Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE DO NOT USE EXCEL The DCM Enterprises buys a machine for $20,000. The company uses the MACRS three-Year Property Class for depreciation. The company

PLEASE DO NOT USE EXCEL

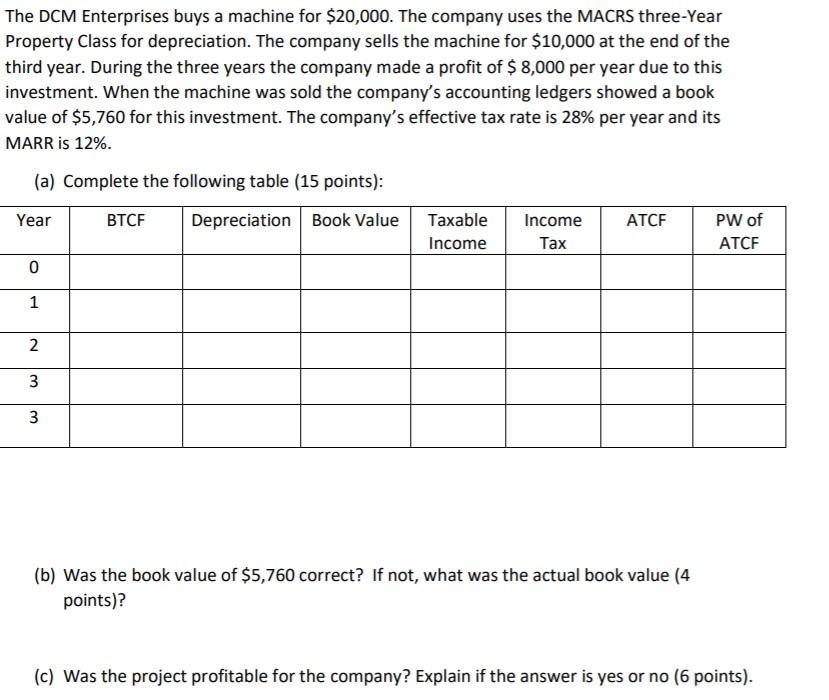

The DCM Enterprises buys a machine for $20,000. The company uses the MACRS three-Year Property Class for depreciation. The company sells the machine for $10,000 at the end of the third year. During the three years the company made a profit of $ 8,000 per year due to this investment. When the machine was sold the company's accounting ledgers showed a book value of $5,760 for this investment. The company's effective tax rate is 28% per year and its MARR is 12%. (a) Complete the following table (15 points): Year BTCF Depreciation Book Value ATCF Taxable Income Income Tax PW of ATCF 0 1 1 2 3 3 (b) Was the book value of $5,760 correct? If not, what was the actual book value (4 points)? (c) Was the project profitable for the company? Explain if the answer is yes or no (6 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started