Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE DO NOT USE EXCEL. Explain every single formula you used in your work. Refer to the non - constant growth model. You are considering

PLEASE DO NOT USE EXCEL. Explain every single formula you used in your work. Refer to the nonconstant growth model.

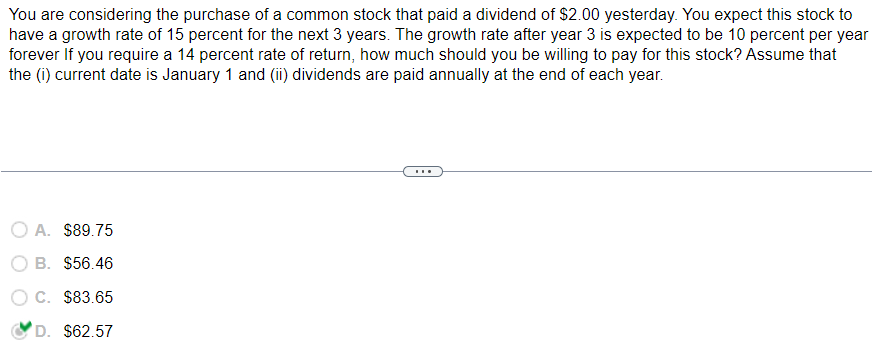

You are considering the purchase of a common stock that paid a dividend of $ yesterday. You expect this stock to

have a growth rate of percent for the next years. The growth rate after year is expected to be percent per year

forever If you require a percent rate of return, how much should you be willing to pay for this stock? Assume that

the i current date is January and ii dividends are paid annually at the end of each year.

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started