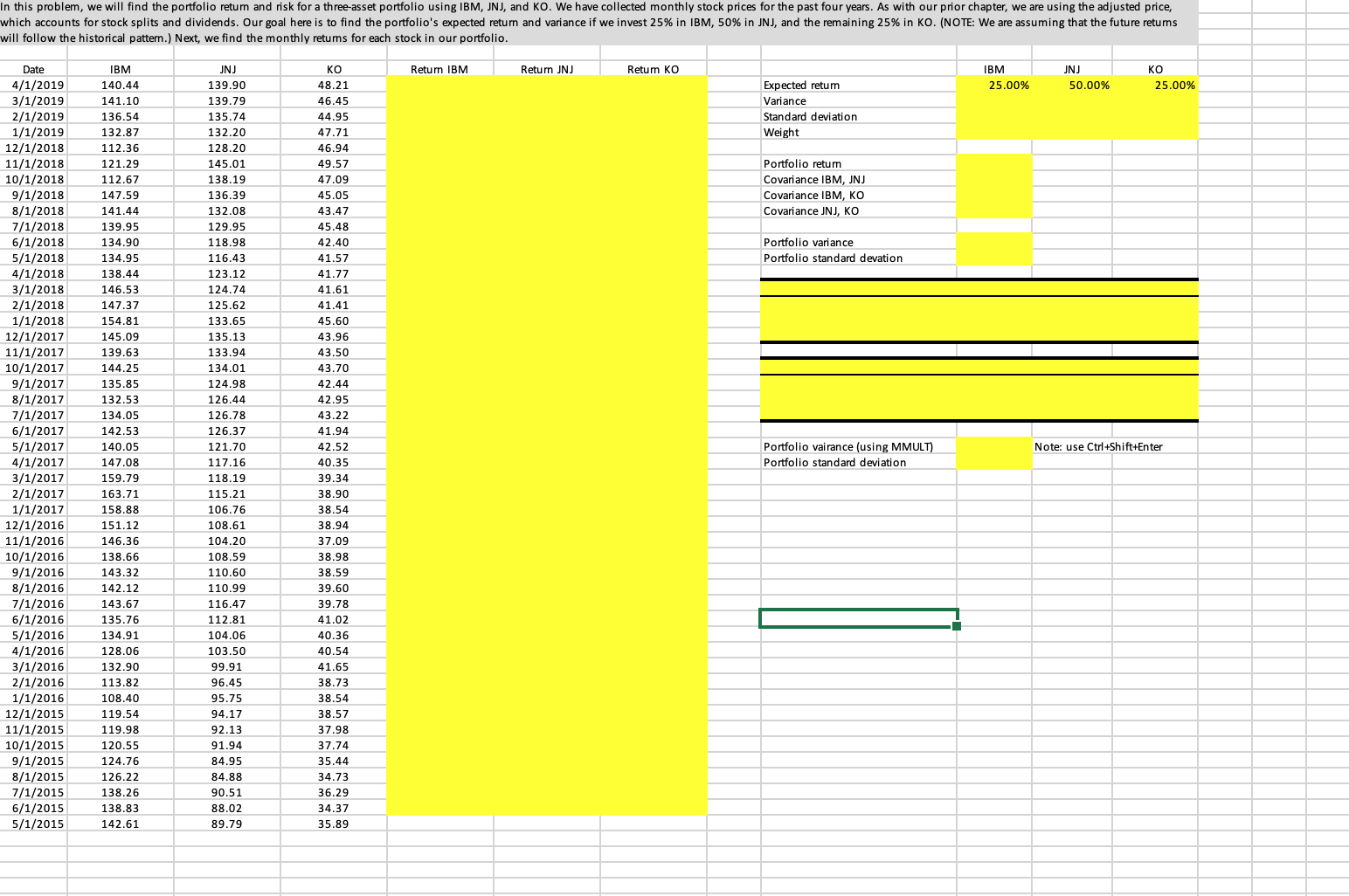

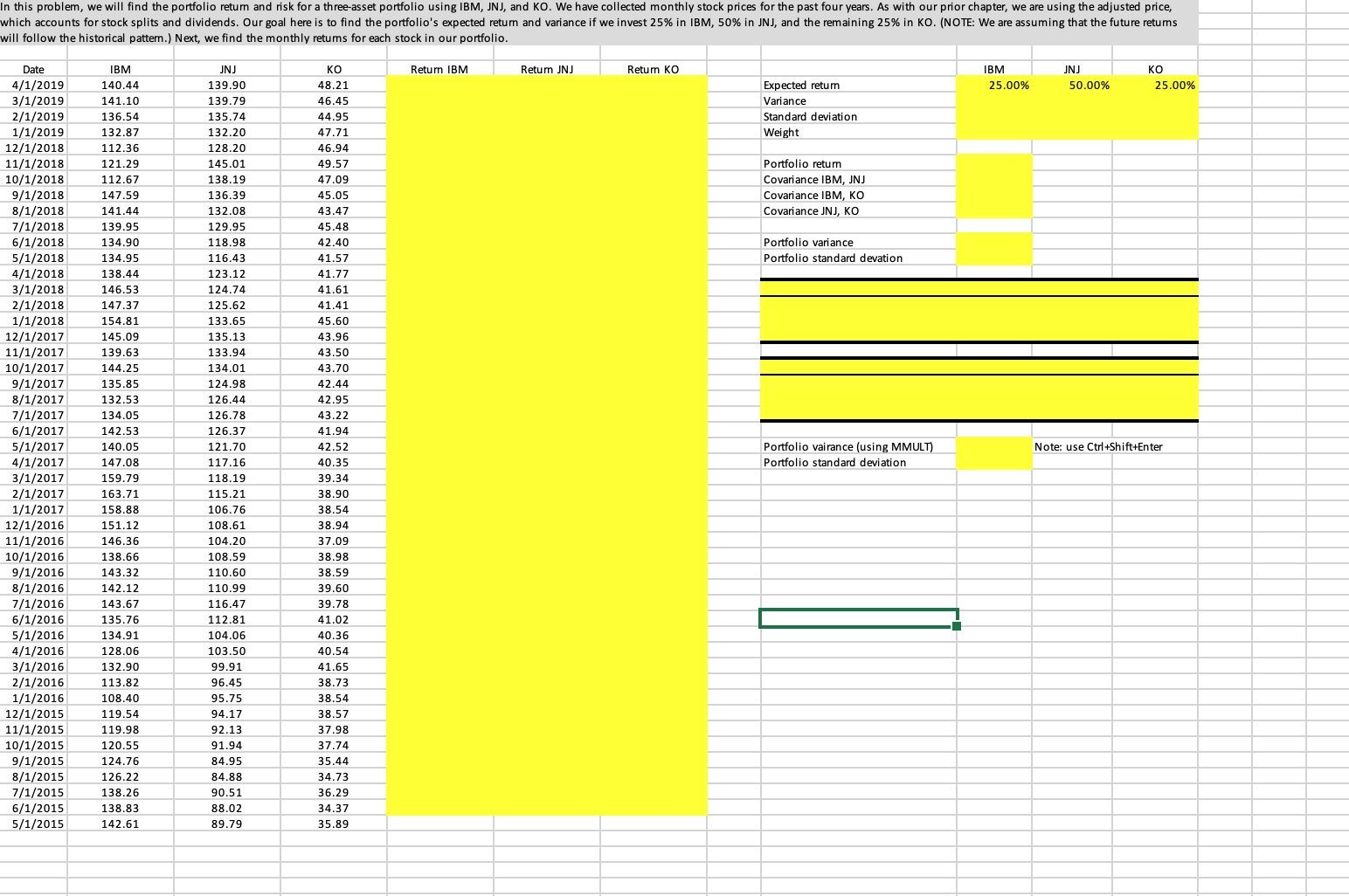

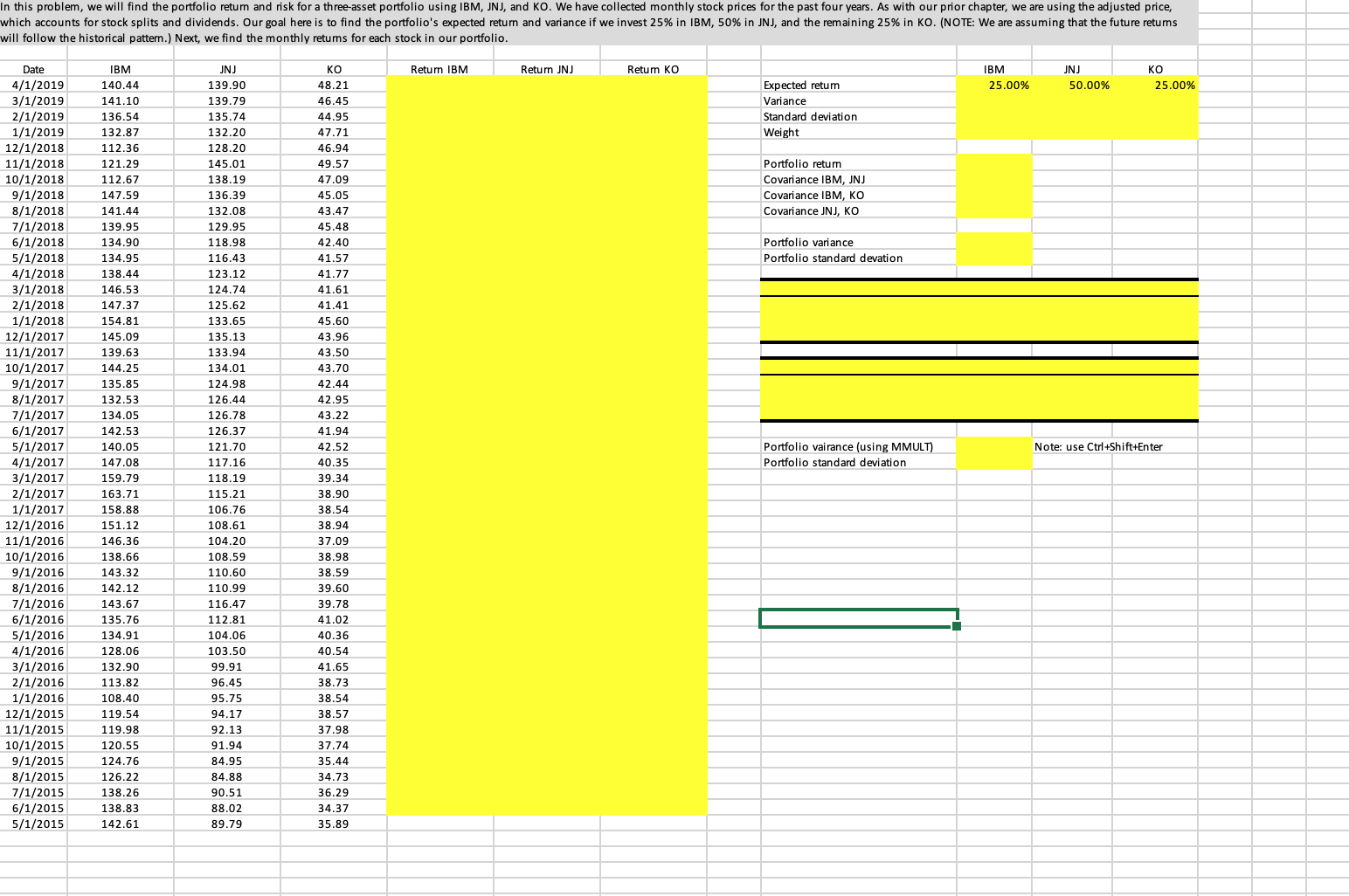

In this problem, we will find the portfolio return and risk for a three-asset portfolio using IBM, JNJ, and KO. We have collected monthly stock prices for the past four years. As with our prior chapter, we are using the adjusted price, which accounts for stock splits and dividends. Our goal here is to find the portfolio's expected return and variance if we invest 25% in IBM, 50% in JNJ, and the remaining 25% in KO. (NOTE: We are assuming that the future returns will follow the historical pattern.) Next, we find the monthly returns for each stock in our portfolio. Date IBM JNJ KO Return IBM Return JNJ Return KO IBM JNJ KO 4/1/2019 140.44 139.90 48.21 Expected return 25.00% 