Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do not post copied answers. This assignment is due today and I need help. I made the amortization table but I am confused about

Please do not post copied answers. This assignment is due today and I need help. I made the amortization table but I am confused about what I am doing. Please show all steps and how you reached your conclusions. Note: the ending balance on year 30 should equal 0 (this is how you know you are right; I was wrong and I got negative numbers).

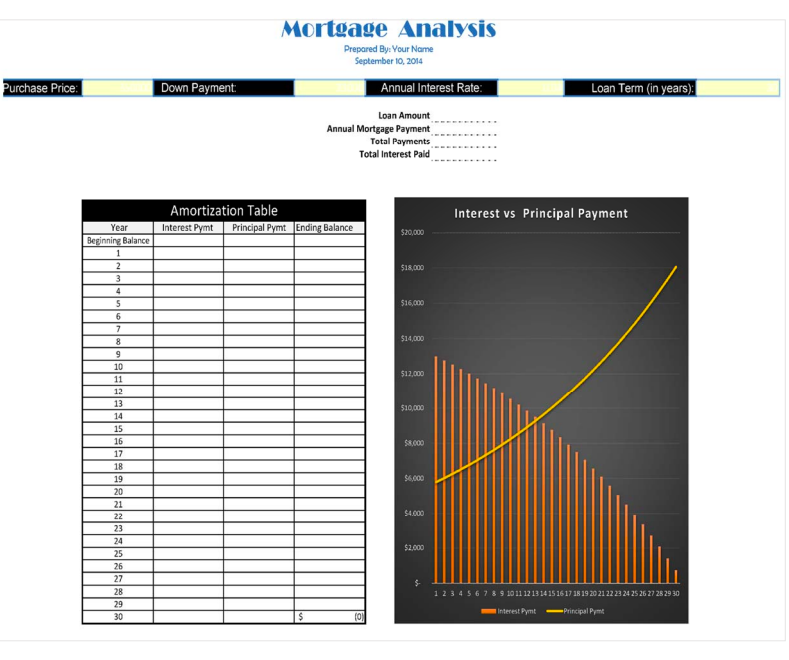

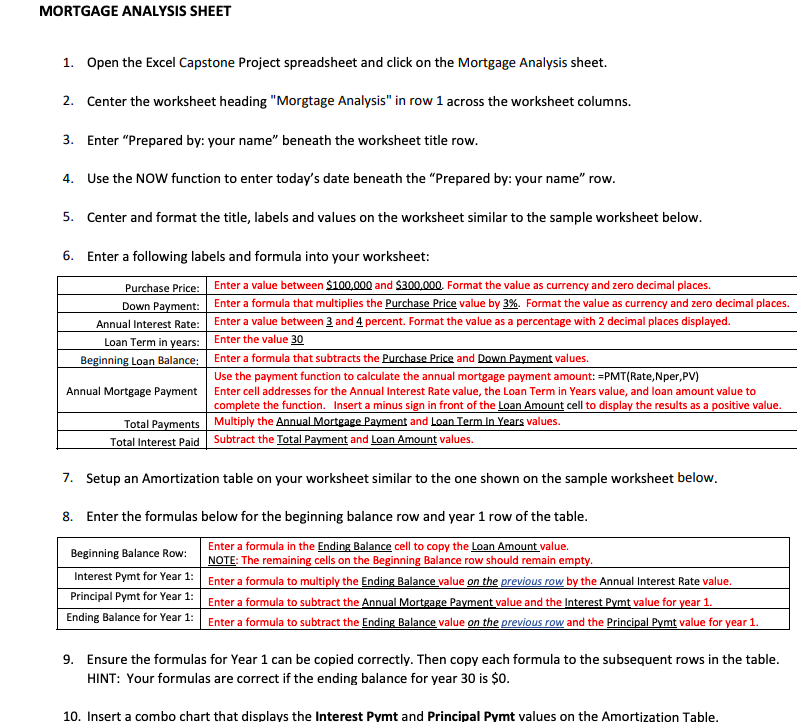

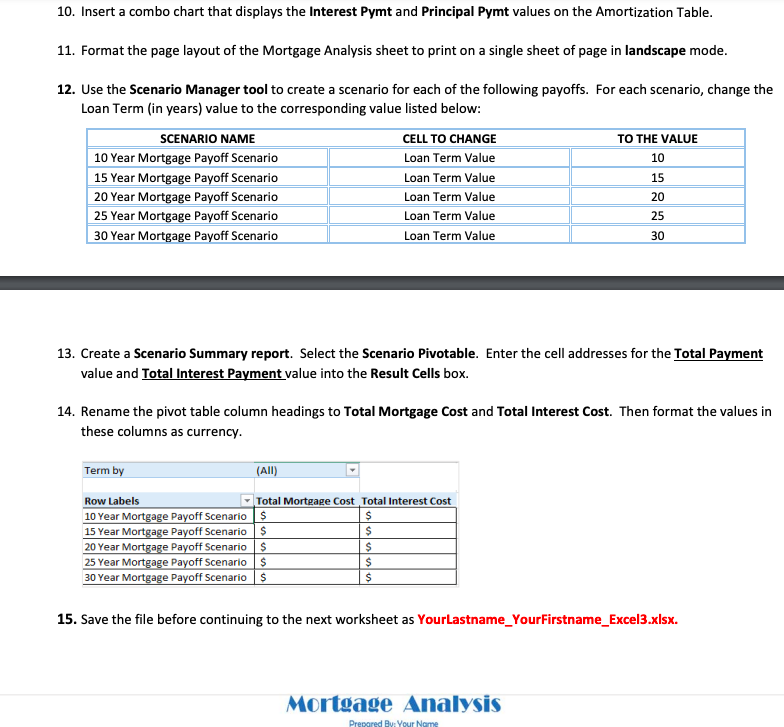

Mortgage Analysis Prepared By: Your Name September to, 2014 MORTGAGE ANALYSIS SHEET 1. Open the Excel Capstone Project spreadsheet and click on the Mortgage Analysis sheet. 2. Center the worksheet heading "Morgtage Analysis" in row 1 across the worksheet columns. 3. Enter "Prepared by: your name" beneath the worksheet title row. 4. Use the NOW function to enter today's date beneath the "Prepared by: your name" row. 5. Center and format the title, labels and values on the worksheet similar to the sample worksheet below. 6. Enter a following labels and formula into your worksheet: 7. Setup an Amortization table on your worksheet similar to the one shown on the sample worksheet below. 8. Enter the formulas below for the beginning balance row and year 1 row of the table. 9. Ensure the formulas for Year 1 can be copied correctly. Then copy each formula to the subsequent rows in the table. HINT: Your formulas are correct if the ending balance for year 30 is $0. 11. Format the page layout of the Mortgage Analysis sheet to print on a single sheet of page in landscape mode. 12. Use the Scenario Manager tool to create a scenario for each of the following payoffs. For each scenario, change the Loan Term (in years) value to the corresponding value listed below: 13. Create a Scenario Summary report. Select the Scenario Pivotable. Enter the cell addresses for the Total Payment value and Total Interest Payment value into the Result Cells box. 14. Rename the pivot table column headings to Total Mortgage Cost and Total Interest Cost. Then format the values in these columns as currency. 