Answered step by step

Verified Expert Solution

Question

1 Approved Answer

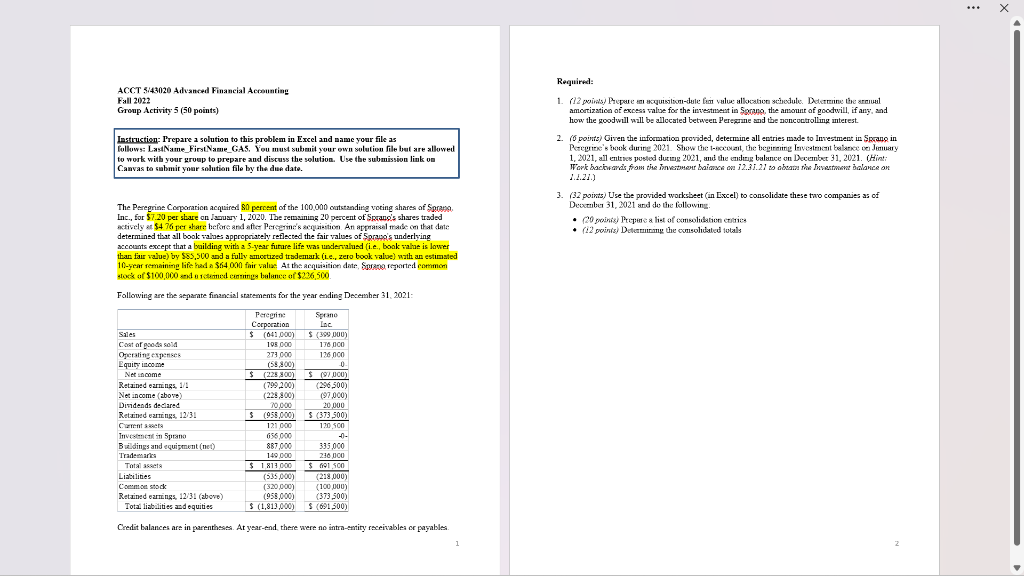

Please do number 3) (32 points) Use the provided worksheet (in Excel) to consolidate these two companies as of December 31, 2021 and do the

Please do number 3)

(32 points) Use the provided worksheet (in Excel) to consolidate these two companies as of December 31, 2021 and do the following:

(20 points) Prepare a list of consolidation entries

(12 points) Determining the consolidated totals

I also have Check figures are as follows:

Goodwill allocated to Parent = $195,200

Goodwill allocated to NCI = $0

Annual amortization of excess value = $23,500

Balance of Investment in Shapiro, 1.1.21 = $613,200

Consolidated total assets, 12.31.21 = $2,146,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started