Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do not round until the end and round to 3 deciaml places im not sure what is unclear. all the info is clearly stated

please do not round until the end and round to 3 deciaml places

im not sure what is unclear. all the info is clearly stated

this is the full question. you just fill in the blanks please refund me the question its past due

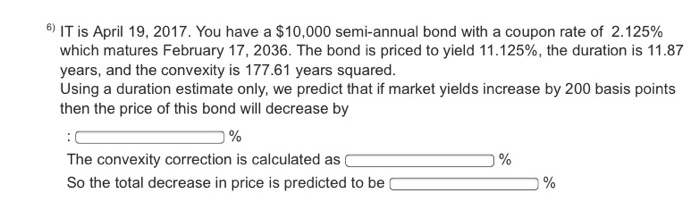

6) IT is April 19, 2017. You have a $10,000 semi-annual bond with a coupon rate of 2.125% which matures February 17, 2036. The bond is priced to yield 11.125%, the duration is 11.87 years, and the convexity is 177.61 years squared. Using a duration estimate only, we predict that if market yields increase by 200 basis points then the price of this bond will decrease by % The convexity correction is calculated as So the total decrease in price is predicted to be % % Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started