Question

Please do not show work and answers in handwriting, I can not always understand what it is supposed to be. A company issued 6%, 10-year

Please do not show work and answers in handwriting, I can not always understand what it is supposed to be.

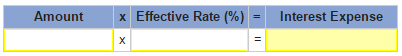

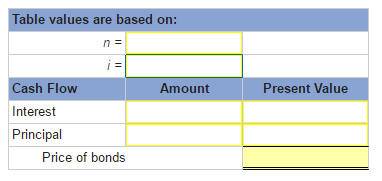

A company issued 6%, 10-year bonds with a face amount of $90 million. The market yield for bonds of similar risk and maturity is 7%. Interest is paid semiannually. At what price did the bonds sell? (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Enter your answers in whole dollars.)

| On January 1, a company issued 10%, 15-year bonds with a face amount of $70 million for $64,913,189.19 to yield 11%. Interest is paid semiannually. What was interest expense at the effective interest rate on June 30, the first interest date? (Enter your answers in whole dollars. Round percentage answers to 2 decimal places. (i.e., .0234 should be entered as 2.34).)

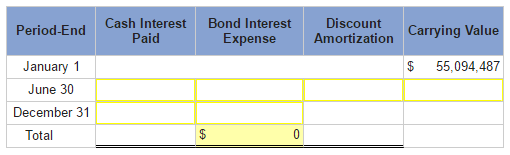

On January 1, a company issued 3%, 10-year bonds with a face amount of $60 million for $55,094,487 to yield 4%. Interest is paid semiannually. What was the interest expense at the effective interest rate on the December 31 annual income statement? (Enter your answers in whole dollars. Round your intermediate calculations to the nearest dollar amount.)

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started