50.00% 25.00% 3/1/2019 141.10 139.79 46.45 Variance 2/1/2019 136.54 135.74 14.95 Standard deviation 1/1/2019 132.87 132.20 47.71 Weight 12/1/2018 112.36 128.20 46.94 11/1/2018 121.29 145.01 49.57 Portfolio return 10/1/201 112.67 138.19 47.09 Covariance IBM, JNJ 9/1/2018 147.59 136.39 45.05 Covariance IBM, KO 8/1/2018 141.4 132.08 43.47 Covariance JNJ, KO 7/1/2018 139.9 129.9 45.48 6/1/2018 134.90 118.9 42.40 Portfolio variance 5/1/2018 134.9 116.43 41.57 Portfolio standard devation 4/1/2018 138.44 123.17 41.77 3/1/2018 146.53 124.74 41.61 2/1/2018 147.37 125.62 41.41 1/1/2018 154.81 133.65 45.60 12/1/2017 145.09 135.13 43.96 11/1/2017 139.63 133.94 43.50 10/1/2017 144.25 134.01 43.70 9/1/2017 135.8 124.98 42.44 8/1/2017 132.53 126.44 42.95 7/1/2017 134.05 126.78 43.22 6/1/2017 142.5 126.37 41.94 5/1/2017 140.05 121.70 42.52 Portfolio vairance (using MMULT) Note: use Ctri+Shift+Enter 4/1/2017 147.0 117.16 40.35 Portfolio standard deviation 3/1/2017 159.79 118.19 39.34 2/1/2017 163.71 115.21 38.90 1/1/2017 158.88 106.76 38.54 12/1/2016 151.12 108.61 38.94 11/1/2016 146.36 104.20 37.09 10/1/2016 138.66 108.59 38.98 9/1/2016 143.32 110.60 38.59 8/1/2016 142.12 110.99 39.60 7/1/2016 143.67 116.47 39.78 6/1/2016 135.76 112.81 41.02 5/1/2016 134.91 104.06 40.36 4/1/2016 128.06 103.50 40.54 3/1/2016 132.90 99.91 41.65 2/1/2016 113.82 96.45 38.73 1/1/2016 108.40 95.75 38.54 12/1/2015 119.54 94.17 38.57 11/1/2015 119.98 2.13 37.98 10/1/2015 120.55 91.94 37.74 9/1/2015 124.76 84.95 35.44 8/1/2015 126.22 $4.88 34.73 7/1/201! 138.26 90.51 36.29 6/1/2015 138.83 88.02 34.37 5/1/2015 142.61 89.79 35.89