Answered step by step

Verified Expert Solution

Question

1 Approved Answer

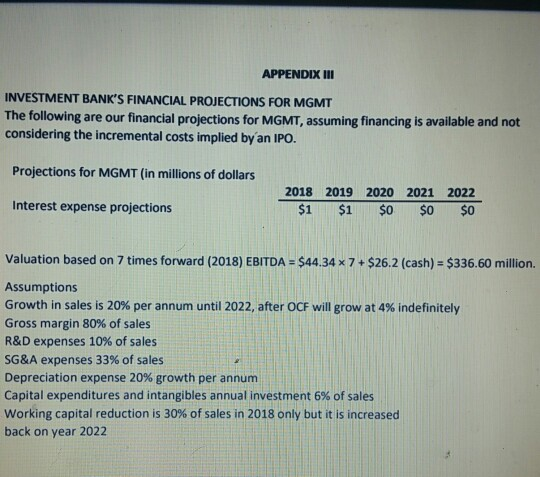

Please do not round your calculations and only round final answers to second decimal. Question: Are the underlying assumptions used by the investment bank in

Please do not round your calculations and only round final answers to second decimal.

Question: Are the underlying assumptions used by the investment bank in appendix III reasonable? use the financial statements to Discuss.

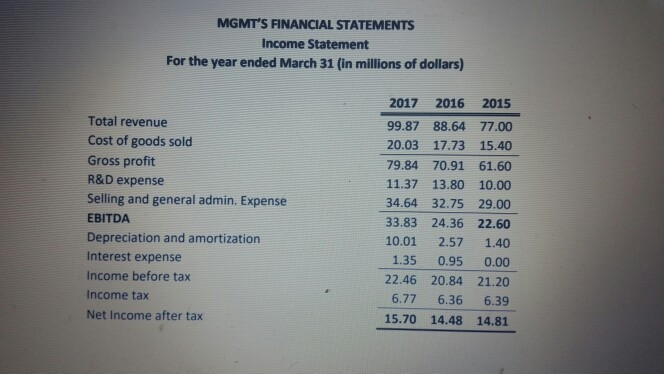

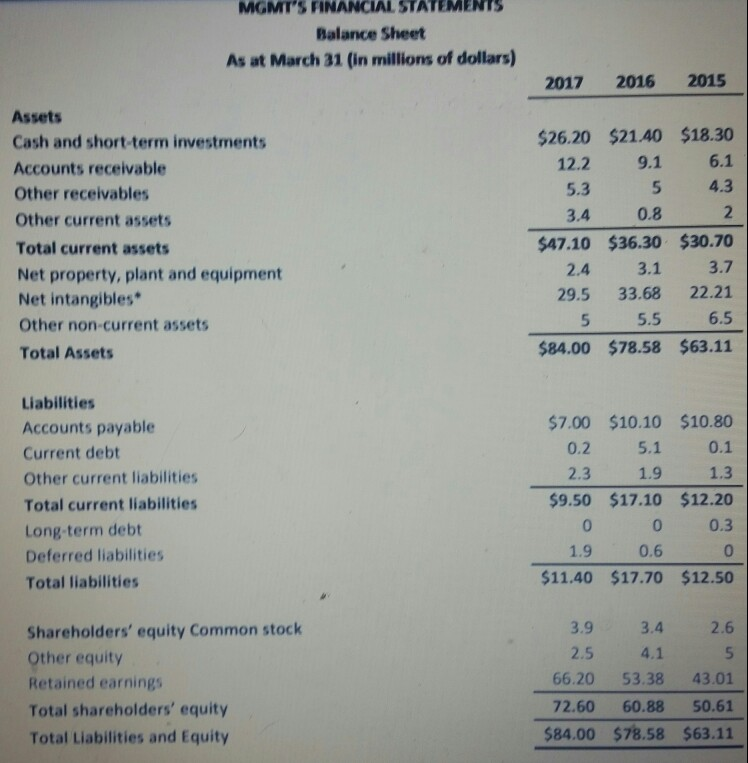

MGMT'S FINANCIAL STATEMENTS Income Statement For the year ended March 31 (in millions of dollars) Total revenue Cost of goods sold Gross profit R&D expense Selling and general admin. Expense EBITDA Depreciation and amortization Interest expense Income before tax Income tax Net Income after tax 2017 2016 2015 99.87 88.64 77.00 20.03 17.73 15.40 79.84 70.91 61.60 11.37 13.80 10.00 34.64 32.75 29.00 33.83 24.36 22.60 10.01 2.57 1.40 1.35 0.95 0.00 22.46 20.84 21.20 6.77 6.36 6.39 15.70 14.48 14.81 MGMT'S FINANCIAL STATEMENTS Balance Sheet As at March 31 (in millions of dollars) 2017 2016 2015 Assets Cash and short-term investments Accounts receivable Other receivables Other current assets Total current assets Net property, plant and equipment Net intangibles Other non-current assets Total Assets $26.20 $21.40 $18.30 12.2 9.1 6.1 5 4.3 5.3 3.4 0.8 $47.10 $36.30 $30.70 2.4 3.1 3.7 29.5 33.68 22.21 5 5.5 6.5 $84.00 $78.58 $63.11 Liabilities Accounts payable Current debt Other current liabilities Total current liabilities Long-term debt Deferred liabilities Total liabilities $7.00 $10.10 $10.80 0.2 5.1 0.1 1.9 1.3 $9.50 $17.10 $12.20 0 0.3 0 $11.40 $17.70 $12.50 2.3 0 1.9 0.6 3.9 3.4 2.6 Shareholders' equity Common stock Other equity Retained earnings Total shareholders' equity Total Liabilities and Equity 2.5 4.1 66.20 53.38 43.01 72.60 60.8850.61 $84.00 $78.58 $63.11 APPENDIX ll INVESTMENT BANK'S FINANCIAL PROJECTIONS FOR MGMT The following are our financial projections for MGMT, assuming financing is available and not considering the incremental costs implied byan IPO. Projections for MGMT (in millions of dollars 2018 2019 2020 2021 2022 $1 $1 $0 $0 $0 Interest expense projections Valuation based on 7 times forward (2018) EBITDA $44.34 x 7 $26.2 (cash)- $336.60 million. Assumptions Growth in sales is 20% per annum until 2022, after OCF will grow at 4% indefinitely Gross margin 80% of sales R&D expenses 10% of sales SG&A expenses 33% of sales Depreciation expense 20% growth per annum Capital expenditures and intangibles annual investment 6% of sales working capital reduction is 30% of sales in 2018 only but it is increased back on year 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started