PLEASE DO NOT SOLVE WITH EXCEL.

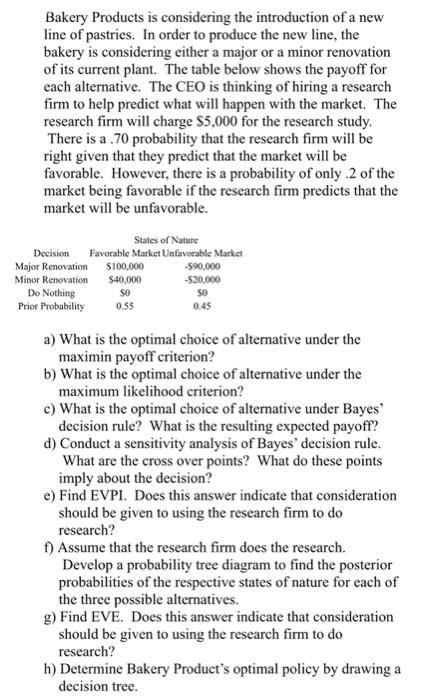

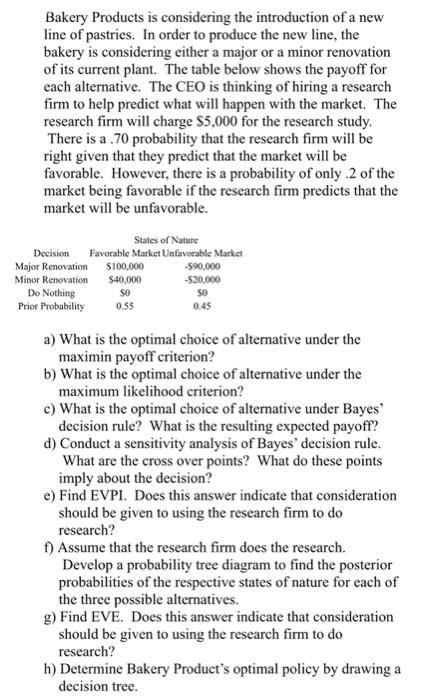

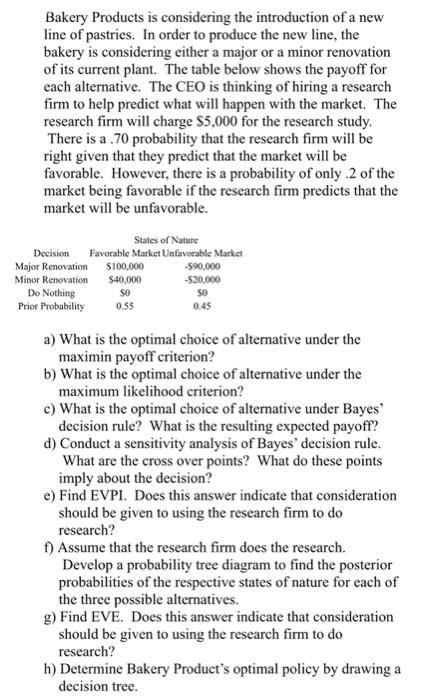

Bakery Products is considering the introduction of a new line of pastries. In order to produce the new line, the bakery is considering either a major or a minor renovation of its current plant. The table below shows the payoff for each alternative. The CEO is thinking of hiring a research firm to help predict what will happen with the market. The research firm will charge $5,000 for the research study. There is a 70 probability that the research firm will be right given that they predict that the market will be favorable. However, there is a probability of only 2 of the market being favorable if the research firm predicts that the market will be unfavorable. States of Nature Decision Favorable Market Unfavorable Market Major Renovation $100,000 -590,000 Minor Renovation $40,000 -$20,000 Do Nothing SO SO Prior Probability 0.55 0.45 a) What is the optimal choice of alternative under the maximin payoff criterion? b) What is the optimal choice of alternative under the maximum likelihood criterion? c) What is the optimal choice of alternative under Bayes' decision rule? What is the resulting expected payoff? d) Conduct a sensitivity analysis of Bayes' decision rule. What are the cross over points? What do these points imply about the decision? e) Find EVPI. Does this answer indicate that consideration should be given to using the research firm to do research? f) Assume that the research firm does the research. Develop a probability tree diagram to find the posterior probabilities of the respective states of nature for each of the three possible alternatives. g) Find EVE. Does this answer indicate that consideration should be given to using the research firm to do research? h) Determine Bakery Product's optimal policy by drawing a decision tree. Bakery Products is considering the introduction of a new line of pastries. In order to produce the new line, the bakery is considering either a major or a minor renovation of its current plant. The table below shows the payoff for each alternative. The CEO is thinking of hiring a research firm to help predict what will happen with the market. The research firm will charge $5,000 for the research study. There is a 70 probability that the research firm will be right given that they predict that the market will be favorable. However, there is a probability of only 2 of the market being favorable if the research firm predicts that the market will be unfavorable. States of Nature Decision Favorable Market Unfavorable Market Major Renovation $100,000 -590,000 Minor Renovation $40,000 -$20,000 Do Nothing SO SO Prior Probability 0.55 0.45 a) What is the optimal choice of alternative under the maximin payoff criterion? b) What is the optimal choice of alternative under the maximum likelihood criterion? c) What is the optimal choice of alternative under Bayes' decision rule? What is the resulting expected payoff? d) Conduct a sensitivity analysis of Bayes' decision rule. What are the cross over points? What do these points imply about the decision? e) Find EVPI. Does this answer indicate that consideration should be given to using the research firm to do research? f) Assume that the research firm does the research. Develop a probability tree diagram to find the posterior probabilities of the respective states of nature for each of the three possible alternatives. g) Find EVE. Does this answer indicate that consideration should be given to using the research firm to do research? h) Determine Bakery Product's optimal policy by drawing a decision tree