15. Save the file before continuing to the next worksheet as YourLastname_YourFirstname_Excel3.xlsx. Mortgage Analysis Prepared By: Your Name September to, 2014 MORTGAGE ANALYSIS SHEET 1. Open the Excel Capstone Project spreadsheet and click on the Mortgage Analysis sheet. 2. Center the worksheet heading "Morgtage Analysis" in row 1 across the worksheet columns. 3. Enter "Prepared by: your name" beneath the worksheet title row. 4. Use the NOW function to enter today's date beneath the "Prepared by: your name" row. 5. Center and format the title, labels and values on the worksheet similar to the sample worksheet below. 6. Enter a following labels and formula into your worksheet: 7. Setup an Amortization table on your worksheet similar to the one shown on the sample worksheet below. 8. Enter the formulas below for the beginning balance row and year 1 row of the table. 9. Ensure the formulas for Year 1 can be copied correctly. Then copy each formula to the subsequent rows in the table. HINT: Your formulas are correct if the ending balance for year 30 is $0. 11. Format the page layout of the Mortgage Analysis sheet to print on a single sheet of page in landscape mode. 12. Use the Scenario Manager tool to create a scenario for each of the following payoffs. For each scenario, change the Loan Term (in years) value to the corresponding value listed below: 13. Create a Scenario Summary report. Select the Scenario Pivotable. Enter the cell addresses for the Total Payment value and Total Interest Payment value into the Result Cells box. 14. Rename the pivot table column headings to Total Mortgage Cost and Total Interest Cost. Then format the values in these columns as currency. 15. Save the file before continuing to the next worksheet as YourLastname_YourFirstname_Excel3.xlsx

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started