Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do number 4 Red River Inc. of Atlanta purchased computer equipment from Sydney Tech. of Australia for AS10,000,000 with payment due in 3 months.

Please do number 4

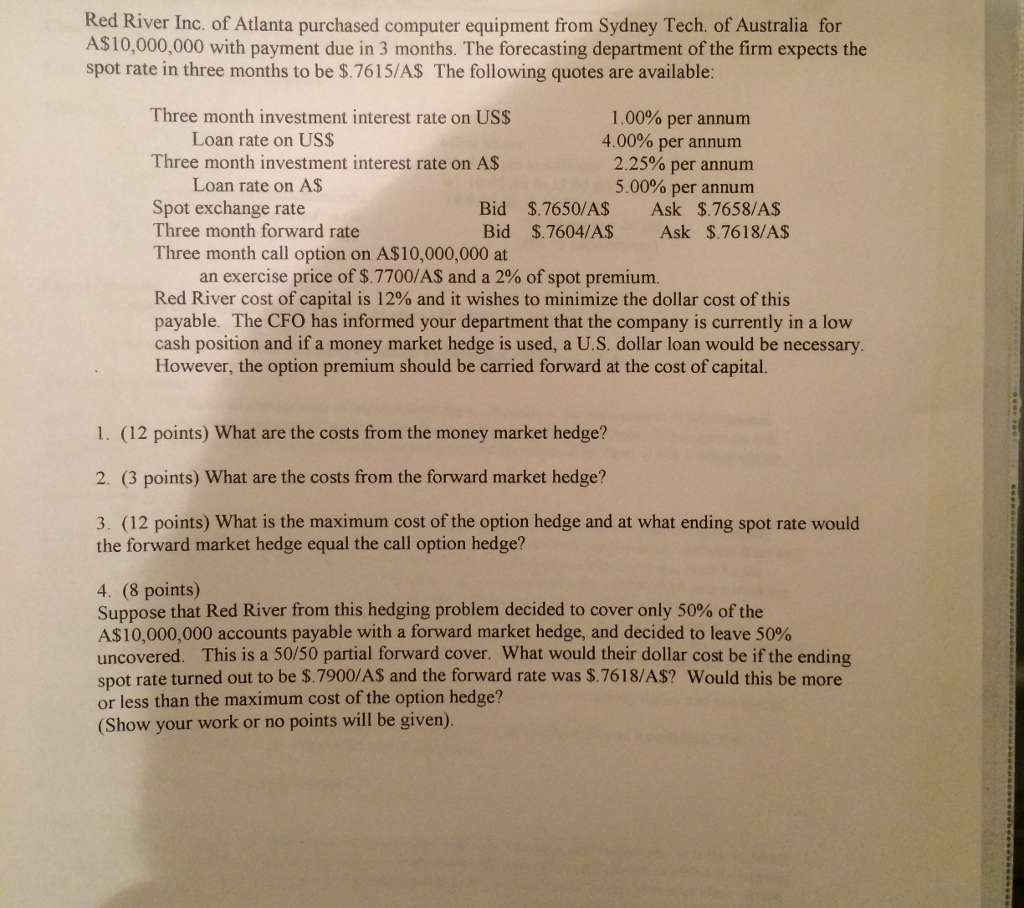

Red River Inc. of Atlanta purchased computer equipment from Sydney Tech. of Australia for AS10,000,000 with payment due in 3 months. The forecasting department of the firm expects the spot rate in three months to be $.7615/AS The following quotes are available: Three month investment interest rate on USs 1 .00% per annum Loan rate on USS 4.00% per annum Three month investment interest rate on AS 2.25% per annum 5.00% per annum Loan rate on AS Spot exchange rate Three month forward rate Three month call option on A$10,000,000 at Bid $.7650/A$ Ask $.7658/A$ Bid $.7604/A$ Ask $.7618/A$ an exercise price of $.7700/A$ and a 2% of spot premium. Red River cost of capital is 12% and it wishes to minimize the dollar cost of this payable. The CFO has informed your department that the company is currently in a low cash position and if a money market hedge is used, a U.S. dollar loan would be necessary However, the option premium should be carried forward at the cost of capital. 1. (12 points) What are the costs from the money market hedge? 2. (3 points) What are the costs from the forward market hedge? 3. (12 points) What is the maximum cost of the option hedge and at what ending spot rate would the forward market hedge equal the call option hedge? 4. (8 points) Suppose that Red River from this hedging problem decided to cover only 50% of the A$ 10,000,000 accounts payable with a forward market hedge, and decided to leave 50% uncovered. This is a 50/50 partial forward cover. What would their dollar cost be if the ending spot rate turned out to be $.7900/AS and the forward rate was $.7618/AS? Would this be more or less than the maximum cost of the option hedge? (Show your work or no points will be given)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started