Question

Please do not show work and answers handwritten, I can not understand it sometimes. Thank you! When Patey Pontoons issued 10% bonds on January 1,

Please do not show work and answers handwritten, I can not understand it sometimes. Thank you!

When Patey Pontoons issued 10% bonds on January 1, 2016, with a face amount of $800,000, the market yield for bonds of similar risk and maturity was 11%. The bonds mature December 31, 2019 (4 years). Interest is paid semiannually on June 30 and December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

Required:

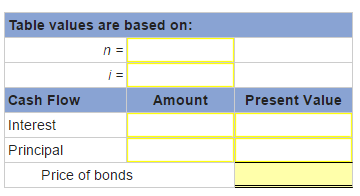

-Determine the price of the bonds at January 1, 2016.

-Prepare the journal entry to record their issuance by Patey on January 1, 2016. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

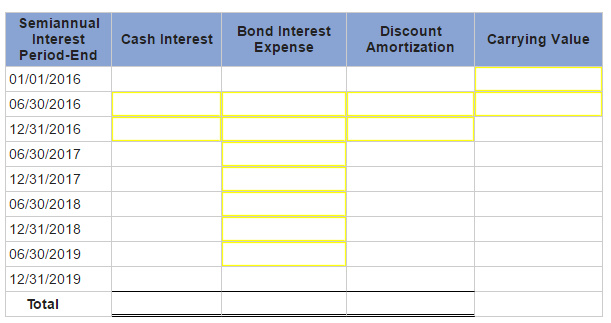

-Prepare an amortization schedule that determines interest at the effective rate each period.

-Prepare the journal entry to record interest on June 30, 2016. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

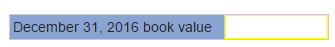

-What is the amount(s) related to the bonds that Patey will report in its balance sheet at December 31, 2016?

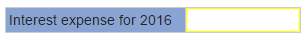

-What is the amount(s) related to the bonds that Patey will report in its income statement for the year ended December 31, 2016? (Ignore income taxes.)

-Prepare the appropriate journal entries at maturity on December 31,(If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started