Answered step by step

Verified Expert Solution

Question

1 Approved Answer

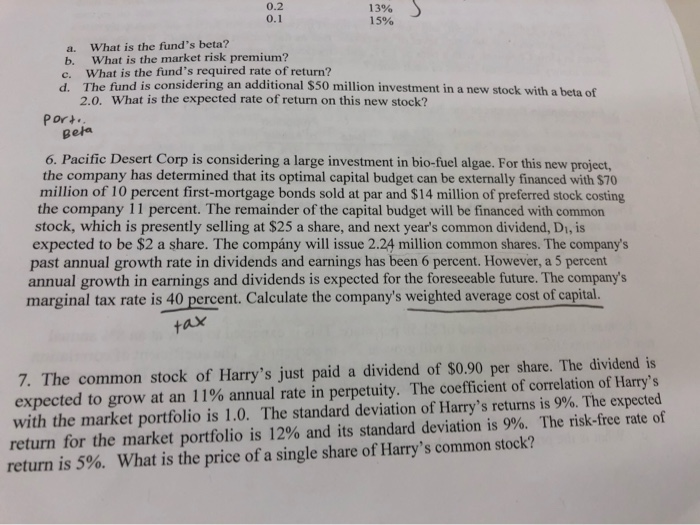

please do number 6 and 7 i have no idea how to do them! 0.2 13% 0.1 15% a. What is the fund's beta? b.

please do number 6 and 7 i have no idea how to do them!

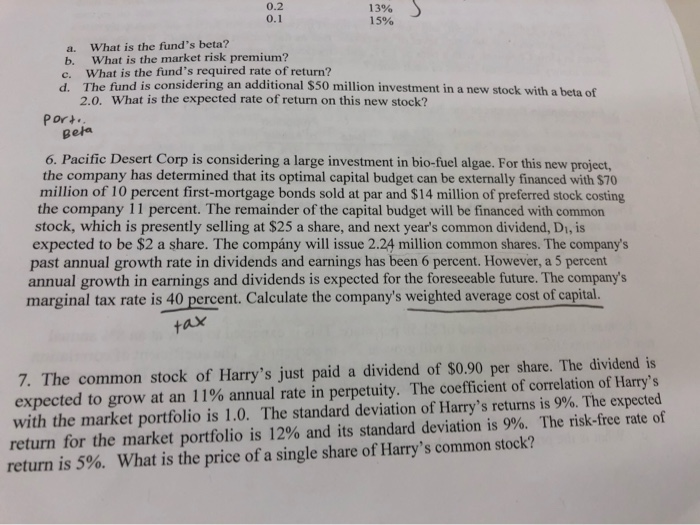

0.2 13% 0.1 15% a. What is the fund's beta? b. What is the market risk premium? c. What is the fund's required rate of return? The fund is considering an additional $50 million investment in a new stock with a beta of 2.0. What is the expected rate of return on this new stock? port. Bela 6. Pacific Desert Corp is considering a large investment in bio-fuel algae. For this new project, the company has determined that its optimal capital budget can be externally financed with $70 million of 10 percent first-mortgage bonds sold at par and $14 million of preferred stock costing the company 11 percent. The remainder of the capital budget will be financed with common stock, which is presently selling at $25 a share, and next year's common dividend, D, is expected to be $2 a share. The company will issue 2.24 million common shares. The company's past annual growth rate in dividends and earnings has been 6 percent. However, a 5 percent annual growth in earnings and dividends is expected for the foreseeable future. The company's marginal tax rate is 40 percent. Calculate the company's weighted average cost of capital. tax 7. The common stock of Harry's just paid a dividend of $0.90 per share. The dividend is expected to grow at an 11% annual rate in perpetuity. The coefficient of correlation of Harry's with the market portfolio is 1.0. The standard deviation of Harry's returns is 9%. The expected return for the market portfolio is 12% and its standard deviation is 9%. The risk-free rate of return is 5%. What is the price of a single share of Harry's common stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started